India’s recent index inclusion: A double-edged sword?

JPMorgan recently announced the inclusion of Indian government bonds to the GBI-EM (Global Bond Index-Emerging Markets) family of indices. The inclusion will start from June 2024 with an overall weight of 10% (the individual country cap) in the GBI-EM Global Diversified Index. Currently there are 23 Indian government bonds with USD 330 billion equivalent amount outstanding under the Fully Accessible Route (FAR), meaning these are exempt from foreign investment restrictions. These FAR bonds qualify as the eligible pool of securities for the index.1

The inclusion is estimated to bring in about USD 22 to 23 billion of passive asset allocation to Indian local currency government bonds over the 10-month course of inclusion. We expect active investors and pre-positioning trades will start months in advance of actual inclusion. The inclusion into JPMorgan’s GBI-EM Global Diversified Index is a strong indicator that other index managers like the Bloomberg Barclays Global Aggregate Index and the FTSE World Government Bond Index will follow suit shortly.

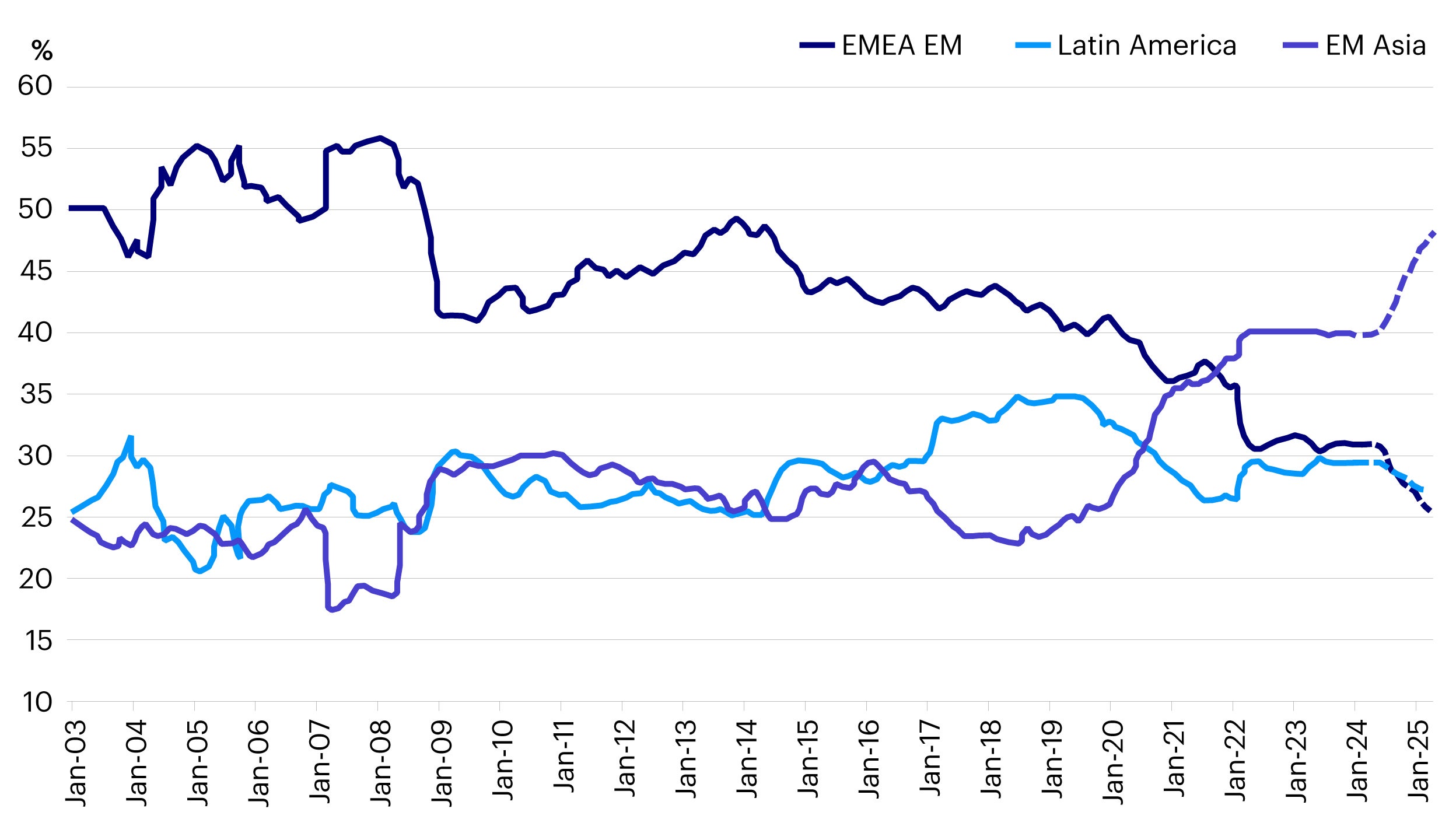

As a result of India’s inclusion, Thai government bonds would be subject to the largest reduction in weighting across the emerging markets, with its weight projected to fall from 9.79% to 8.14%. However, given that the JPMorgan GBI-EM Global Diversified Index recently added China in 2020 and now India, Asia’s weighting in the index will grow to almost half or 48%. This is much higher than the weighting of bonds from the EMEA region or Latin America.

Source: JPMorgan, data as of September 2023. Note: Dashed lines represent projections over India’s 10-month phased inclusion.

In our earlier 2022 piece, we covered of the potential impact of India’s index inclusion and analyzed the flows this could bring about. In this piece we seek to evaluate how inclusion might impact other aspects of India’s financial markets.

While inclusion is expected to propel foreign inflows into India’s government bond market, we believe policymakers on the ground will have to consider two major ramifications. On the one hand, India can enjoy the benefits of a deeper local currency market with a more diversified investor base. On the other hand, the increase in the share of benchmark-driven investments may also be a source of vulnerability as capital flows would become more sensitive to external economic conditions.

We believe that higher foreign participation in the local government bond market will push Indian policymakers to further enhance India’s economic fundamentals so that the country can navigate complex macroeconomic environments in the future.

It is widely anticipated that the active and passive flows into India’s local currency government bond market will cause the Indian Rupee (INR) to appreciate. Although we hold the positive view on the INR, historical lessons have shown us that this outcome is not certain. For instance, FTSE’s study on the inclusion of Israeli Shekel-denominated government bonds into the FTSE World Government Bond Index failed to have a significant impact on Israel’s exchange rate as other factors were also at play.2

We believe that continued efforts to enhance the exchange rate management regime and a more robust economic growth story cause currencies to strengthen in the medium to long term. We can look at the recent example of China’s efforts to reform its currency convertibility after its inclusion into major emerging market bond indices.

Bond Connect was introduced in 2017 to grant international investors easier access to the local currency bond market in China. The Bloomberg-Barclays Global Aggregate Index, the JPMorgan GBI-EM Index and the FTSE World Government Bond Index respectively started including China onshore bonds since April 2019, February 2020, and October 2021 respectively. During that time, Chinese and Hong Kong policymakers delivered on various initiatives. In 2018, delivery-versus-payment settlement, block trading function, and tax exemption was introduced. While in 2019, a new electronic trading platform was added, settlement cut-off time were extended and increased options provided for settlement cycles. In 2020, policymakers rolled out a special settlement cycle service, extended trading hours and, introduced flexibility for investors to engage more than one bank to conduct relevant currency conversion and foreign exchange hedging. We expect Indian policymakers to follow a similar approach and roll out a more international investor-friendly framework to facilitate efficient access to their local currency bond market.

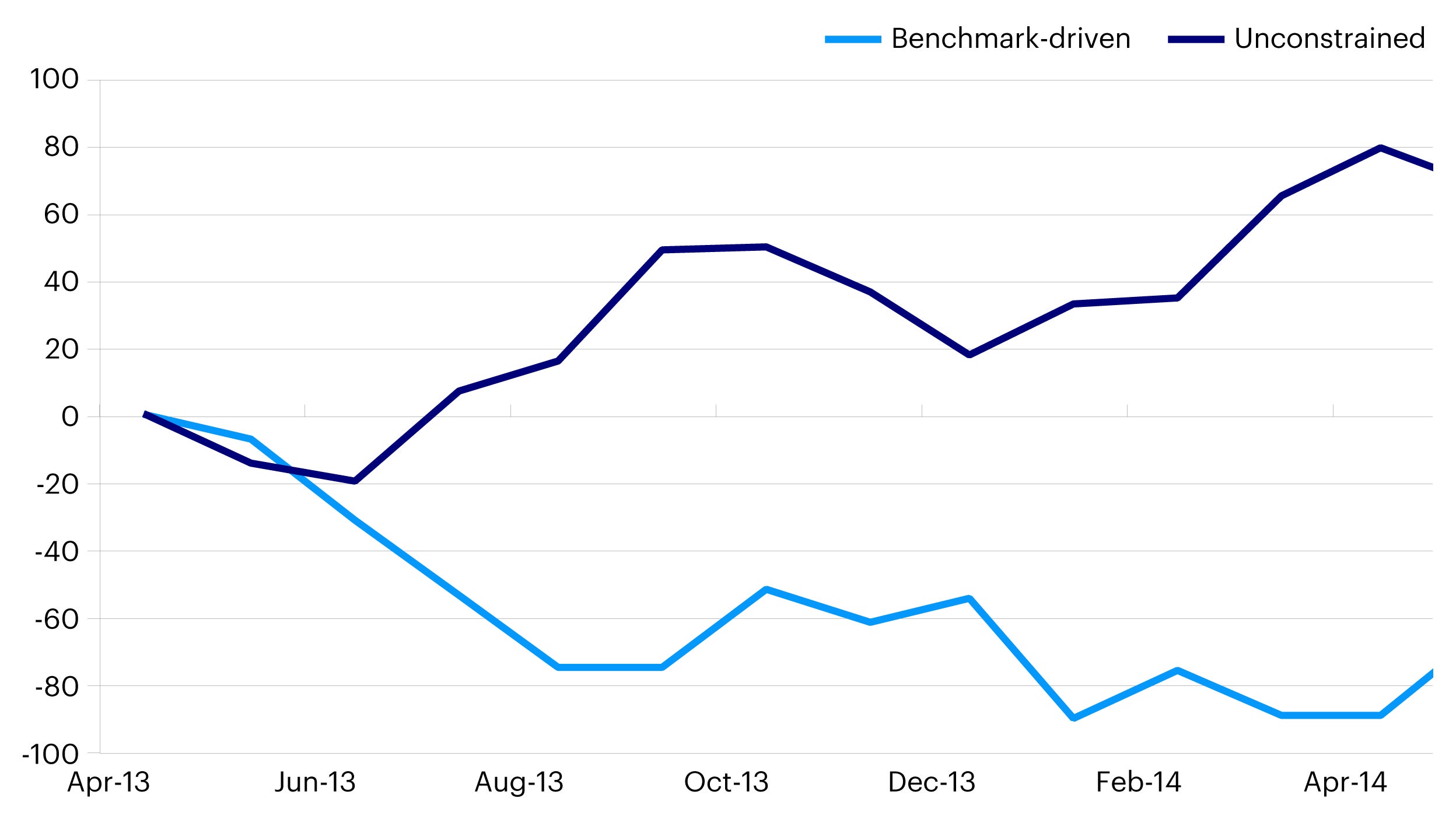

According to a 2015 IMF Working Paper3, benchmark-driven flows tend to be less sticky compared to unconstrained flows in less favorable market conditions. During the taper tantrum episode in 2013, we saw a much larger and more prolonged period of outflows from emerging market local bond holdings that were benchmark-driven compared to holdings by unconstrained investors. Looking back to that period, countries that had large current account deficits, low foreign exchange reserves or lacked reform momentums suffered the most drawdowns.

Source: IMF working paper - Emerging Market Portfolio Flows: The Role of Benchmark-Driven Investors. Data as of December 2015.

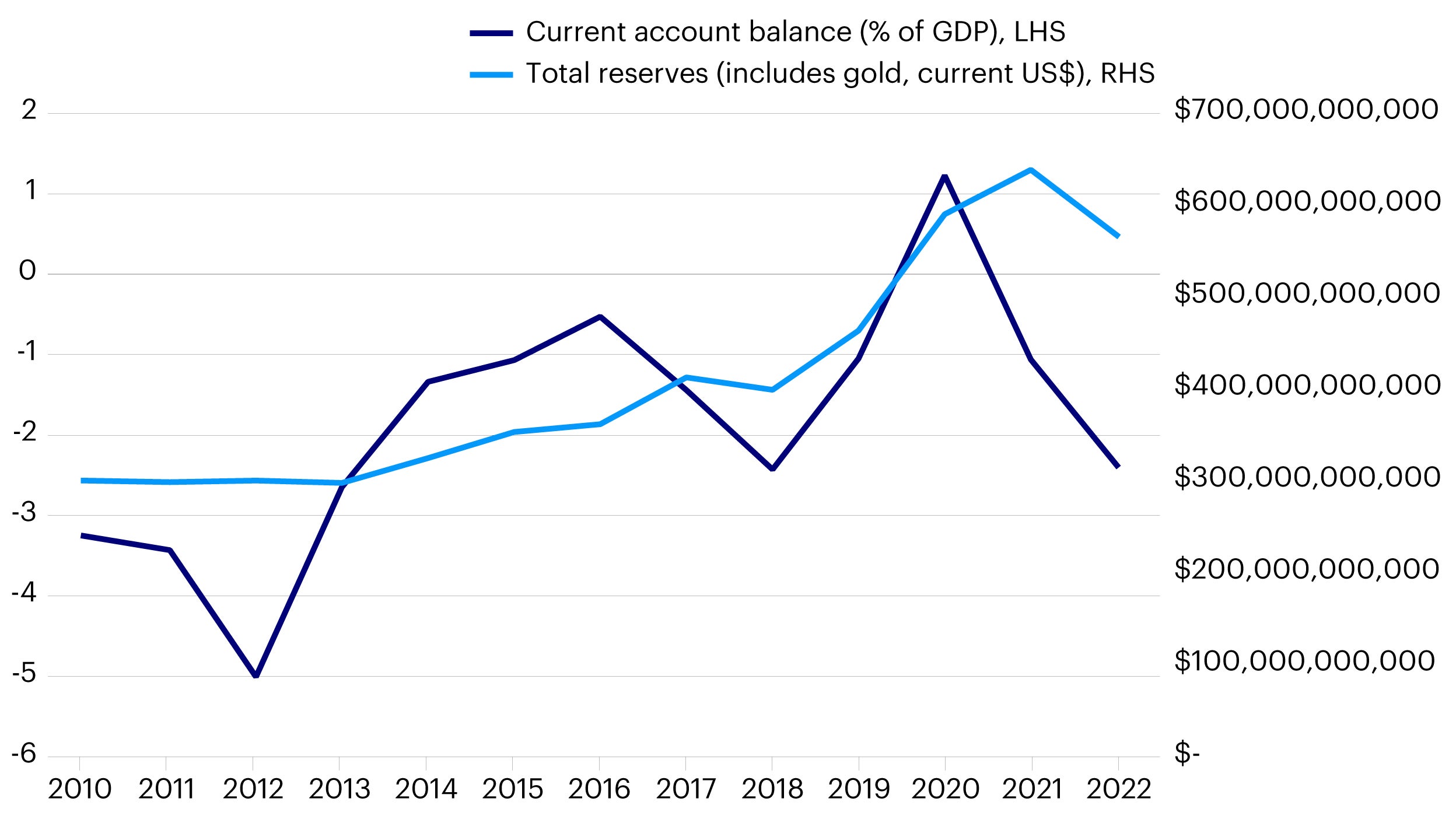

We see that the Indian policymakers, like other countries, have taken this lesson seriously and are working to ensure the country’s economic fundamentals are less vulnerable to such flow pressures. India has been on a positive trajectory in recent years to improve its external balances. Even during 2022, when the oil prices rose on the back of geopolitical risks, its foreign exchange reserves did not suffer large declines.

Source: World Bank Development Indicators, Invesco. Data as of September 2023.

If recent history is anything to go by, we believe the Indian government will also look to enhance the quality of its regulatory infrastructure. One could argue that this is precipitated by the participation of international investors in a nation’s capital markets. In the past, countries seeking to withstand the open market competition of capital flows have made successful efforts to improve their financial market infrastructure and regulatory infrastructure.

Figure 4 – Date and type of inclusion of emerging market countries into the JPMorgan GBI-EM indices since 2010

| Announced Date | Inclusion type | |

|---|---|---|

| Egypt | 12/10/2021 | Phased |

| Serbia | 10/02/2021 | Immediate |

| China | 04/09/2019 | Phased |

| Dominican Republic | 19/04/2018 | Immediate |

| Uruguay | 20/07/2017 | Immediate |

| Czech Republic | 22/02/2017 | Phased |

| Argentina | 05/01/2017 | Immediate |

| Colombia | 19/03/2014 | Phased |

| Romania | 15/01/2013 | Phased |

| Nigeria | 14/08/2012 | Phased |

Source: JPMorgan, Invesco. Data as of September 2023.

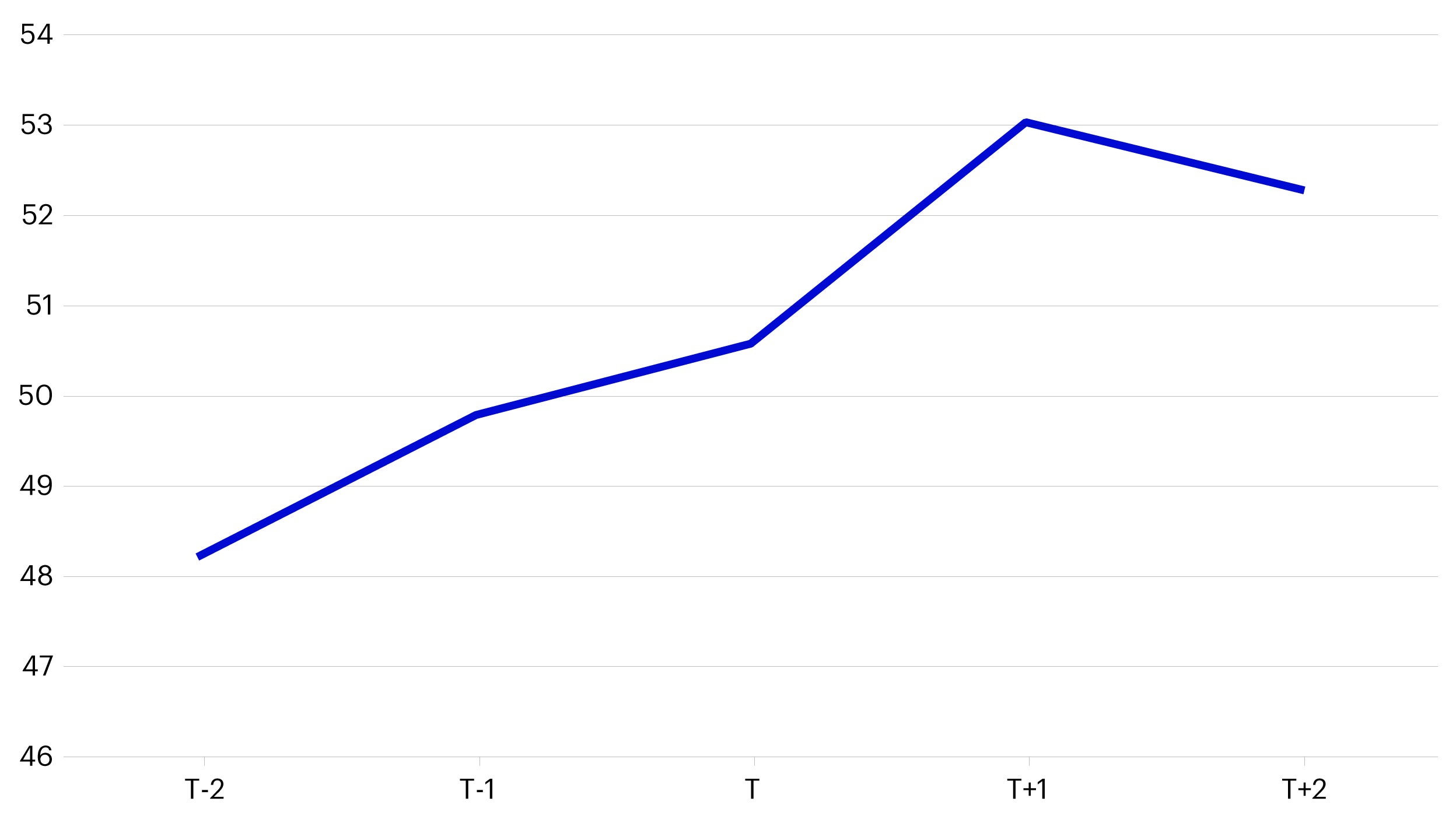

The JPMorgan GBI-EM indices have admitted ten different countries from various continents since 2010 (Figure 4). We find that the average rule of law percentile ranking of these countries improved from 48.2, two years ahead of the inclusion, to 52.3, two years after the inclusion.

Source: World Bank Development Indicators, Invesco. Data as of September 2023. Note: Since latest available Rule of Law data is from 2022, the above chart shows data for China, Dominican Republic, Uruguay, Czech Republic, Argentina, Colombia, Romania, and Nigeria. In the case of China, years 2017 through 2021 were used for the calculation.

To conclude, we believe the inclusion of Indian government securities into major emerging market bond indices such as the JPMorgan GBI-EM indices will bring significant upside to the country in the form of capital inflows and improved market sentiment. The inclusion presents opportunities for policymakers to further reform India’s financial markets in areas such as foreign exchange policies and to enhance the country’s macroeconomic fundamentals and regulatory infrastructure. We expect India to continue to make progress on all these fronts and therefore attract sustainable medium to long term flows into the local currency bond market.

A precursor to this article was written in September 2022, titled Inclusion of Indian government bonds into major indices: A matter of time.