ESG Implications for Asia in today’s macro environment – Part 2

2022 to-date has seen geopolitical geopolitical and market movements, macroeconomic adjustment, and regulatory events. In the second of this 2-part series, we examine the impact of current market environment on the future of climate investing.

The future of climate investing in Asia

In our previous piece, we discussed how recent ESG market flows are driving interest towards ESG integration and regulatory developments. At the same time, recent market events have also impacted climate related investing. We believe amidst short term volatility, climate transition will still be a long term structural trend and broader sustainability thematics will be increasingly important.

Examining market impact on climate investing

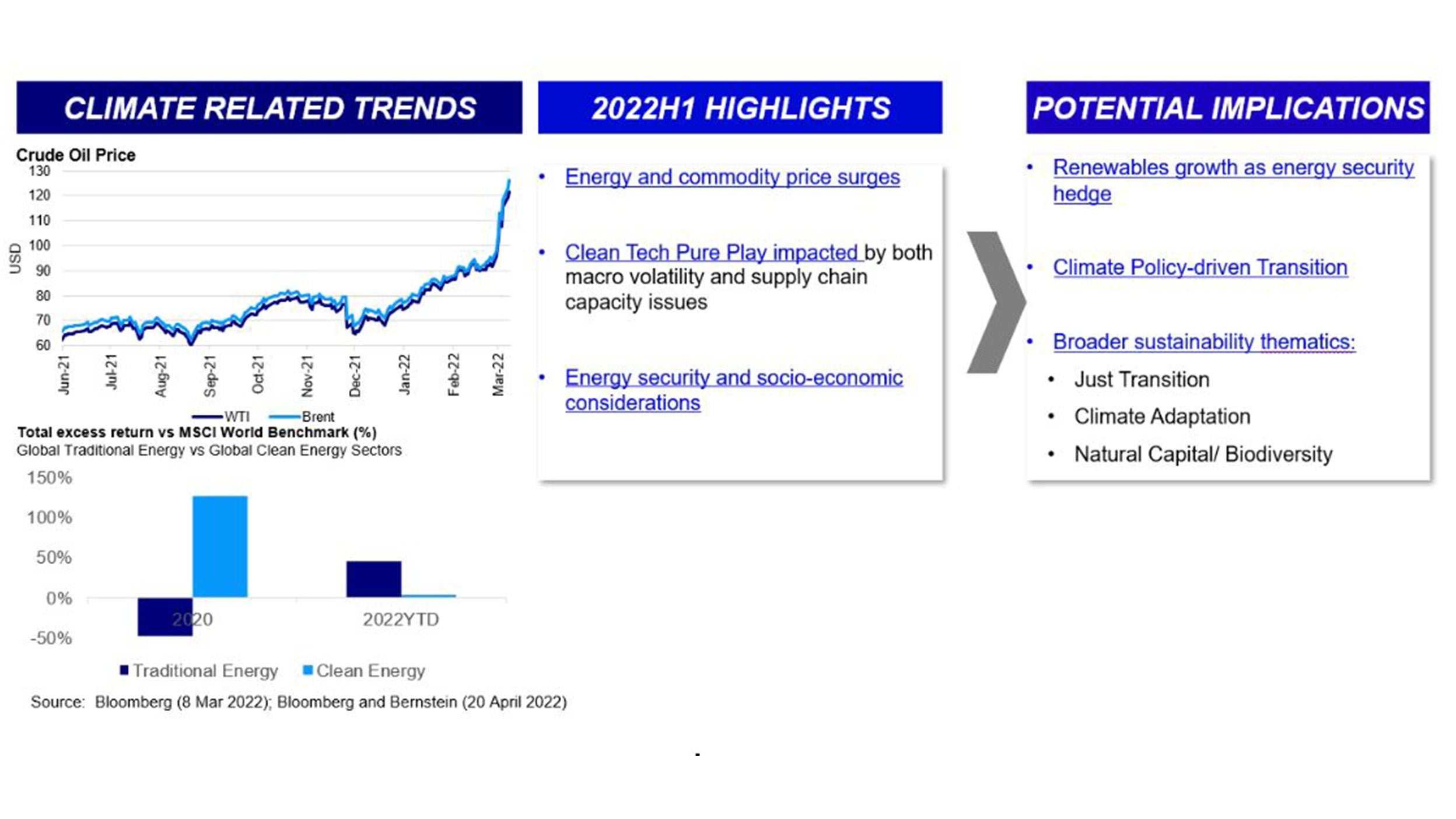

As discussed in a previous piece, recent geopolitical events have shone light on the challenges Europe faces by being over-reliant on Russia gas. Over this period:

- Energy and commodities prices have surged raising industry questions on viability of shifting away from traditional energy.

- Clean Tech Impacted: Clean tech plays in renewables or EVs that have outperformed previously has also taken a tumble driven by overall macro sentiment and by supply chain capacity issues particularly by shortage in components (like polysilicon) or raw materials (like nickel).

- Transition concerns: The move towards decarbonization has also raised questions relating to energy security and impact on livelihoods and economy.

Looking at the future of sustainable investing in Asia

While volatility may persist in the short term, governments around the world have been translating climate commitments into policies and budgets. In parallel, there is also increasing attention towards the broader impact that climate transition can have.

Energy Security and Policy-driven Transition

Energy security driven demand: Increasing demands for energy security accelerates renewable growth as a hedge against relying on energy imports. The European Commission’s updated REPowerEU plan increases 2030 renewables target from 40% to 45%, doubles solar capacity while also driving electrification and uptake of renewables in industrial production.1 This could create longer-term tailwinds for the renewables space particularly in solar and wind where cost declines over time have driven price parity and created export opportunities for Asia and China clean tech leaders.

Climate Policy driven growth: In parallel, global climate urgency will continue to see national commitments translate into policies and development plans. Coming out of COP26 nearly 90% of global emissions now have net zero pledges2 yet only 50% of these are already covered by climate laws and policies.3 Many regions have set in place policies, including:

National decarbonization plans such as the European Green Deal and China’s 1+N decarbonization framework

Sectoral roadmaps like increasing renewable mix (such as REPowerEU plans or subsidies for distributed generation) or enacting policies to support EV growth (zero emission vehicles policies in UK, Canada and various other countries4)

Carbon price instruments: including carbon taxes (like in Singapore) or launching emissions trading schemes (like Europe or China).

- Sectoral policies drive demand towards clean technologies and low carbon sectors while carbon pricing incentivize corporate to consider transition plans creating opportunities to invest in industry leaders making decarbonization progress.

Growth of Broader Sustainability Thematics: Broader sustainability themes are also gaining interest, including themes relating to just transition, climate adaptation and natural capital.

Just Transition: Climate transition implies a need to ensure just transition (taking socio-economic impact into account in the shift from an extractive to regenerative economy) especially for regions like Asia that are most affected by physical and transition risks. Ensuring that decarbonization is balanced against social considerations like employment, economic growth and re-training and education is critical to enable a successful transition and help mitigate socio-economic investment risks.

Adaptation: Relatedly, climate adaptation is crucial to reduce investment risks in economies most vulnerable to physical risks. Much of climate investing today is concentrated on mitigation and there is an opportunity for greater adaptation finance focused on building resiliency.

Natural Capital: Natural capital is also emerging as a material investment theme. In 2022 we expect to see the launch of the TNFD framework (Taskforce on Nature-related Financial Disclosures). While natural capital and biodiversity is a complex topic given wide-ranging supply chain impacts and challenges in measurement, we anticipate that nature-related risks will become an additional investment risk consideration with thematic opportunities in agriculture and food, water and reforestation.

Source: Invesco, for illustrative purposes only.

Approaches to Climate Investing

Climate transition could present material investment risks alongside thematic opportunities. Climate investing approaches include climate as integration, sustainability thematics and transition plays. Climate integration actively considers material physical and transition risks in investment process. Investors can also factor in decarbonization trajectories of portfolios to evaluate potential value-at-risks; this is supported by tools like our Net Zero Investment Framework or our partnership with Tsinghua on emissions data. Sustainability thematics focuses attention on both carbon reduction technologies and policy-driven demand trends. Transition plays look to capture upvaluation from companies making decarbonization progress often enabled by having targeted engagement aligned with our decarbonization framework. In short, multiple approaches to climate investing are available based on what’s best suited to investment objectives and requirements.

Footnotes

- 1

-

2

Data correct at February 16th 2022 - https://zerotracker.net

-

3

Carbon Brief https://www.carbonbrief.org/in-depth-qa-the-ipccs-sixth-assessment-on-how-to-tackle-climate-change

-

4

Zero Emission Vehicle Pledges Made at COP26 - UNFCC, November 2021, https://unfccc.int/news/zero-emission-vehicle-pledges-made-at-cop26