2022 Mid-Year Investment Outlook

While COVID-19’s remarkable effects on economies and policies remain top of mind, a new set of uncertainties has entered the picture.

Executive summary

Historic pandemic-era moves by both fiscal and monetary policymakers have reawakened inflation, and Russia’s invasion of Ukraine has exacerbated these inflationary pressures and hindered economic growth through a surge in commodity/energy prices. Markets are contending with all this just as some major central banks are tightening policy. We explore what this all might mean for investors in the second half of 2022 and beyond.

Inflation: The critical question for investors

Transcript

Kristina Hooper (00:05):

Hi, I'm Kristina Hooper, chief global market strategist at Invesco, and it is my privilege to introduce you to the mid-year 2022 outlook.

Kristina Hooper (00:15):

Now, let me start by explaining our objective in formulating an outlook. Our goal is really twofold — to meet client requests for a macro outlook with asset class implications, while also honoring our commitment to the value of diversity of thought. Needless to say, this was an incredibly collaborative effort, pulling together thought leaders and investment professionals from all over Invesco. Now, we come together and collectively create a framework, as opposed to a specific outlook. That’s because with a framework, we can provide a macro scenario that we believe is most likely, but also offer two alternate scenarios that clients might anticipate along with asset implications in the event either scenario were to come to fruition.

Kristina Hooper (01:02):

Much of the world continues to move past the COVID-19 pandemic — much, but not all. Now, having said that, its remarkable effects on economies and policies remain top of mind as a new set of uncertainties enter the picture. Historic pandemic era moves by both fiscal and monetary policy makers have already reawakened inflation after a multi-decade slumber in most economies. Then, Russia's invasion of Ukraine exacerbated these inflationary pressures, while also exerting downward pressure on economic growth through a surge in commodities, especially energy prices.

Kristina Hooper (01:42):

Now, markets are contending with all of this, just as some major central banks are tightening policy. So, our outlook seeks to assess the balance of geopolitical risks against a backdrop of elevated global inflation and diverging monetary policy.

Kristina Hooper (01:59):

We assume in our base case that hostilities continue at about their current level without any major escalation or de-escalation intentions that might cause an abrupt disruption to Russian energy supplies to Europe.

Kristina Hooper (02:13):

In this scenario, in the US, we expect continued momentum from the post-Omicron reopening to help sustain growth despite the Fed's focus on reaching a neutral policy rate as quickly as possible during 2022, in addition to shrinking its balance sheet.

Kristina Hooper (02:31):

In contrast with major developed Western economies, China continues to be in a substantially different cyclical position, largely driven by continuing challenges resulting from the pandemic. We expect a reacceleration of Chinese growth in the second half of 2022, largely driven by policy support, both monetary and fiscal.

Kristina Hooper (02:52):

Now, in the first alternate tail risk scenario — what we call the Russian energy cut-off scenario — the world experiences an energy shock by a Russian embargo or European boycott of the energy trade, resulting in significantly higher inflation, especially in Europe. In this scenario, we assume this results in stagflation in Europe, and bites into real incomes throughout the globe, resulting in overall lower global growth.

Kristina Hooper (03:23):

Our other tail risk scenario is the improved war outlook scenario, which of course is a more positive outcome. In this scenario, a surprise de-escalation of hostilities almost eliminates the risk of an embargo or boycott on Russian energy, in turn reducing the current geopolitical risk premium in energy prices, as well as other key commodities. We expect this to yield overall higher growth and expand the leeway for central banks to tighten monetary policy globally.

What do we see ahead?

Chief Global Market Strategist Kristina Hooper summarizes our expectations for the second half of 2022, including the view that continued momentum from the post-Omicron reopening should help sustain growth in the US. She also highlights two alternate scenarios.

Time to watch: 4:10 minutes

Our base case and alternate scenarios

Our base case anticipates slower near-term growth due to elevated commodity prices and a peak in inflation in mid-2022, but a return to more normal levels for both in 2023. We also consider two alternate scenarios. First, if Russia cuts off energy to Europe, we would anticipate higher inflation, weaker growth, and less monetary tightening globally. Second, if tensions with Russia ease, that could lead to decreased inflation, higher growth, and more aggressive monetary tightening.

Inflation is currently well above the Federal Reserve’s “comfort zone.” While markets are anticipating elevated inflation in the near term, longer-term expectations remain reasonably anchored. We believe the remainder of 2022 is likely to bring a slowdown in growth for major developed economies, though we expect growth to pick up to trend rates as economies digest current geopolitical tensions.

Sources: Bloomberg, Macrobond, University of Michigan and Invesco, as of April 29, 2022

Sources: Macrobond, OECD, and US Bureau of Economic Analysis. As of March 31, 2022

We see economies continuing to slow from their elevated post-pandemic growth rates and converging to trend in 2023 – but with key challenges. We expect the US and eurozone to benefit from a post-Omicron reopening in the second half of 2022, gliding into trend growth rates as we move through the year. While Chinese growth faces short-term COVID headwinds, we expect a policy-induced reacceleration throughout the rest of 2022.

Sources: Bloomberg L.P., Invesco, as of April 30, 2022. Dashed lines indicate expected growth path. There can be no assurance that stated figures for future dates will be realized.

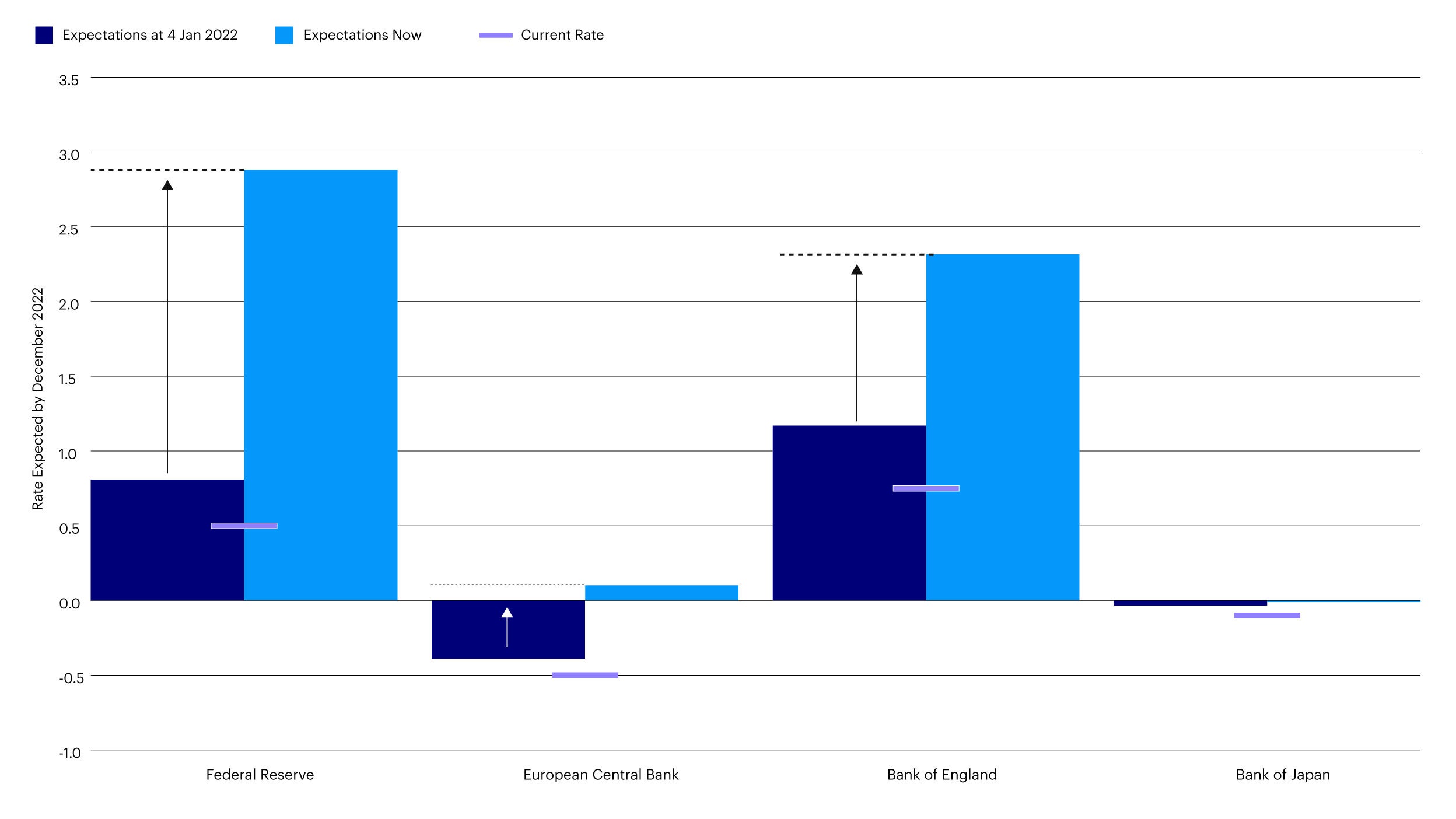

Rapid tightening is expected across the Federal Reserve and Bank of England in an effort to control inflation. We anticipate the Fed’s policy rate to range between 2.50-3.00 by Q1 2023, resulting in a neutral to slightly restrictive policy stance and a flattened yield curve by year-end. In China, we look for slowing growth to moderate over the remainder of 2022 as the impact of COVID fades and policy support takes effect.

Amount of tightening expected in 2022

Sources: Bloomberg and Invesco, as of May 3, 2022. Expectations are based on the implied forward rate expressed in the appropriate overnight index swaps (OIS) curves.

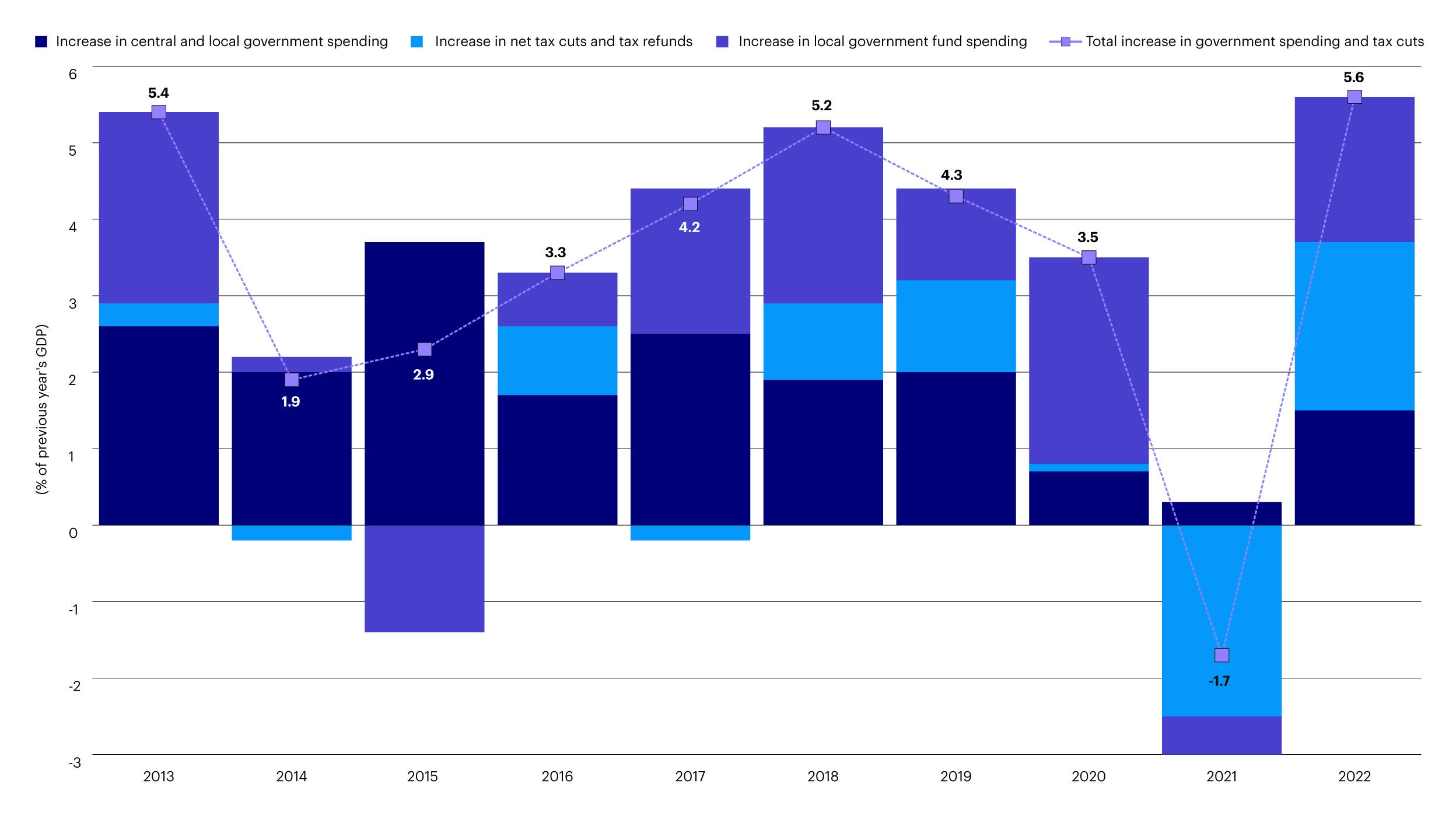

China likely to reaccelerate in second half of 2022

Relative size of China’s fiscal policy stimulus (% of previous year’s GDP)

Source: Estimates by Invesco from Xinhua News Agency. As of May 3, 2022. Lockdown data: Wind, CITI Investment Research.

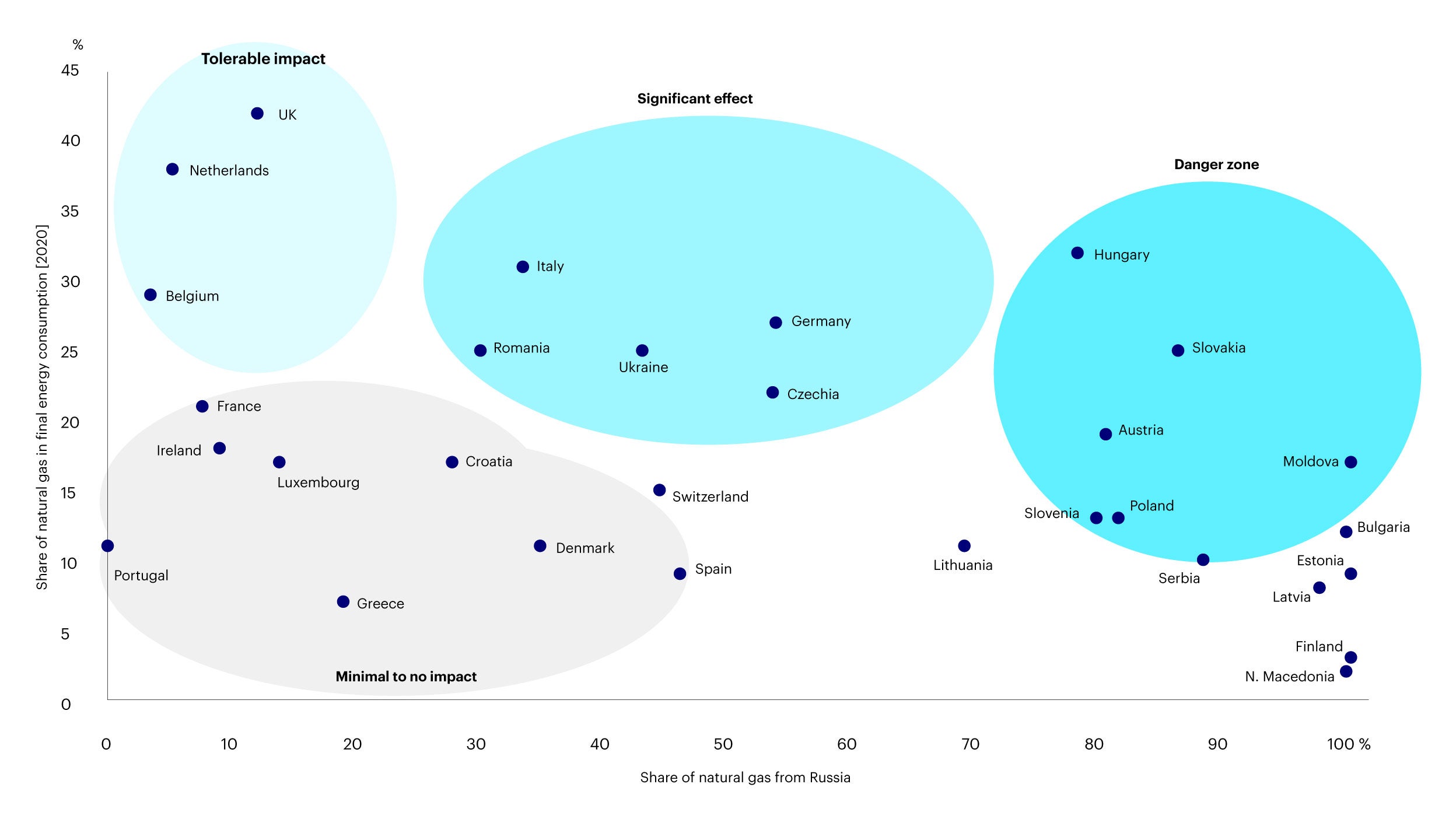

Europe is heavily dependent on Russian energy, especially gas, and we would expect a complete cut-off of Russian energy to lead to greater tensions, potential stagflation in Europe, and higher commodity prices and inflation globally. It is noteworthy that the European Union (EU) has already announced plans to end purchases of Russian oil by the end of 2022.

Russian energy in Europe

Source: Bruegel: McWilliams, B., Sgaravatti, G., Tagliapietra, S. and G. Zachmann (2022) “Preparing for the first winter without Russian gas,” Bruegel Blog, Feb. 28, 2022

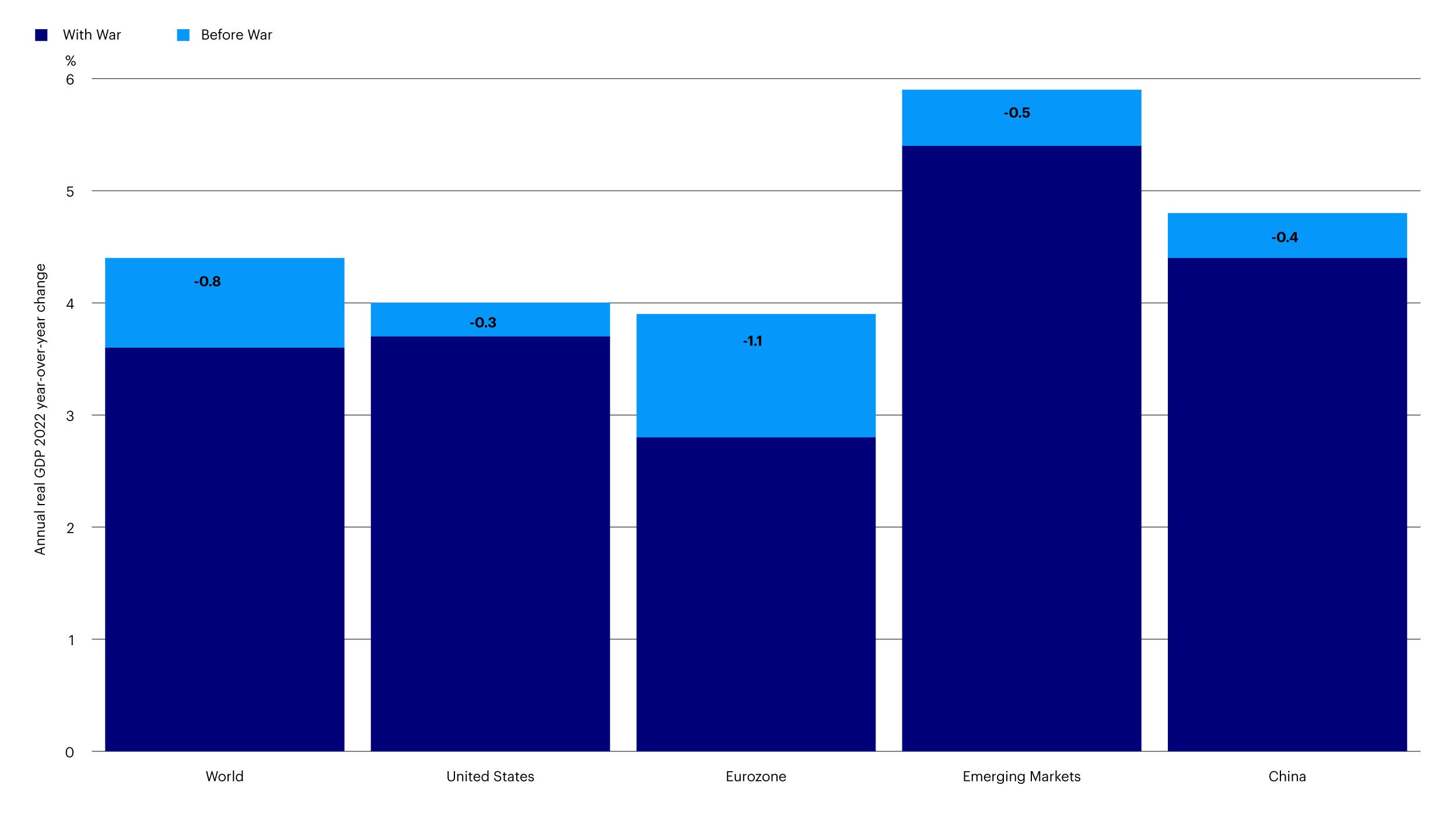

A significant easing of tensions would likely result in a rebound in global GDP as geopolitical risk premia on key commodities fade more quickly. However, the impacts of lost harvests, destruction of infrastructure, sanctions, and change of energy strategy are likely to have lasting implications, so we would not expect growth forecasts to immediately return to pre-invasion levels or inflationary pressures to disappear completely. We would therefore anticipate more aggressive monetary policy tightening for most major developed central banks under this scenario.

International Monetary Fund (IMF) 2022 growth forecasts, before and with Russia-Ukraine war

Sources: IMF World Economic Outlooks, January 2022 update and April 2022 edition

What are the asset allocation implications?

What does all this mean for investor portfolios? Drill down into the charts below to see which assets we favor within fixed income, equities, commodities and alternatives.

Fixed Income

Footnotes

-

G7 - The Group of Seven (G7) is an inter-governmental political forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States

GDP - Gross domestic product (GDP) is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

Yield curve - The yield curve plots interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates to project future interest rate changes and economic activity.

Download the full investment outlook

A collection of charts that illustrate the details of our base case and alternate scenarios.

Important information

NA2254153

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

All data as of April 30, 2022, unless otherwise stated. All data is USD, unless otherwise stated.

The document contains general information only and does not take into account individual objectives, taxation position or financial needs. Nor does this constitute a recommendation of the suitability of any investment strategy for a particular investor. Investors should consult a financial professional before making any investment decisions. Past performance is not indicative of future results.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Commodities may subject an investor to greater volatility than traditional securities such as stocks and bonds and can fluctuate significantly based on weather, political, tax, and other regulatory and market developments.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.