Equities An increasingly connected world

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

Video games have come a long way since the days of Atari. The consoles have become smaller, the graphics slicker, while the internet now allows you to play video games with friends and almost anyone around the globe. In our opinion, the video games software group stands to gain from the continuing shift towards mobile consumption.

In Figure 1, we can see the substantial growth the gaming market has experienced over the past decade. We can see that a large part of this growth came through mobile games, where sales have been driven by consumers playing casual games on mobile devices.

We can also see a lot of growth in digital revenue. The business model of selling video games has shifted from a physical sale of a disk in a store to a digital sale of a download to a device. This is a positive trend for the video games software industry because of two things.

Firstly, the margin on a download is higher than on a disk sale, and secondly, by selling directly to a consumer and establishing a digital connection, the software company establishes an ongoing relationship with the end-user. This means that once a title has been sold, the software company can sell even more goods related to the game to the end-user, such as an extra map, an extra character or an expansion to the game.

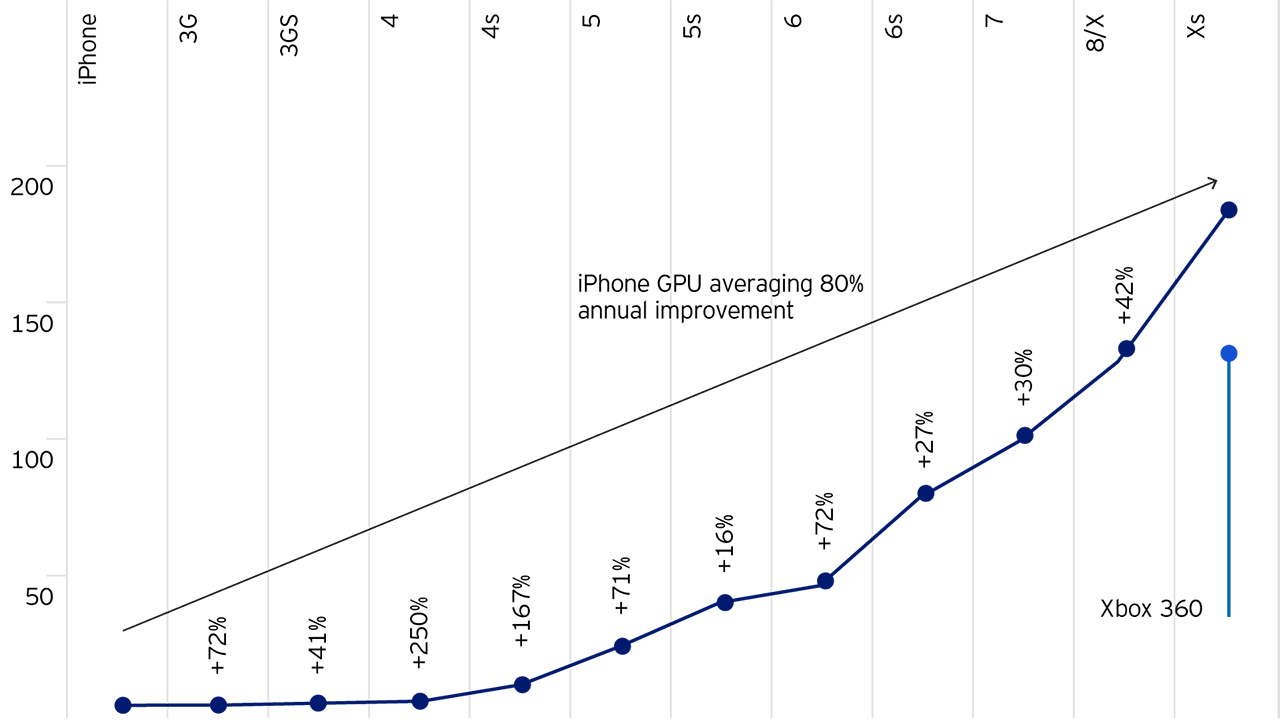

There are other developments that provide us with optimism about the video games software industry. If we look at all the different forms of media that can now be consumed through mobile phones, the only one that has faced real obstacles in the past is video games. Premium video games are not available on mobile, and that’s because they require very strong underlying graphics processing power in the hardware. We believe this is set to change.

Figure 2 illustrates the annual improvement in the graphics processing chip of Apple’s iPhone. Here, we can see that the most recent update of the device (the iPhone XS) has now surpassed the prior console cycle (the XBOX 360). At this pace, mobile phones have the potential to catch up with the current console cycle three to four years down the line.

Now, why is this so important? The answer lies in the numbers: the addressable market of smartphones is over three billion large, whereas the addressable market that we are currently selling premium video games into (the PC and console market) is only about 500 million users large. If we were to sell the premium games of the industry into a smartphone-addressable market, we would therefore be talking about a potential six-fold increase in market size. In the software industry, the incremental margins are very high on every incremental sale, so this could be a very powerful driver of growth.

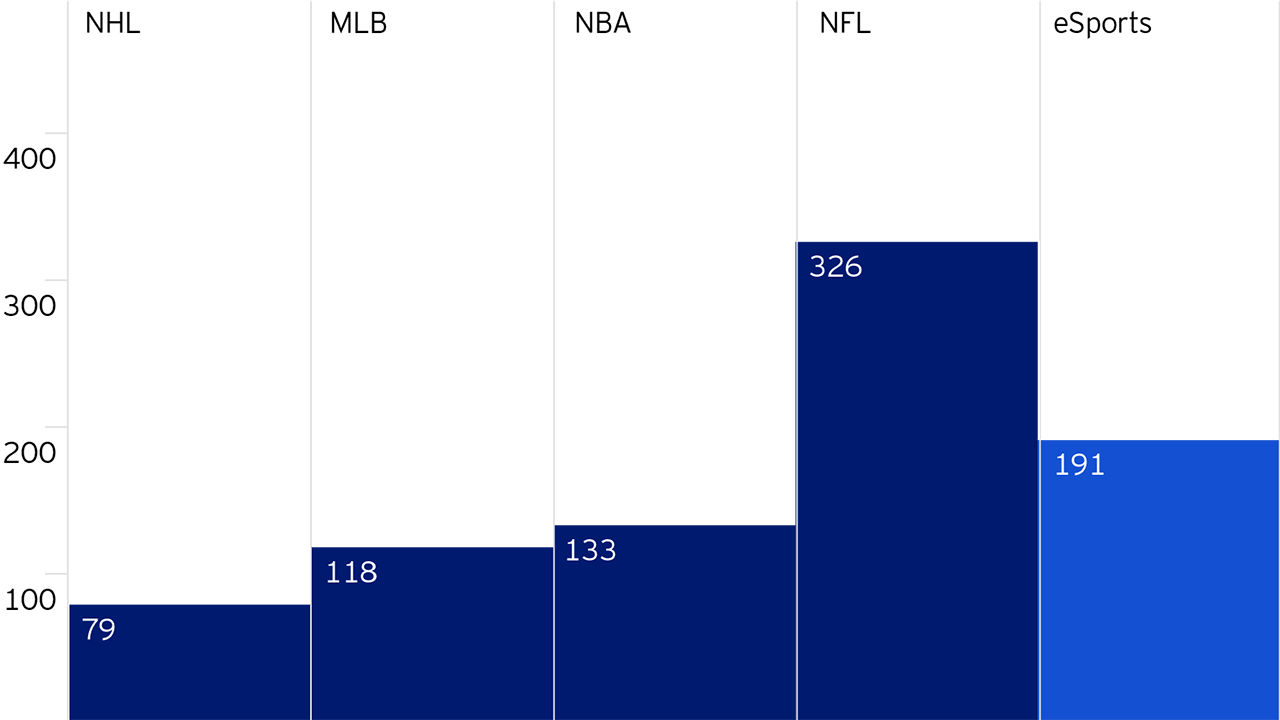

During the heyday of arcades, it wasn’t uncommon for people to huddle around a machine to watch a player beat a record. But as video games moved into homes, playing video games became more of a private affair. However, recent years have seen us move back to where it all started. Not only are we playing more video games today, technology has also enabled us to watch other people play – this is called eSports.

In Figure 3, we can see that eSports now attracts a larger viewership than many of the traditional sports. However, unlike traditional sports, which have the power to make billions each year, monetization in eSports is still very low.

To begin to grow the revenue in eSports, there has to be a formalization of this activity: the formation of teams and leagues, a set schedule, play-offs and championships. It is those events that you can really monetize – they can be sold to a broadcaster that collects advertising revenue against the events, and that is really where the money in sport is derived from. We think we are on the cusp of that in the video games software industry and see a lot of opportunity here.

In 2018 we have seen the video games industry face a number of challenges. The whole Chinese video games market has had the issue of increased regulation. Our portfolio has very little exposure to the Chinese video game market, but this has affected the industry overall. There have also been mis-execution issues at two of the largest US companies: EA Games has had games-specific missteps and Activision has had unexpected delays.

To us, these events were idiosyncratic in nature, but together they led to multiple compressions for the whole industry. We believe many of the issues have been transitory, and the industry has seen some recovery in 2019. Moreover, the positive drivers have remained in place: a strong console cycle, a strong downloadable content trend and the increasing processing power of mobile phones. There are also potential new markets ahead of us through new peripherals, such as augmented and virtual reality.

One of the video games companies the Invesco Global Consumer Trends Strategy has exposure to is a company called Take Two Interactive. We believe the company is well-positioned for the direction the video games industry is moving into. It has multiple key franchises, including the best-selling first-person shooter franchise of all time: Grand Theft Auto. It also owns popular sports franchises in NBA 2K and WWE 2K, as well as strong strategy assets in Civilization and X-COM.

We also believe that Take Two stands to gain from geographic expansion into historically PC-dominated markets, as Take Two’s intellectual property resonates globally. However, in the past it has simply faced the challenge of a lack of console gaming in such markets.

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

Devices have played a role in the shift of our media and music consumption towards mobile

For complete information on risks, refer to the legal documents. The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As this fund is invested in a particular sector, you should be prepared to accept greater fluctuations in the value of the fund than for a fund with a broader investment mandate.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements. This marketing document is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. This fund is domiciled in Luxembourg.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.