Equities An increasingly connected world

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

We have shown in previous sections that our world has become increasingly connected, and the adoption of mobile devices has a large part to play in that trend. We have also highlighted how our media consumption has increasingly shifted towards mobile devices, and the one thing we need to ask ourselves is: how is this trend affecting our wireless network requirements?

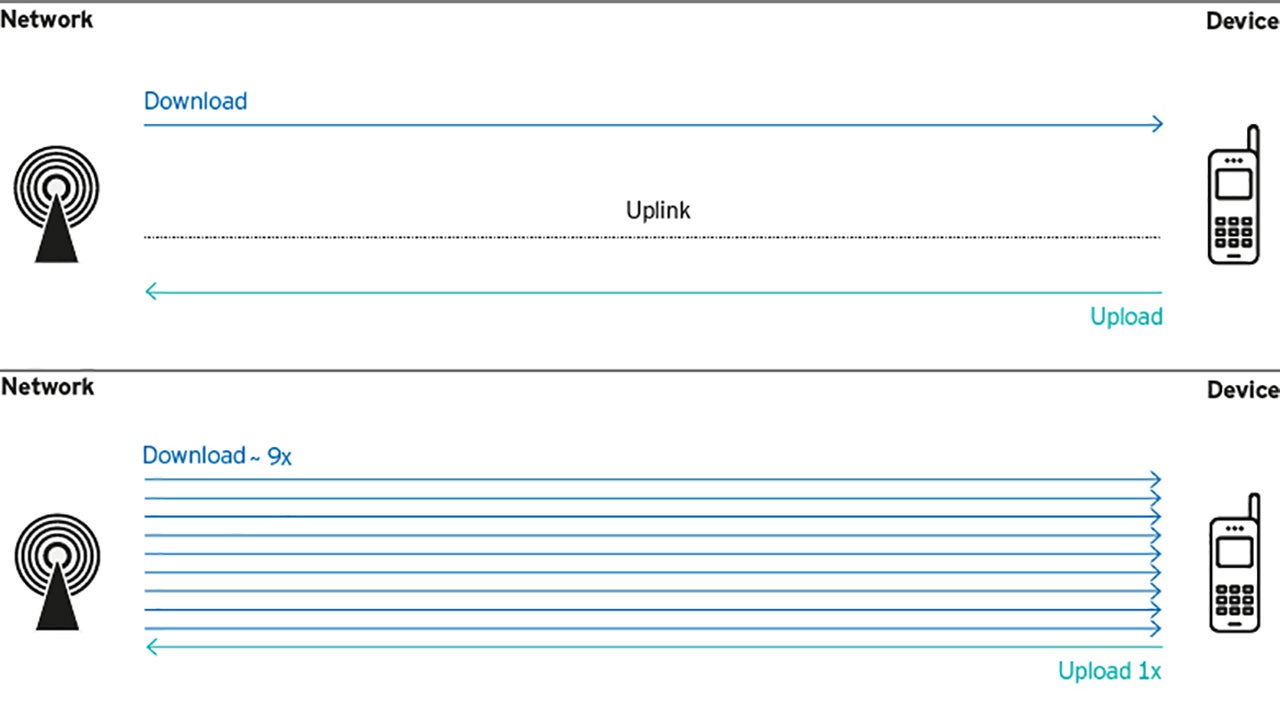

Wireless networks were originally built for a voice use case (Figure 8). In the ‘old world’, traffic flows were symmetric – that means the amount of traffic that flowed from the tower to the handset was similar to that which flowed from the handset to the tower: it’s a conversation.

But now that we are consuming media through our smartphones, traffic flow has changed from symmetric to heavily downstream from the tower to the handset. In our view, this is driving up the value of the downstream capacity, and the scarce asset here is the wireless airwaves. The frequencies that wireless companies get capacity from are hard to get, and the ones that are available for downstream are in our view growing in value because of this paradigm.

Looking ahead, there are also a lot of other use cases that are going to continue to put pressure on this dynamic. Automated vehicles or drones or the Internet of Things in general should all require a lot more capacity from the network.

The Invesco Global Consumer Trends Strategy has exposure to a number of companies with excess wireless licenses that are still undeployed, and which we think are undervalued within those companies.

One of our holdings within the portfolio is Intelsat, which is a Luxembourg-based communications satellite services provider. The company has a portfolio of C-Band spectrum assets that we believe is attractive.1 The use of C-Band frequency ranges has technical and economic advantages to help provide the means to transition away from 4G to 5G, as well as to help manage the increasing mobile broadband capacity constraints.

Additionally, Intelsat is a provider of scarce telecommunications spectrum that is needed to help foster autonomous vehicle communication and connectivity – another long-term growth theme the portfolio is seeking to capitalize from.

1 Spectrum is a broad range of frequencies used to facilitate the transmission data for telecommunications and radio communications.

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

Devices have played a role in the shift of our media and music consumption towards mobile

For complete information on risks, refer to the legal documents. The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As this fund is invested in a particular sector, you should be prepared to accept greater fluctuations in the value of the fund than for a fund with a broader investment mandate.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements. This marketing document is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. This fund is domiciled in Luxembourg.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.