Inclusion of Indian government bonds into major indices: A matter of time

The inclusion of Indian government bonds (G-Secs) into major government bond indices such as the JPM GBI-EM Index (J.P.Morgan Government Bond Index - Emerging Market), Bloomberg Global Aggregate Index, FTSE EM-GBI Index (FTSE Emerging Markets Government Bond Index) is a matter of when, not if. The market conversation around this topic started to gain traction in early 2021. Since then, the Indian authorities have made meaningful progress towards making a case for inclusion by improving areas such as reporting and custodian margins.

In past years, there have been several obstacles that have slowed India’s path toward index inclusion, including among others, foreign ownership restrictions, settlement or operational hurdles, and tax implications. The Indian government introduced Fully Accessible Route (FAR) Indian government securities (G-Secs) in March of 2020 to address the issue of foreign ownership limits. While FAR G-Secs currently comprise less than half of outstanding G-Secs, the number and proportion relative to the overall G-Sec space is growing. Indices are however expected to admit only FAR G-Secs once index inclusion occurs.

Another concern is not being able to settle G-Secs via Euroclear. However, in our view, achieving Euroclear settlement may not be as difficult as anticipated if the Indian authorities can work out the details of the tax payment mechanism. Additionally, being able to settle through Euroclear is not a deal-breaker for index inclusion.

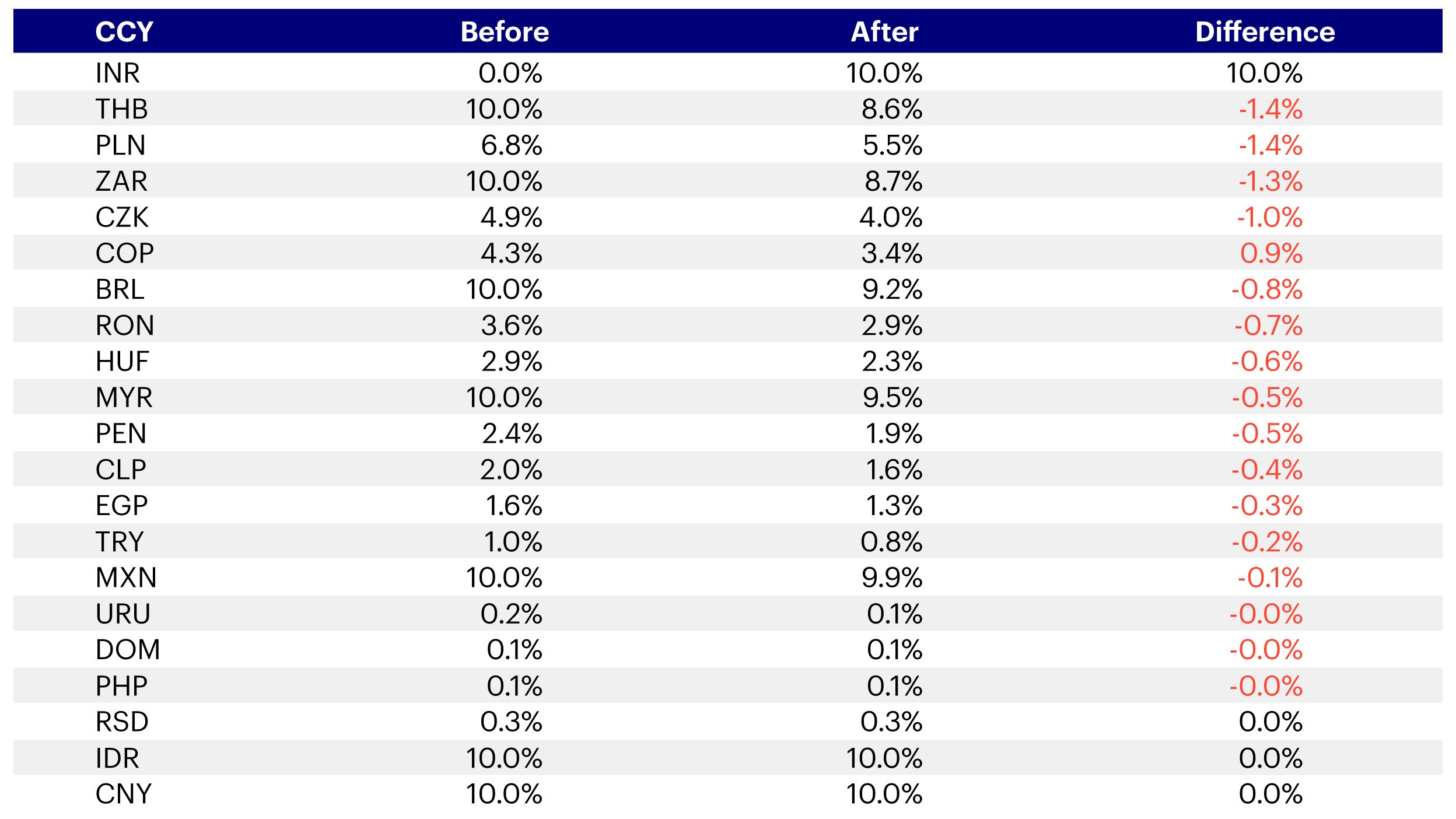

Our estimate is that G-Sec inclusion into the JPM GBI-EM index can be announced as early as September of this year and that actual inclusion will take place six months after that. Given the size of the G-Sec market, India’s local government bonds are most likely to achieve a maximum of 10% weighting in the index upon joining (Figure 1). This will come at the expense of other countries such as Thailand, Poland and South Africa. On the other hand, as the Bloomberg Global Aggregate Index includes the government bonds of several major countries, we expect G-Secs to only occupy around 0.3 to 0.5% of the index once included.

Source: Bloomberg, Morgan Stanley, data as of September 2022.

The capital invested in products that track the JPM GBI-EM Index and Bloomberg Global Aggregate Index is sizeable. The assets under management (AUM) tracking the former index is approximately USD 300 billion while the AUM tracking the latter is much larger at USD 2 to 2.5 trillion. Therefore, we expect passive inflows into Indian local G-Secs to be around USD 35 billion to USD 40 billion during 2023 and 2024. To provide some context, current foreign ownership of FAR G-Secs is about 2.4%, amounting to approximately USD 6.4 billion, while total foreign ownership of all G-Secs is approximately USD 18 billion.

With sizable inflows expected into G-Secs in the coming years, we anticipate there to be positive structural support for India’s local bond market. We’ve seen how this story pans out based on earlier cases where a new country has been admitted into a major index. We anticipate that active accounts will try to position themselves ahead of the passive money before actual inclusion takes place. Passive inflows are likely to follow in adding exposure, with less concern for the external environment than their active peers, until full index inclusion is achieved.

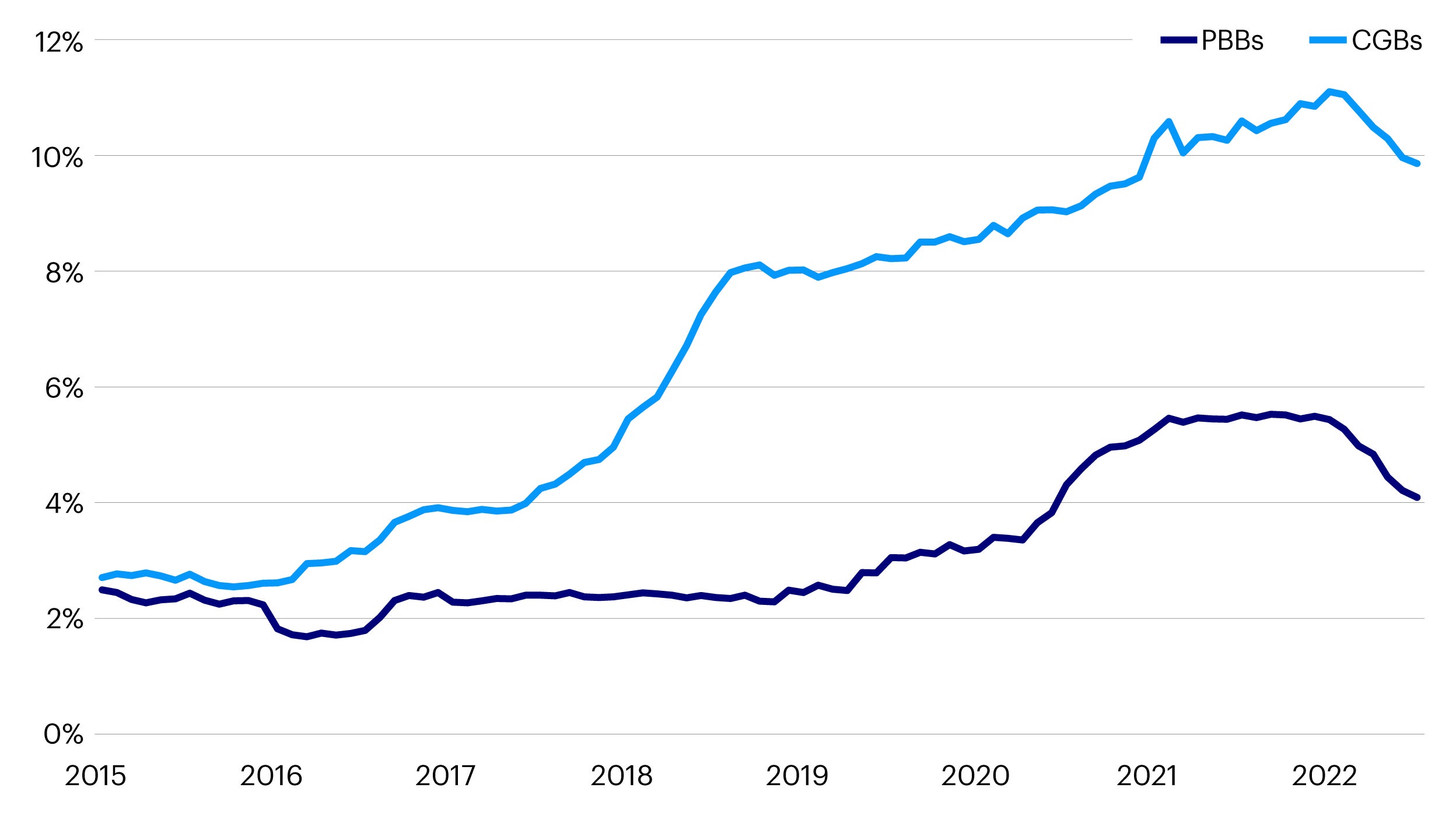

As global investors become more comfortable and familiar with the local bond market, they are likely to then branch out from local government bonds and look toward corporate issuers. The most recent example of this path being China (Figure 2).

Source: HSBC, data as of 1 July 2022.

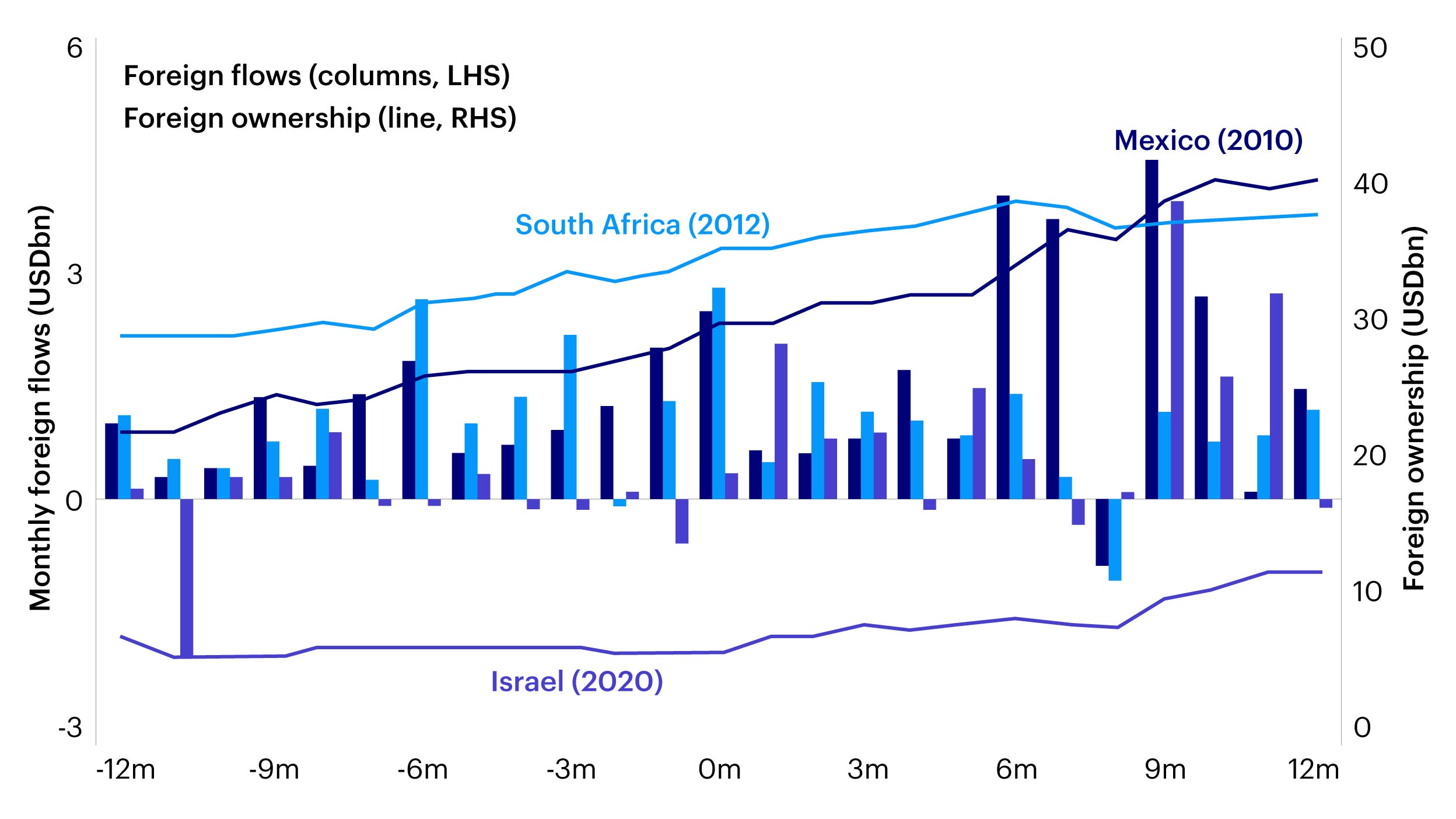

History has shown us that when market conditions are more favorable, foreign ownership flows tend to occur more rapidly, as demonstrated by countries like Mexico and South Africa when these nations joined major global indices (Figure 3).

Source: Central Bank websites, HSBC, data as of October 2021.

Investment implications

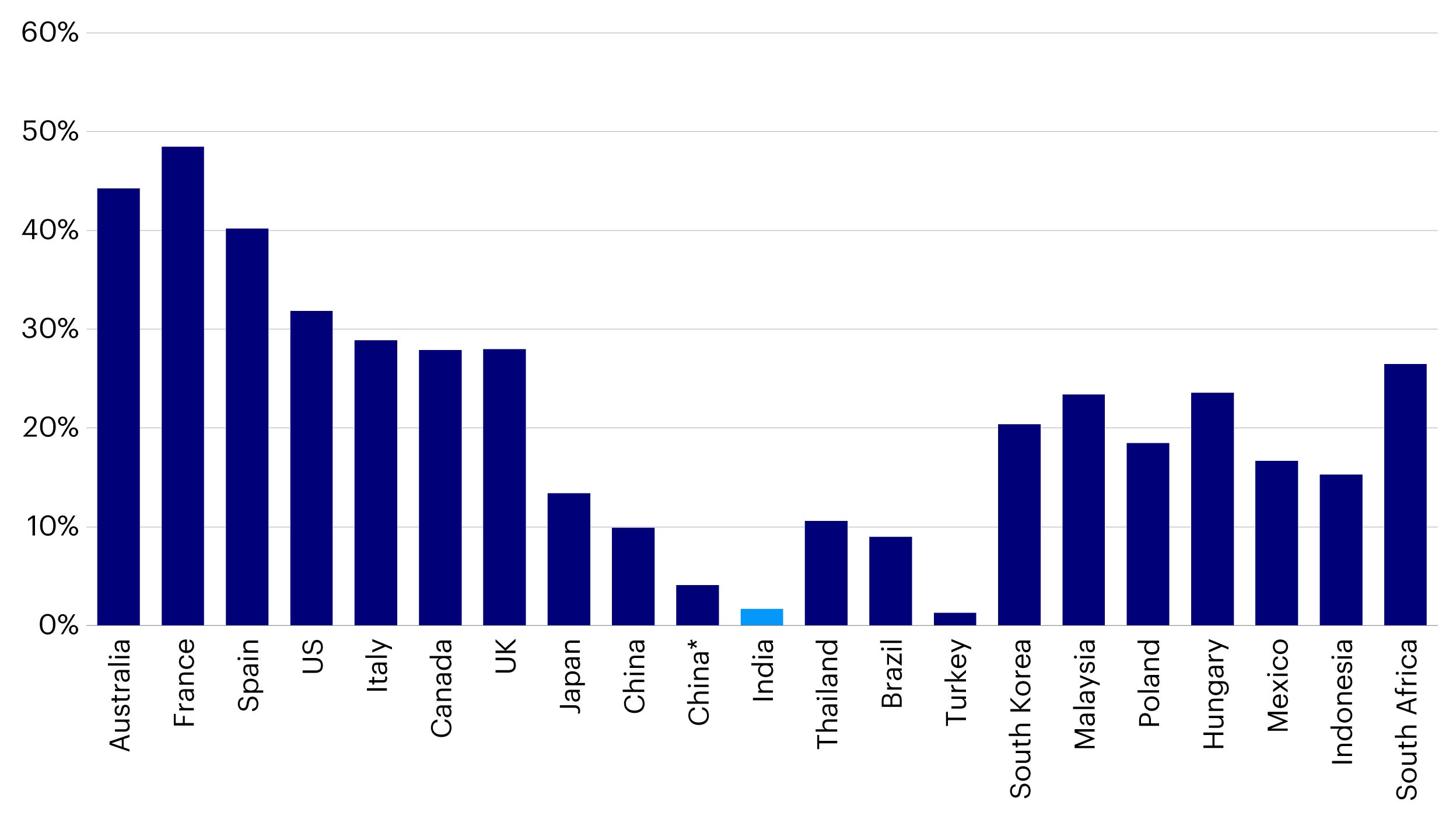

Currently, foreign ownership of Indian bonds is relatively low compared to its peer countries (Figure 4). We therefore hold a positive medium-term view towards the Indian local bond market given this potential positive catalyst. The expected inclusion of the G-Secs into major government bond indices demonstrates the robustness of India’s economic fundamentals and the financial openness that Indian authorities have been striving for. We expect these drivers to positively impact investments in this space in the medium to long term.

Source: HSBC, as of 1 July 2022. Note: China includes China government bonds only. China* includes policy bank bonds only, which are considered as central government risk and traded as rates products.

An update to this article was written in September 2023 following the inclusion of Indian government bonds into the JPMorgan GBI-EM Index, titled India’s recent index inclusion: A double-edged sword?

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.