ESG implications for Asia in today’s macro environment – Part 1

2022 to-date has seen geopolitical and market movements, macroeconomic adjustment, and regulatory events. In the first of this 2-part series, we examine the impact of current market environment on the future of ESG investing.

The future of ESG investing in Asia

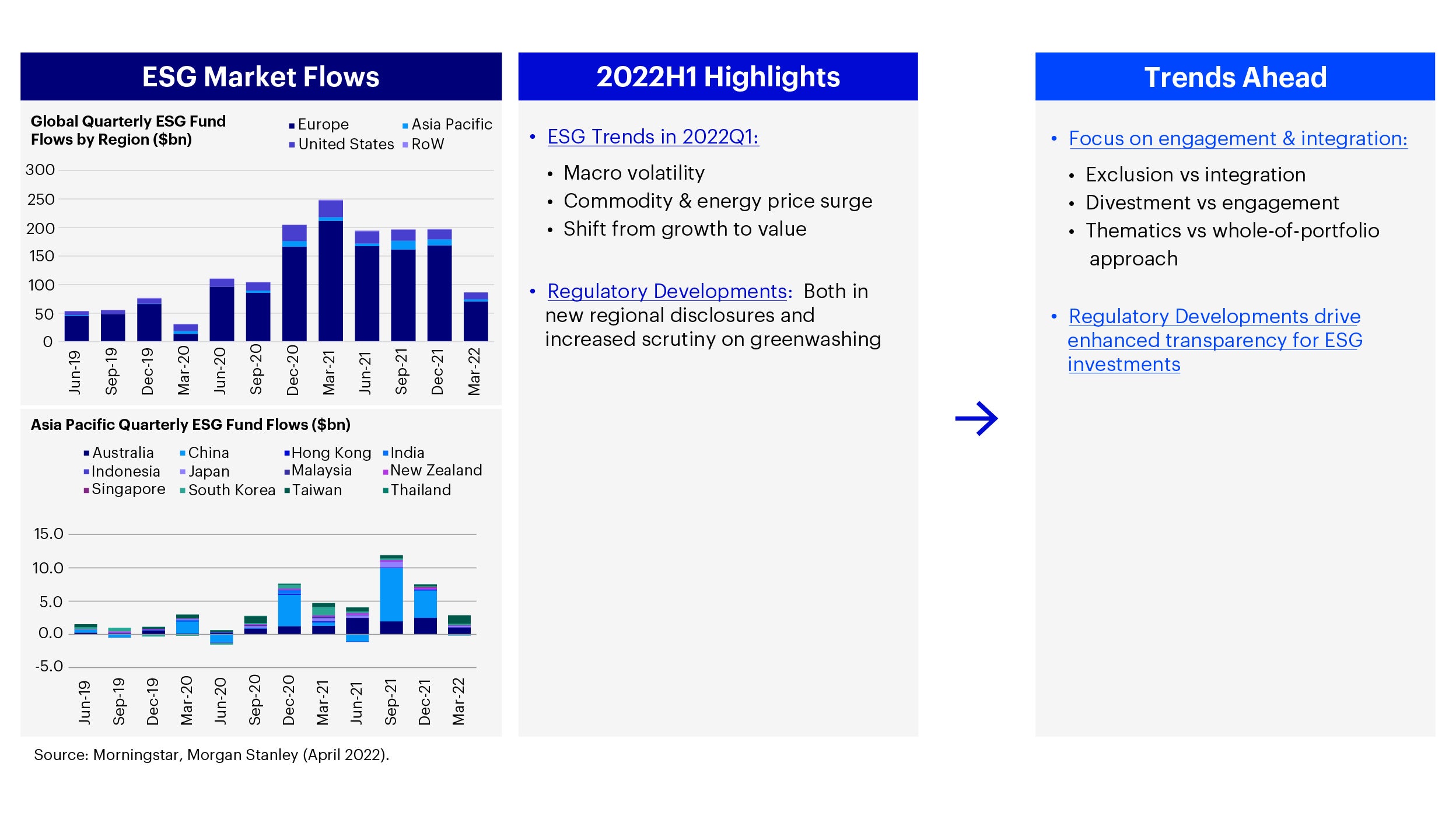

In the ESG space, while 2020 to 2021 has seen strong ESG fund flows and outperformance, 2022 to-date has continued inflows amidst market adjustments. The market has also seen increased regulatory activity on ESG investing strategies. How has the ESG investing space been impacted and what implications and opportunities does it present for Asia investors ahead? We believe that current market environment highlights the importance of taking a broad-based approach to ESG investing by looking at longer-term structural trends to capture potential investment opportunities. Regulatory developments will also enhance transparency for investors.

Understanding the ESG Cycle: ESG investing trends in Asia

While global ESG AUM flows have seen strong growth over 2020 to 2021, the first quarter of 2022 has seen adjusted ESG flows though overall net flows are still positive.1 Some ESG indices have underperformed market indices by 1-7% in 2022 year-to-date across different regions.2 This recent movement has been driven by:

- Macro market environment has affected markets and flows across the board.

- Energy and Commodity surges: Geopolitical events have also resulted in energy shortages and corresponding supply shocks leading to price increases in certain raw materials and commodities. Commodities and energy sectors are often excluded in ESG funds and recent price surges have seen some investors reallocate, while at the same time longer-term pure plays in renewables or clean energy have also seen short-term readjustments.

- Growth to value reallocation: Finally, current macro environment generally sees a shift from growth into value, leading to some adjustments as conventional ESG investing tends to be tilted to quality and growth sectors.

ESG as a structural trend: longer-term implications for Asia

While short-term macro environment has affected recent ESG investment flows and performance, we expect longer-term structural trends on integration and increased regulatory momentum to provide potential opportunities for ESG investing in Asia.

- Increasing focus on integration and engagement: While many ESG strategies center on exclusions or divestments, increasingly there is greater emphasis on broad based ESG approaches and we see a shift from exclusions to integration, from divestment to engagement and from thematics to whole-of-portfolio approaches.

- Integration vs exclusions: While exclusionary approaches are often helpful in mitigating sectors or issuers with higher ESG risks, a broad based ESG integrated approach assesses material ESG risks and opportunities for each issuer and balancing that against other investment considerations. From a financial perspective, this approach also reduces risks from macro factors or having concentrated sectoral tilts and is a good hedge against short-term volatility.

- Engagement driven returns: Engagement and active ownership allow investors to work closely with prioritized issuers to think about ESG risks and opportunities such as having climate commitments, targets, disclosures and decarbonization roadmaps to mitigate against transition and policy risks.

- Whole-of-portfolio: Similarly, while certain thematics have benefited from climate tailwinds, in parallel there are also value plays in transition names that are making good decarbonization progress or ESG momentum which also fits well when thinking about style during an current macro environment. A whole-of-portfolio approach will include both thematic growth names alongside transition value or quality plays.

2. ESG Regulatory driven growth: Amidst market volatility this year, 2022 has seen a flurry of ESG regulatory activity and scrutiny on ESG investing and greenwashing.

Regulatory developments: In our previous whitepaper on ESG Regulation in Asia, we cover how there have been more than a thousand regulations globally with at least 200 in Asia.3 Notable developments include:

- Corporate Disclosures: The International Sustainability Standards Board is currently undergoing consultations for its draft proposed standards. With a focus on climate-related disclosures, this proposal is notable with the goal to bring harmonization and comparability in standards and also converging different standard-setting organizations together.

- Climate Risks Disclosures: Focused on the disclosure of climate-related risks and metrics, most of these are aligned to the Task Force on Climate-Related Financial Disclosures (TCFD) framework. In 2022, we expect Singapore’s Monetary Authority and Hong Kong’s Securities and Futures Commission to require climate-risk disclosures for asset managers with similar disclosures expected for corporates as well as other regions (like the UK) in the years ahead. The US Securities and Exchange Commission (SEC) is currently also undergoing consultations for its climate risk-related disclosures. Scope 3 emissions requirements, capturing materiality and assurances would be interesting points to monitor.

- Regulations on ESG investors: The EU has led the way in regulating ESG investments with its Sustainable Finance Disclosure Regulation (SFDR). The US SEC also recently announced proposals for ESG fund disclosures and updates to fund names rules to include ESG in scope.4 The objectives of such regulations are to help address greenwashing risks and improve ESG reporting.

- Taxonomies: Serving as a classification framework of how to define sustainability, globally there are more than 20 taxonomies in development. Notable ones include the EU Taxonomy and China's Green Catalogue, Singapore and ASEAN taxonomy; with thinking on convergence beginning with the EU and PBOC’s work on the Common Ground Taxonomy, a comparison on the taxonomies of both regions.

- Governance: different regions in Asia have seen governance-related reforms, such as Hong Kong mandating gender-diverse boards, Japan’s corporate governance code reforms or Singapore’s mandatory enforcement of sustainability training for directors.

Enhanced transparency: Growing regulations will enhance transparency between leaders and laggards and investors will likely prioritize holdings with better ESG progress such as on decarbonization given increasing material climate physical risks or pricing of transitions risks like carbon taxes. Regulatory focus on ESG will also help improve investors disclosures on ESG investing strategies creating greater investor confidence in the space.

Source: Invesco, for illustrative purposes only.

Invesco’s ESG Investing Approach

ESG investing is key in sustainable value creation and effective risk mitigation in our investment processes. This is enabled by underlying tools and processes, including our proprietary tech tools like ESGIntel (issuer-level ESG ratings platform) and ESGCentral (portfolio-level ESG analytics tool) as well as our approach to active ownership like targeted engagements (>3K engagements in 2021) including collaborative engagement partnerships and also our global proxy voting approach and policy. As a firm we have nearly $90B USD in ESG AUM5, allowing Invesco to provide a range of ESG investing capabilities and solutions across geographies and asset classes.

Footnotes

-

1

Morningstar and Morgan Stanley ESG Fund Flows Asia Sustainability: ESG Fund Flows in April Fall YoY but Turn Positive MoM (ms.com)

-

2

MSCI, Bloomberg

-

3

Invesco https://www.invesco.com/apac/en/institutional/insights/esg/esg-regulation-in-asia.html ; GS SUSTAIN. APAC ESG Regulations in Asia. A new era for ESG in Asia Pacific (gs.com)

-

4

CNCB https://www.cnbc.com/2022/05/25/sec-unveils-rules-to-prevent-misleading-claims-by-esg-funds-.html

-

5

2021 UK Stewardship Code, April 2022, Invesco UK Stewardship Code Report