ESG & Impact: Impact investing in Asia

In this podcast, Norbert Ling, ESG Credit Portfolio Manager, Alexander Chan, Head of ESG Client Strategy, Asia Pacific and Yifei Ding, Senior Portfolio Manager examine the investment themes and challenges of impact investing and climate adaptation in Asia.

Impact investing has seen growing investor interest; this 2-part series starts with an overview on impact investing before deep-diving into climate adaptation as a theme of interest.

The case for impact investing in Asia

What exactly is impact investing?

We previously shared that ESG investing is a spectrum, with differing investor ESG objectives and corresponding approaches. A helpful starting point when thinking about impact is that investors primarily seek to achieve a specific ESG outcome. At times this might be done alongside other financial and investment objectives (where corresponding thematic or sustainable strategies would be suitable), but for some investors impact could be the prioritized objective. This is where impact investing comes in, specifically referring to strategies whose objective is to generate an intentional, measurable, and beneficial social or environmental impact. In the case of impact investing, this objective is prioritized above financial objectives.

Sources: Morgan Stanley Research, Broadridge Global Market Intelligence, Global Impact Investing Network (GIIN).There is no guarantee that the forecast will be reached.

Market Overview

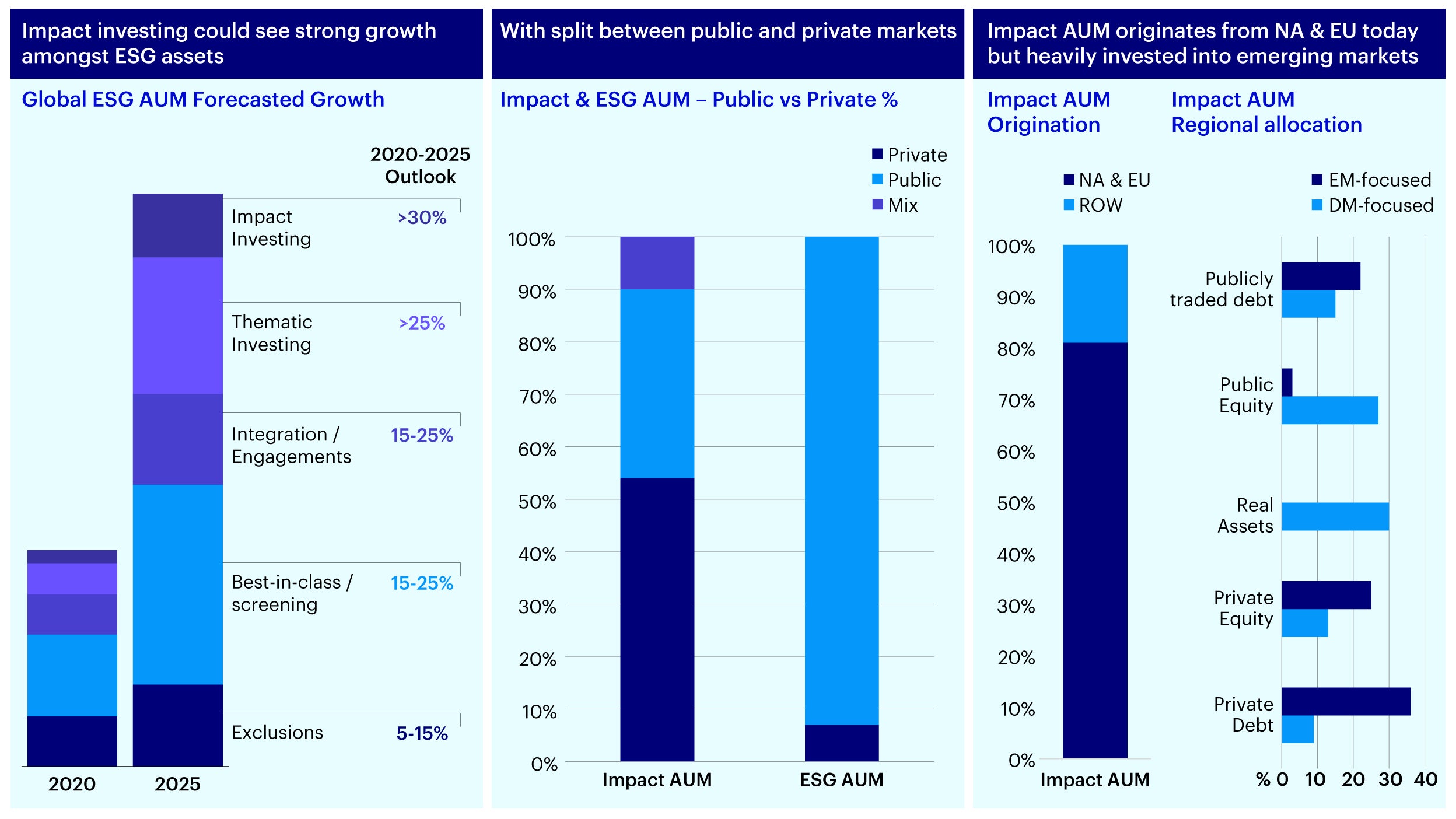

While global impact investing assets under management (AUM) is still small relative to the overall ESG investing market (Global Impact Investing Network, GIIN, estimates it was at $1.1 trillion USD as of October 20221), industry research estimates that impact investment will see the fastest growth during the period between 2020 and 2025.

- Private/public split in assets: Compared with general ESG investing where public markets take majority share, private markets make up a more sizeable share of impact investing AUM. This includes investments across private debt, private equity and real assets like real estate and infrastructure.

- Developed market originated, emerging market focused: While most of the impact AUM today originates primarily from developed markets (most notably US and Europe)2, these impact capital funds tend to be invested in emerging markets in the private space. While funds that invest in public markets typically deploy capital into developed market investments.

Sources: Invesco Global Sovereign Asset Management Study 2022; Knight Frank Wealth Report; Glasgow Financial Alliance for Net Zero (GFANZ); Invesco Analysis. Note: EU: Europe; NA: North America.

Drivers of impact investing in Asia

Impact investing is expected to see faster growth compared to other ESG investing approaches; with main drivers being:

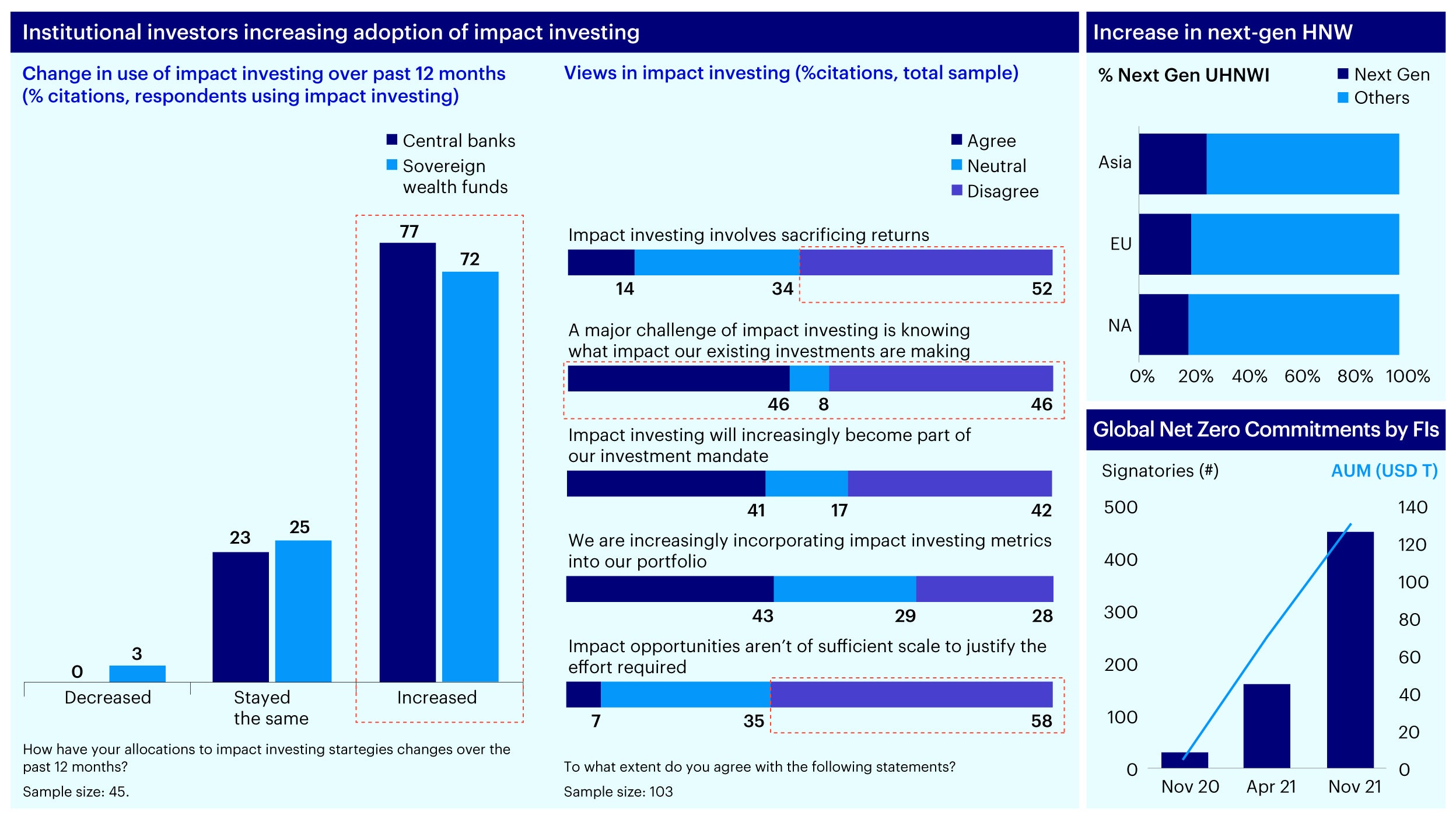

- Institutional adoption: Institutional investors have increased their focus on this segment. Invesco’s Global Sovereign Asset Management Study 2022 saw over 70% of both central banks and sovereign wealth funds increase their use of impact investing in past 12 months with most institutions already actively adopting impact investing. This is driven partly by the goal to deliver greater positive outcomes for society in the investment process while minimizing risks of greenwashing. Many also disagree that impact investing involves sacrificing returns with a keen interest to assess actual impact and to deliver impact at scale3.

- Next generation wealth: Industry wealth reports highlight the increasing growth of next generation wealth, particularly ultra-high-net-worth individuals (UHNWIs) who are self-made and under the age of 40 taking increasing share amongst the overall UHNWI segment. Asia as a region has the highest proportion of next generation wealth compared to North America and Europe4. More importantly, this segment also identifies “impact investing and philanthropy” as the top driver in investment strategy and asset allocation decisions with varying motivations including the belief that sustainability delivers better returns over time, seeing sustainability as a source of brand differentiation and a desire to give back to society.

- Asia transition progress: As shared in our ESG Outlook, global focus on climate has shifted from net zero commitments towards implementation. Within Asia, most governments have commitments, but Climate Action Tracker has also assessed most existing plans as insufficient5. Investor and shareholder scrutiny on actual decarbonization progress creates opportunities for impact investing as a segment.

Sources: IEA; IMF; World Bank; Natural Capital Finance Alliance; ENCORE database; World Economic Forum, AlphaBeta analysis. Note: CCUS: Carbon Capture, Utilization and Storage; ROW: Rest of World.

Impact investment themes in Asia

Asia as a region has a diverse range of needs given countries with differing socioeconomic conditions and varying vulnerability to climate and nature-related risks.

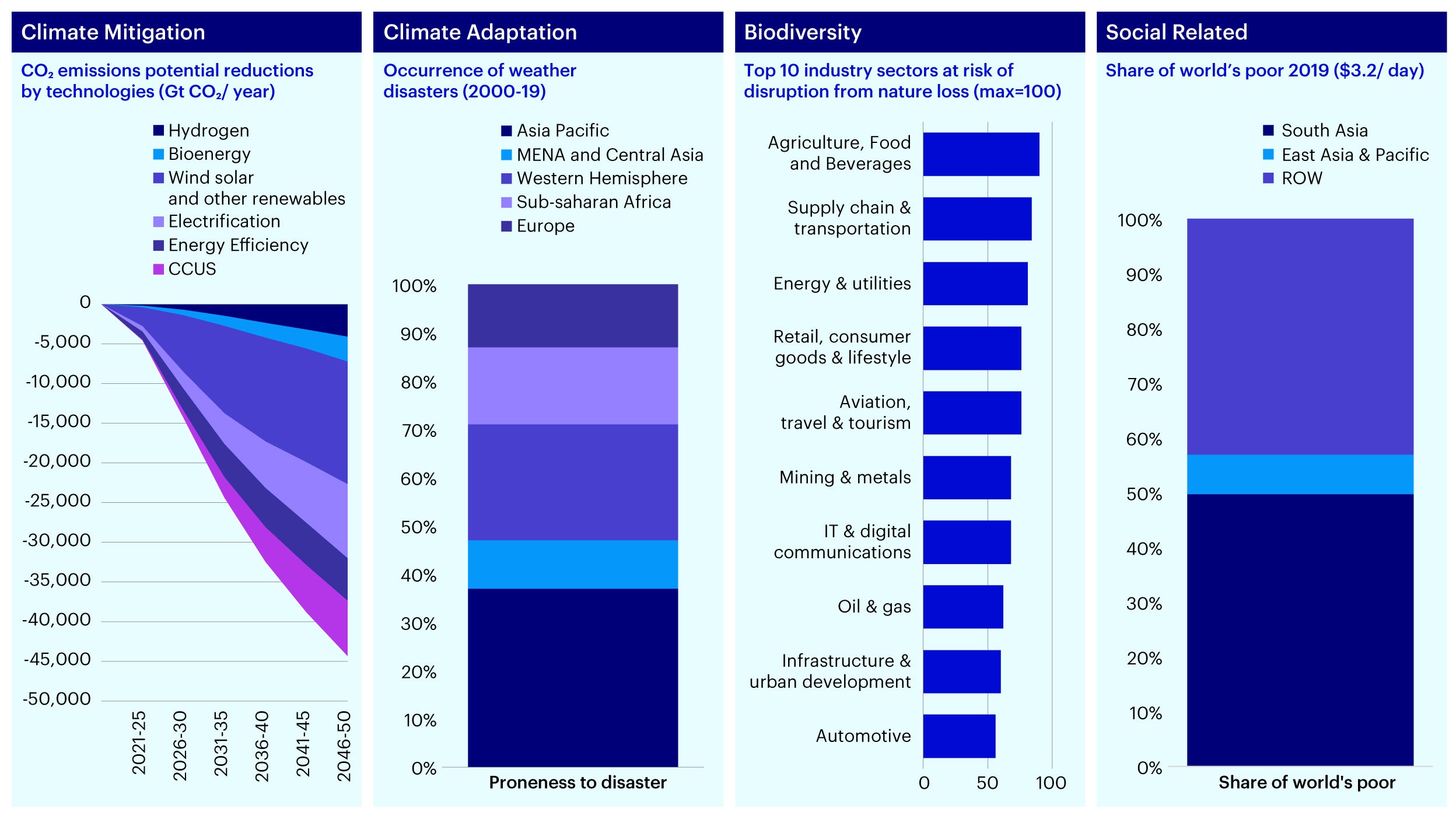

- Climate mitigation: As shared in our report Targeting Net Zero in Asia, today Asia still contributes to more than half of global emissions and has a high coal dependency. To move towards climate mitigation, we see the major themes of renewable energy generation, low carbon transport, energy efficiency and innovative climate solutions come into play. The further roll-out and expansion of the scope of carbon markets can help price signaling and we expect this to drive carbon prices to be aligned to the cost of abatement. Net zero transition has already begun, and we believe this will impact all sectors within Asia, particularly given its role as the world’s global supply chain. The opportunity set is to be invested in companies that are decarbonizing, particularly within the material emitting sectors.

- Climate adaptation: The Asia Pacific region is likely to see a greater number of weather-related disasters than other regions, both in terms of frequency and severity. Globally, adaptation finance is increasing but there remains a large financing gap and it is still predominantly funded by the public sector. It is estimated that adaptation costs in developing countries could reach $300 billion annually by 2030, while only 21% of climate finance provided by the developed countries to support developing nations goes toward adaptation and resilience6. There are several clear investment themes incorporated as part of climate adaptation which include: water, agriculture and food security, urban infrastructure, nature-based solutions, and forestry and land use amongst others.

- Biodiversity and nature losses: Ecological degradation and loss of biodiversity remains a serious problem in Asia where a large portion of the population live in rural areas. In South and East Asia and the Pacific, 73 to 84% of the poor live in rural areas7. We expect more asset owners to pledge to reverse biodiversity loss in the coming decade. While part of the focus on climate mitigation has been reforestation and generating carbon credits, this does not consider the impact of biodiversity loss that has already occurred. With the evolution of the Taskforce on Nature-Related Financial Disclosures (TNFD) and associated reporting, we expect that methodologies to measure the impact on biodiversity will only broaden.

- Social related: While the focus on impact investing has been largely environmental till date, we believe that social and environmental issues are deeply intertwined particularly as these relate to gender issues and poverty reduction. We have seen an increasing trend of green bond issuers reporting on social key performance indicators (KPIs). Even while China has carried a strong weight to reduce poverty rates over the last few decades, South Asia still lags in the Asia-Pacific region. South Asia, East Asia, and the Pacific accounts for 58% of the world’s poor at $3.2 a day or lower8. Alongside reducing poverty rates, improving equity via access to health care, affordable housing, education, and financial services is equally important. For example, annual per capita healthcare in developing Asia significantly lags developed Asia. We are seeing more issuers focusing on the triple bottom line of environmental, social, and financial targets, and anticipate that this will correspondingly drive a larger issuance of social bonds in Asia.

Sources: GIIN (Global Impact Investing Network), CDP, Bain, Morgan Stanley (end 2021), Morningstar. Notes: UN SDGs: United Nations Sustainable Development Goals; SFDR: Sustainable Finance Disclosure Regulation.

Key challenges and capabilities to impact investing

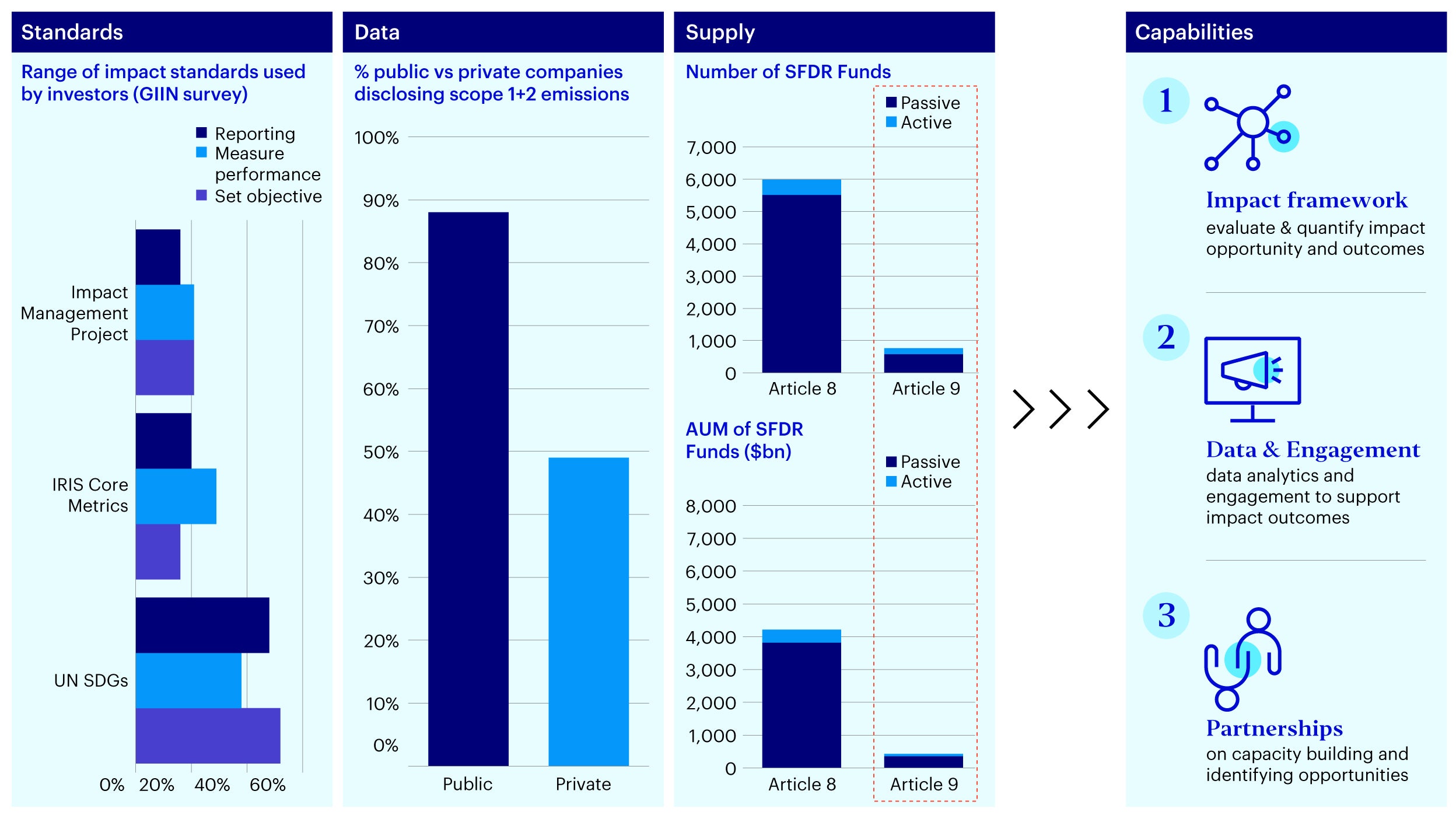

GIIN has previously defined the important characteristics of impact investing, including ensuring intentionality, evidenced based impact design, impact monitoring and industry contributions9. Yet with the implementation of impact investing strategies, common challenges include:

- Impact assessment: Evaluation of impact often requires clear and consistent frameworks that allow the assessment and monitoring of impact outcomes and progress over time. This is especially important given greenwashing risks involved across how impact is defined, measured, and quantified, tracked, and reported. Additional complexities:

o Consensus on frameworks: There is no singular standard for impact assessment; frameworks commonly used include UN Sustainable Development Goals (giving a map of thematic areas to align to), Impact Management Project (giving guiding steps in considering impact) and IRIS+ (set of core impact data metrics). Taxonomies are also an additional source of reference defining a prescriptive list of green activities and in this space alone there are already varying taxonomies being developed in Asia, from China’s Green Bond Catalogue to ASEAN or Singapore’s taxonomies. These broad frameworks also signify challenges in assessing and comparing impact across different projects or investment strategies.

o Clarity on regulations: We previously covered differing fund regulations across regions; some regions do include fund label and disclosure requirements for impact investing (e.g. Sustainable Finance Disclosure Regulation Article 9 or UK Financial Conduct Authority Impact Label) with differences such as requirements relating to assessing “do no significant harm” or fund’s sustainable composition. Within Asia, there’s also yet to be specific labelling or disclosure requirements relating to “impact investing”, with the segment falling more under general ESG funds guidelines in some regions.

o Other nuances: Additionality – showing that impact would not have happened otherwise – is often hard to demonstrate. Impact quantification reliant on past projects also brings into challenges of context and external validity that may vary across region or sectors.

- Data availability and quality: Data disclosures are often a challenge especially in private companies and more broadly in Asia. There are also implementation challenges in capacity building for issuers on impact data collection and tracking.

- Supply of opportunities: Operational challenges alongside greenwashing scrutiny has also meant that the supply of quality impact investing opportunities tend to be limited. In Europe for instance, the number of Article 9 funds are much smaller in proportion compared to Article 8 funds.

Given the challenges laid out, corresponding capabilities required for impact investing include:

- Impact evaluation framework: This would be specific to the impact theme and theory of change; providing a way for investors to evaluate and quantify the impact opportunity and magnitude of outcomes achieved.

- Proprietary data and engagement: Impact data that corresponds to the impact assessment framework. For private issuers, engagement would play a key role in assessing impact outcomes.

- Industry partnerships: Be it for industry capacity building or for identification of impact opportunities, having a network of industry partners plays a key role in impact investing strategies.

Given the range of impact needs discussed, impact investing as a segment presents unique opportunities for investors looking to achieve specific ESG outcomes in Asia. In the next article, we will deep-dive into the theme of climate adaptation and highlight approaches to investing for adaptation impact.