A big couple of days for bond markets

Key takeaways

Government yields moving higher

Will inflation decline this year?

How we’re positioned

It’s been a big couple of days in bond markets, with government yields moving significantly higher.

The epicentre has been US Treasuries, where 2-year yields have risen a remarkable +54bps since Friday and 10-year yields +32bps.

10-year yields broke through the peak of the 2018 bear market. At 3.29% at the time of writing, they stand at their highest level since 2011.

This brings the total year-to-date return for the US Treasury market to -11.3%. The 2s/10s curve1 has continued to flatten and ended yesterday’s session very slightly inverted.

What’s happening in Europe?

European markets have moved in the same direction, although to a lesser extent.

2-year bund2 yields have risen +32bps and 10-year bunds are nearly +20bps higher in the past 2 sessions. The entire bund curve is now well and truly positive yielding and positively sloped with 1-year bunds now yielding +43bps.

The YTD bund market return is now -12.7%, a truly awful return for a nominally safe asset. Given that 10-year bunds today still only yield 1.65%, it will take investors years to earn back the YTD losses.

BTP3 yields also moved higher and took the yield on the 10-year briefly beyond 4% for the first time since they were declining in 2014 from the eurozone crisis. The YTD BTP index return is -15.5%.

Challenging the inflation narrative

The sell-off was sparked by a hawkish ECB meeting on Thursday and the US CPI number on Friday, which was quite a bit stronger than expected.

This challenges the narrative that inflation will gradually decline this year. There is lots of talk of 50bps rate hikes in the eurozone and of even a 75bps hike in the US this week.

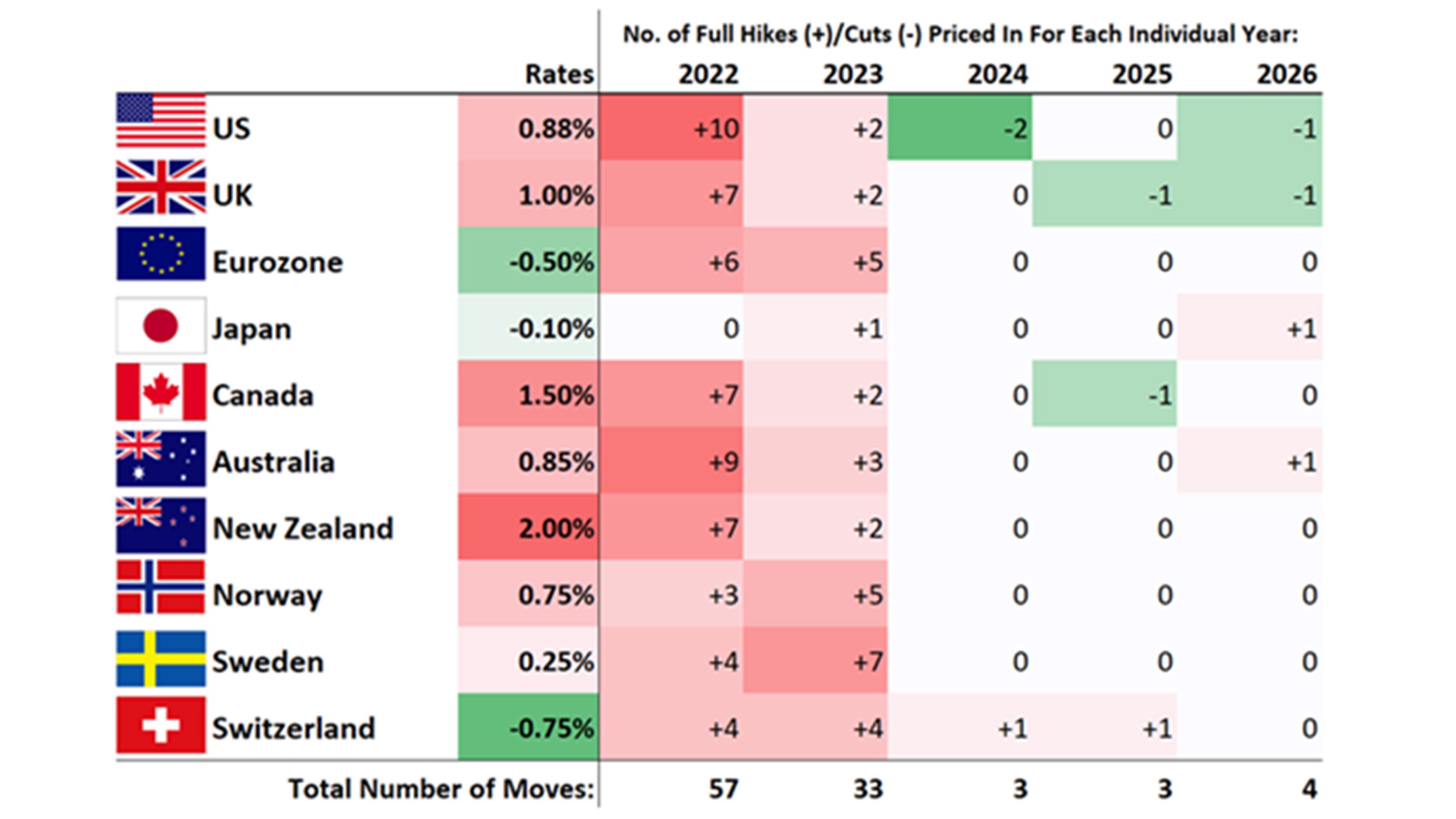

It’s also important to note what is priced in for rates.

The below table shows the hikes in terms of 25bps moves. In the US, 10x 25bps hikes are now fully priced for the remainder of the year. Spread over the five remaining meetings, this equates to 50bps of tightening at each meeting. This would bring the Fed Funds rate to 3.38% from its current mid-rate of 0.88%

Figure 1. Rate hikes in terms of 25bps moves

After years of negative interest rate policy in the eurozone, we are now priced for 150bps of tightening (170bps to be exact) by year-end, with only four scheduled meetings remaining, hence the discussion around a 50bps move in September.

How we’re positioning

With this radical repricing underway, our thoughts have focused on the timing of our move back into duration. Thankfully, our starting point at the beginning of this year generally across the desk was pretty defensive, which has given us room to build.

We have reduced the underweights across the portfolios. These now stand somewhere between slightly underweight and neutral, depending on the fund.

Inflationary risks are visible everywhere – prices, energy markets, wages, inflation expectations and so on. But there is now a lot of tightening priced in. In fact, in the US, more tightening than we have seen since the late 70s in such a short space of time.

It may still not be enough. And the degree of tightening expected even today could well generate a recession.

Market sentiment is understandably fragile and yields may need to move higher still. But we are being increasingly well paid for those risks.

Today, we can lock in 5.5% annual returns on investment grade-rated US corporates, with many bonds’ cash prices in the 90s and 80s. Those rates of return were barely available even in the high yield market in Europe last year. So, slowly but surely, we are minded to keep adding.