For complete information on risks, refer to the legal documents.

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

The value of equities and equity-related securities can be affected by a number of factors including the activities and results of the issuer and general and regional economic and market conditions. This may result in fluctuations in the value of the Fund.

The use of a representative sampling approach will result in the Fund holding a smaller number of securities than are in the underlying index. As a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the underlying index.

The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Global equity exposure without the concentration risk

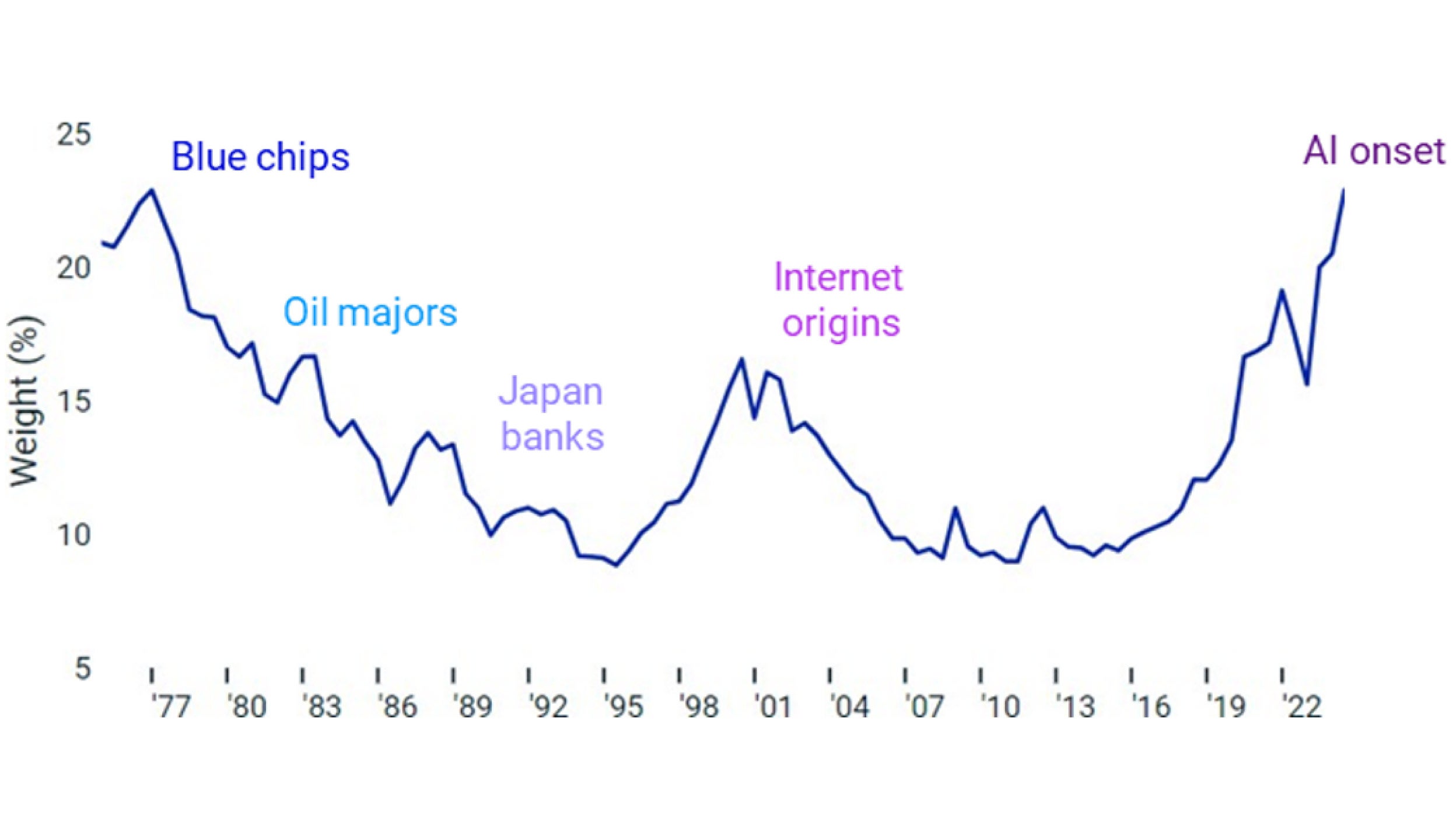

The mini stock market correction in July may have been short-lived, but it served as a reminder of just how quickly sentiment and momentum can change. Although subsequent data alleviated some of the economic fears surrounding that event, many investors are still left wondering how to position their equity portfolios. An equal weight version of the MSCI World index may offer investors a compelling solution for broad-based global equity exposure that avoids the concentration risk associated with a standard market-cap-weighted approach.

Market cap v equal weight

A standard index weights the constituents by size, with the result being that the largest companies contribute more to the index performance than smaller companies. For example, the top 10 stocks in MSCI World make up less than 1% of the number of stocks in that index but currently comprise 25% of its market capitalisation1. That concentration can be an advantage in a highly momentum-driven market when the largest stocks are performing well, as has been the case over the past year, but can pose a significant risk as was highlighted in July this year.