Monthly Market Roundup

In our monthly market roundup for November, Invesco experts provide a rundown of a mixed month for global equities and an update on the fixed income markets.

In December 2023, President of the European Commission Ursula von der Leyen stated that the EU will “not be able to tolerate that our industrial base is undermined by unfair competition.”

Since then, European Commission has imposed provisional tariffs on China-origin electric vehicles (EVs) and biodiesel after separate investigations found that they had been sold in the EU at unfairly low prices.

EU decisions on whether to impose definitive tariffs on Chinese EVs and biodiesel are expected to be taken in November 2024 and February 2025, respectively.

Western policymakers have become increasingly concerned about the global dominance of Chinese producers of green technologies and so-called overcapacity.

In December 2023, following a meeting with the Chinese President Xi Jinping, President of the European Commission Ursula von der Leyen told reporters that the EU will “not be able to tolerate that our industrial base is undermined by unfair competition”. The remarks echoed those of US Treasury Secretary Janet Yellen, who told Chinese Vice Premier He Lifeng that Beijing’s economic policies threaten American workers.

More broadly, according to Global Trade Alert, since 2021 countries around the world have imposed an average of one trade restriction every other day on imports of environmental goods from China.

![Figure 1: Import Restrictions on Chinese Green Goods[1]](/content/dam/invesco/emea/en/insights/eu-imposes-provisional-anti-dumping-measures-f1-v2.jpg)

Source: Global Trade Alert

The EU has developed a swathe of new regulatory and trade instruments to tackle the perceived unfair trade practices of China and others.

These include the new Foreign Subsidies Regulation (FSR)2, which allows the European Commission to investigate and penalise firms operating within the EU single market if they are suspected of benefitting from foreign subsidies; the International Procurement Instrument (IPI)3, which allows the Commission to penalise foreign bidders if their home country does not offer a reciprocal level of access to tenders for EU firms; and its anti-coercion instrument (ACI)4, which allows the EU to penalise countries that attempt to pressure EU Member States into taking actions that are against their interest.

The FSR has already been used to some effect to investigate China-linked bidders for a Romanian solar project and a Bulgarian contract to manufacture trains, as well as a general investigation into Chinese firms involved in the EU’s offshore wind sector.

In addition to introducing these new trade instruments, the EU has instigated a series of traditional trade defence investigations. These include the high-profile anti-subsidy investigation into imported China-origin electric vehicles and an anti-dumping investigation into Chinese biodiesel.

In October 2023, President von der Leyen announced an EU anti-subsidy investigation into imported Chinese electric vehicles (EVs). Unusually, the investigation was not triggered in response to an industry, or company, complaint, but instead was instigated “ex officio” by the European Commission.

This Commission-led decision to initiate the investigation reflects the lack of consensus among EU automakers as to whether to impose additional tariffs on Chinese EV imports and provides a degree of political cover for those EU companies that fear Chinese retaliation. When gathering evidence for its investigation, the EU focused specifically on three Chinese-owned companies: BYD Group, Geely Group, and SAIC Motor Corporation.

A few months ago, the EU published the preliminary results of its investigation, which found that the “battery electric vehicles (BEVs) value chain in China benefits from unfair subsidisation, which is causing a threat of economic injury to EU BEV producers.”

On 20 August, it published a communication5 outlining new definitive tariffs on China-origin EVs, applied on top of the existing 10% duty. The provisional duties being applied are as follows:

The European Commission also agreed to perform a further company-specific investigation into Tesla, following a request from the company. Imports of Chinese-origin Tesla vehicles would be subject to an additional 9% tariff.

In November, EU Member States will decide whether to impose “definitive” duties, which would result in the tariffs being locked in for five years. For the tariffs to be rejected, 15 Member States representing 65% of the EU population would need to vote against the proposed measures.

In a behind-closed-doors 16 July advisory vote, news reports suggest that only four EU Member States voted against the tariffs (Cyprus, Hungary, Malta, and Slovakia) with 11 abstaining. This means the base case is that, while specific tariff levels could change, the tariffs as proposed will be put on a more permanent footing later in the year.

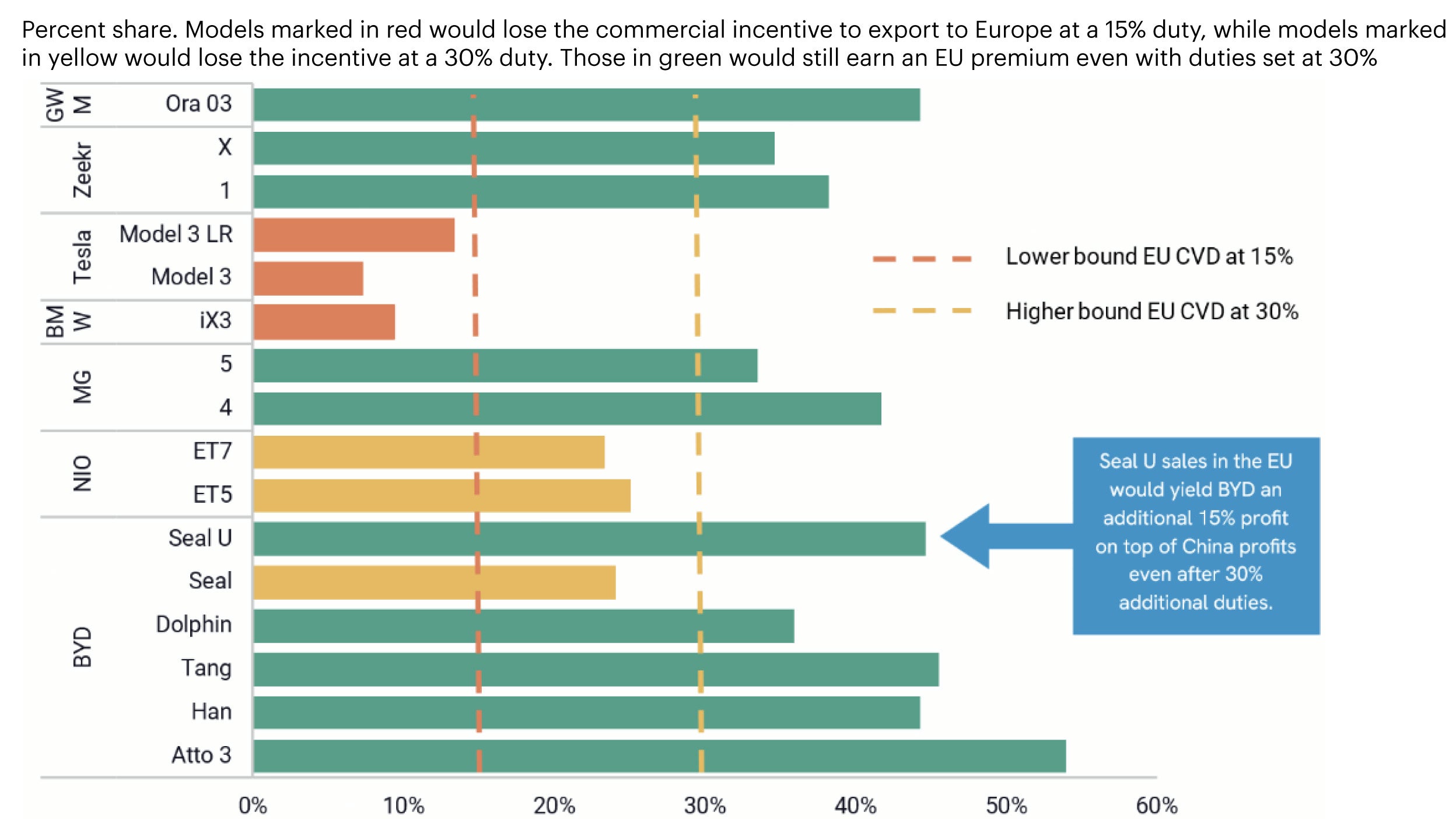

The tariffs are unlikely to shut Chinese EVs out of the EU market entirely, but they may reduce their price advantage. Research by the Rhodium Group suggests that duties in the range of 40-50% or more would be required to make the EU unattractive to Chinese exporters. Indeed, evidence from Rhodium Group suggests that at current levels, EU sales of Chinese BEVs would still be profitable.

Source: Rhodium Group

Notes: Manufacturer's suggested retail prices (MSRP) as of March 27, 2024. Price in the EU for Germany.

Unlike the application of anti-dumping measures on imports of Chinese EVs, which were initiated politically, the EU’s investigation in relation to Chinese biodiesel imports follows continued industry complaints.

The alleged dumping has led to reduced biodiesel production in the EU, with the European Biodiesel Board (EBB) suggesting that the EU’s biodiesel industry may not be able to continue if it remains unprofitable, especially when competing against what it sees as fraudulent imports. Indeed, legitimate concerns have been raised about provenance and fraud, with Chinese producers accused of mixing of biodiesel destined for export to the EU with cheaper ingredients, which are then mislabelled in order to qualify for EU renewable energy incentives.

Provisionally, the European Commission has imposed duties of 12.8-36.4% on Chinese biodiesel after finding it is being sold in EU markets at unfairly low prices. However, the investigation is due to continue until February, when definitive tariffs could be set for the next five years.

Notably, the duties will not cover fuels used for Sustainable Aviation Fuel (SAF), as there is not enough local capacity to deliver on EU targets. Chinese imports are required to meet the levels needed – though the EBB has expressed concerns in this regard and has undertaken further discussions with European regulators to include SAFs.

While the duties will be welcomed by EU producers, the region has built up an ample supply of biodiesel in any case. As such, any immediate bounce for the EU industry is expected to be muted.

With contributions from Flint Global.

In our monthly market roundup for November, Invesco experts provide a rundown of a mixed month for global equities and an update on the fixed income markets.

The market greeted a week of economic meetings, executive orders, and important announcements with rising stocks and falling volatility.

Will US inflation rise? Are tariffs a concern? With the new year and a new Trump administration, investors have questions about the economy and markets.

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

1 Source: Global Trade Alert, Zeitgeist Series Briefing #19 – The Green Goods Trade War is in Full Swing, April 2024

2 Regulation (EU) 2022/2560 of the European Parliament and of the Council of 14 December 2022 on foreign subsidies distorting the internal market

3 Regulation (EU) 2022/1031 of the European Parliament and of the Council of 23 June 2022 on the access of third-country economic operators, goods and services to the Union’s public procurement and concession markets and procedures supporting negotiations on access of Union economic operators, goods and services to the public procurement and concession markets of third countries

4 Regulation (EU) 2023/2675 of the European Parliament and of the Council of 22 November 2023 on the protection of the Union and its Member States from economic coercion by third countries

5 European Commission, China BEVs investigation draft definitive findings, August 2024

6 Source: Rhodium Group, Ain’t No Duty High Enough, April 2024

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

All data as of August 14th, 2024, unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.

EMEA3791376