The EU’s approach

The EU has developed a swathe of new regulatory and trade instruments to tackle the perceived unfair trade practices of China and others.

These include the new Foreign Subsidies Regulation (FSR)2, which allows the European Commission to investigate and penalise firms operating within the EU single market if they are suspected of benefitting from foreign subsidies; the International Procurement Instrument (IPI)3, which allows the Commission to penalise foreign bidders if their home country does not offer a reciprocal level of access to tenders for EU firms; and its anti-coercion instrument (ACI)4, which allows the EU to penalise countries that attempt to pressure EU Member States into taking actions that are against their interest.

The FSR has already been used to some effect to investigate China-linked bidders for a Romanian solar project and a Bulgarian contract to manufacture trains, as well as a general investigation into Chinese firms involved in the EU’s offshore wind sector.

In addition to introducing these new trade instruments, the EU has instigated a series of traditional trade defence investigations. These include the high-profile anti-subsidy investigation into imported China-origin electric vehicles and an anti-dumping investigation into Chinese biodiesel.

Electric vehicles anti-subsidy investigation

In October 2023, President von der Leyen announced an EU anti-subsidy investigation into imported Chinese electric vehicles (EVs). Unusually, the investigation was not triggered in response to an industry, or company, complaint, but instead was instigated “ex officio” by the European Commission.

This Commission-led decision to initiate the investigation reflects the lack of consensus among EU automakers as to whether to impose additional tariffs on Chinese EV imports and provides a degree of political cover for those EU companies that fear Chinese retaliation. When gathering evidence for its investigation, the EU focused specifically on three Chinese-owned companies: BYD Group, Geely Group, and SAIC Motor Corporation.

A few months ago, the EU published the preliminary results of its investigation, which found that the “battery electric vehicles (BEVs) value chain in China benefits from unfair subsidisation, which is causing a threat of economic injury to EU BEV producers.”

On 20 August, it published a communication5 outlining new definitive tariffs on China-origin EVs, applied on top of the existing 10% duty. The provisional duties being applied are as follows:

- BYD Group: 17.0%

- Geely Group: 19.3%

- SAIC Motor Corporation: 36.3%

- Other BEV producers in China which cooperated with the investigation but were not sampled: 21.3%

- All other companies: 36.3%

The European Commission also agreed to perform a further company-specific investigation into Tesla, following a request from the company. Imports of Chinese-origin Tesla vehicles would be subject to an additional 9% tariff.

In November, EU Member States will decide whether to impose “definitive” duties, which would result in the tariffs being locked in for five years. For the tariffs to be rejected, 15 Member States representing 65% of the EU population would need to vote against the proposed measures.

In a behind-closed-doors 16 July advisory vote, news reports suggest that only four EU Member States voted against the tariffs (Cyprus, Hungary, Malta, and Slovakia) with 11 abstaining. This means the base case is that, while specific tariff levels could change, the tariffs as proposed will be put on a more permanent footing later in the year.

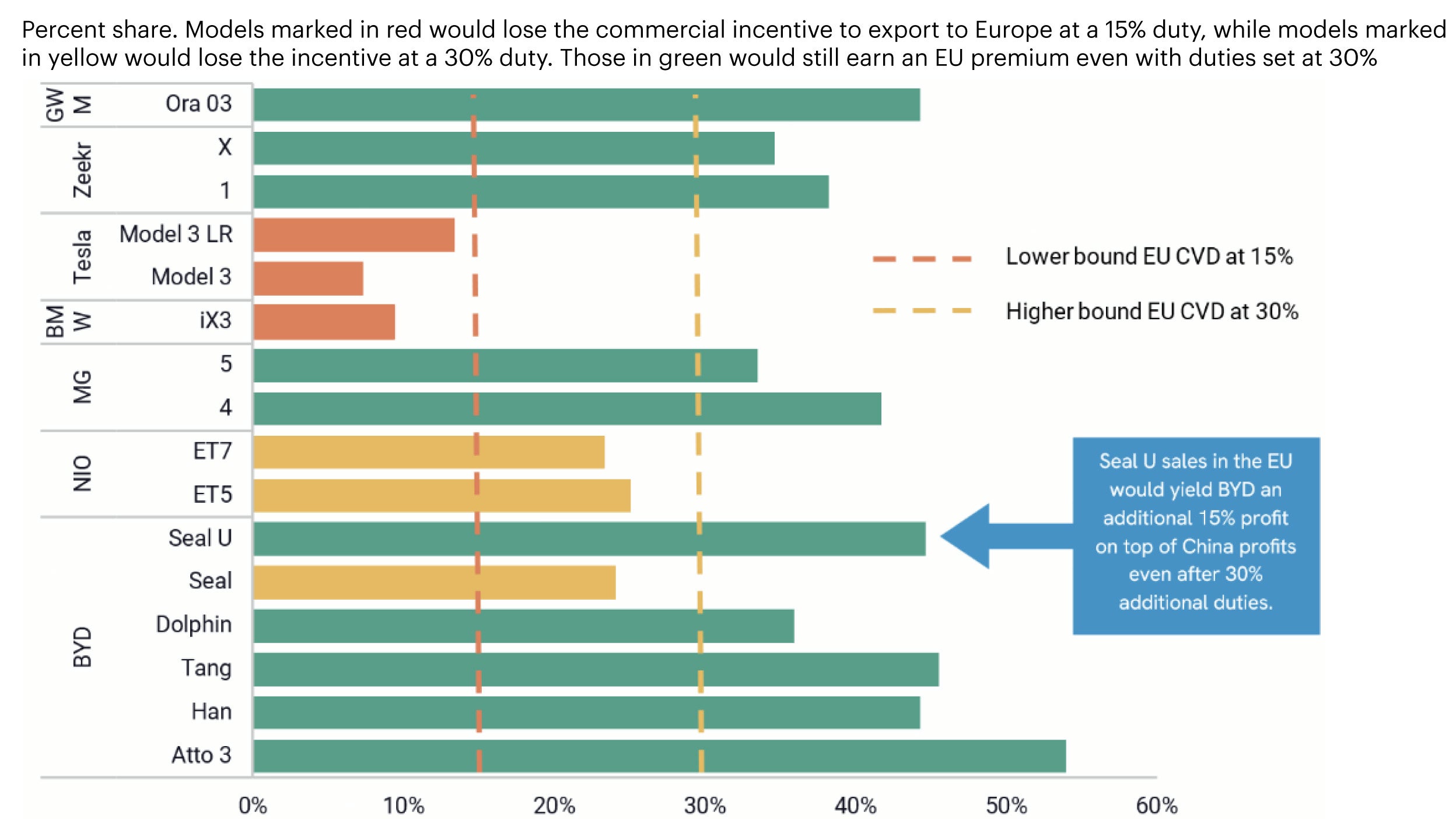

The tariffs are unlikely to shut Chinese EVs out of the EU market entirely, but they may reduce their price advantage. Research by the Rhodium Group suggests that duties in the range of 40-50% or more would be required to make the EU unattractive to Chinese exporters. Indeed, evidence from Rhodium Group suggests that at current levels, EU sales of Chinese BEVs would still be profitable.

![Figure 1: Import Restrictions on Chinese Green Goods[1]](/content/dam/invesco/emea/en/insights/eu-imposes-provisional-anti-dumping-measures-f1-v2.jpg)