ETF Digital assets: Is the bitcoin bull run just getting started?

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

Exchange-traded funds and commodities are a hotbed of innovation and an exciting way for investors to access capital markets. Read our insights on the latest news and developments in this fast moving area.

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

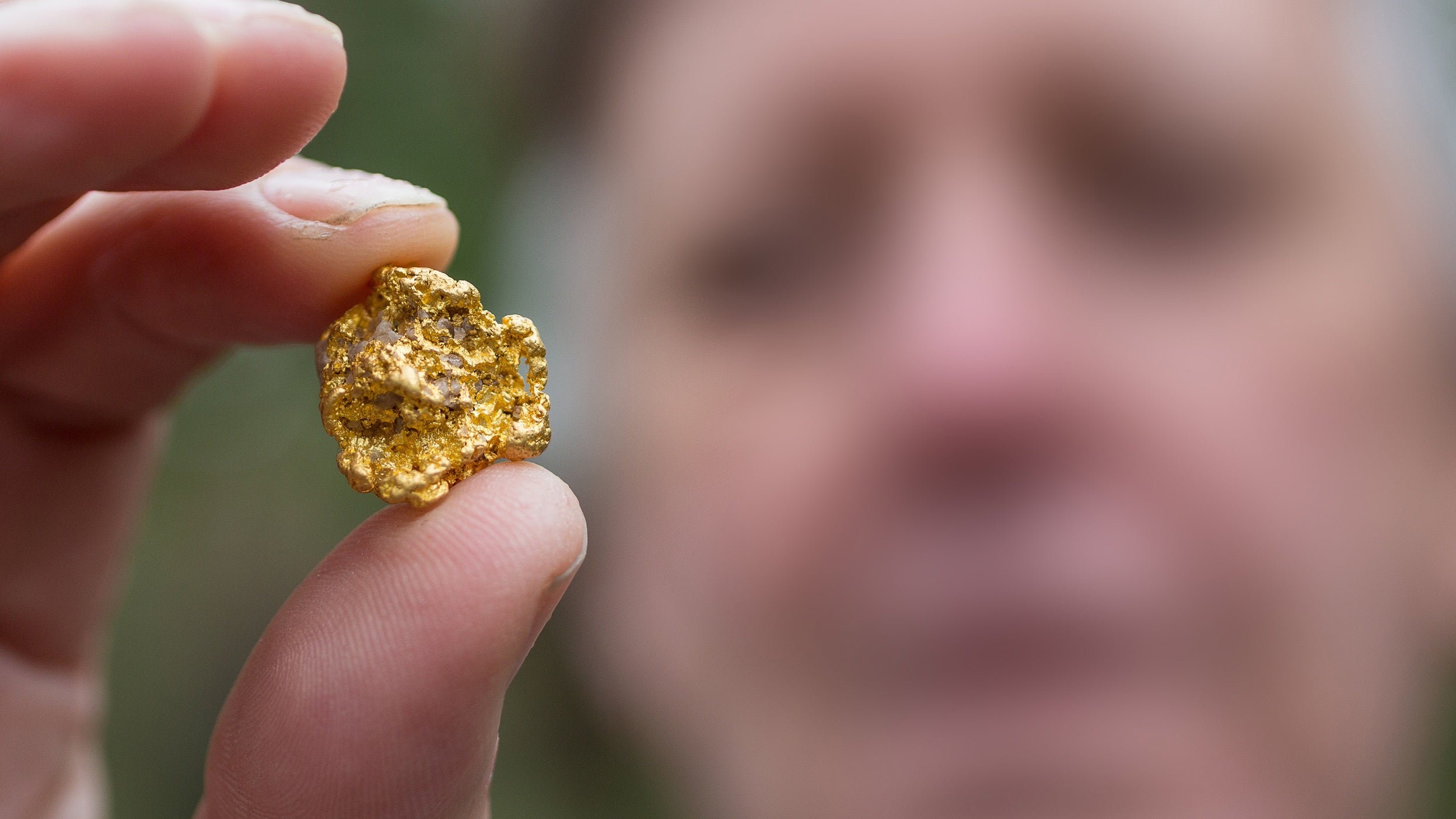

Gold endured a choppy month, hitting a high of US$2,952 before ending February at US$2,858, a gain of 2.1% for the month. Geopolitics continued to play a significant role in the gold price. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

Bond markets generally performed well in February, although there were varying outcomes across different regions. Read our latest thoughts on how fixed income markets fared during the month and what we think you should be looking out for in the near term.

While most standard equity benchmarks weight their constituents according to market capitalisation, an equal-weighted approach can sometimes make more sense. Discover more about equal-weight and how to gain broad equity exposure without the concentration risk.

Satisfying climate-related goals without the resulting performance deviating too much from standard indices can be challenging. Learn how the EU Climate Transition Benchmark (CTB) offers a solid framework for ETF providers to customise solutions for investors’ needs.

The European ETF market had a record year, bringing the industry’s total assets under management to US$2.3 trillion at the end of 2024. Find out more in our latest European ETF Demand Monitor.

Discover the potential of equal weight strategies and how they could offer enhanced diversification.

The most popular way most investors gain exposure to commodities is through exchange-traded products. You can gain exposure to a single commodity’s price via an exchange-traded commodity (ETC) or to a basket of commodities, such as those represented by the BCOM Index, via an ETF.

Thematics funds provide diversified exposure to specific themes or trends, regardless of traditional sector classifications. Discover more in our latest article.

Q3 2024 was certainly eventful, with the replacement of Biden as Democratic presidential candidate, a sharp sell-off in July extending into August and an interest rate hike by the Bank of Japan, to name a few. Read our quarterly US equities update to find out more.

ETFs replicate benchmark indices in different ways: physically, and synthetically – also known as a swap-based approach. Find out how a swap-based ETF works.

A swap-based ETF replicates the performance of the index it tracks, without owning the stocks directly. This can be advantageous in certain markets. Watch our world tour to find out more.

Any debate over whether physical or synthetic replication is the best way to track an index has been all but laid to rest, with both methods now appreciated for their potential benefits. Discover more.

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

If you’re among the millions worldwide considering diving into the world of exchange-traded funds (ETFs), here’s what you should know about the different replication methods used.