China’s new energy stocks tell a compelling story: Solar and wind power

Between 2012 and 2021, the total share of solar and wind energy in China’s power generation increased four-fold from 2.6% to 11.8%.1 Investors are buying into the structural growth story for these sectors and whole value chains are seeing the benefits. In the second of this two-part blog series, we outline the main policy drivers and competitive advantages for the solar and wind power industries and make sense of market positioning and current valuations. The earlier blog in this series looked at the electric vehicle industry through a similar lens. With strong policy support providing tailwinds for the long-term growth of these sectors, we believe “new energy” stocks can offer attractive investment opportunities.

Policy drivers

There are three major policy drivers supporting the growth of solar and wind industries:

- The government’s aim to achieve peak carbon emissions by 2030 and carbon neutrality by 2060 has provided a supportive environment for companies in the solar and wind sectors.2 Since 2005, the government has enacted accommodative policies for renewables including tax incentives, feed-in tariff schemes and subsidies from their Renewable Energy Development Fund.3 This has led to the rapid expansion of renewable energy capacity. However, given solar and wind power have now entered a new phase in terms of cost effectiveness and are nearing grid parity, these subsidies are now starting to get phased out. The aim is both to reduce the accumulated subsidy deficit and to incentivize growth among Chinese companies in this space.

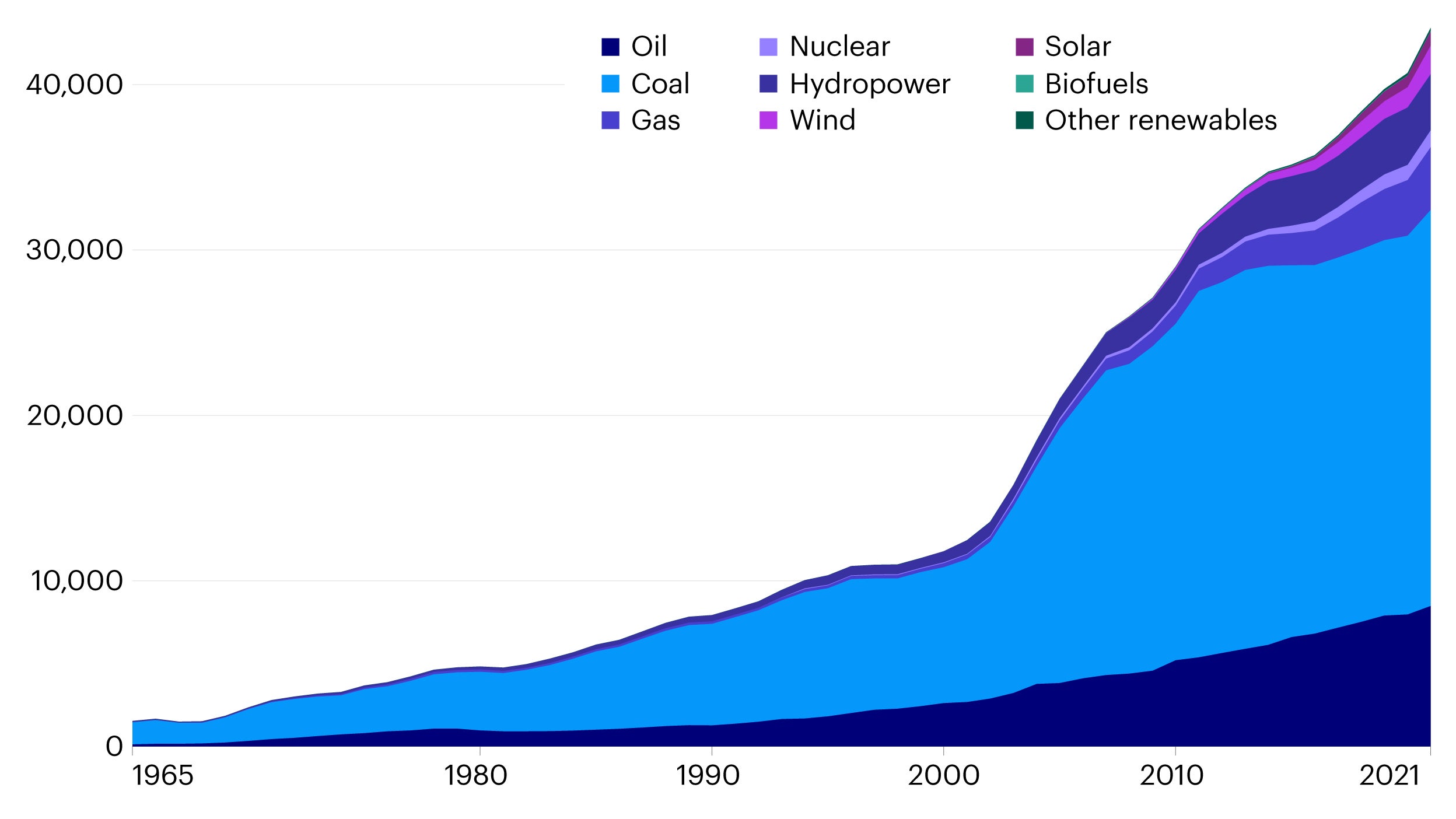

- Despite the rapid development of China’s renewable power generation capacity over the last decade, the country’s installed power capacity is still dominated by coal and oil. In 2021, solar and wind power reached 27% of China’s installed capacity and only 12% of the country’s power generation. The potential for growth is huge and given the plans for wind and solar project installations in the next few years, these sectors expected to account for 45% of total installed capacity and close to 20% of power generation in China by 2025.4

Source: BP Statistical Review of World Energy 2022, data as of 2021. Note: ‘Other renewables’ includes geothermal, biomass and waste energy.

3. In the long run, China’s policymakers are looking to boost their domestic renewable energy capacity to avoid having to rely on foreign sources. Recent geopolitical concerns stemming from Russia’s invasion of Ukraine has made this mandate more critical. The war has catalyzed the government’s push to reduce foreign dependence on oil, as countries across the globe battle escalating energy costs.

Competitive advantages

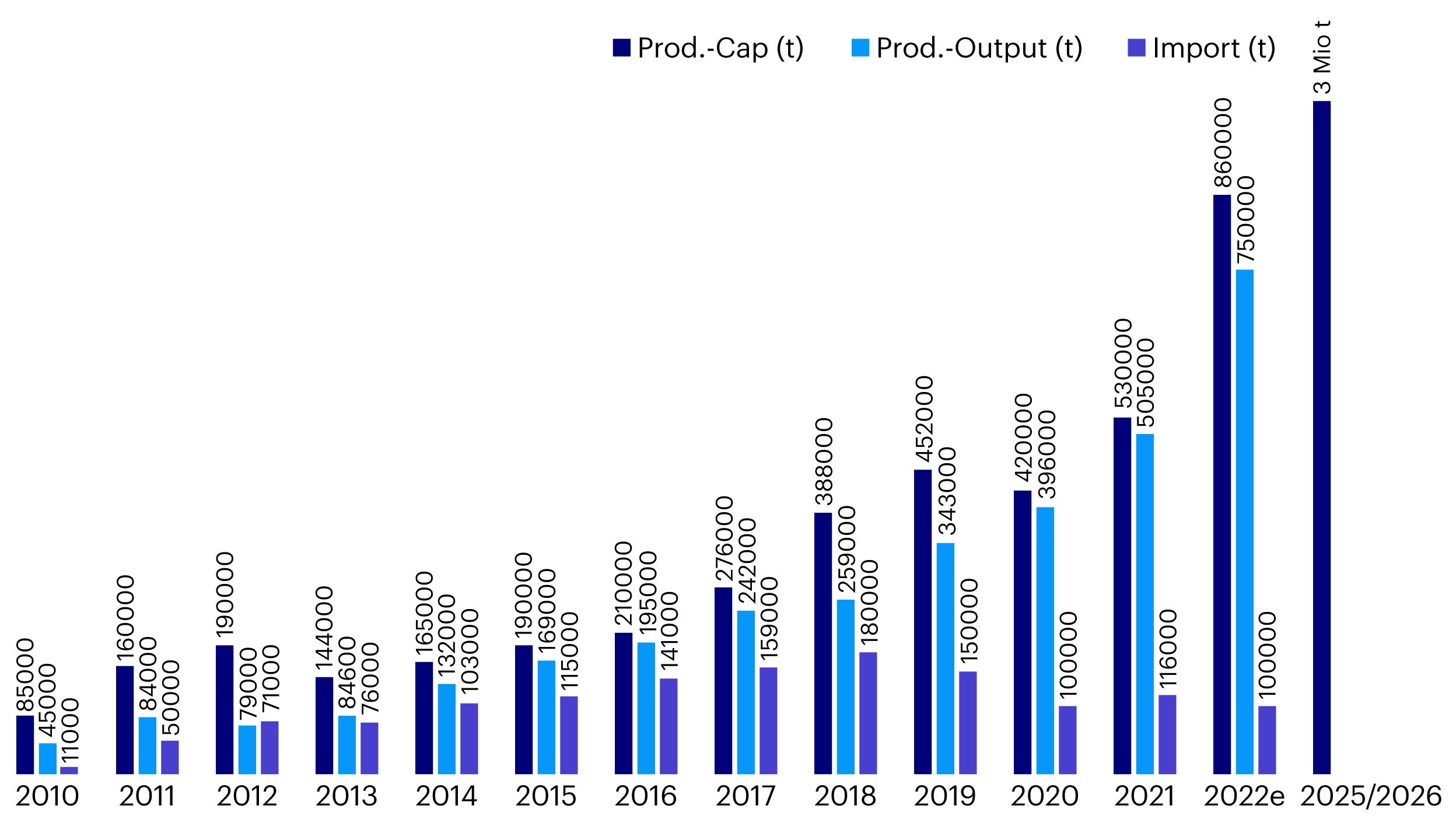

- Solar power: The whole solar value chain from polysilicon to wafer and cell/module production is dominated by Chinese companies. Polysilicon is abundant in China. The country controls about 80% of global production capacity5, thus, upstream mining costs are not likely to be a major concern. While costs have risen for polysilicon recently as demand has outpaced supply in the short term, polysilicon prices are likely to decline again after capacity ramps up. Increases in solar demand are also likely to lead to further growth in capacity. Looking at downstream operations, Chinese players are also responsible for around 70% of global photovoltaic (PV) solar module production capacity.6

Source: AECEA, data as of February 2022.

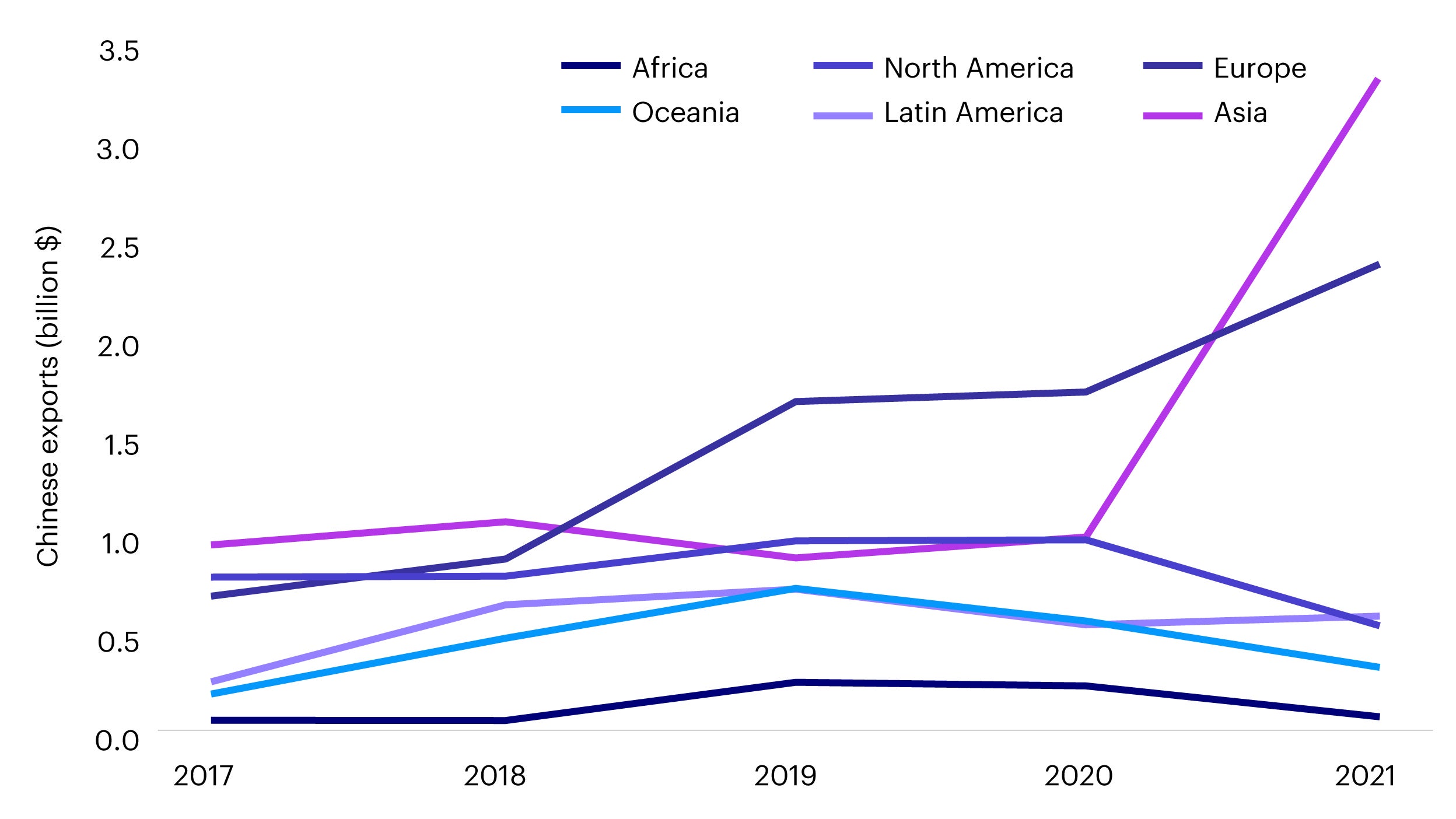

- Wind power: About half of the world's wind turbines are produced in China.7 China has competitive advantages in the global production of wind turbine components including main shafts, blades, and gear boxes. While China uses onshore wind power, their offshore capacity is growing quickly as turbines are being built in the sea nearer to coastal provinces. The country is also a global export hub for wind turbine parts to Europe and many other developed and developing countries. Chinese wind turbine exports increased from US$2.9 billion in 2017 to US$7.2 billion in 2021 with a US$2.2 billion increase occurring from 2020 to 2021.8 This rapid growth in exports indicates the competitiveness of Chinese original equipment manufacturers in foreign markets.

Source: IHS Markit, Global Trade Atlas.

Market positioning and valuations

China’s renewable energy boom and its ability to scale up output has caused production costs associated with solar and wind power to decrease relative to other countries. In the long term we expect solar and wind power production costs to fall further in order to compete with traditional electricity from coal-fired power plants. For example, Chinese wind turbine prices fell by 24% on the year in 2021 and are expected to fall by another 20% in 2022.9

In terms of valuations given strong demand for renewable energy globally in the next few years and the low-cost advantages of Chinese solar and wind products, we believe the current valuations of Chinese companies in these sectors are justified. On average basis, we are seeing wind company PE valuations in the mid-teens with high-teens earnings growth. For solar companies, taking the example of one major PV solar cell/module producer, it has a current PE of 25x (versus 58% earnings growth), and consensus forecast expects 19x PE in 2023 (with 31% earnings growth).

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.