Fixed Income Managing for asymmetrical risk in EM local debt - Planning for a smoother ride

We believe the unique character of locally denominated debt in emerging markets calls for a different look at risk management and manager skill.

The first half of this year has been dominated by the spreading coronavirus pandemic and the policy response to it. The latter has been overwhelming; both monetary and fiscal policy are fully engaged in developed countries and monetary policy is leading the charge in emerging markets (EM).

This immense policy response is well-documented and its impact on markets has been to remove almost all of the funding and balance sheet-related risk premia that were built into valuations in March. In addition, a significant amount of the economic risk premia have also been removed. The impact of policy is best seen in the development of the path of inflation expectations in the US. Over the course of the second quarter, five-year real yields in the US fell by 60 basis points (bps) to -83 bps, while nominal yields fell by ten bps, leading to an increase in inflation expectations of 50 bps.¹

It remains our belief that real yields will need to rally further and inflation expectations will need to increase for risk assets to continue performing.

Other assets that have benefited most have been, as expected, the ones the central banks have focused on. Risk and liquidity premia have largely been removed from assets such as US investment grade, the European periphery and emerging market rates. Other assets – EM high yield comes to mind - have seen a significant reduction in liquidity premia, but a smaller reduction in economic risk. The change in liquidity and funding dynamics has been best reflected in the US dollar. Its rapid ascent was quickly arrested and reversed in the second quarter, with the broad US dollar index ending the quarter nearly 2% lower.²

The evolution of the pandemic and governments’ responses to it will likely continue to drive macro conditions. In most countries (certainly developed markets), health will largely determine the opening or re-closing of economies, which will impact macro variables. However, some EM are likely to have no choice as they cannot afford to close down again, meaning the human toll will likely rise. Even under such an unfortunate scenario, the outcome for growth may not be that different in the short term, as external factors may weigh on EM economies. However, the longer-term effect of additional fiscal spending could impact growth rates for years.

While relatively unpredictable, the current path of the pandemic does not show significant signs of abating globally. The economic outlook will likely continue to be muddled by better data from economic reopening in regions where the virus is under control and worse data from new restrictions, such as in the US. Current global economic data seem to indicate that our base case of an economic contraction of over 6% in the US, nearly 10% in Europe and 5% globally is the most likely outcome. The risks of a more bearish or materially better outcome have diminished significantly. The very high economic volatility seen in Q2 will likely diminish by Q4, however, it is likely we will not return to normal before Q2 2021, when the consensus indicates that we should have a vaccine. Despite the expected reduction in uncertainty, underlying economic activity in the US and globally is highly unlikely to return to trend before 2022.

Under the current conditions of low inflation, a high output gap and high borrowing requirements, we see little limitation to policy responses. Both monetary and fiscal policy are likely to remain fully engaged and cushion the downside, more for markets, but also economically. The US Federal Reserve (Fed) will likely do the heaviest lifting as dollar funding, by virtue of it being the reserve currency, is likely to have the largest impact globally. EM central banks are likely continue to ease policy interest rates, adding to the significant number of rate cuts that have already been delivered. EM central banks have delivered, on average, around 150 bps in total interest rate cuts since the beginning of March 2020.³ While we are at lower bounds in some EM, we believe there is room for additional cuts in many others, such as Mexico, India and Indonesia.

The V-shaped recovery in asset prices has certainly removed a significant amount of the excess risk premia that were priced into markets at the end of the first quarter. We continue to classify investment opportunities into three categories:

The opportunity set in the last category is currently the least attractive, in our view, while we believe the first two categories continue to offer attractive long-term investment potential.

We continue to see attractive opportunities for alpha and capital gains in both EM and developed market rates. For assets that central banks are trying to buy, some of the market dislocation has been corrected, however, given the very uncertain economic outlook they still remain attractive in our view. It continues to be our belief that, for those opportunities in the investment grade space to be realised, real rates in the US must continue to fall. While five-year real rates have fallen to -0.83%, we believe they could continue to fall as economic recovery gains momentum. If the Fed moves to enhanced forward guidance, whether using a form of yield curve control or not, the primary beneficiary should be materially lower real rates.

Similarly, in Europe, after a slow start, the European Central Bank’s (ECB) bond buying is starting to overwhelm market risk aversion. We believe this will continue as there is little restriction on the ECB to continue with this policy, since inflation is likely to disappoint on the downside.

The greatest seismic shift has occurred in EM where interest rates have been lowered to record lows and risk premia have shifted from currency risk to term premia (additional yield earned for holding longer-maturity bonds). The rally in front-end rates is having significant ancillary effects on EM longer-term rates markets. Having benefitted from the first order effects of policy, we are now focused on the second order effects from the same policy changes. Given the expansion of fiscal policy and the excess deficits that would need to be funded, the natural market reaction is to increase term premia. Throughout the past 20 years, EM term premia have often been quite low, being built into front-end rates as currency risk premia. This was generally appropriate given the highly elastic current account deficits. Recently, however, the external accounts of several countries have shown significant improvement for both good (structural changes) and bad (cyclical domestic demand collapse) reasons. This has reduced the need for currency risk premia, which have declined, while increasing the need for term premia so that deficits could be funded on both an unhedged and hedged basis by external investors, domestic banks and other domestic financial intermediaries.

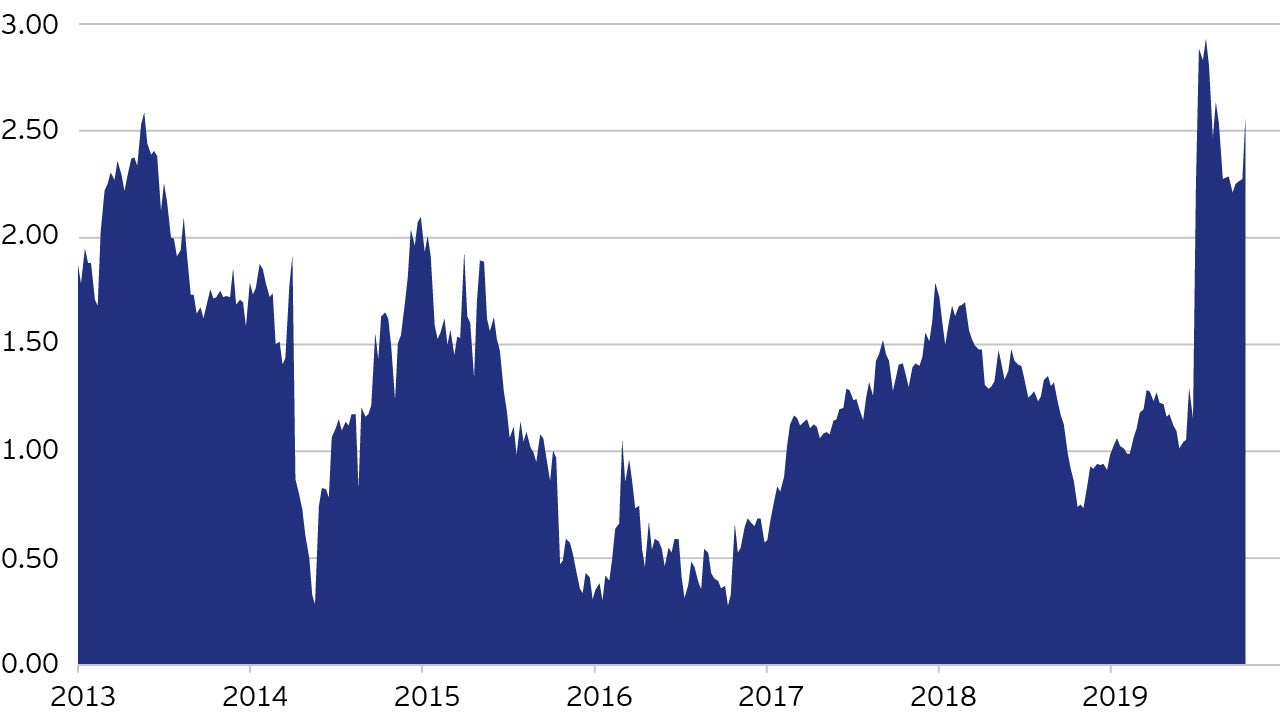

Figure 1 shows overnight rates in several countries (Mexico, Colombia, Russia, South Africa, India and Indonesia, excluding Brazil, where the yield curve is very steep) subtracted from ten-year government bond yields. The increase in term premia is unmistakable in our view.

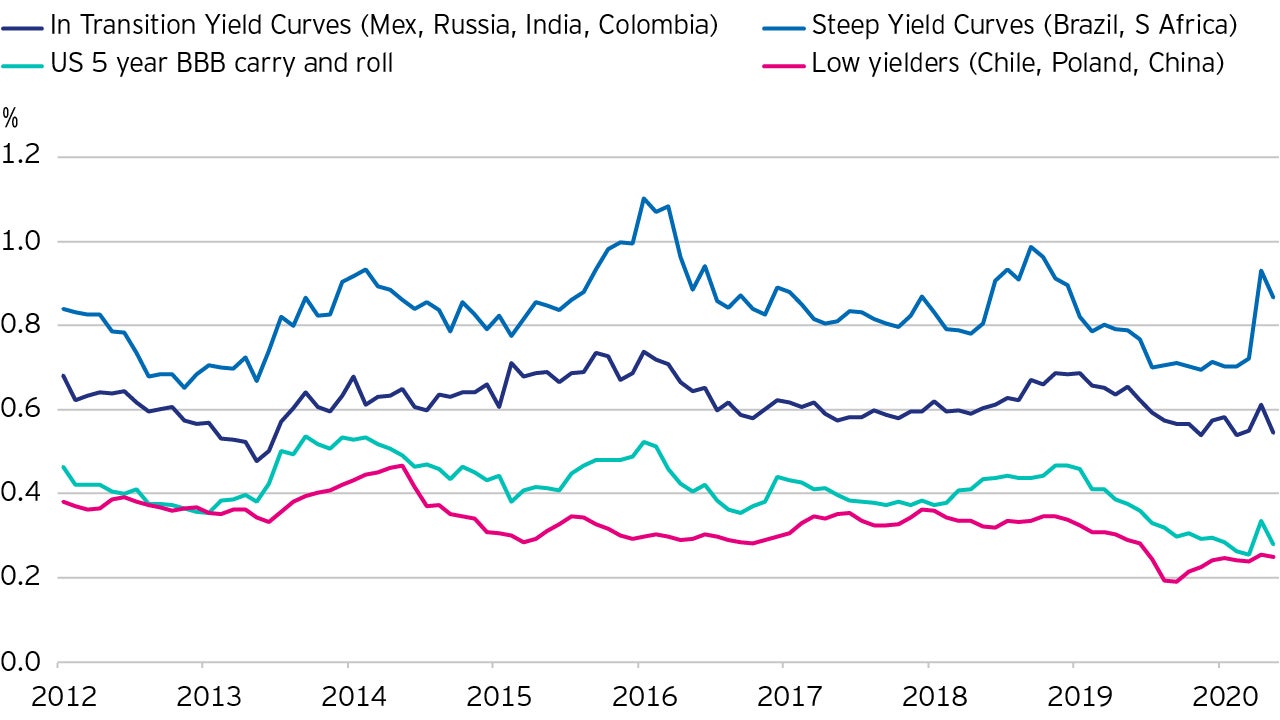

The increase in term premia can be viewed another way - are hedged EM rates competitive with other assets? We looked at five-year EM local government bonds in different countries, segmenting them into low yielding, steep yield curves and those in transition where rates are still being eased. We then compared them to five-year BBB rated US dollar-denominated corporate bonds. We looked at the carry and roll in EM on an unhedged and hedged basis and found them to be competitive for the first time in years.

Figure 2 shows the expected monthly carry plus roll on an unhedged basis (Carry and roll is a bond’s combined expected total return based on its current interest rate and its potential for capital appreciation should it season toward maturity to a lower interest rate, within a steep yield curve environment). As the chart indicates, the recent huge declines in front-end rates in EM have had minimal impact on the expected carry and roll due to the increase in term premia.

Despite the rate cuts enacted by the emerging market central banks, we believe the opportunity set in emerging market rates is remarkably attractive and one we remain focused on for the Invesco Emerging Markets Local Bond Fund.

The opportunities in currency markets is likely to come from developed market central bank actions. Measures taken by the Fed arrested the rise in the US dollar very quickly in April. Since then, the dollar has declined leaving it unchanged from the start of the market dislocation that began in February and barely up on the year.

We continue to believe that the Fed’s long-term injection of liquidity combined with a zero interest rate policy will lead to the depreciation of the US dollar when the current period of risk aversion ends.

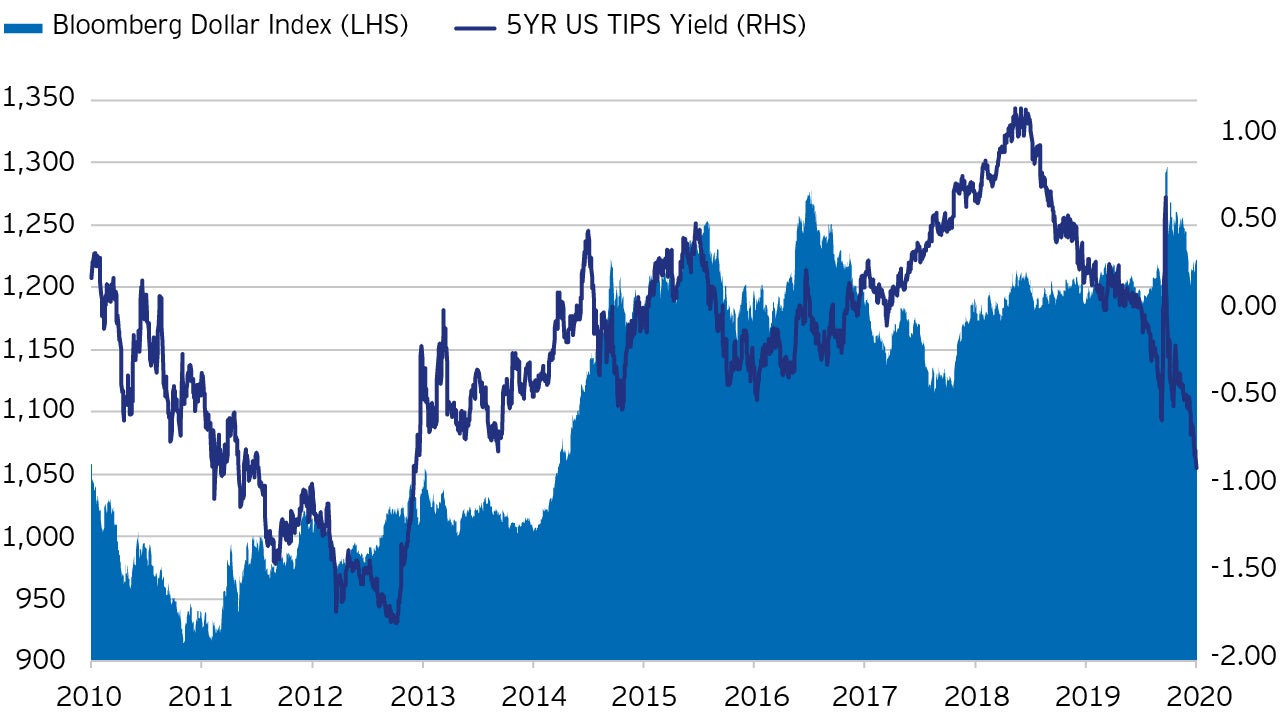

The path of the US dollar is likely to be impacted by the Fed’s exit strategy. If, as expected, it moves to enhanced forward guidance utilising yield curve control, we believe real interest rates in the US will decline to record low levels.

Figure 3 shows that the divergence of the US dollar from the level of real interest rates is reaching historically wide levels. Materially lower real interest rates should remove the interest rate support for an extended period of time in our view.

For credit assets to perform well - outside of those that are systemically important for central banks - we would need to see a resurgence in economic activity and a reduction in economic volatility in our view. The recent rally in prices is related to the removal of liquidity concerns and recently improving economic data. While economic volatility has been reduced, as have bearish and optimistic tail risk probabilities, the base economic case argues for caution. We continue to favour long-dated EM investment-grade bonds and European financials that are critical for the functioning of monetary transmission in the European Union.

Markets have recovered from the selloff in Q1 2020. However, the pandemic has not shown signs of abating and economic volatility, while declining, is unlikely to return to normal metrics before Q2 2021. In such an environment, an investment process that evaluates both fundamentals and valuations is critical to sequencing investments to generate higher excess returns from the current market turmoil.

The seismic shift in global central bank policy has created significant opportunities in EM and developed market rates, which we believe will be the first to be realised. We are also focused on taking advantage of the Fed’s extraordinary policy moves and the expected impact on the dollar. We have been reducing our emphasis on the high-yield credit markets as we believe they will be late in recovering. The fiscal and monetary policy actions in developed market countries have removed some of the longer-term headwinds to EM assets and we remain very constructive on the asset class.

1 Source: Bloomberg L.P. Data from 1 April 2020 to 30 June 2020.

² Source: Bloomberg L.P. Data from 1 April 2020 to 30 June 2020.

³ Source: Bloomberg L.P. Data from 1 April 2020 to 30 June 2020.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Changes in interest rates will result in fluctuations in the value of the fund. The fund uses derivatives (complex instruments) for investment purposes, which may result in the fund being significantly leveraged and may result in large fluctuations in the value of the fund. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund.

The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund. Investments in debt instruments which are of lower credit quality may result in large fluctuations in the value of the Fund. The fund may invest in distressed securities which carry a significant risk of capital loss.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.