Evolution of China’s Belt and Road Initiative: Digital Silk Road

The Belt and Road Initiative (BRI) remains one of China’s most important national strategies. In the past most achievements related to promoting the primary targets of the initiative, the land-based Silk Road Economic Belt and sea-based 21st Century Maritime Silk Road. In recent years, China has expanded its ambitions with the introduction of the Digital Silk Road, Green Silk Road, Health Silk Road, and Polar Silk Road. While developments in these four areas have already changed the BRI landscape, global investors’ knowledge of the progress being made is still nascent. In this four-part blog series, we delve into these dimensions of the BRI to allow global investors to better understand the initiative’s future roadmap and the relevant investment implications. The first blog covers the Digital Silk Road.

What is the Digital Silk Road (DSR)?

Digital Silk Road (DSR) is the technological dimension of the BRI that aims to improve digital connectivity in Belt and Road countries. The concept was endorsed by Chinese officials in 2015 and further promoted at the second Belt and Road Forum in 2019. With the rapidly changing geopolitical landscape and speed of technological development over the past years, DSR has been getting more attention particularly as it relates to new technologies, rising technology-related tensions between the US and China, and the emergence of COVID-19.

The DSR can be broken down into three main areas: 1) digital infrastructure; 2) smart city; 3) cross-border e-commerce.

Digital Infrastructure - This includes 4G/5G wireless communications, broadband, subsea cables, cloud computing, surveillance systems, and satellite systems. China already leads in most of these areas, for example, the top two Chinese surveillance giants together supply 60% of the world’s surveillance cameras.1

Connecting the Internet across Belt and Road countries using fiber-optic cables is a major component of the DSR. As of 2019, China was a landing point, owner, or supplier for 11.4% of the world’s undersea cables. This proportion is expected to grow to 20% between 2025 and 2030.2 The Pakistan and East Africa Connecting Europe (PEACE) project is an ambitious element of this plan where a 15,000 km long subsea cable network is being built to service countries across the BRI region with the aim to link Asia, Africa, and Europe (Figure 1).

Source: PEACE, data as of July 31, 2022

The launch of the BeiDou Navigation Satellite System has also upgraded China’s BRI network to a multi-dimensional project with a land, sea, and space presence. Completed in 2020, it serves as an alternative to the American Global Positioning System (GPS), Russia’s Global Navigation Satellite System (GLONASS) and Europe’s Galileo. 137 countries have signed cooperation agreements with the project.3

Smart city - Chinese companies have actively participated in building smart cities both domestically and internationally. Kuala Lumpur has become the first city outside of China to adopt a smart-city system, smart-city technologies, and information and communication technology (ICT) infrastructure developed by Chinese companies. China is also helping Egypt build to be located between the Nile and the Suez Canal.

Cross-border e-commerce - China has signed MoUs on e-commerce cooperation and established bilateral ecommerce cooperation mechanisms with over 20 countries from five continents. It has established cross-border e-commerce comprehensive pilot zones in six batches and rolled out a series of supportive policies, expanding its list for cross-border e-commerce retail imports. China's cross-border e-commerce exports in the first quarter of 2022 rose by 92.7% year on year.4

Why is China motivated to promote the DSR?

While traditional infrastructure was the focus of the earlier BRI phase, DSR has taken precedence in recent years. We believe that the DSR encompasses far more than just the digital component of BRI’s infrastructure projects and could be a game changer for the global digital landscape. The Chinese government has several reasons to promote the DSR:

1. DSR fits with China’s ambitions to achieve high-tech leadership. Similar to China’s major national goals such as Made in China 2025 and China Standards 2035, the DSR aims to position the country for technology primacy and greater autonomy in the global digital order. Through the DSR, China can build and offer digital ecosystems to Belt and Road countries that are almost entirely homegrown.

2. DSR can reduce China’s dependence on other global technology leaders. DSR sets a good foundation to engender a less US-centric and more Sino-centric Asian and global digital order. By the end of 2018, more than half of the undersea cable bandwidth, carrying close to 98% of international Internet data and telephone traffic, was owned or leased by leading US tech giants.5 Such dominance is not healthy for the development of other players in the space. US-China tensions have pushed China to focus more on their technological independence.

3. DSR may facilitate homegrown cyber norms and standards for digital infrastructure and next-generation technology. There are currently no universal digital standards being applied globally. Given China’s strengths in this area, this is a precious opportunity for the country to set domestic and international standards. This can bring considerable strategic advantages and likely boost China’s supply chains and overall global economic influence.

4. DSR can help leading Chinese technology companies become global champions. Through DSR, Chinese businesses can gain better access to local markets in BRI countries. Other countries’ reliance on Chinese infrastructure could also be strengthened.

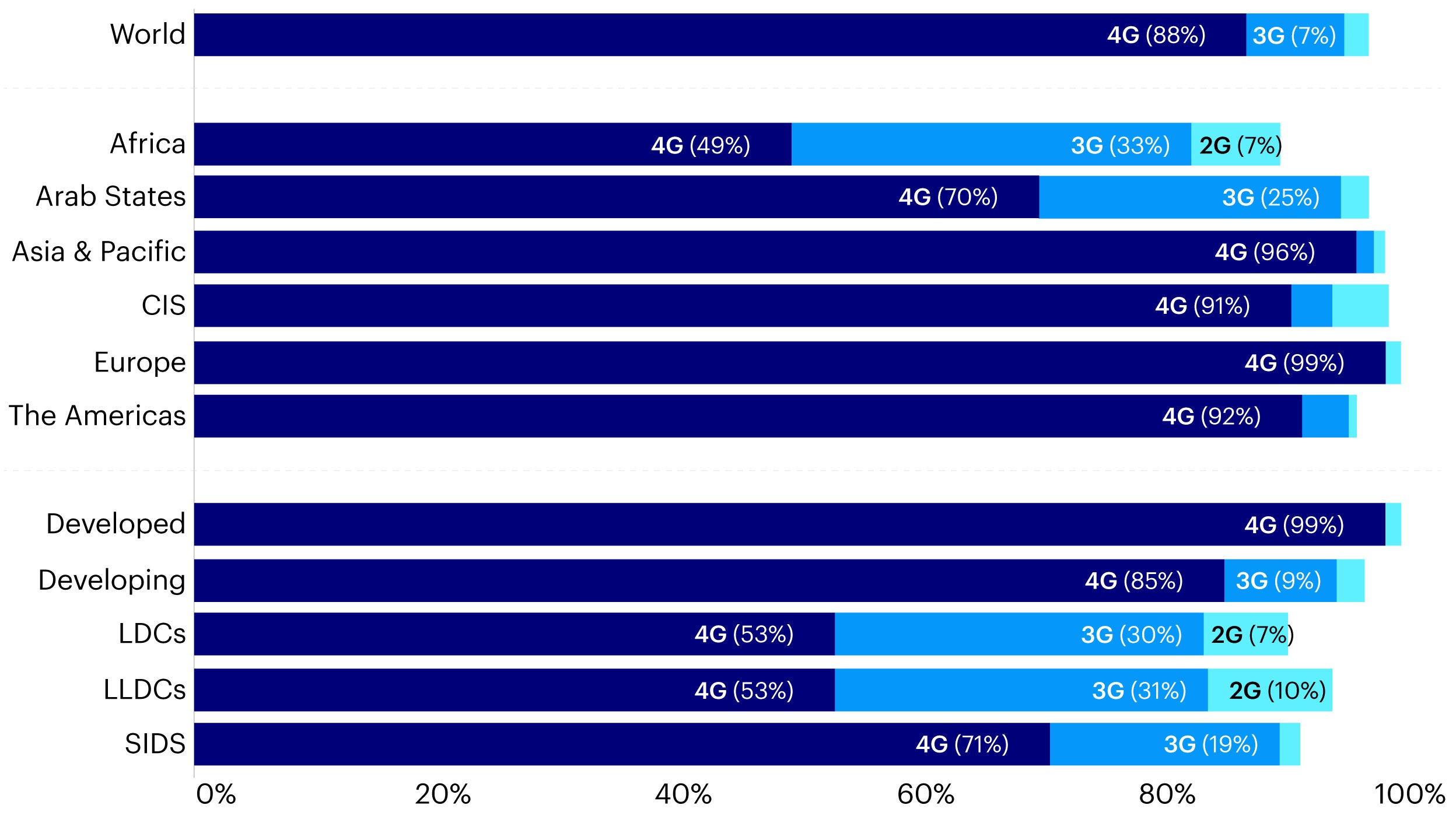

5. DSR aligns with the current development trend as digital activities become more important. Many BRI countries still suffer from poor digital infrastructure and lack of talent. The mobile network coverage gap is significant for some developing economies (Figure 2) and Internet penetration rate remains low, particularly in African countries (Figure 3).

Source: International Telecommunication Union, data as of December 31, 2021. Note: CIS stands for Commonwealth of Independent States; SIDS stands for Small Island Developing States; LLDC stands for Landlocked developing countries, LDC stands for least developed countries.

Source: International Telecommunication Union, data as of December 31, 2021. Note: CIS stands for Commonwealth of Independent States; SIDS stands for Small Island Developing States; LLDC stands for Landlocked developing countries, LDC stands for least developed countries.

Outlook for DSR and investment implications

A growing number of countries have started to cooperate with China on the DSR. According to a 2021 report published by the Cyberspace Administration of China (CAC), 17 countries have signed Digital Silk Road-specific MoUs with China.6 201 Chinese companies in the digital sphere have implemented 1,334 overseas investment and cooperation projects in the past two years, 57% of which have been associated with the Digital Silk Road.7 The push to develop the DSR has involved state-backed telecom carriers as well as privately owned technology companies.

It’s not surprising that China’s technological success and emphasis on DSR has contributed to ongoing US-China tensions. However, we cannot ignore the rapidly growing demand for digital technologies in developing world and China’s success in improving digital infrastructure and connectivity in the Belt and Road region. The US and other developed economies are also trying to compete to bring these services to developing countries. However, while China still competes with the US for technological leadership, Chinese products are popular in emerging markets given their decent quality and affordability.

Advanced Chinese technologies are likely to remain attractive for developing markets, despite the West’s questions around their security and quality. We believe the future of China’s DSR remains bright and expect more long-term investment opportunities will emerge in Belt and Road countries given the technological innovation and digitalization reshaping the region. As Chinese companies bring their knowhow and expertise to the developing regions and build a better digital infrastructure network, we anticipate that select Belt and Road countries will structurally benefit.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

FOOTNOTES

-

1

TIME, data as of Feb 9, 2023

-

2

Huawei-Backed Cable Linking China, Europe, Africa Lands in Kenya, March 2022, https://www.bloomberg.com/news/articles/2022-03-29/huawei-backed-cable-linking-china-europe-africa-lands-in-kenya

-

3

The completion of the Beidou satellite navigation network opens up new opportunities for China to serve the world, August 2020, http://www.chinafrica.cn/Homepage/202008/t20200803_800216550.html

-

4

China Ecommerce Exports Up 92.7% As BRI Countries Develop Mutual Digital Trade Engagement, November 2022, https://www.silkroadbriefing.com/news/2022/11/14/china-ecommerce-exports-up-92-7-as-bri-countries-develop-mutual-digital-trade-engagement/

-

5

China’s Digital Silk Road and the Global Digital Order, April 2021,https://thediplomat.com/2021/04/chinas-digital-silk-road-and-the-global-digital-order/

-

6

China’s post-pandemic Digital Silk Road, February 2021, https://www.eurasian-research.org/publication/chinas-post-pandemic-digital-silk-road

-

7

China’s post-pandemic Digital Silk Road, February 2021, https://www.eurasian-research.org/publication/chinas-post-pandemic-digital-silk-road