Equities Introduction to Factor Investing

Equities provide a return for bearing investment risk over the long term. The question for an investor is, how to identify stocks with the best return potential given their inherent investment risks.

Invesco Quantitative Strategies manages sustainable multi-factor low volatility equity strategies that aim to deliver superior long-term performance with a below-market level of risk. The investment process is built on three pillars: ESG, Low Volatility and our Multi-Factor model comprising of Momentum, Quality and Value. Time-proven academic research is used to determine the team’s factor definitions which are expected to deliver returns above the industry standard definitions. With more than 20 years of experience in running ESG mandates, sustainability is not new to us.

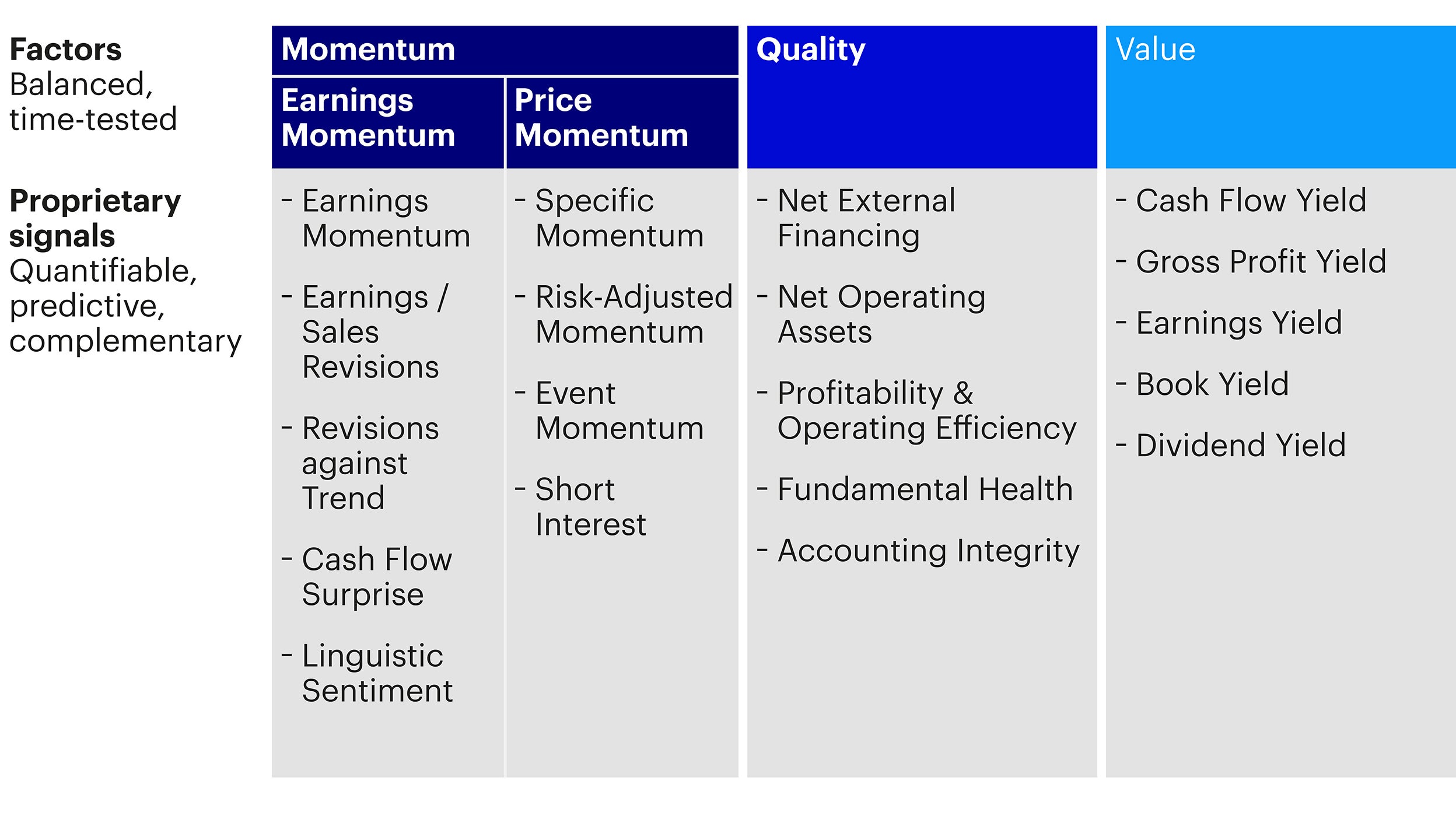

The investment process is built on three major pillars: ESG, Low Volatility and our proprietary Multi-Factor model comprising of Momentum, Quality and Value. Based on in-depth factor research, the team uses proprietary factor definitions which are expected to achieve returns over and above the industry standard factor definitions.

The definitions include the application of Price to Cashflow measures within Value, sophisticated measures of Price Momentum and Earnings Momentum as well as Quality components, such as a fundamental health score (balance sheet strength) or net asset growth (where very high asset growth usually suggests poorer future performance).

These IQS factor definitions are based on widely respected academic research. Improving definitions, as well as utilising alternative data sources, is at the heart of our research process. For an overview of the factors applied in our process, please see figure 1 below.

As markets constantly evolve, the team continuously challenges the investment process. The model evolution is handled with particular care and changes are only implemented if in-depth research proves that changes would enhance the process. Recent enhancements include a linguistic sentiment indicator that complements our Earnings Momentum factors.

For all stocks in the European investable universe (close to 1,000 companies), the team calculates daily factor scores. These scores are then compared with the average factor exposure of all other companies in the same peer group, (i.e. the same industry and region). In a final step, all factor scores are aggregated to a multi-factor attractiveness score for each stock. The higher the score, the more the stock reflects the intended characteristics that are driving the return.

At the same time, a proprietary risk model determines a corresponding risk forecast for each stock in the universe using the same multi-factor building blocks. The risk assessment also includes a measure of a stock’s volatility as well as correlation effects.

ESG criteria are added to the investment universe in order to promote sustainability within the fund. As regards energy transition, our best-in-class approach promotes stocks which are making notable progress towards a greener economy and are in a position to cope well with any imminent climate change. Another key objective is to reduce the portfolio’s carbon footprint. Furthermore, stocks involved in controversial business activities are excluded.

Through a portfolio optimisation process, the combination of stocks that maximises the exposure to the intended return factors for a target level of portfolio volatility within the defined ESG investable universe is determined. Simultaneously, the optimisation algorithm ensures, a reduction in carbon intensity and a stronger ESG score than the benchmark. Liquidity characteristics and diversification parameters are embedded in the optimisation process with the targeted volatility level typically being halfway between market risk and the lowest risk achievable from a fully invested portfolio (i.e. the minimum variance portfolio).

Using this optimisation approach, the portfolio achieves exposures to two additional intended factor characteristics that can improve the risk-adjusted performance over the cycle, Low Volatility and Size. Research (Haugen and Heins1) has shown that higher risk does not necessarily translate into higher returns and low volatility shares have outperformed those with high volatility over the long-term on a risk-adjusted basis.

This has led us to believe that a strategy focused on achieving market returns while taking on risk below the market risk level is an attractive option for investors. This is one of the three objectives that our multi-factor low volatility strategy aims to achieve:

To achieve these three objectives, the portfolio only allocates to stocks in our ESG investable universe that offer the intended factor exposures. While traditional indices may apply a market cap weighting scheme, this strategy’s weights are derived from the stocks’ factor exposures. This leads to a “Size effect” (i.e. a smaller average market cap than the index).

In detail, the optimisation is achieved in two steps:

The resulting portfolio typically holds a diversified mix of stocks and has diversified factor exposures aimed at capturing the long-term premia of the factors Momentum, Quality, Value, Size and Low Volatility while exhibiting superior ESG characteristics.

The process is generally very flexible and can adjust to individual clients’ needs.

1 Haugen, Robert A. and Heins, A. James, On the Evidence Supporting the Existence of Risk Premiums in the Capital Market (December 1, 1972). Available at SSRN: https://ssrn.com/abstract=1783797 or http://dx.doi.org/10.2139/ssrn.1783797

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.