Key Takeaways from US October CPI Print

Finally, an inflation print in the US that missed expectations.

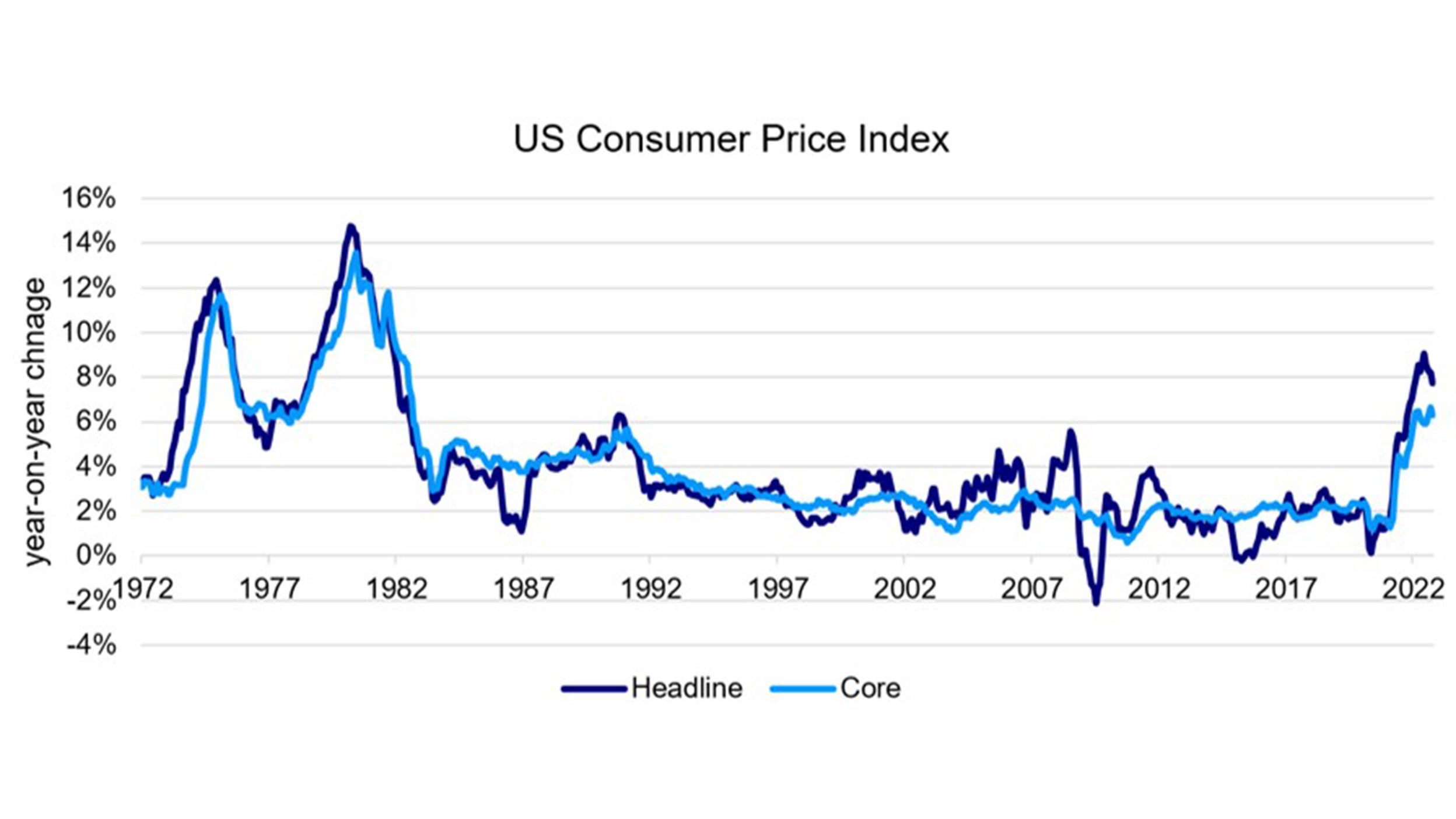

The downside surprise appeared across the board - headline CPI grew 7.7% y/y in October, versus a consensus estimate of 7.9% and down from 8.2% in September (the peak was 9.1% in June).1

Core CPI (ex-food & energy) grew 6.3% y/y, versus consensus 6.5% and down from 6.6% in September (the peak, so far).1

On a sequential basis, core CPI rose by 0.27% m/m which was significantly below last month’s 0.58% m/m increase. The big drags in the month of October were shelter, and some service categories and health insurance premiums.1

Source: U.S. Bureau of Labor Statistics (BLS). Data as of October 2022.

Implications on monetary policies

Clearly, October’s CPI print is a big deal as any downward trajectory of inflation may allow the Fed more wiggle room with their tightening monetary policy. It’s likely that the Fed will downshift to a 50bps hike instead of another 75bps hike for the December FOMC meeting.

I believe it’s fair for markets to take a breath of relief and assume that we have just passed through peak Fed hawkishness.

Skeptics may also point out that October’s drop in m/m core CPI inflation could be a head fake and another repeat of the July and March drops in core CPI. Both decelerations then, were followed in the next month by a reacceleration.

Investors have opined many times about the imminent “Fed pivot” only to be disappointed by persistently high inflation readings. Though this time around, there are other indicators - such as bank lending requirements, mortgage applications - that already show that the economy has been dragged down by much higher rates.

Investment Implications

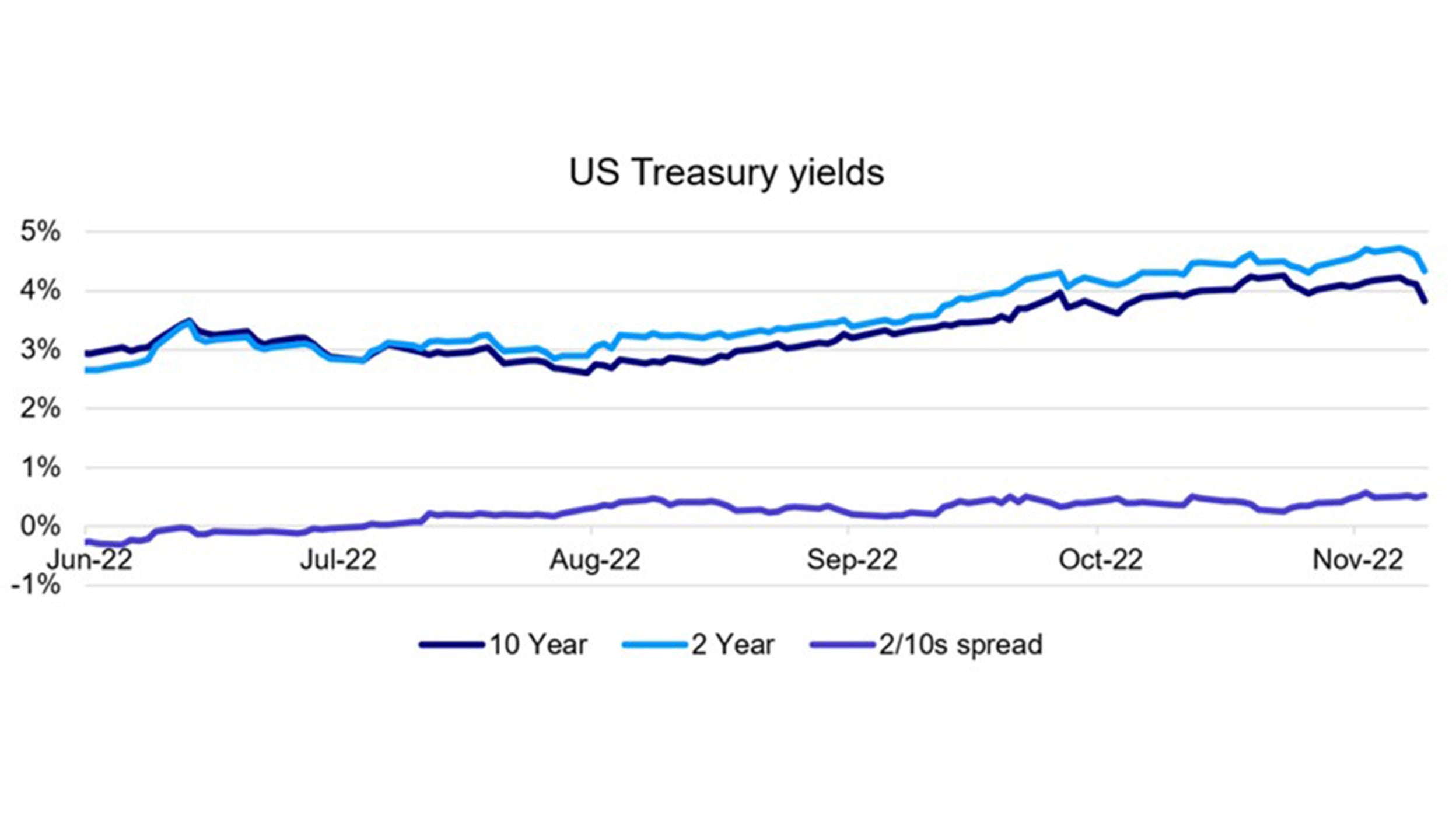

US stocks traded sharply higher with the S&P 500 up over 4% as 10-year Treasury yields declined by around 30bps to 3.81%. The USD fell as investors plough into the moderating inflation narrative.2

Investors may already be seeing through some of the near-term economic pain in the US.

Corporate earnings for Q3 have been a mixed bag, with companies reporting margins under pressure as pricing pressure fades and demand softens. The S&P 500 is expected to have flat or 0% earnings growth in 2022.

Source: U.S. Department of Treasury. Data as of 10 November 2022.

The moderating inflation news was cheered across APAC markets, with the MSCI AsiaPac seeing it’s biggest jump since March and the Hang Seng index extending its two-week rally up +7.0%, mostly due to a surge in Chinese H shares tech stocks.3

In addition, an announcement that China is easing COVID measures – such as a reduction in the hotel quarantine requirement and removal of the COVID flight bans – could signal that policymakers have started to recalibrate their stringent COVID-zero policies.

Although the market reaction to US inflation data may be overblown for one, relatively soft month’s inflation data, the same could be said for last week’s negative reaction to Powell’s press conference.

Still, I believe too much market enthusiasm too early on, may actually serve to loosen financial conditions and could cause the Fed to push back.

Outlook

Going forward, I will keep a close eye on the University of Michigan inflation expectations data as well as the PCE inflation data. Also, the Fed pays more attention to the PCE inflation rather than CPI inflation and we won’t get the PCE data until 1st December.

From an asset allocation point of view, I remain defensive in the near-term with an overweight on quality such as government bonds and Investment Grade and mitigating risks for drawdowns as growth decelerates around the world.

Still, I believe the current macro uncertainties could fade starting at the end of Q1/Q2 2023, and that investors may start preparing for growth and inflation dynamics to improve.

Reference:

-

1

Source: U.S. Bureau of Labor Statistics (BLS). Data as of October 2022.

-

2

Source: Bloomberg. Data as of Nov 10, 2022.

-

3

Source: Bloomberg. Data as of Nov 11, 2022.