"Our outlook for the rest of the year centres on the path of inflation and how central bankers weigh the balance of risks in beginning to ease monetary policy."

Kristina Hooper, Invesco Chief Global Market Strategist

At the mid-way point of 2024, divergence between individual economies has re-emerged as a theme. How will key economic factors play out and what will the impact on markets be?

Despite expectations of a global economic slowdown this year, growth in many markets has shown good levels of resilience.

Though disinflation isn’t happening quite as quickly as expected, major central banks are expected to start cutting interest rates soon.

We believe individual economies will experience varied economic and market recovery going forward.

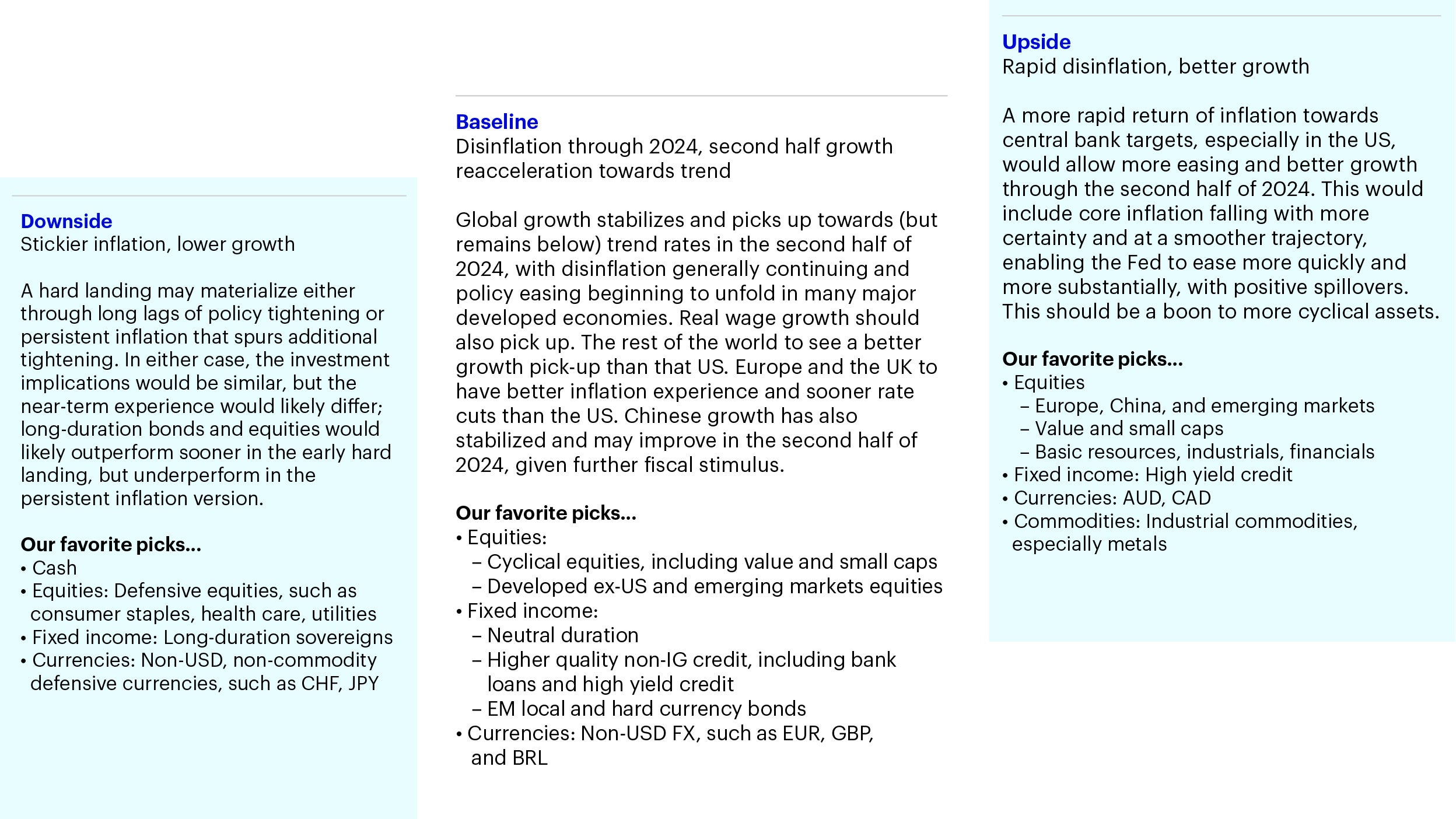

The global economy is in a soft patch. But, despite widespread expectations of a global economic slowdown in 2024, growth and inflation have performed above expectations across most major economies. Divergence has re-emerged as a theme, with individual economies likely to see various growth and inflation experiences going forward.

"Our outlook for the rest of the year centres on the path of inflation and how central bankers weigh the balance of risks in beginning to ease monetary policy."

Kristina Hooper, Invesco Chief Global Market Strategist

In the second half of 2024, we still expect inflation to fall further across most Western developed economies, but we believe it will fall faster outside of the US. And as long as the disinflation process continues, we believe Western central banks may start to gradually cut rates before their target level for inflation is reached.

Throughout the rest of 2024, markets are likely to react to shifts in the outlook for interest rates. But in our view, the precise number of rate cuts is less important than the view that the next move is a cut rather than a hike, especially as the market narrative continues to be highly volatile.

In terms of growth, the global economy remains in a soft patch overall, but we expect to see some divergence among individual economies. In the US, we continue to expect exceptionalism in growth, and in the eurozone, we anticipate relative softness with the potential for positive surprises. In Japan, the weak yen and structural reforms have helped rekindle inflation and enabled the Bank of Japan to begin a very gentle tightening process. In China, continued weakness in the property market mixed with slowly improving consumer sentiment indicate an environment of below-trend but improving growth.

Some markets appear to have priced in much of the positive sentiment already. In fact, there’s a significant risk that some markets are overly positive and have not fully priced in potential problems. However, given the positive macro backdrop, we favor an overweight to risky assets, but would look to keep risks tightly controlled as very tight valuations limit the upside for risky assets.

Explore more of our insights for the second half in our Mid-Year Investment Outlook.

In 2H 2024, we still expect inflation to fall further across most Western developed economies, but we believe it will fall faster outside of the US. In terms of growth, the global economy remains in a soft patch overall, but we expect to see some divergence among individual economies. Kristina Hooper shares her insights for the second half of the year in this video.

Note: There can be no assurance that market views will come to pass.

Though divergence underpins our outlook, we see opportunities across key asset classes.

Valuations in fixed income are tight, with inverted yield curves and tight credit spreads. Near term, we favor exploiting the range trade in rates. Technicals are quite positive, and in medium term, we believe current bond yields offer a buying opportunity.

High yields and near zero duration make loans and private credit attractive in a “high for longer” environment. Real estate funds' valuations are near trough levels. Private equity general partners (GPs) are highly incentivised to ramp up deployment as dry powder ages. |

The Fed pivot back to “high for longer” has discouraged EM flows, but specific stories

stand out: India’s fast growth; Turkey, Argentina turnarounds; high yields in LatAm and

Central Europe. As Fed rate cuts materialize, we expect the dollar to soften, supporting

the EM asset class.

Source: Invesco, as of May 31, 2024.

2024 Mid-Year Investment Outlook – Asia Fixed Income: Emerging Markets

Emerging market Asia hard currency sovereign bonds continued to trade tighter in 1H 2024. Rather than hard currency, we are more positive on Asian local currency bonds for 2H.

2024 Mid-Year Investment Outlook – Asia Fixed Income: High Yield

Asia high yield bonds have significantly outperformed both Europe and US high yield bonds year-to-date, the latter two asset classes delivering negative total returns.

2024 Mid-Year Investment Outlook – Asia Fixed Income: Investment Grade

Asia investment grade credits held up relative well in 1H. In our view, solid fundamentals, strong technicals and the fact that all-in yields look attractive from a historical perspective will continue to support the credit markets into 2H.

2024 Mid-Year Investment Outlook – Asia Equities

The Asia ex Japan equity market showed robust performance in 1H 2024. Fueled by strong domestic demand and a resurgence in global demand, we believe the market is poised for continued growth in 2H 2024.

2024 Mid-Year Investment Outlook – China Equities

China’s equity market has seen positive momentum so far this year, rebounding by over 30 percent since the trough in January. The positive factors that drove economic stabilization and upward momentum in the first half of 2024 are expected to continue into the second half.

Fixed income markets offer strong income opportunities at attractive valuations for the first time since the global financial crisis. Explore the capabilities designed to capture market potential.

Uncovering the potential of Private Credit starts with gaining access to them. It’s a world of opportunity – and we have the expertise and the network you need to unlock it.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

All data as of May 31 2024, unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.

Connect with us for a tailored conversation focused on your investment challenges and opportunities.

By providing your details here you consent to receiving marketing materials which includes our newsletters and information from Invesco globally that we think maybe of interest to you (including direct marketing). You can withdraw your consent at any time by selecting the unsubscribe option in the communication you receive or by contacting your regional sales representative. For further information on how we store and use data, please refer to our Privacy Policy.