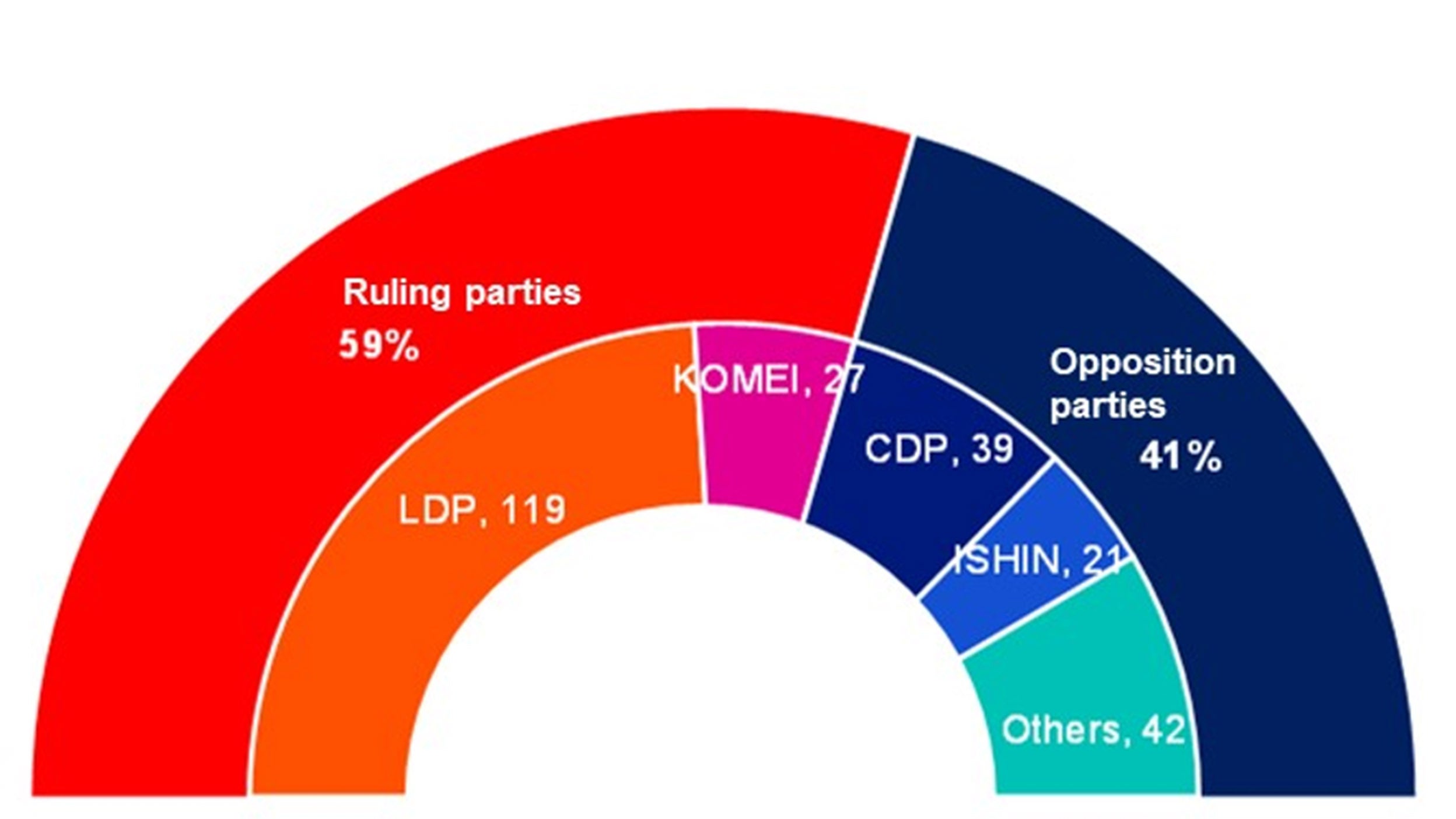

The result of Japan’s Upper House election – the ruling coalition parties marked another big victory

Just two days after the assassination of former Prime Minister (PM) Shinzo Abe shocked Japan, the ruling Liberal Democratic Party, in which Abe led the largest political faction, and its junior coalition partner Komeito marked another big victory in the Upper House election on 10th July. In the election, half the parliament member of the less powerful Upper House was elected, and the result is typically seen as a referendum on the current government. Now voters granted PM Fumio Kishida three years to pursue his “new form of capitalism” plans before the next general election in 2025.

As at 11 July 2022.

Source: NHK

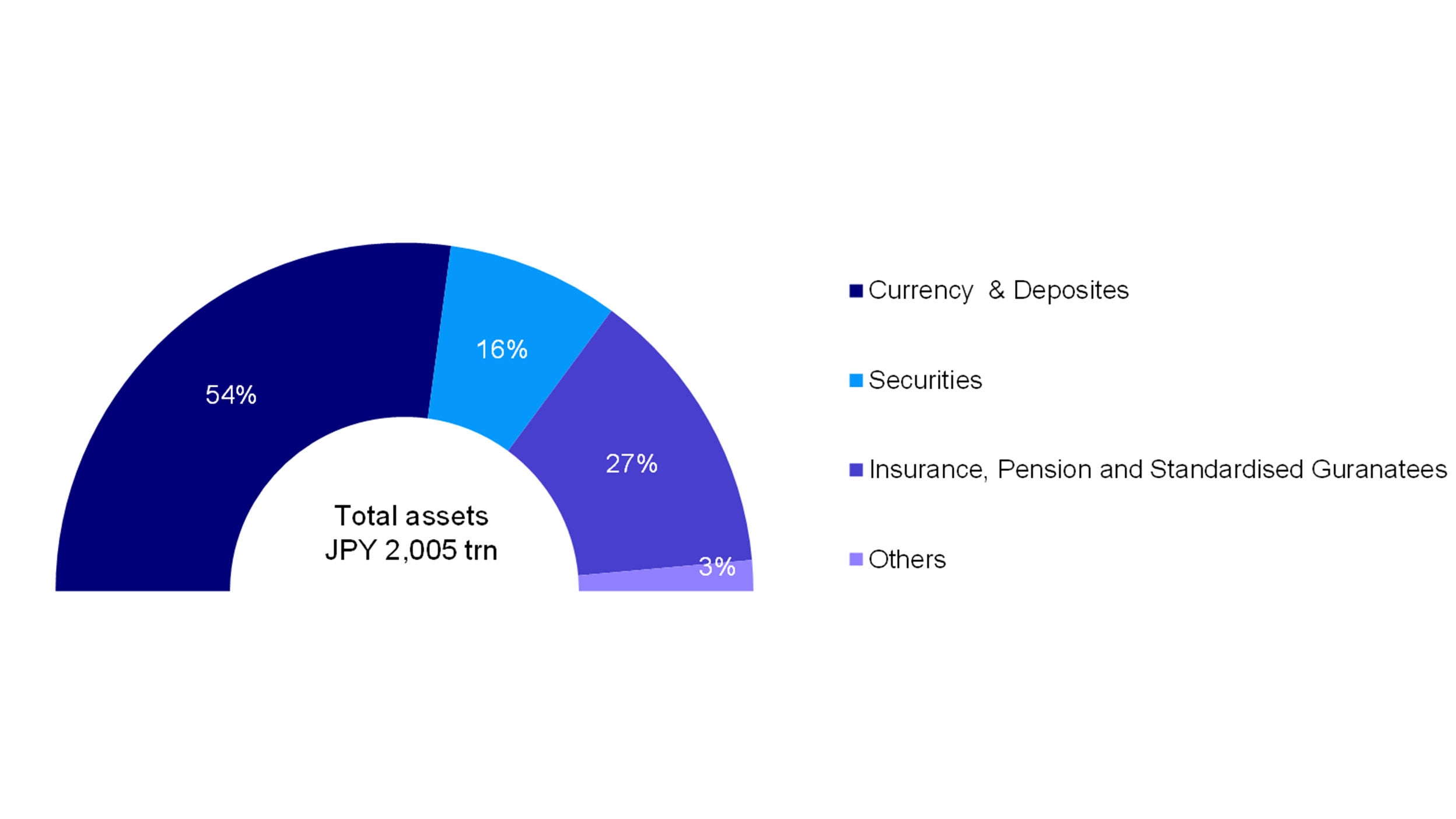

Prior to the election, the Kishida Administration finally published the “new form of capitalism” grand design and action plans, determining the four investment focus areas for sustained growth; human capital; technology & innovation; start-ups, digital and green transformation. At the same time, the action plan indicates PM Kishida’s policy has converted from increasing financial income taxes to doubling households’ financial incomes. It now aims to bring about a long-awaited shift from saving to investment among JPY 2,000 trillion (approximately USD15 trillion) households’ financial assets, roughly half of which currently sits in bank deposits and cash, and plans to expand a tax exemption program for investment saving accounts. This policy adjustment has eased investors’ concern about Japan’s economic reform setback.

As at 30 March 2022.

Source: Flows of Funds for the First Quarter of 2022 (Preliminary report), Bank of Japan.

Moreover, the human capital agenda includes an immediate action to rectify long-time gender-based inequalities in Japan. The government will require large enterprises with more than 300 employees to disclose gender and part-time pay gap from the fiscal year end after the enforcement scheduled this July. Besides, much-needed digitalisation and carbon neutrality remain key political agendas. Overall, Kishida’s “new capitalism” follows the way toward transformation for the betterment of Japan’s economy and society.

We also expect more or less consistency in the Bank of Japan’s (BoJ) accommodative monetary policies under stable political leadership. Although inflation has risen in Japan too, unlike other major developed economies, it remains tame, with a 0.8% increase in Core Core (excluding fresh food and energy) Consumer Price Index (CPI) in May, allowing the bank to strive for its multi-decade goal – sustained reflation of the economy.

As at May 2022.

Source: Bloomberg

With the monetary policy gap between the BoJ and other central banks diverging, the Japanese yen has weakened, putting further pressure on rising food, energy and raw material prices for consumers. That said, so far, household consumption recovery has broadly continued thanks to economic reopening. Besides, PM Kishida’s coalition ruling party’s win has pointed to no major public backlash.

Instead, inflation is not a necessarily bad thing for Kishida’s “new capitalism” as the core purpose of its human capital strategy is to increase wages, which have been stagnating over the last two decades. If the BoJ and Kishida administration can manoeuvre the current price hikes to spill over into wage growth, a long-waited virtuous cycle of reflation and sustained domestic economic growth would come into sight.

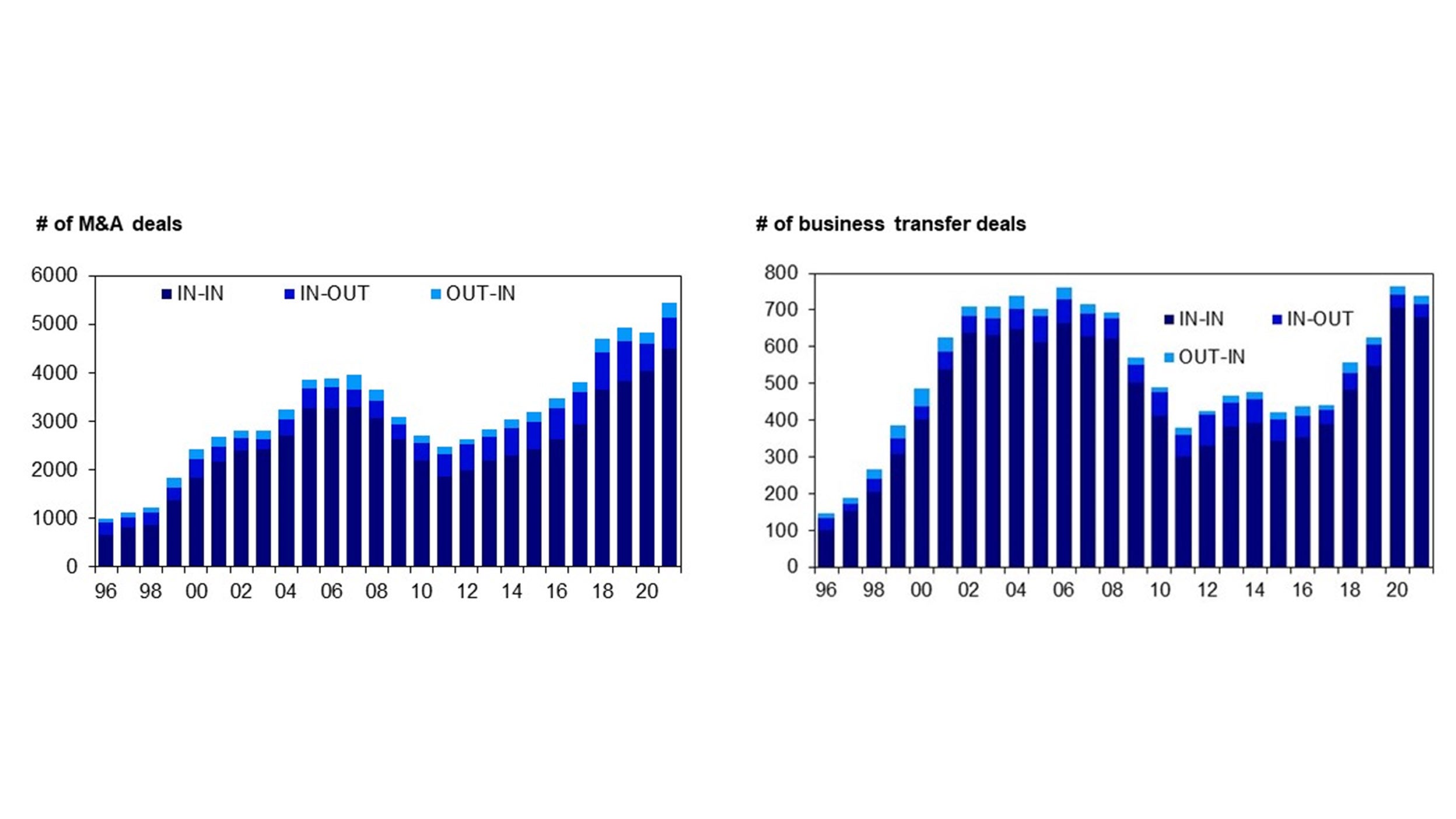

On the ground we have been hearing the increased number of episodes of passing on cost hikes, and this year’s Shunto spring wage negotiations have agreed to a 2.07% rise on average, reaching the above 2% level for the first time in three years. In addition, the weakening Japanese yen is a tailwind for exporters, which is the primary driver of Japanese corporate earnings growth. More importantly, since Abenomics started, corporate governance reform has been progressing. Rises in M&A and business transfer deals have been contributing to productivity and profitability improvement among Japanese companies. These factors have been expanding a compensation pool for employees.

Source: Recof, SMBC NIKKO

While we keep an eye on consumption recovery to continue later this year after the reopening and holiday season and wage increases to keep up the pace, hope for healthy economic and wage growth is ignited in Japan.