US-China trade “decoupling” and the road ahead

The economic links between the US and China are significant. The latest figures indicate that bilateral trade between the two countries is worth in excess of US$750 billion annually.1 Yet since the 2018 trade war there has been much talk of trade “decoupling” between the two countries. The US and China have been implementing policies to reduce their interdependence while also protecting their domestic economies at increasing speed.

China announced its dual circulation economic strategy in late 2020 which involves prioritising the domestic market and domestic innovation while still remaining open to international trade and investment. Policymakers have also imposed market access limits and offered preferential subsidies and funding to support Chinese companies and reduce the dependence on US technology. The US has enacted similar policies in past years such as restricting foreign acquisitions of US firms and expanding the use of export controls in order to prevent sensitive technology transfers.

Notes: Indexed value of US monthly imports, not seasonally adjusted, 12-month trailing sums. Pre-trade war trend based on US imports from the world from August 2016 through June 2018.

Source: PIIE, US import data from US Bureau of the Census, data as of August 2022.

In the last few months in particular, American protectionist policies have become more pronounced, specifically in advanced technology sectors such as semiconductors, biotechnology, and clean energy, where Chinese firms are strong competitors.

In August, President Biden signed the Inflation Reduction Act which will offer tax credits to consumers that buy electric vehicles (EVs) assembled in North America. The legislation states that as of January 2024, at least 40% of the critical minerals in the EV battery component must come from the US or a country that it has signed a free trade agreement with, while the battery itself must have at least 50% of North American content.2 Biden also signed an executive order to strengthen domestic biotechnology and bio-manufacturing and cut reliance on foreign companies in September.3

The latest development in October was the restriction on the sale of semiconductors and chipmaking equipment to China. The move is significant and a 2021 report by the U.S. Chamber of Commerce found that a loss of access to Chinese customers could cost the U.S. semiconductor industry $54 billion to $124 billion in lost output, risking more than 100,000 jobs, $12 billion in R&D spending, and $13 billion in capital spending.4

Investment implications

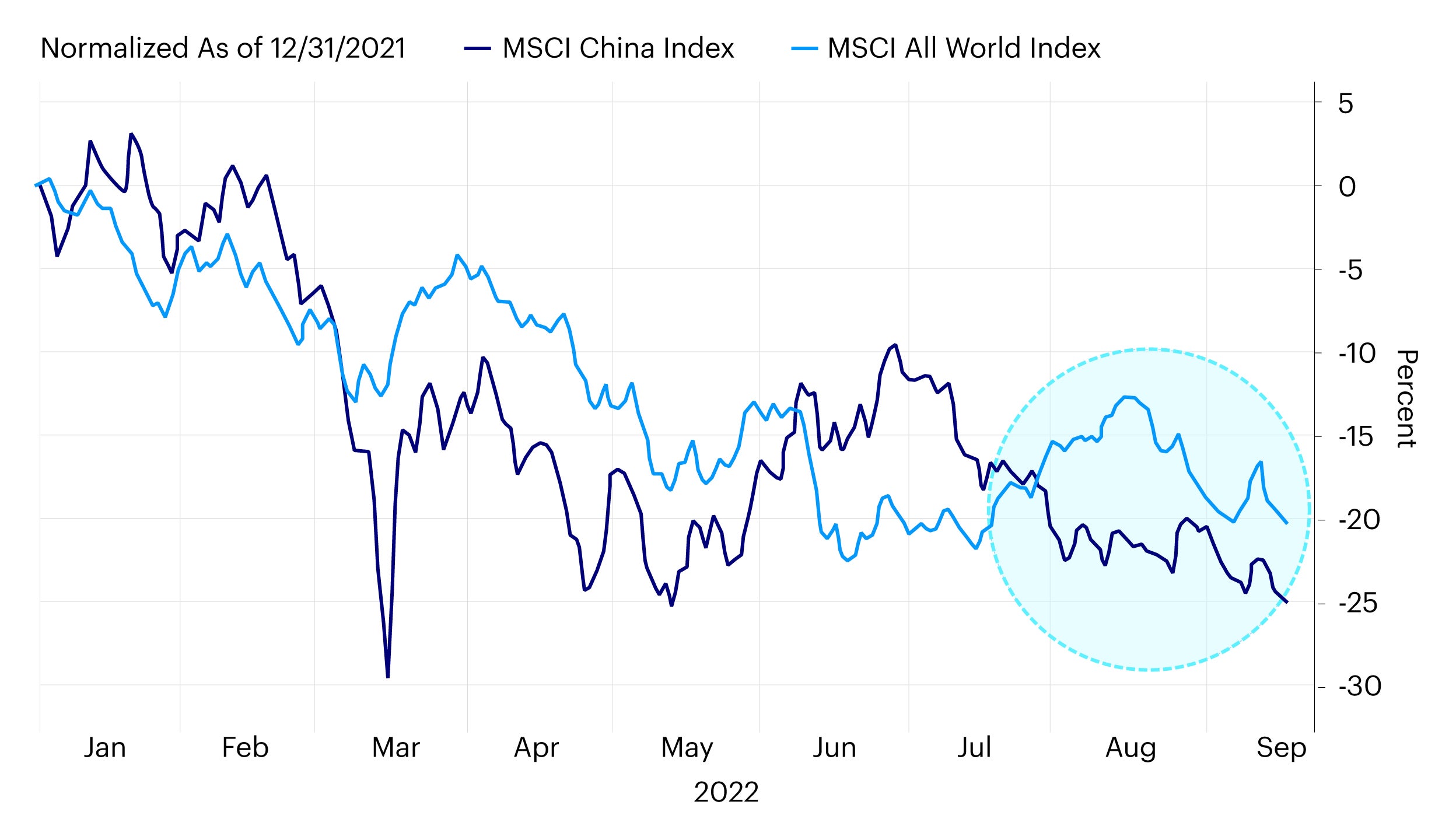

These policy developments have been impacting China’s hard-hit stock market which has also been affected by ongoing Covid restrictions and stress in the property market. The MSCI China Index is among the worst-performing major benchmarks this year (Figure 2).5 Though recent announcements on Covid quarantine changes as well as measures to support the property sector have since led to a rally in the index, sentiment among international investors towards the world’s second-largest stock market is still mixed.6

We expect Chinese companies to remain competitive in areas such as electric vehicles and renewable energy where they have strong policy support and competitive advantages throughout the supply chain, and therefore are much less vulnerable to geopolitical risks.

The recent tech curbs are of course negative for Chinese chip manufacturing companies and supply chain, however in the long run we expect China will invest heavily in developing its own chip supply chain with indigenous technologies that could bring opportunities for upstream chip-related materials and machinery sectors.

Source: Bloomberg, data as of 18, September 2022. Note: Data normalised as of 31/12/21. Past performance is not a guide to future returns.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Sino-US Tensions Here to Stay but Decoupling Advances Slowly, November 2022, https://www.fitchratings.com/research/sovereigns/sino-us-tensions-here-to-stay-decoupling-advances-slowly-10-11-2022

-

2

What the world thinks about the new US electric vehicle tax plan, November 2022, https://www.weforum.org/agenda/2022/11/not-everyone-is-happy-with-the-new-us-electric-vehicle-tax-plan-heres-why/

-

3

China Biotech Rout Shows Growing Pain From US Decoupling Drive, September 13, https://www.bloomberg.com/news/articles/2022-09-13/china-biotech-rout-shows-growing-pain-from-us-decoupling-drive

-

4

Understanding U.S.-China Decoupling: Macro Trends and Industry Impacts, February 2021, https://www.uschamber.com/international/understanding-us-china-decoupling-macro-trends-and-industry-impacts

-

5

US-China Tech Rivalry Adds to Headaches for Stock Investors, September 2022, https://www.bloomberg.com/news/articles/2022-09-18/us-china-tech-rivalry-adds-to-headaches-for-stock-investors

-

6

China Investors Look for Turning Point After $370 Billion Rally, November 2022, https://www.bloomberg.com/news/articles/2022-11-24/china-investors-identify-trigger-points-to-buy-as-economy-opens