Invesco Global Equity Income Fund

A core global fund with a focus on dividends and capital growth.

Important Information

-

- The Fund invests primarily in global equities.

- Investors should note the currency exchange risk, equities risk, volatility risk, and general investment risk.

- Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund.

- For certain share class(es), the Fund may at discretion pay dividend out of the capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share in respect of such share class after the monthly distribution date. (Note 1)

- In addition, investors of Monthly Distribution-1 share class that are currency hedged (MD-1 hedged) should be aware of the uncertainty of relative interest rates. The net asset value of the MD-1 hedged may fluctuate and may significantly differ from other share class due to fluctuation of the interest rate differential between the currency in which the MD-1 hedged is denominated and the base currency of the Fund and may result in a greater erosion of capital than other non-hedged share class. (Note 2)

- The value of the Fund can be volatile and could go down substantially.

- Investors should not base their investment decision on this material alone.

Why Invesco Global Equity Income Fund?

A balanced portfolio with no excessive style or factor bias

A high conviction portfolio of around 45 holdings

Good performance - 1st quartile performance over 1 year, 3 year and 5 year^

Source: Invesco, as at 30 September 2024

^Source: Performance is sourced from ©2024 Morningstar, data as of 30 September 2024, based on A (USD) - Acc share class. Peer group: EAA Fund Global Equity Income. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

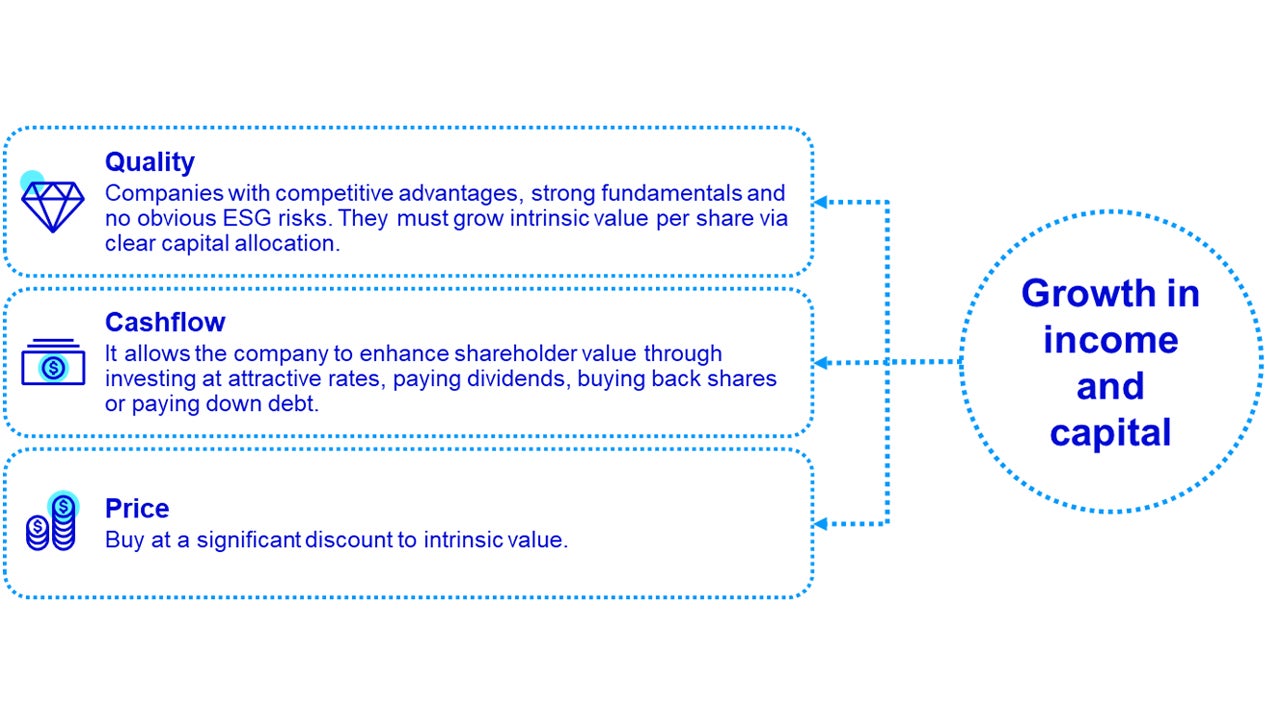

A combination of income and growth

In the past year, there was a negative correlation between dividend yield and total return.* Therefore, pure focus on high dividend paying stocks could have a negative impact on total returns.

We believe that investing in both companies that have a history of growing dividends and companies that have a lower yield but can reinvest at attractive rates of return could potentially lead to higher total returns.

* Source: Invesco, as at 31 July 2024. Monthly total returns in USD (net of fees). Time period: 1 August 2023 to 31 July 2024. Calculation benchmark: MSCI World Index (Net Total Return).

Source: Invesco as at 30 September 2024. For illustrative purposes only.

A balanced portfolio with no significant style or factor bias

Dividend funds typically overweight dividend sectors such as communication services, financials, and utilities. The dividend-first approach creates a bias towards value.

Our fund adopts a balanced approach of taking both yields and growth potential into consideration.

Source: Invesco as at 30 September 2024. For illustrative purposes only.

Source: Invesco as at 30 September 2024. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice. The weightings for each breakdown are rounded to the nearest tenth or hundredth of a percent; therefore, the aggregate weights for each breakdown may not equal 100%.

Portfolio characteristics

Invesco Global Equity Income Fund |

MSCI World index* |

|

| Dividend yield | 2.3% | 1.9% |

| Price to earnings | 17.2x | 18.9x |

| Debt/EBITDA | 2.4x | 3.1x |

| Return on equity | 15.8% | 14.0% |

Source: Bloomberg as at 30 September 2024. Trailing 12-month figures except dividend yield and price to earnings are 12-month forward figures.

*Benchmark index, subject to further change without notice.

Top 10 holdings

1. 3i 2. UnitedHealth 3. Rolls-Royce 4. Microsoft 5. Union Pacific

Total holdings: 47 |

5.1% 4.4% 4.3% 4.1% 3.4% |

6. Texas Instruments 7. London Stock Exchange 8. AIA 9. Azelis 10. Coca-Cola Europacific Partners |

3.4% 3.4% 3.4% 3.3% 3.1% |

Source: Invesco as at 30 September 2024. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice.

Source: Invesco as at 30 September 2024. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice. The weightings for each breakdown are rounded to the nearest tenth or hundredth of a percent; therefore, the aggregate weights for each breakdown may not equal 100%.

Distribution information*

*Aims to pay dividend on monthly basis. Dividend is not guaranteed; For MD-1 shares, dividend may be paid out of capital. (Please refer to Note 1 and/or Note 2 of the "Important information")

| Intended frequency | Record date | Amount/Share | Annualized dividend (%) | |

| A (AUD Hgd)-MD1 Shares | Monthly | 30/09/24 | 0.0410 | 4.51% |

| A (USD)-MD1 Shares | Monthly | 30/09/24 |

0.0560 | 5.27% |

| A (HKD)-MD1 Shares | Monthly | 30/09/24 |

0.5100 | 5.29% |

| A (RMB Hgd)-MD1 Shares | Monthly | 30/09/24 |

0.2940 | 3.34% |

Source: Invesco as at 30 September 2024.

Annualized dividend (%) = (Amount/Share X Frequency) ÷ Price on record date. Upon dividend distribution, the Fund's net asset value may fall on the ex-dividend date. For Frequency, Monthly = 12; Quarterly = 4; Semi-Annually = 2; Annually =1. All distributions below USD 50/AUD 50/HKD 400/RMB 400 will be automatically applied in the purchase of further shares of the same class. Positive distribution yield does not imply a positive return.