Insurance Insights Q1 2023: Insurance asset allocation

Invesco’s Capital Market Assumptions (CMAs) are updated on a regular basis and incorporate the latest market developments. Such assumptions form vital inputs for any strategic asset allocation analyses and especially for insurers looking at long-term allocations. Here, we outline a practical approach that reiterates the importance of such inputs and how updated assumptions can and should be used to continually assess the efficiency of any allocation and also to consider new asset classes in order to most effectively meet target yields or returns.

For this analysis, we have used Singapore’s RBC 2 framework for assessing the relevant risk charges as an example of general risk-based capital regimes. As avid readers of the newsletter will no doubt recall, we have Solvency II incorporated in Invesco Vision (our portfolio management and decision support system) as well and so can assess portfolios on this basis if required. Even for frameworks not yet formally approved or constructed in our system, we feel the trend or direction of changes (even based on Singapore RBC 2/Solvency II) on allocations can still be meaningful and of relevance.1

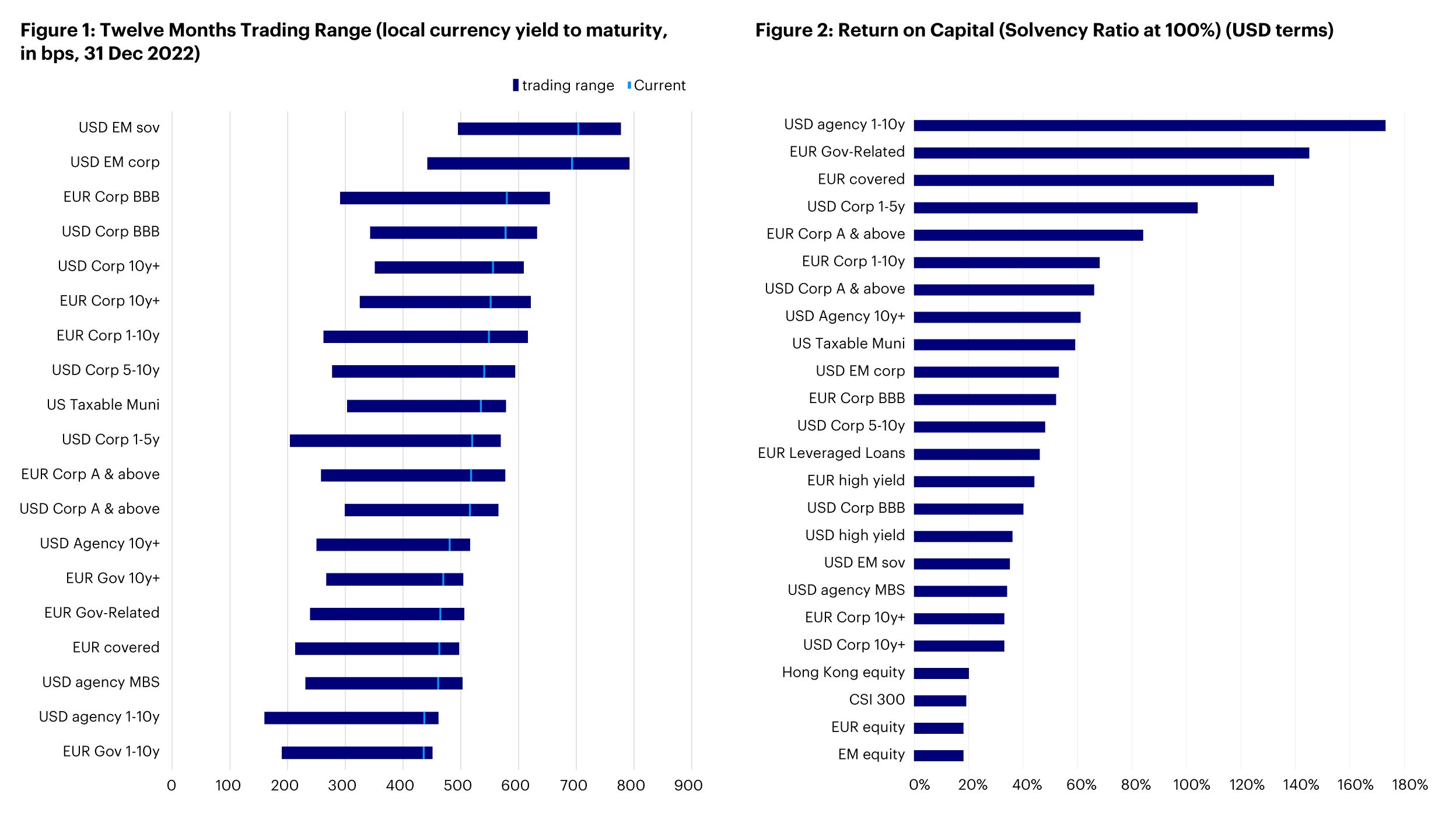

How asset class expected returns stack up against potential capital charges is always an interesting parameter to look at and we illustrate this for selected asset types in the charts below (Figure 1 and 2).2 Of course, one may need to consider the relative attractiveness of various asset classes from both an absolute return perspective and from an expected return-to-risk perspective:

Source: Invesco as of 31 December 2022; Return on Capital = Expected Return / (Solvency Ratio * SCR). For fixed income assets, Barra's duration weighted yield to maturity is used as expected return. For other assets, Invesco CMAs are used where available. CMAs are as of 2022-12-31. Otherwise, manual inputs from Invesco Solutions are used. EUR Direct Lending and USD CML are assumed to be in private equity-style fund vehicles. All the hedging of fixed income assets is based upon swap curves from Barra and basis curves from Bloomberg; where hedging is not assumed, yields / returns are converted into the report’s base currency based upon Bloomberg Generic Govt 10Y Yield differentials. Interest rate risk is excluded from SCR charges. Assets with zero SCR charges are not shown in the graph.

Looking at one dimension alone could potentially lead to inefficiencies in the portfolio. As an example, US Taxable Municipal bonds and USD Corporate A & Above bonds have middle-of-the-road spreads compared to some of the other asset classes. But, if we were to consider these from a return on capital perspective, for a longer-term horizon, these asset classes appear relatively efficient. Conversely, USD emerging market (EM) sovereign debt, while having a relatively high current spread, does not look as efficient based on an expected return on capital perspective. Additionally, there is an FX component as well – Euro-denominated assets hedged to the US dollar provide some pick-up (as of the date of the charts), and this gets reflected in the efficiency as well. Hence, a lot of Euro-denominated assets can be found at the top of the Figure 2 chart as of that time.

Hence, it is important to assess portfolios across several dimensions and that the premise of any portfolio is re-assessed on a regular basis to ensure the objectives are still valid and achievable.

Implementing Capital Market Assumptions (CMAs) into our analysis

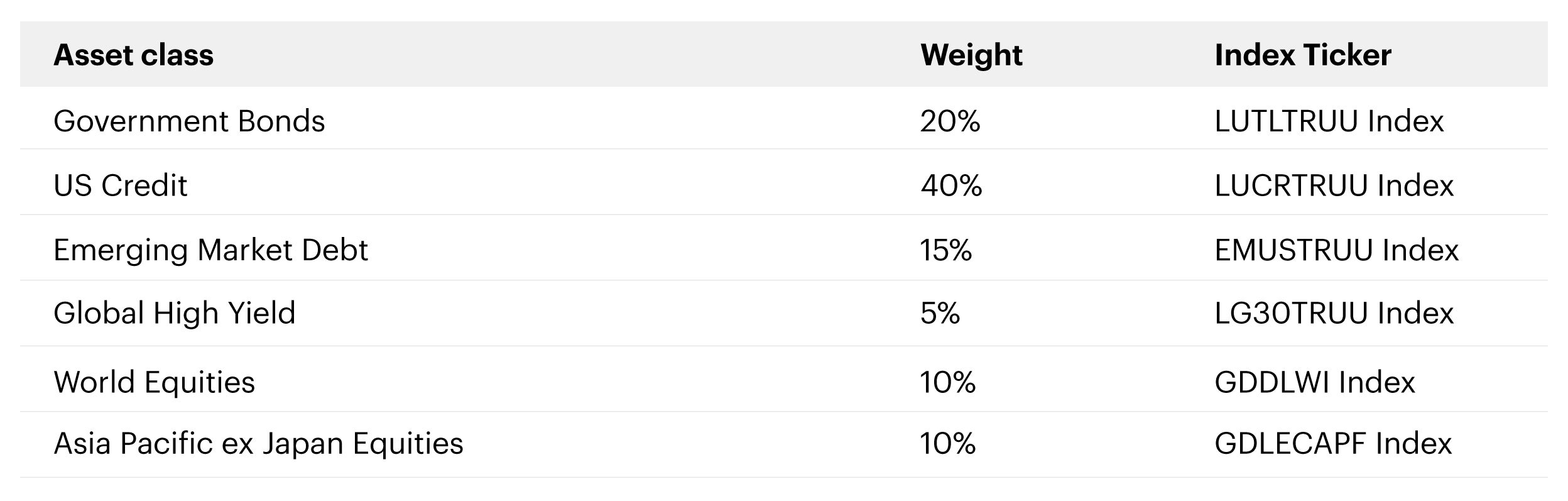

For this example, we start with a generic asset allocation comprising the following asset classes – represented by the indicated indices/proxies below – meant to roughly represent a fairly plain vanilla portfolio (government bonds to manage duration; credit exposure and listed equities to provide potential upside for policyholders):

Note: Bloomberg Barclays US Long Treasury Total Return (LUTLTRUU IDX), US Corporate Total Return Value Unhedged USD (LUCRTRUU IDX), EM USD Aggregate USD Unhedged (EMUSTRUU IDX), Global High Yield Total Return (LG30TRUU IDX). MSCI Daily TR Gross World Local (GDDLWI IDX), MSCI Daily TR Gross AC Asia Pacific Ex Japan Local (GDLECAPF IDX)

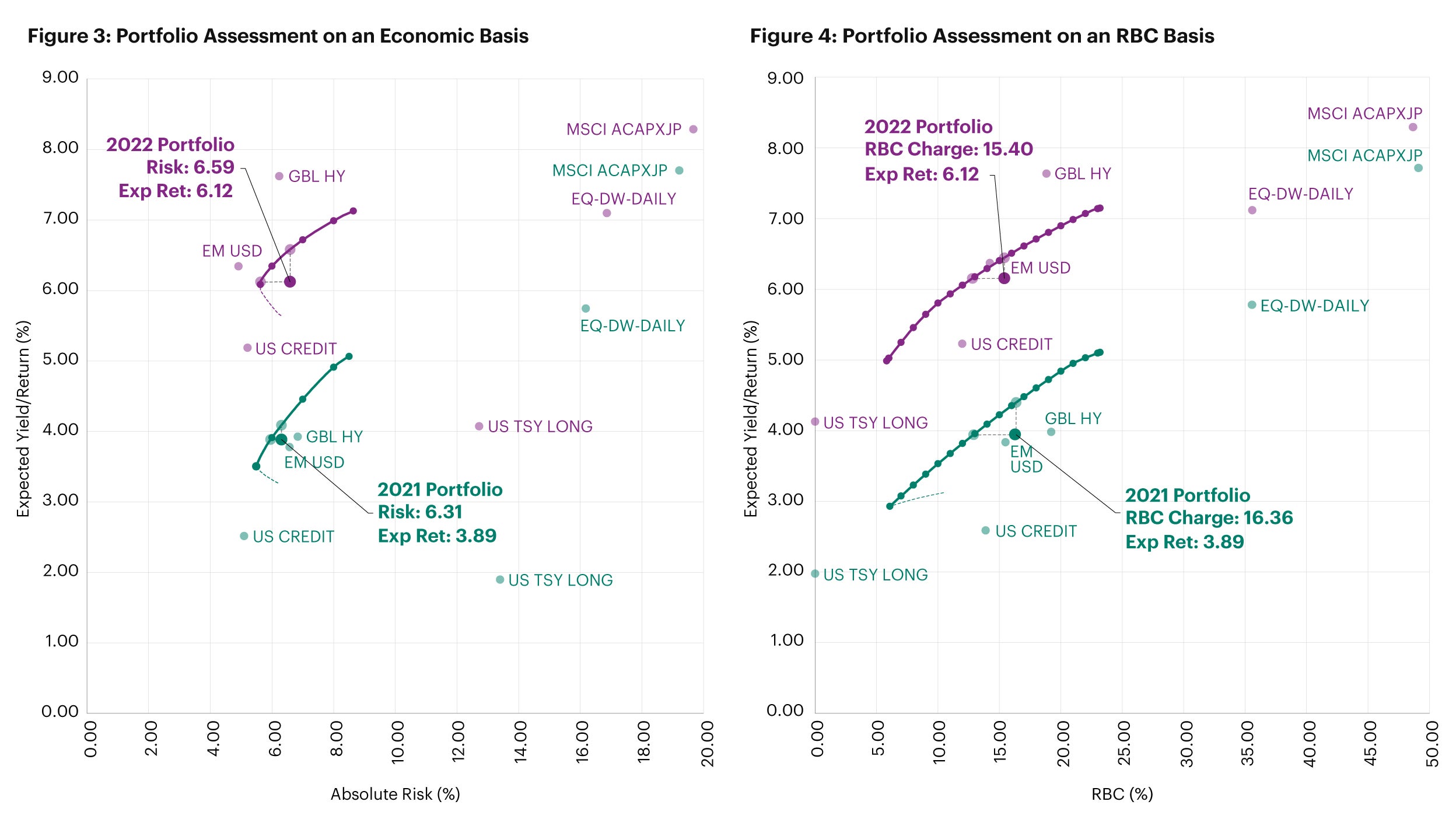

The charts (Figure 3 and 4) compare risk-return profiles of a hypothetical portfolio using the December 2021 CMAs and the latest December 2022 CMAs. The aim is to assess how this risk-return profile changes as a result of changed assumptions for certain asset classes.

Source: Invesco analysis, 31 December 2022.

Figure 3 (left) shows the portfolio characteristics on an economic basis and Figure 4 (right) shows the characteristics on an RBC basis. The green lines represent the frontiers with CMAs from December 2021 and those in purple represent the CMAs as of December 2022.

We observe that under both bases, there is an increase in the expected return of the portfolio over a 10-year horizon with a very slight increase in expected economic volatility and with the RBC charge very slightly decreased (reflecting some drift in the underlying representative indices). Therefore, the portfolio seems reasonably well positioned at this time compared to a year ago – based on the latest set of CMAs. This is not surprising as the market environment is dynamic and ever-changing — and our views and expectations have evolved over time, incorporating additional information over the past year.

The effects of adding more asset classes to a portfolio

However, for insurers, it’s not always optimal to rest on one’s laurels. Capital market expectations tend to be fickle, and the intent should always be to improve the portfolio at every step. Therefore, our next step is to consider asset classes that may be able to further improve the risk-return profile. As we observed earlier, while the capital charges for certain asset classes might be relatively high, their correspondingly higher expected returns could still make them attractive in some cases. Within a portfolio context, the additional benefit of diversification may also help with generating further efficiencies.

We continue our analysis by taking the above hypothetical portfolio and adjusting it to include new asset classes, then re-generating the risk-return profile with our modelling tool (Invesco Vision3) based on the latest CMAs.

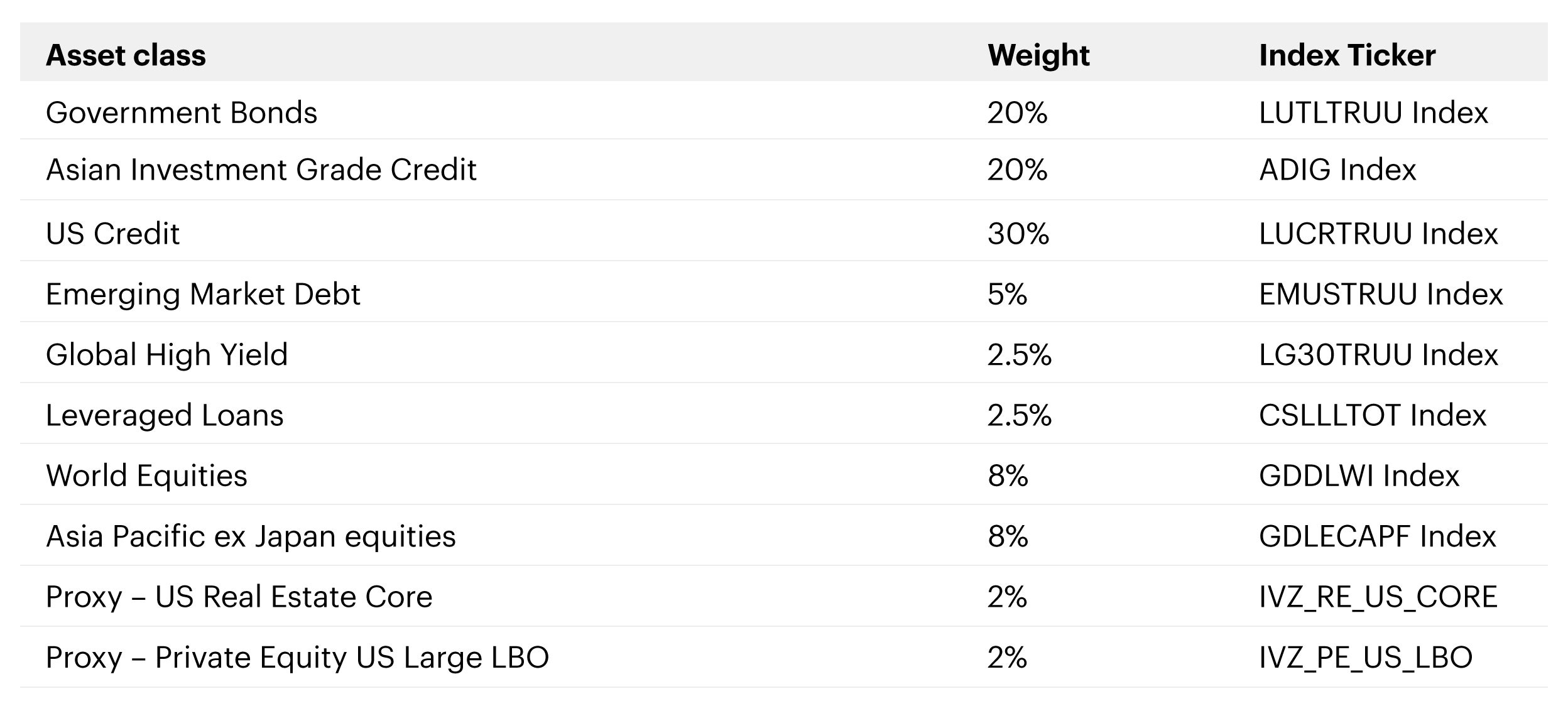

In this case, we included a subset of investment grade credit (Asian investment grade) and some alternative asset classes – Leveraged loans, Core US real estate, and US large leveraged buyout. We reduced the weightings on the listed equities, US credit, and emerging market debt exposures slightly. Our updated portfolio comprises of the following exposures, represented by the indicated indices/proxies below:

Note: ICE BofA Asian Dollar Investment Grade Index (ADIG IDX), Bloomberg Barclays Global High Yield Total Return Index Value Unhedged (LG30TRUU IDX), Credit Suisse Leveraged Loan Index (CSLLLTOT IDX). Invesco Core Real Estate-USA LLC Fund (IVZ_RE_US_CORE), Invesco Private Equity US Large Leveraged buyout fund (IVZ_PE_US_LBO).

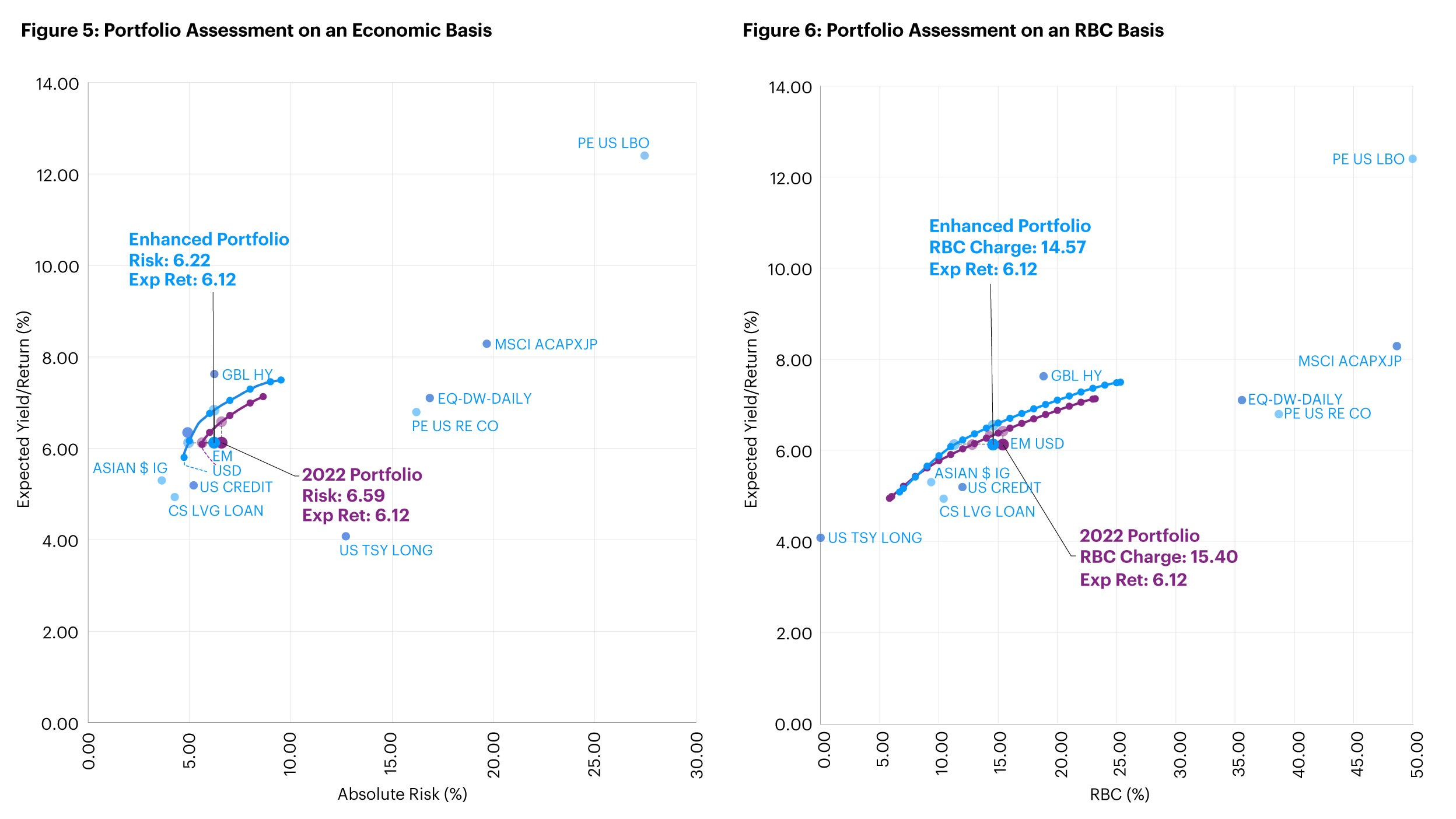

We then compare the risk-return profile of this adjusted hypothetical portfolio to the original portfolio (all using the latest 2022 assumptions). The aim is to assess how these slight adjustments can change the risk-return profile of the portfolio. The charts below demonstrate changes to the efficient frontier of adding new asset classes.

Source: Invesco analysis, 31 December 2022.

Figure 5 (left) shows the portfolio characteristics on an economic basis and Figure 6 (right) indicate the characteristics on an RBC basis. The purple line represents the initial base portfolio using the CMAs as of December 2022, and the blue line represent the adjusted enhanced portfolio using the CMAs as of December 2022.

We observe that under both bases, there is an improvement in the risk-return profile of the adjusted enhanced portfolio — that is, the blue dot representing this enhanced portfolio has moved to the left compared to the purple dot which represents the initial base portfolio with the latest CMAs applied. The adjusted portfolio shows a slight lowering of the risk/RBC charge. This result has been obtained with a fairly minor adjustment to the portfolio – the aim here was to maintain the expected return and see if we could reduce the capital charge. Additional adjustments can be made to focus on other key parameters as might be desired.

We note that we have been able to enhance the portfolio profile by selectively adding asset classes that have favorable risk-reward characteristics. Often, this may mean the reduction in exposures to public/listed assets and a corresponding increase in private/unlisted assets in order to generate additional premium. Of course, as part of any such analysis, the sources of additional premium need to be assessed carefully and one needs to ensure that other risk parameters (such as liquidity) remain well managed and in accordance with an insurer’s risk appetite. Private assets can be a good complement to public asset classes and can help bring about additional diversification some of this gets reflected in improvements in the efficient frontier. This opens up the potential for further adjustments to the asset allocation, taking into consideration any changes to an insurer’s risk appetite, in order to achieve the desired profile. This example is meant to illustrate the process that can be implemented and through Invesco Vision, our modelling tool, results can be assessed quite swiftly.

As an extension to this analysis, we also share an illustrative example that takes a closer look at the impact of spread risk requirements on credit duration exposures generically and assesses ways to manage this duration-spread interplay.

What this means for insurance portfolios

The earlier analysis shows the utility of combining risk and return assumptions with a powerful modeling tool to assess portfolios on an on-going basis. By considering other asset types and an insurer’s specific needs, we are able to widen the possibilities to enhance risk-return profiles and make portfolios more efficient.

It should be stressed that it is important to ensure a deep and thorough understanding of any such new asset class and what is required from an implementation and monitoring perspective. There will be sources of additional yield/return offered by different asset types and remains vital to assess whether or not these asset types are within the appetite of the insurer. This extends to manager selection as well – it remains important to ensure that managers have the expertise, capabilities, and resources to appropriately manage any such asset classes.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Diversification and asset allocation do not guarantee a profit or eliminate the risk of loss.

Invesco Investment Solutions (IIS) develops Capital Market Assumptions (CMAs) that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on 5- and 10-year investment time horizon, are intended to guide these strategic asset class allocations. For each selected asset class, IIS develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. Estimated returns are subject to uncertainty and error and can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.