China’s new energy stocks tell a compelling story: Electric Vehicles

China has been an early mover in the electric vehicle (EV) space and now has the largest EV market in the world accounting for around 57.4% of global EV production in 2021.1 Investors are buying into the structural growth story and whole value chains are seeing the benefits. The first of this two-part blog series focuses on the electric vehicles industry in China. We outline the main policy drivers and competitive advantages for EVs and make sense of market positioning and current valuations. The subsequent blog in this series will cover solar and wind industries viewed through a similar lens. With strong policy support providing tailwinds for the long-term growth of these sectors, we believe “new energy” stocks can offer attractive investment opportunities.

Policy drivers

There are three major policy drivers supporting the growth of the EV industry in China.

- The government’s ambitious carbon neutrality targets offer a favorable policy environment for EVs. In September 2020, President Xi Jinping announced the country’s aims to achieve peak carbon emissions by 2030 and target net-zero by 2060. Since then, the government has acted swiftly to curb carbon emissions in areas such as energy policy, industrial policy and construction and transportation. On the EV side, they have enacted various policies including subsidies and an EV credit system to mandate that a certain percentage of all vehicles sold by a manufacturer each year must be battery powered.2

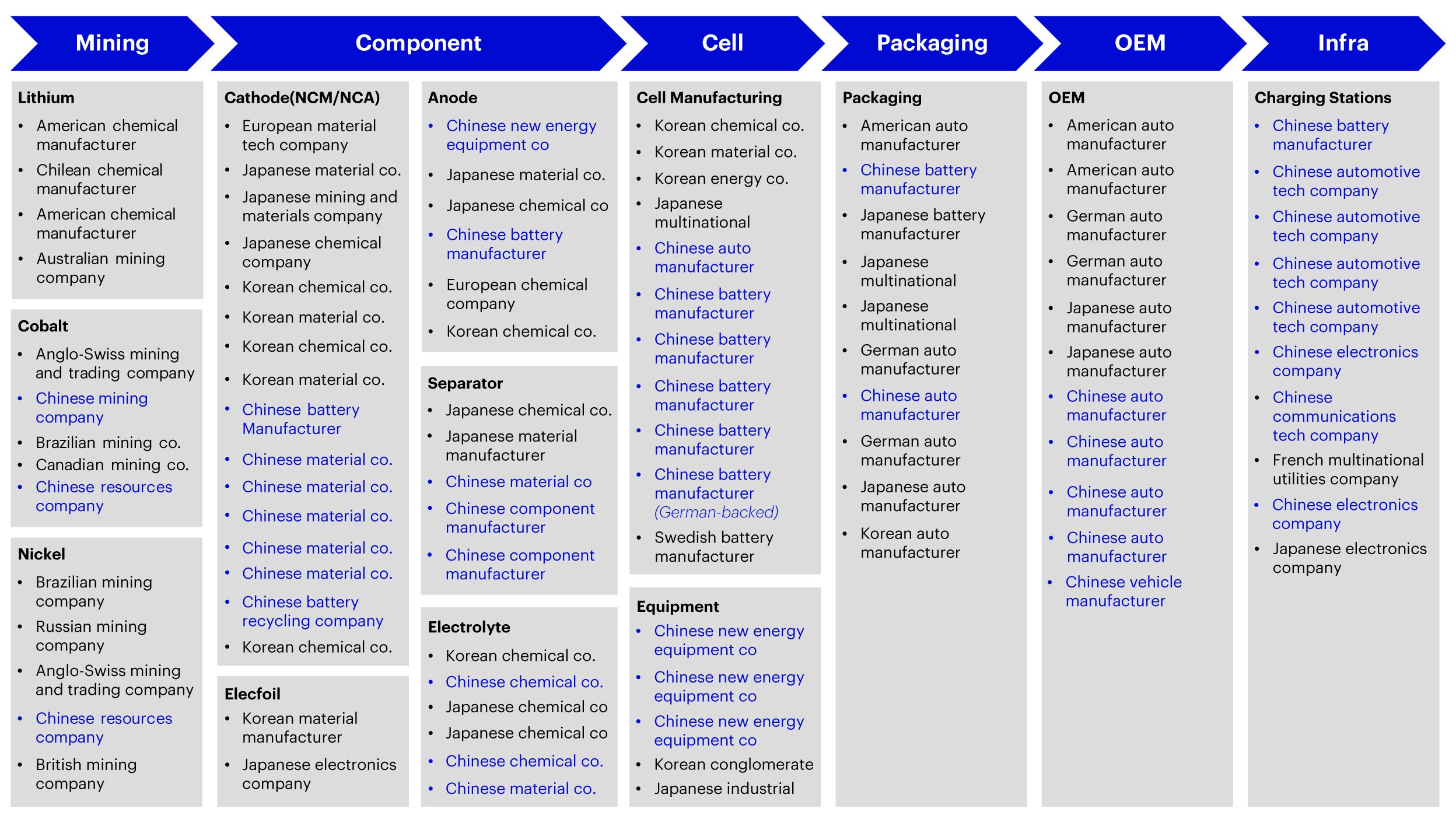

- The government is heavily supporting the growth of the domestic automotive industry. German, Japanese, and American auto manufacturers have long dominated the production of internal combustion engine (ICE) cars, given their expertise and investments in this space. As a result, foreign-local JVs occupy most of the traditional vehicle space in China, and local players, while catching up, still find it difficult to compete. On the EV side, China has a competitive advantage due to the strength of its domestic EV battery value chain (Figure 1). Domestic players also dominate global market share in the midstream and downstream processes of EV battery production.

- In the long run, China’s policymakers aim to reduce the country’s dependence on foreign oil imports. As Russia’s invasion of Ukraine has shown, achieving energy self-sufficiency is becoming increasingly critical for countries that are having to battle escalating energy costs. Most of China’s oil is from the Middle East and Russia, thus increasing the share of EVs on the road can help to reduce this dependence. Policymakers are aiming to increase EVs as a proportion of overall new car sales with a goal to replace traditional ICE cars entirely in the foreseeable future. They are well on their way and a recent report found that 25% of new car sales in China in May of this year were EVs.3

Competitive advantages

Several factors have contributed to China’s increasing EV penetration rate in recent years.

High-speed rail network: Thanks to the rapid growth of the country’s high-speed rail network over the past decade, inter-city travel via rail has become far easier and has shortened travel time considerably. One knock-on effect of this is that cars are now used for inner-city travel much more frequently than inter-city travel, the latter being quite rare. As EVs typically run for up to 300 kilometers before requiring a charge, the typical person would only need to charge their car once or twice a week in order to meet their travel needs. For these reasons as well as the affordable maintenance costs, transitioning from traditional petrol cars to EVs has become very common.

Advanced network of charging infrastructure: The Chinese government has heavily supported the development of EV charging poles in most tier 1 cities in China and is now moving into tiers 2 and 3 cities. In 32 major cities in China, the average density of EV charging poles is an impressive 21.5 poles per square kilometer. The cities that have the highest densities of charging poles include Shenzhen, Shanghai, Guangzhou, Changsha, Nanjing, and Haikou with an average of 30 poles per square kilometer, Shenzhen tops this group boasting 129 poles per square kilometer.4 As EVs penetrate lower-tier cities, the infrastructure is expected to continue to expand.

Component players have majority market share: China boasts more domestic companies in the EV battery value chain than any other country (Figure 1). It is home to the world’s only EV corporate that has fully integrated their midstream and downstream processes. With the help of China’s electronics players, smart cockpits are becoming more popular in China and are an important part of smart EV development.

Source: Morgan Stanley Research, data as of January 2022. For illustrative purposes only.

Market positioning and valuations

Lithium has been in short supply over the past three to four years and prices have tripled during this time. This has been creating problems for midstream and downstream players. Electrolyte manufacturers in particular have faced margin issues in having to absorb the lithium costs given the bargaining power of their downstream counterparts. Upstream lithium capacity is therefore a key bottleneck that China faces in achieving its EV targets in the short term.

While Australian and South American mining companies are responsible for the bulk of supply, Chinese players are expanding their reach rapidly and are applying for mining licenses overseas to secure lithium supply in the longer term. Once the supply bottleneck becomes less severe, Chinese midstream and downstream companies can expand relatively quickly to cater to the expected increases in EV demand given their superior market position.

Relative to other new energy stocks, namely solar and wind, EV stock valuations are currently the highest. However, taking battery manufacturers as an example, growth is expected to remain at around 35% for the coming two years. We deep dive into one major player in this space and look at their key financial indicators (Figure 2). While their PE ratio by the end of this year is expected to be trading at around 38 times, this is anticipated to drop to around 24x by 2023 end and 18x by 2024 end . Thus, we expect that if sustainable growth drivers persist, the sector can remain attractive in the long term.

Source: Shenzhen Stock Exchange, data as of September 2022.