Asset owner insights: Insurers’ approaches to climate investing and asset allocation

In 2024, we released a whitepaper on Asia asset owners’ approaches to ESG and climate investing, where we looked at 52 APAC asset owners with $15T USD in assets under management to assess the increasing range of sustainable investing objectives and strategies that asset owners are considering.

The insurance segment is particularly interesting given the financially material risks and opportunities that climate can have on that industry. Many insurers have set interim targets and made increasing allocations to the climate investing theme.

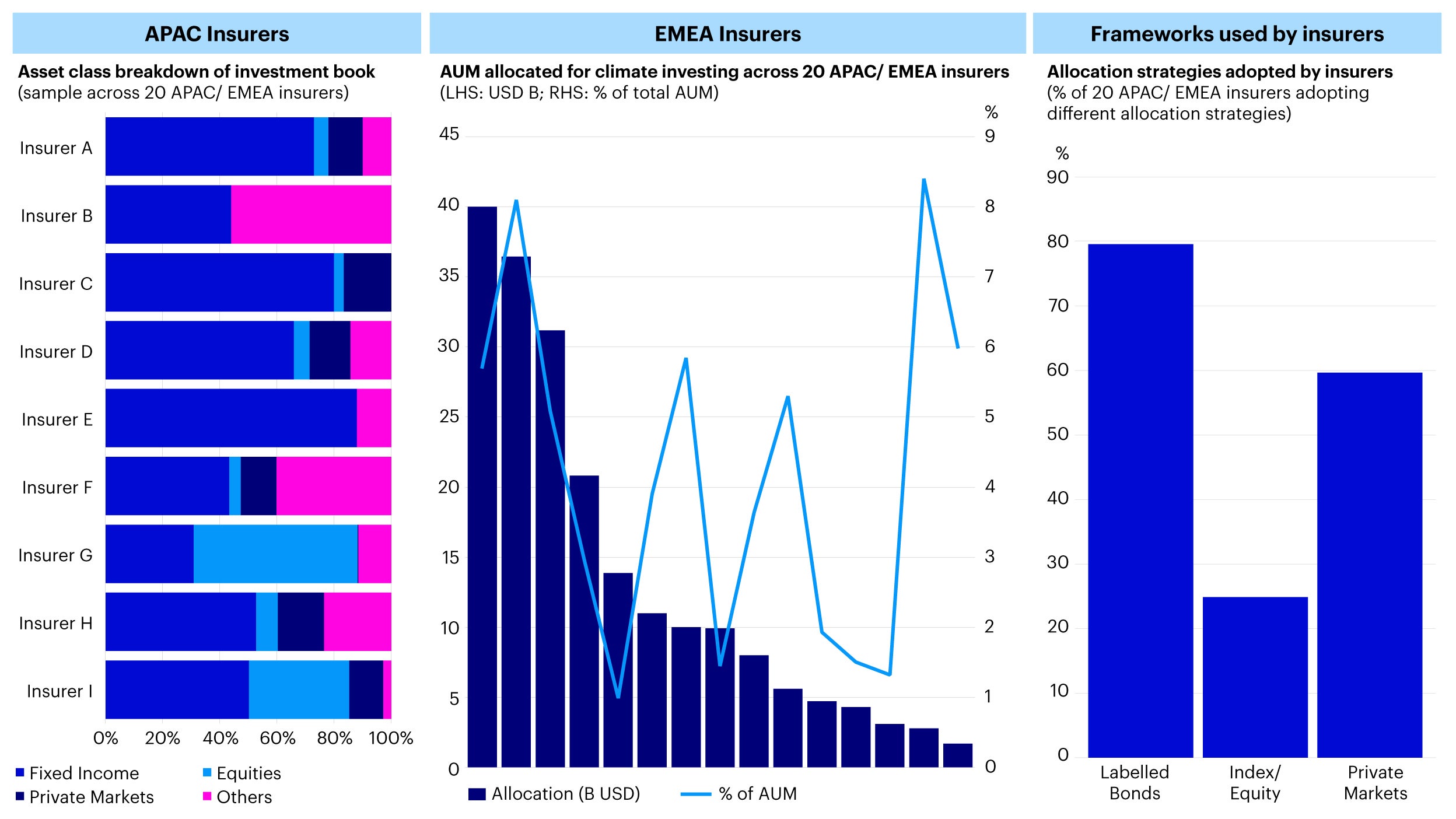

In this piece, we deep-dive into 20 of the largest APAC/ EMEA insurers with over $7B USD in assets management (which we refer to as “the insurers” or “these insurers” going forward), and assess their approaches to climate investing including targets, strategy and asset allocation.

Strategic questions for insurers

Source: APAC insurers – Invesco analysis of large APAC/ EMEA insurers based on publicly available policies and sustainability reports. Data as of March 2025.

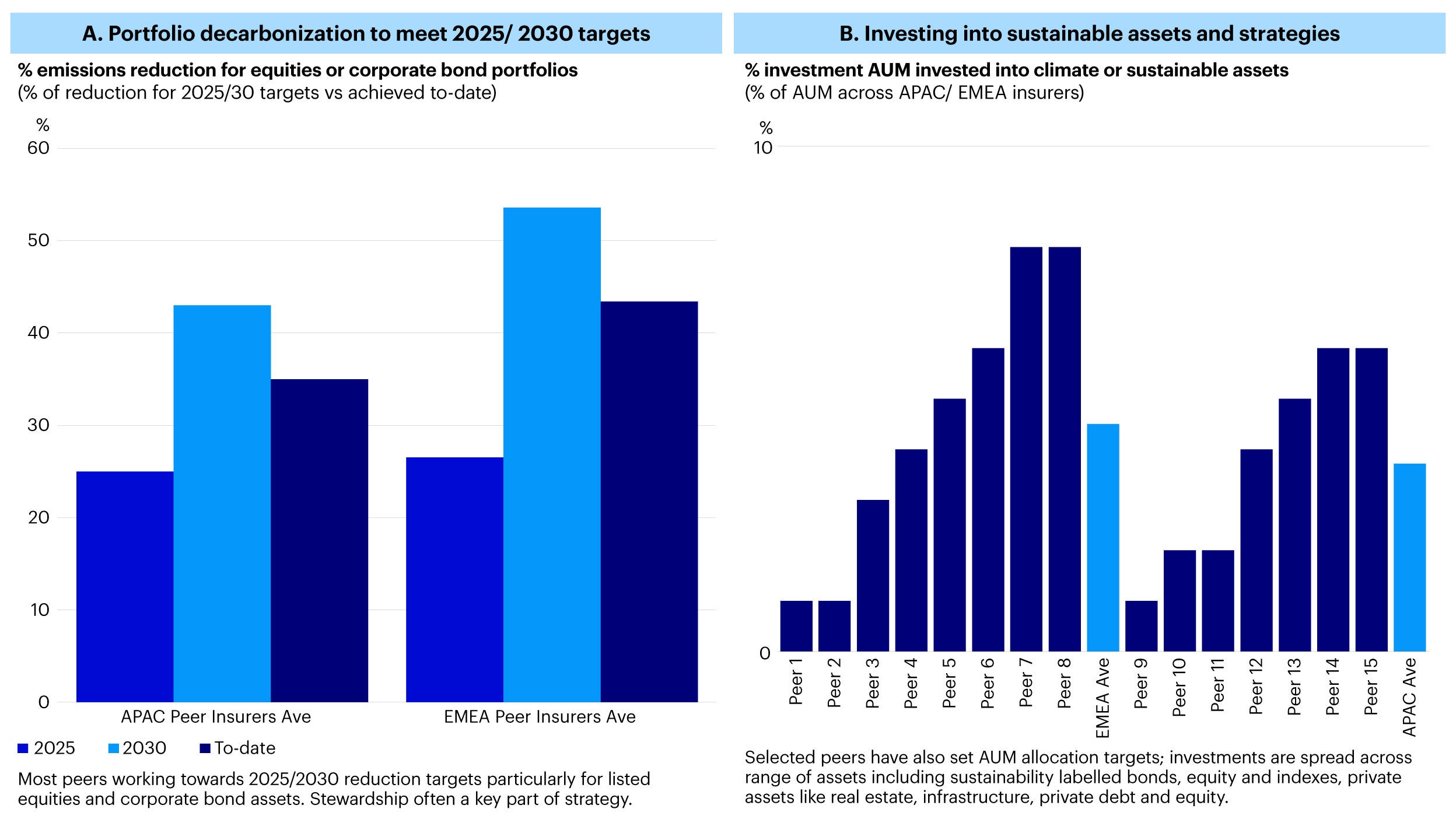

From our analysis of the insurers we studied, the majority are in process of a) seeing how their portfolios can move towards 2025/ 2030 targets they have set, while also b) evaluating opportunities to invest in sustainable assets and strategies. Amidst these investment goals, we believe there are a couple of strategic questions they can consider:

1) Target setting and broader climate strategy: How can the insurers we studied decarbonize their portfolios to meet targets while balancing performance? From identifying the right targets to set (and by extension relevant frameworks to use) to considering what to implement in the investment process (such as stewardship approaches), most are working towards 2025 or 2030 reduction targets particularly for listed equities and corporate bond assets while also ensuring this is aligned to their fiduciary duties and delivering investment returns.

2) Regulatory developments: What are the various regional regulatory developments for the insurers we looked at that provides additional guidance for them to consider in their strategies and investment processes?

3) Climate investing and asset allocation: What are opportunities to invest in climate themes and solutions? Selected peers have also set AUM allocation targets; investments are spread across range of assets including sustainability labelled bonds, equity and indexes, and private assets like real estate, infrastructure, private debt and equity.

Current state of play

We set out to consider each of the above questions, sharing the current state of play for these insurers.

1) Target setting and broader climate strategy

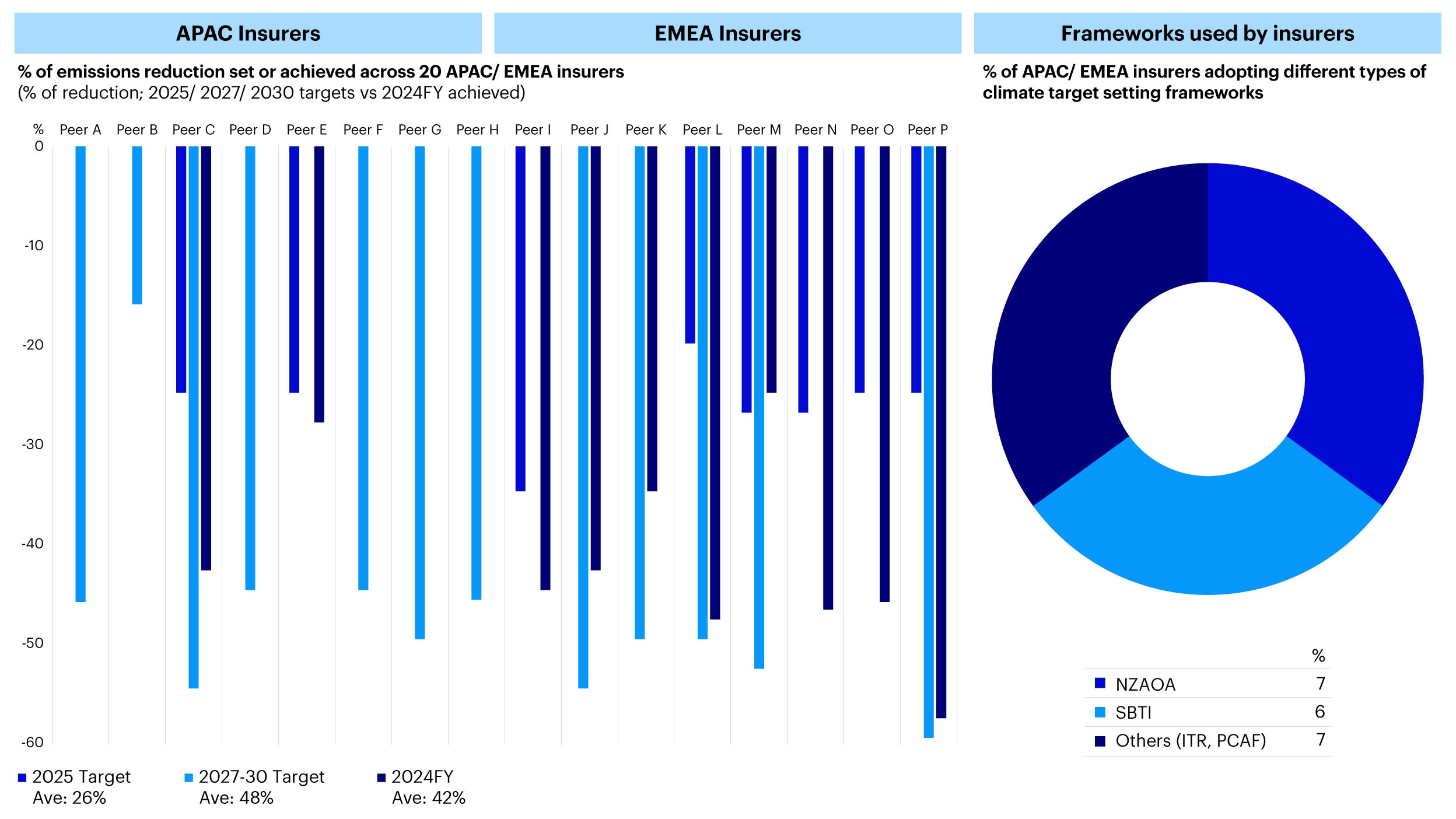

Source: APAC insurers – Invesco analysis of 20 APAC/ EMEA insurers based on publicly available policies and sustainability reports. Data as of March 2025. Note: NZAOA (Net Zero Asset Owner Alliance), SBTI (Science Based Targets Initiative), Others- ITR (Implied Temperature Rise), PCAF (Partnership for Carbon Accounting Financials)

To address potential financially material climate-related risks, the majority of the insurers we looked at have developed a broader climate investment strategy including near-term investment portfolio emission reduction targets alongside key approaches to managing risks.

The key questions here are a) what targets should insurers be considering, b) what are the common frameworks to support target setting, c) what asset classes should insurers prioritize, and d) what drivers or approaches can insurers use in their processes.

Across the board, these insurers have set on average ~26% reduction targets for 2025 and ~48% reduction targets for 2027-2030, in some instances the insurers have also reported back on an average of 42% reduction achieved in their portfolio as of 2024.

In terms of regional nuances, EMEA insurers tend to have set 2025 targets, which have been achieved in some instances before setting 2030 targets more recently, while most APAC insurers tend to have just set 2030 targets from the get-go and only a select minority have reported on actual reduction realized to-date.

Amongst the insurers group, a range of target setting frameworks have been utilized notably including frameworks from SBTI (Science-based Targets Initiative) and NZAOA (Net Zero Assets Owner Alliance). Most targets are also primarily defined for their listed equities and corporate bonds asset classes and in some cases for real estate assets.

Source: APAC insurers – Invesco analysis of 20 APAC/ EMEA insurers based on publicly available policies and sustainability reports. Data as of March 2025.

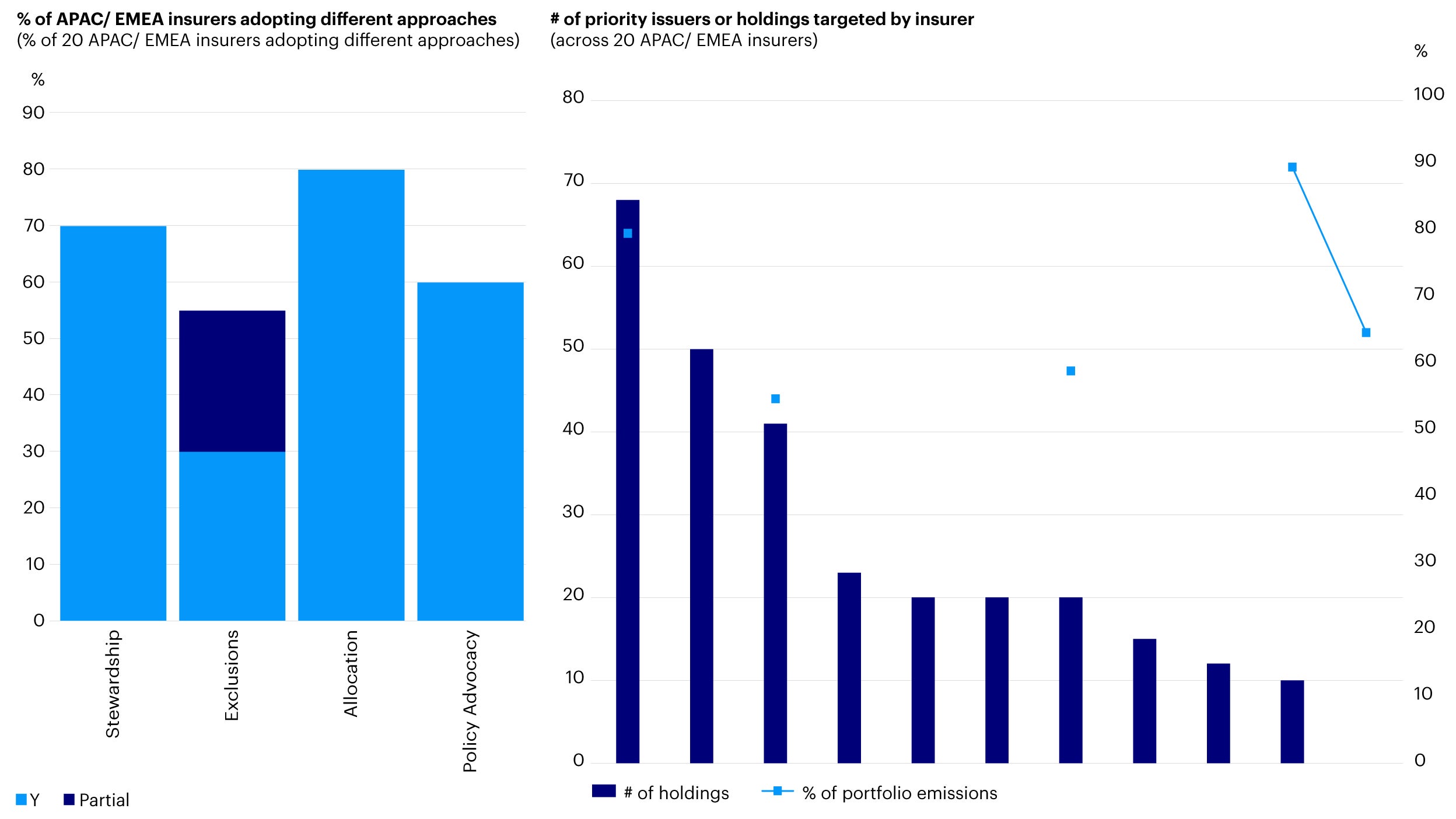

The insurers we looked at have also adopted a range of approaches in their overall climate investment strategy that include:

- Stewardship: Majority of the insurers have conducted analysis on drivers of their existing portfolio emissions and identified prioritized holdings for stewardship. Some of the insurers have set in-place stewardship targets (with average of ~20-30 holdings) and in several cases these holdings contribute a substantial share of portfolio emissions, anywhere from 50-90%.

In some instances, these insurers would also work with their investment managers on priority holdings and conducting more bottom-up research at the sector and issuer level to understand the emissions trajectory and impact on financials such as capex or potential green revenue growth.

- Exclusions: A portion of the insurers we studied have set in-place exclusions in their sustainable investment policy, but a greater number have either partial exclusions or planned phasing in of exclusions in certain high-emitting sectors in the longer-term to balance against potential portfolio impact on returns.

- Allocation: A significant portion of the insurers have also deployed capital towards different climate themes and asset classes as part of their broader investment strategy. These serve a dual role of helping the insurers meet their targets while also pursuing investment opportunities from fast-growing themes, technologies and markets. Climate solutions is a key area of focus, and we explore this more in the subsequent section.

- Policy Advocacy: Some of these insurers also work with policymakers or regulators both to understand financial implications of upcoming policies or regulations and to contribute to developments that are helpful for market growth, such as improving disclosures which leads to better data availability and information for investors’ analysis and comparability, or undertaking research and capacity building on emerging themes like nature and biodiversity or just transition considerations in investment processes.

2) Regulatory developments

Source: Invesco Analysis; MAS Insurers Transition Planning Guidelines (https://www.mas.gov.sg/publications/consultations/2023/consultation-paper-on-guidelines-on-transition-planning-for-insurers); SFC Climate Risks Circular (https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/intermediaries/supervision/doc?refNo=21EC31); Australia AASB S2 (https://standards.aasb.gov.au/aasb-s2-sep-2024)

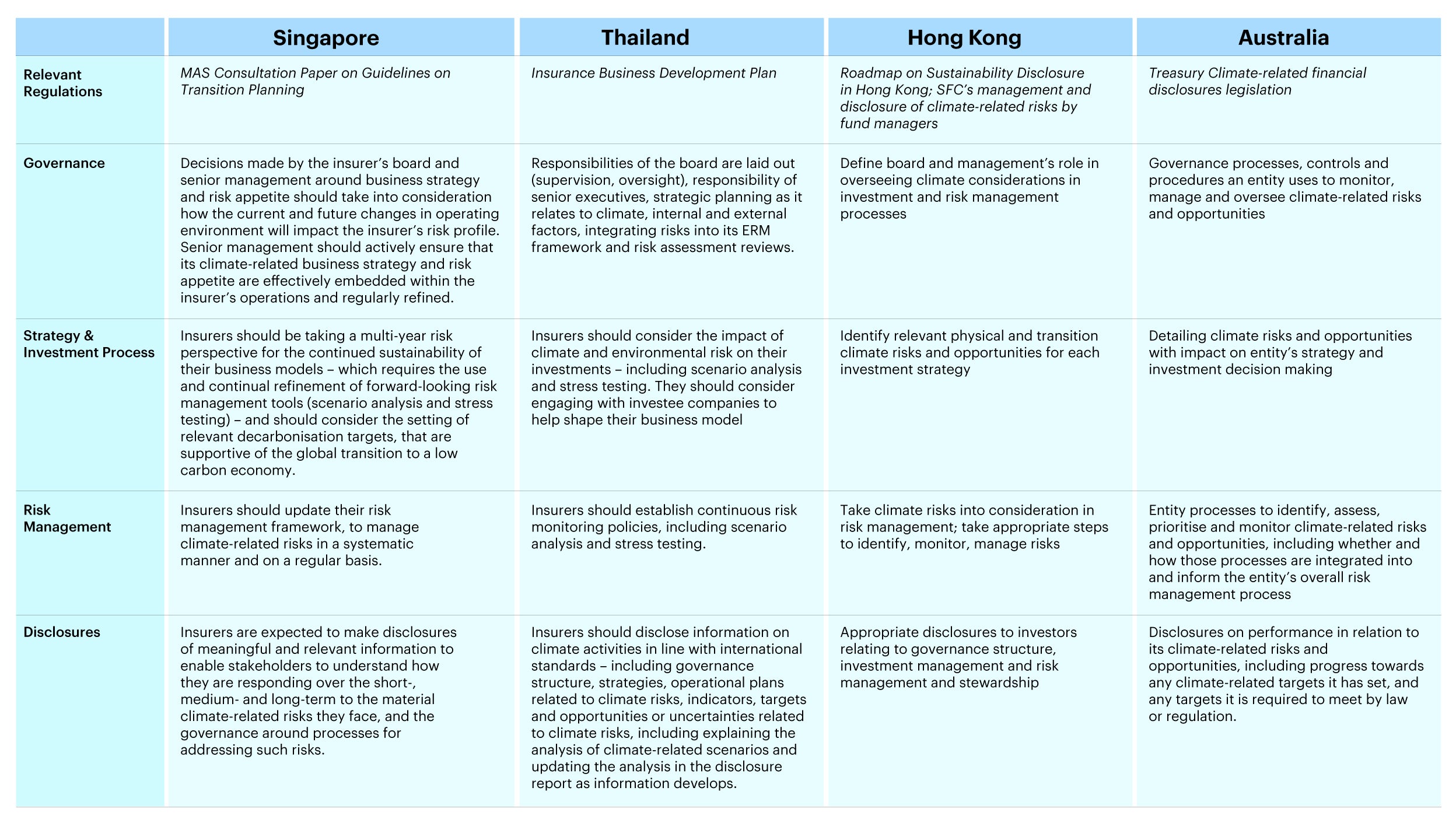

Various regions have developed climate-related regulations that are potentially applicable to insurers. Often these relate to governance alignment, investment processes and risk management such as scenario analysis or stewardship approaches, and disclosures and reporting on progress. Some examples include:

- Singapore: MAS (Monetary Authority of Singapore) released a consultation paper on Guidelines on Transition Planning for Insurers in Oct 20231, expecting insurers to have a sound transition planning process and play the role of an effective steward of their customers, asset managers, and investees through comprehensive engagement and stewardship and to encourage changes (for example, through the adoption of risk mitigation and adaptation strategies) in their customers’ and investees’ strategies and risk profiles.

Insurers are well-positioned to engage their asset managers and investees on the risks faced, and work with sensitive investees to implement appropriate risk-mitigating measures; insurers are expected to engage and steer their in-house and/or external asset managers to proactively manage climate-related risks of their portfolios on a continuous basis.

Insurers can have differentiated strategies for investments that are vulnerable to different levels of climate-related risks and asset managers that are at various stages of preparedness to progress on the path to net zero.

- Thailand: Thailand’s Office of Insurance Commission (OIC) has established the 4th Insurance Business Development Plan (2021 - 2025)2, which focuses on encouraging the insurance sector to play a role in supporting the economy and society sustainably in terms of ESG matters through risk management and policy implementation.

The OIC expects insurers to supervise and manage risks arising from climate and environmental changes according to the size, nature of business activities, and complexity of the entities. The document has given examples of sources of climate risk (transition risks, physical risks), the impact on the insurance sector (through credit risk, market risk, liquidity risk, reputation risk, insurance risk), and highlighted the transition channels to the broader financial system and society more generally.

General principles for scenario design highlight physical and transition risk, future trajectory of climate change including incorporating government policies, likely scenarios and tail events, consideration of quantitative information on climate path, and covering an appropriate time horizon to assess long-term impacts. There are also helpful examples of modelling approaches outlined – such as a fixed or dynamic balance sheet, how transition risk/physical risk flow through market risk/credit risk and impacts assets and liabilities, and a possible methodology used to estimate the financial impact of transition risk on various asset classes.

- Hong Kong: The HKSAR government launched a Roadmap on Sustainability Disclosures in December 2024 followed by the Green and Sustainable Finance Cross-Agency Steering Group setting 2025 priorities3 with a focus on developing and implementing a comprehensive sustainability disclosures ecosystem in Hong Kong. Part of the disclosure’s roadmap includes requirements on reporting for large financial institutions while also reinforcing Hong Kong’s role as a leading sustainable and transition finance hub - to enhance the flow of green and sustainable finance, engage the industry to expand the Hong Kong Taxonomy for Sustainable Finance to incorporate transition elements, and add new sustainable and resilience activities.

Hong Kong insurance rules also include the application of a 10% discount on relevant stress factors to green bonds4, the details of which are to be finalized later. This may drive investment activities going forward depending on the criteria and availability of such qualified bonds.

- Australia: Australia’s Treasury released a climate-related financial disclosure legislation in 20245 covering large listed and unlisted companies, financial institutions, superannuation entities and asset owners. Similar to some of the other regions, the disclosure requirements are aligned to the International Sustainability Standards Board and Australia Sustainability Reporting Standard (AASB S2)6 and include information relating to governance, strategy, risk management, and metrics and targets.

The implications of the above regulatory developments could include:

- Climate investing strategy: Most regulations will require insurers to develop a holistic climate investment strategy from governance alignment and oversight on financially material climate matters, setting up adequate risk monitoring system and more importantly building these considerations as part of their investment processes.

- Insurers-manager co-creation: Regulations will also encourage insurers to better consider their investment and climate objectives and encourage insurers and managers co-creation of relevant investment strategies including selection of relevant frameworks, benchmark and stewardship requirements.

- Labelled bond investments: Finally, the development of taxonomies alongside discounts or incentives on labelled bond instruments could also facilitate the growth of investments into labelled bonds by insurers. Such investments could help meet climate solution allocation targets that some insurers have set.

3) Climate investing and asset allocation

Source: APAC insurers – Invesco analysis of 20 APAC/ EMEA insurers based on publicly available policies and sustainability reports. Data as of March 2025.

A significant portion of the insurers we looked at have a predominantly fixed income book in their investments portfolio and that remains a primary focus when considering the broader climate investment strategy. Often this includes looking for frameworks and analytical tools that can help support their climate investment objectives and targets while managing against performance implications.

Additionally, some of the insurers we studied have also carved out dedicated allocations or investment targets for climate themes or have made substantial allocations over time that averages to ~4% of their total AUM book. Such allocations include investing in green and sustainable labelled bonds, index or equity strategies and mandates, and private market allocations to real estate, infrastructure and private investment funds.

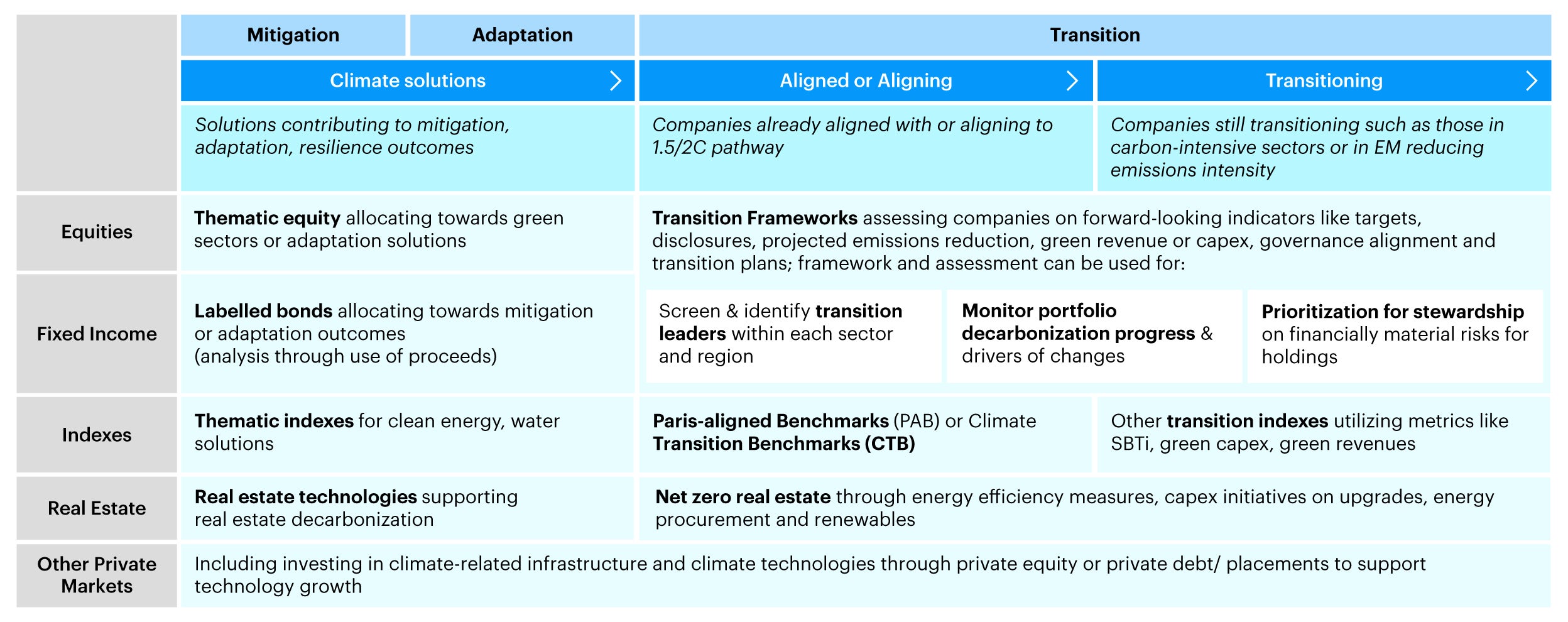

Source: Invesco analysis. For illustrative purposes only.

Insurers thinking about allocation to climate investments can consider holistically how different allocations and asset classes match with their broader investment objectives and asset allocation considerations. For insurers focused on meeting their climate targets and portfolio decarbonization initiatives, the key allocation would be focused on identifying the right climate frameworks and stewardship approaches that can be overlaid into their existing portfolio and holdings, while for insurers looking at climate as a structural market trend, they can identify alpha and growth opportunities in climate solutions and other thematic allocations.

Outlook ahead

Across the APAC and EMEA insurers that we studied, a significant majority recognizes the financially material risks and opportunities that climate would have on their business and investment portfolios. Many have designed in-depth transition plans and investment strategies and with 2030 targets on the horizon, we expect the space to see continued developments and innovations in approaches. There are multiple areas that insurers can consider from thinking of the overall climate targets to strategy to designing specific investment portfolios to the monitoring and analysis of portfolios risks and changes. Each of these layers provide an interesting conversation and discussion item and going forward we look forward to continuing to collaborate and support insurers in their climate investing objectives and strategies.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

MAS, Oct 2023, Consultation Paper on Guidelines on Transition Planning for Insurers, https://www.mas.gov.sg/publications/consultations/2023/consultation-paper-on-guidelines-on-transition-planning-for-insurers

-

2

OIC, December 2024, Guidelines_Climate Risk Management, https://www.oic.or.th/th/climate-change-and-environment

-

3

HKMA, Feb 2025, Cross-Agency Steering Group sets 2025 priorities to support growth of sustainable finance in Hong Kong, https://www.hkma.gov.hk/eng/news-and-media/press-releases/2025/02/20250206-3/#:~:text=In%20December%202024%2C%20the%20HKSAR,Standards%20no%20later%20than%202028.

-

4

Hong Kong Insurance Authority, Apr 2024, Consultation Conclusions on Draft Insurance Rules, https://www.ia.org.hk/en/infocenter/files/Consultation_Conclusions_on_Draft_RBC_Rules_Eng.pdf Insurance (Valuation and Capital) Rules Cap. 41 sub. leg. R), https://www.elegislation.gov.hk/hk/cap41R

-

5

Australia Treasury, Jan-Feb 2024, Climate-related financial disclosure: exposure draft legislation, https://treasury.gov.au/consultation/c2024-466491

-

6

AASB, Jan 2025, Australian Sustainability Reporting Standard, https://standards.aasb.gov.au/aasb-s2-sep-2024