US Mid-Term Election Takeaways

The “red tsunami” expected in US mid-term elections did not materialize; it was more of a “red puddle”.

This was very unusual, as mid-term elections in a new president’s term usually result in a power shift into the hands of the opposing party.

In addition, with inflation at 40-year highs and a low approval rating for President Biden, conventional wisdom anticipated a strong rebuke for Democrats.

Instead, exit polling showed that issues such as abortion and political extremism played a significant role in voting decisions.

The good news is that the environment appears to be shifting away from election denials and back to more normalcy, as those candidates have conceded defeat.

Implications from the election results

The election results suggest that Florida Governor Ron DeSantis is the presumptive Republican nominee for president in 2024 for two reasons:

- DeSantis had a very strong election showing;

- Donald Trump’s chosen candidates did not perform well. It seems the Republican Party may be moving away from Trumpism and towards DeSantis as it looks to the future.

Stocks were up in the days leading up to the US mid-term elections, helped by excitement over a likely ‘red wave’ and a divided government.

And so it stands to reason that stocks would be down, as the red wave never materialized in a significant way.

Still uncertainty

There is still uncertainty about the outcome of the elections; it seems likely that the GOP controls the House but it will be by a much smaller margin than expected.

That might not be a bad thing – it might encourage the two parties to work more closely and focus more on compromise and reduce the chances of a serious fiscal gridlock.

The US Senate is still very much up for grabs. We might not know until December which party will be controlling it after the Georgia runoff.

Markets don’t like uncertainty but I would expect volatility in the near term anyway, since we have uncertainty around inflation and central bank policy, so this will only be one more factor adding to it.

Investment Implications

While everyone is laser focused on the mid-term elections, I believe it’s important to note that its impact on markets is pretty irrelevant beyond the very near term.

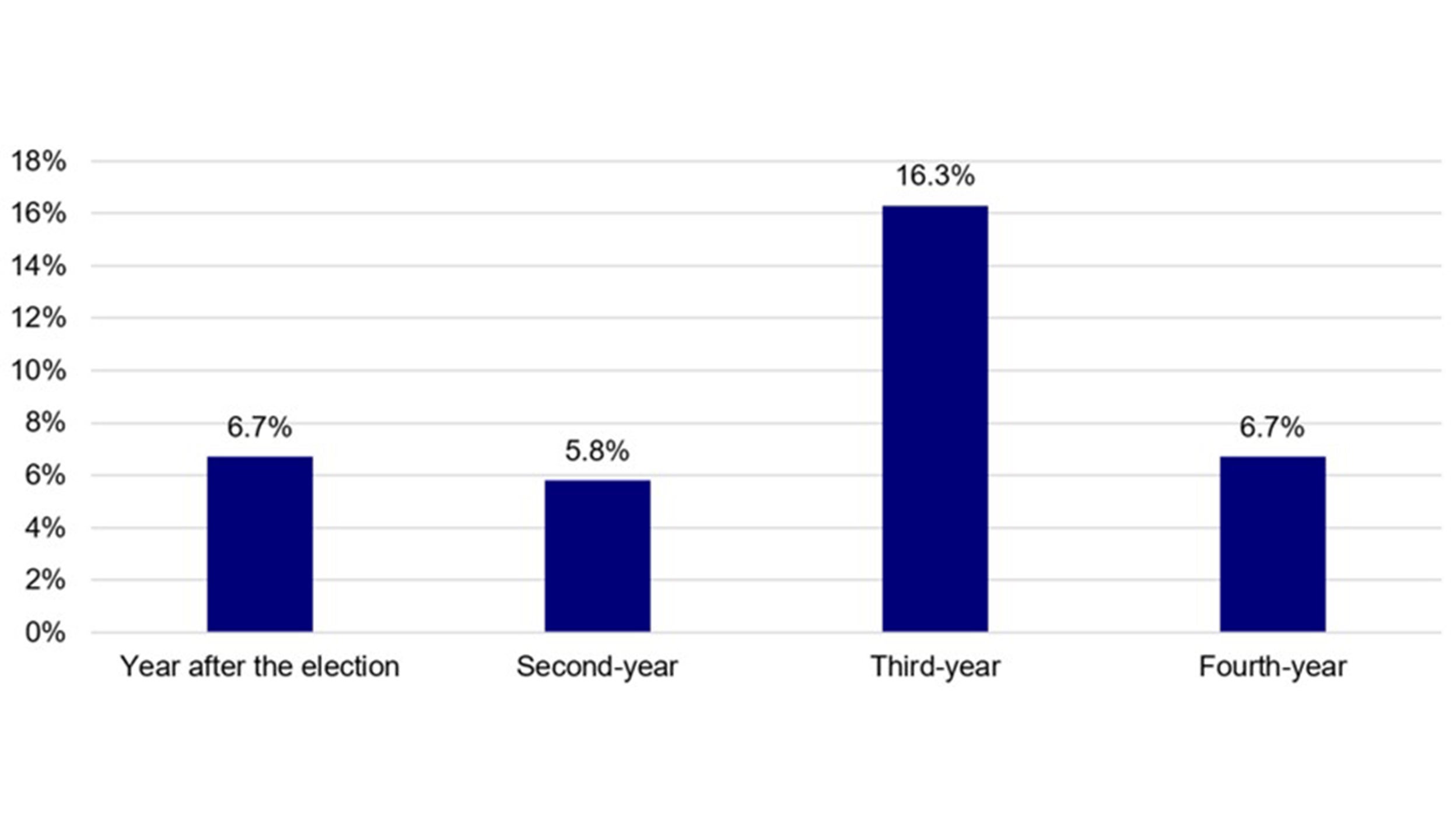

In fact, historically we have seen that the third year in a presidential cycle has been the best year for stock market performance – and that is regardless of the composition of the executive and legislative branches. So investors may not worry about election results.

Source: Charles Schwab. Note: S&P 500 market data between 1933 and 2015.

Investors should be worried about inflation, since that will help to dictate the Fed’s future path. I am hoping for slight improvement over last month.

It would be even better if inflation could clock in slightly lower than expectations – I believe that would give a nice boost to stocks.

But we have to remember that it’s not just about inflation – it’s about inflation expectations. And so I will be focused on the survey results from University of Michigan and New York Fed.

We need to see longer-term inflation expectations moving in the right direction.

An APAC perspective

From an APAC perspective, the absence of a strong Republican mandate and diminishing prospects of another Trump White House lowers the chances of escalating US-China tensions and the associated shrill rhetoric.

This could mean that US-China relations stabilize at current levels. All eyes will now turn to the upcoming Xi-Biden in-person meeting later this month.