Mind the Gap

Key takeaways

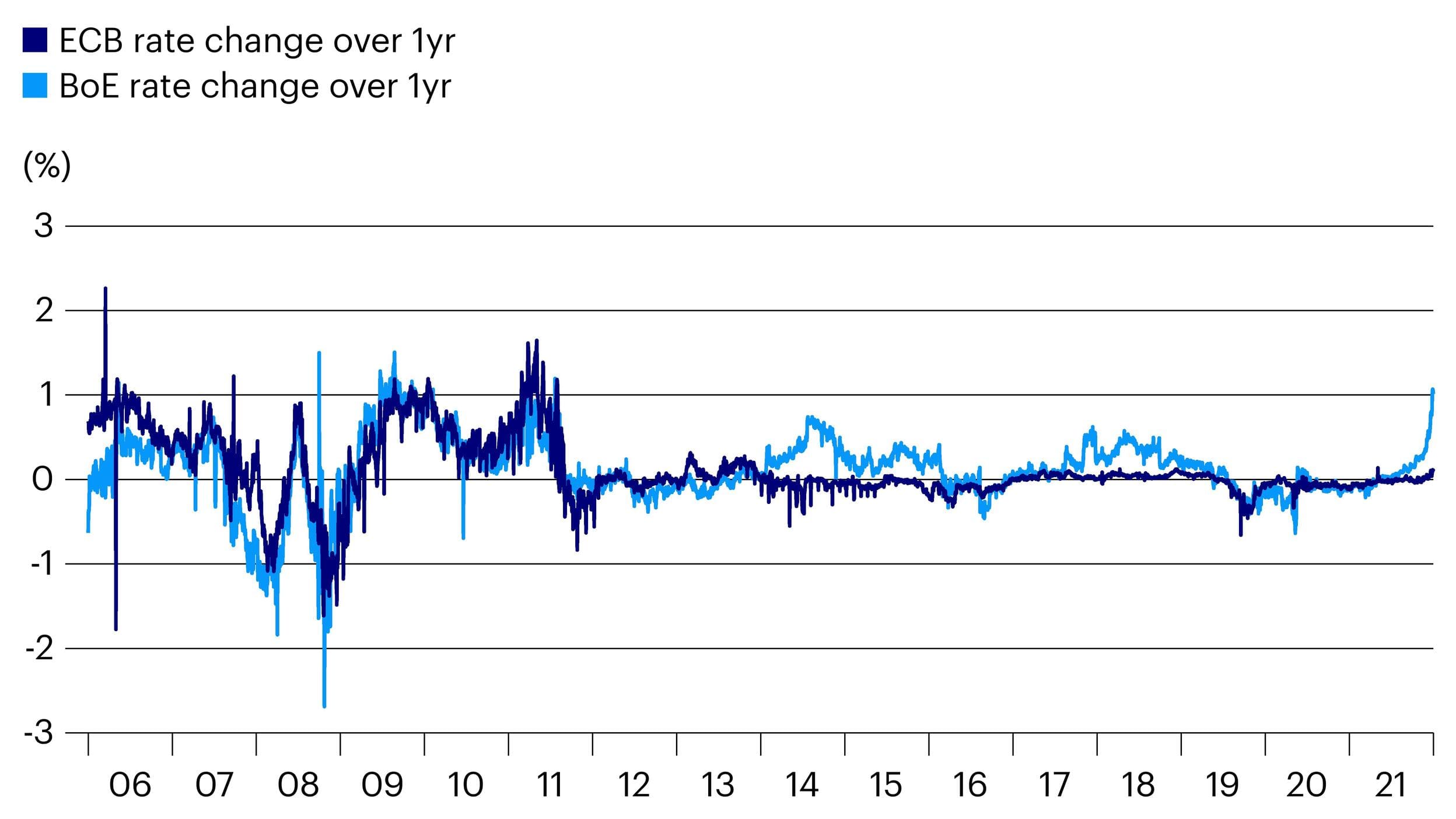

There has been a marked uptick in UK implied interest rate increases relative to the euro area. This poses two questions:

- Will this trend persist?

- To what extent will it influence decision-making within our funds?

Figure 1 below shows the market implied change in interest rates over the next year. The Bank of England (BoE) is expected to hike by 1% whereas the European Central Bank (ECB) is expected to hike by just 0.10%.

Out of sync

The big gap can be partly explained by a different approach to monetary policy between the two banks as the UK and Eurozone economies recover from the pandemic.

The BoE has said interest rates will be the main tool when tightening policy. This means the bank will raise interest rates before tapering asset purchases of government bonds and rowing back from the current policy of quantitative easing. More specifically, the bank will stop reinvesting their asset purchases when rates reach 0.5% – and will actively consider asset sales when rates reach 1%.

In contrast, the ECB has said it will taper net purchases under its asset purchase programme shortly before raising rates.

The elastic band may not stretch further

There are three reasons why the 1yr implied interest rate is unlikely to go much higher in the UK.

Firstly, the gap between the 1yr implied change in ECB and BoE policy is already towards the upper end of the historic range. In fact, it is now at a similar level to a previous period of divergence in 2014. This was when the UK economy was recovering following the Global Financial Crisis and the ECB had been prepping the market for Quantitative Easing and deposit rate cuts.

Secondly, can the smaller UK economy ($2.7 trillion GDP) raise interest rates when the Eurozone ($12.9 trillion) is holding rates steady? Much will likely depend on what happens to capital flows and currency pressure as this may tighten UK financial conditions.

Lastly, the BoE sequencing means rate hikes are unlikely when interest rates reach 1%. At this point, the BoE will move from interest rates to tighten policy by shrinking their balance sheet.

Implications for investment strategy?

We are watching the relative moves of core government bond curves closely. Whilst I am sure this gap between UK and euro money markets is warranted, for the reasons above I think it unlikely that this difference can stretch too much further.

We’ve had relatively low levels of UK duration in our funds and low duration risk overall. As a result, we’ve avoided the capital loss from the recent increase in UK gilt yields.

Related articles

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 27 October 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.