Bitcoin and portfolio choice: An assessment of Bitcoin in multi-asset portfolios

Key findings

Small allocations to BTC appear to offer notable benefits to multi-asset portfolios—even when return expectations for BTC are significantly reduced.

Allocations to BTC should be evaluated relative to an investor’s initial risk preferences.

BTC allocation sizing and portfolio rebalancing are critical aspects of risk management for portfolios with BTC allocations.

In October 2008, Satoshi Nakamoto, the pseudonym for the still unverified author (or authors) of a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash Sys-tem,” introduced Bitcoin (BTC) to the world. Originally conceived as an electronic cash system that was to serve as a replacement to the traditional banking system, the instrument was implemented in January of 2009. The intended use case as a store of value has since been limited by the extreme volatility exhibited over its short history. Currently, the question of whether BTC should be considered a currency, a commodity, or a collectible remains hotly debated among academics, investors, and even regulators. For example, Damodaran (2017) suggests that a possible path for BTC would be that it might be viewed as “gold for millennials.” More recently, Damodaran stated that “Bitcoin is the currency that nobody uses and a collectible that doesn’t behave like a collectible” (Business Today 2023). In short, clarity on the matter is still lacking, even among well-respected research-ers. Other questions, such as how to value BTC or how to forecast BTC returns, also remain open.

Despite the open questions, the potential for the outsized returns offered by BTC have led many to begin considering it for inclusion in their portfolios. Perspectives on whether BTC should be considered as an investment generally range from deep skepticism to unbounded optimism, with seemingly little middle ground.1 However, any objective assessment of BTC as an investment should include the following salient points:

1. BTC has exhibited substantially outsized returns relative to traditional asset classes.

2. BTC is a highly volatility instrument that exposes investors to remarkable run-ups and significant drawdowns.

3. The drivers of BTC return, risk, and correlation characteristics are indeterminate.

These facts present a conundrum to multi-asset investors considering an allo-cation to BTC. In this article, we approach the BTC allocation question from the per-spective of multi-asset investors who are sufficiently optimistic about the prospects for BTC to consider allocating some portion of their portfolios to BTC. We define multi-asset investors as those who have gone through the portfolio selection exercise and carefully considered the return and risk trade-offs of a variety of risk-efficient portfolios and ultimately selected a portfolio that is aligned with their specific risk preferences. As such, the multi-asset investors we consider temper their optimism about the prospects for BTC against their desire to effectively manage the risk impli-cations that result from BTC allocations.

Given the uncertain nature of BTC’s price characteristics and its high volatility, how should multi-asset investors consider the inclusion of BTC in their portfolios? To provide insights into this question, we first explore each of the three points above from the perspective of a multi-asset investor. We then assess the historical per-formance characteristics of a variety of multi-asset portfolios with BTC allocations and then consider 10,000 alternative “histories” for these portfolios through a block-bootstrap simulation exercise. In assessing allocations, we do not rely on any specialized portfolio optimization methods or the consideration of alternative investor utility functions. Rather, we simply construct stock/bond portfolios with specified allocations to BTC and assess the return and risk implications of those allocations. The incremental benefits and risks of BTC allocations are evaluated relative to an investor’s initial portfolio. The purpose of this analysis is to approach the BTC allo-cation question objectively and to share key insights that can be used by multi-asset investors to inform possible BTC allocations.

An overview of BTC returns, risks, and correlations

As this article is directed to multi-asset investors considering BTC, it would be useful to first gain an understanding of the characteristics of BTC across the three dimensions most relevant to multi-asset investors: return, risk, and correlations. As previously mentioned, BTC was first launched in January 2009. That means that there is a very limited history with which to inform forward-looking views. It is also the case that BTC was the first cryptocurrency introduced to the world. We make this point to note that both BTC and the systems that have facilitated the exchange (purchase and sale) of the instrument were all nascent and untested. Since 2009, the adoption of BTC and the systems that support pricing and marketability have improved notably. As such, understanding the dynamics of the evolution of these aspects of BTC will be useful in forming views for portfolio construction.

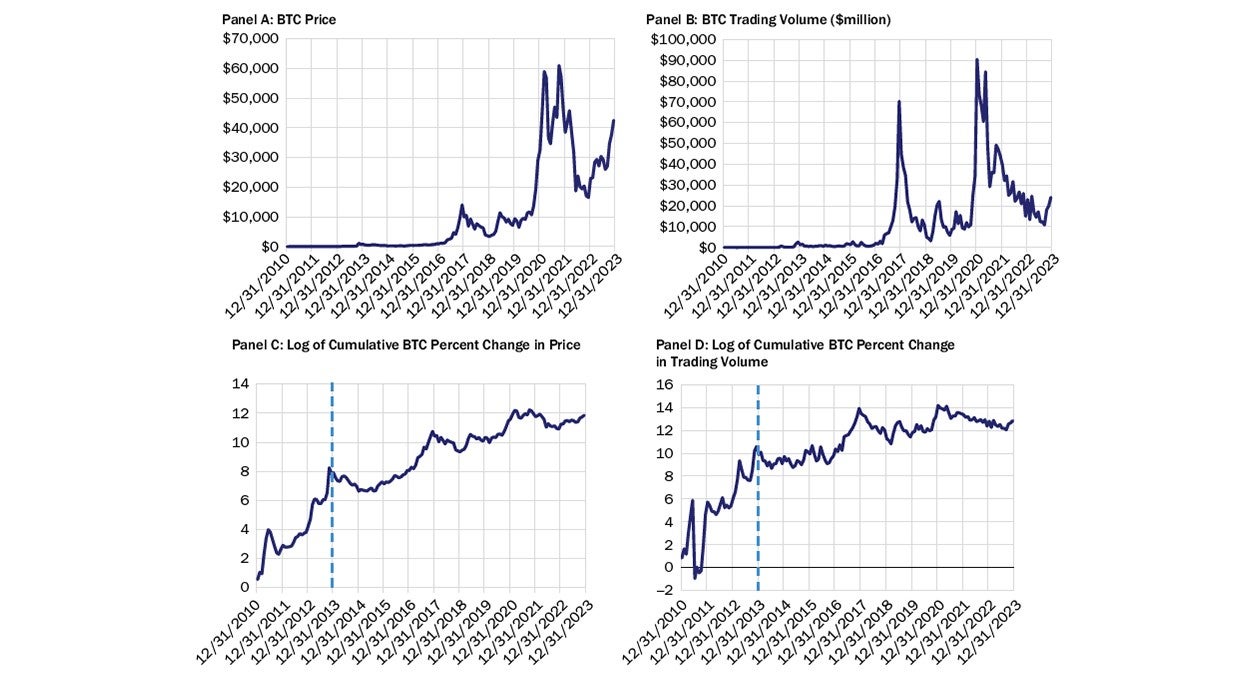

In Exhibit 1, Panels A and B, we present a price history of BTC along with corre-sponding trading volumes. Unfortunately, the significant jumps in BTC prices seen in Panel A directly affect the trading volumes shown in Panel B. This makes gaining an understanding of the evolution of dynamics across either of these series nearly impossible. To remove the impact of the significant variability in BTC prices, we pres-ent the cumulative percentage change of the same two series in logarithmic terms in Panels C and D. This results in time series plots in which the vertical (y-axis) distances represent equal percentage changes. For example, a change in the price of BTC from $2 to $4 would look substantially different from a change in price from $20,000 to $40,000 in Panel A, even though these changes, in percentage terms, are identical. In Panel C, these two price changes would represent equal vertical distances.

Note: Sample period for BTC price and trading volumes shown is 12/31/2010 through 12/31/2023.

Source: Bloomberg, Galaxy, bitcoinity.org.

With Panels C and D of Exhibit 1, we can now gain a better understanding of how prices and trading volumes have evolved.

An examination of the log BTC price changes and log trading volume changes shows what appears to be indicative of moderation in price increases and trading volumes. Looking at the period from 12/31/2010, the beginning of values charted, through 12/31/2013, we see a substantial change from 0.55 to 7.82 in log terms, or $0.30 to $746.89 in discrete terms. The dramatic increase in the price of BTC during this period also corresponds to a dramatic increase in daily trading volume from 0.85 to 10.60 in log terms, or $148,000 to $2,533,670,949 in discrete terms.

The dramatic increase during this initial period accounts for a substantial portion of the price and trading volume changes for BTC over the entire period analyzed. This initial period for price and volume dynamics is substantially different from what BTC has exhibited since and is not likely to recur. In fact, this is made all the clearer by an examination of the dramatic differences in the distributional properties of BTC returns pre-2014 (skew: 1.2; kurtosis: 11.7) and post-2014 (skew: 0.4; kurtosis: 5.8). These values translate to a pre-2014 period characterized by a fat-tailed distribution with a significant number of positive outliers and a post-2014 period characterized by a fat-tailed distribution (although much less so than pre-2014) with big positive and negative outliers that are approximately symmetric (normally distributed). As such, we believe the post-2014 history of BTC returns is likely to be much more representative of what investors will experience.

Having identified a period of representative BTC returns for consideration as part of our analysis, we can calculate some statistics to summarize the characteristics of BTC during that period. The average annual (arithmetic) return for BTC during this period is 63%, the average annual compound (geometric) return is 48%, and the standard deviation (volatility) is 69%. An assessment of these values leads one to recall the apocryphal example of the statistician that drowned while crossing a river that was, on average, only three feet deep (Savage 2009). Hidden in the estimated average depth of the river was the fact that the river was substantially deeper than three feet in the middle and notably shallower than three feet in the areas closer to the riverbanks. That information would have been useful for the statistician to consider before crossing the river. As such, an analysis of BTC return and risk dynamics during the representative period would also be helpful in establishing a better understanding of what BTC investors are likely to experience.

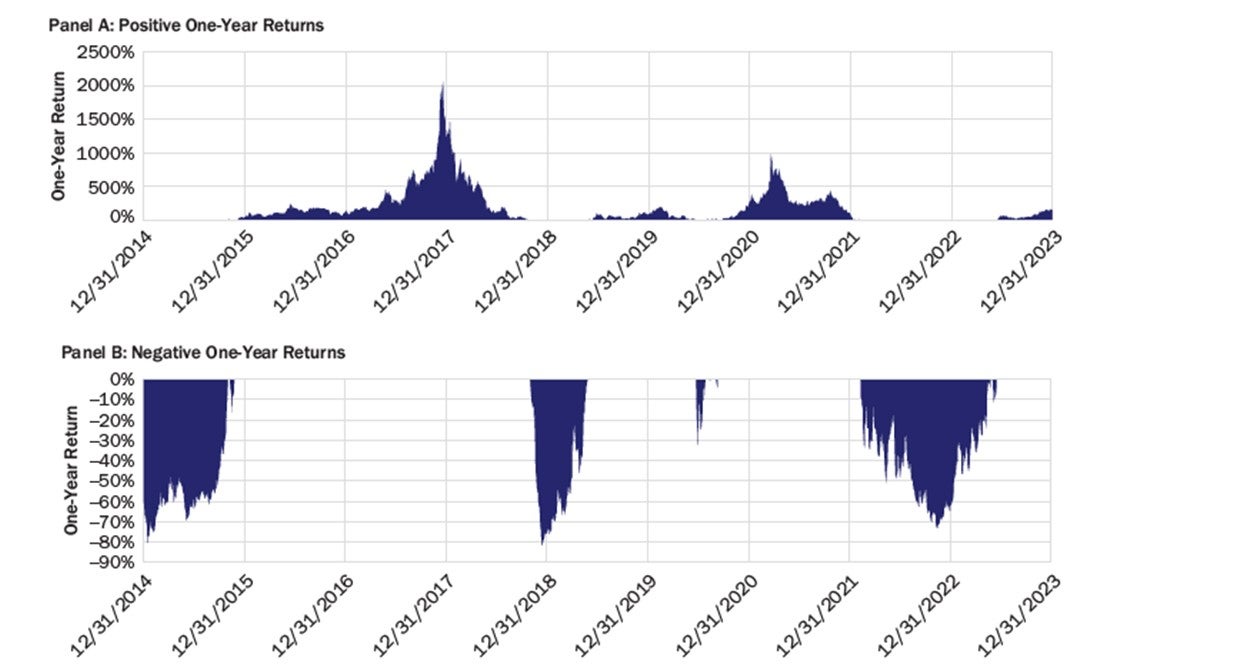

In Exhibit 2, we present the history of the daily rolling one-year returns for BTC beginning 12/31/2013 and extending through 12/31/2023, broken out by positive one-year returns (Panel A) and negative one- year returns (Panel B). It is useful to focus on positive and negative returns separately as there are significant scaling dif-ferences. Negative returns are bound by a maximum loss of 100%, whereas gains are theoretically unlimited and not equivalently bound. Indeed, in the case of BTC, simply showing rolling one-year returns would result in the size of losses being dwarfed by the significant gains BTC has exhibited.

An examination of Exhibit 2, Panel A, provides a clear indication of why BTC has garnered investor interest to the extent it has. Here we see some one-year return periods that were well above 1,000% and a nontrivial number of one-year periods that exceeded 100%. It is likely that investors’ interest in BTC would be much more tempered if its returns were more aligned with those of other traditional financial assets. That said, Panel B of Exhibit 2 does offer some balance to the BTC argument and provides reason for some pause in considering BTC for investors’ portfolios. Here, we see several one-year periods in which losses have exceeded 70%.

Source: Bloomberg, Galaxy, Invesco. Sample period for BTC returns shown is 12/31/2013 through 12/31/2023.

Taleb (2021) puts forth the view that many cryptocurrencies are assets with a fair value of zero and positive probability of ruin. However, it isn’t necessary to hold such a negative view of cryptocurrencies to understand that the sizing of a cryptocurrency allocation is a critical part of risk management. Investors considering a BTC allocation would certainly not expect it to go to zero, but they should expect that it will likely exhibit significant losses, as shown in Panel B. The best way to manage the possibility of those losses is to size the portfolio allocation to BTC such that losses, should they occur, fall within the investor’s behavioral and financial tolerances and do not result in an irreparable impairment in the ability to achieve important financial objectives. In short, don’t allocate more than you are willing to lose. The point here is that risk management is more than volatility management. However, this does not mean that understanding the risk of BTC, in terms of volatility, is not important. It provides an indication of how likely we are to experience an asset’s expected (arithmetic mean) return.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Past performance is not a guide to future returns.

Bitcoin has historically exhibited high price volatility relative to more traditional asset classes, which may be due to speculation regarding potential future appreciation in value.

The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development or acceptance of the network may adversely affect the price of bitcoin.

Regulatory changes or actions may alter the nature of an investment in bitcoin or restrict the use of bitcoin or the operations of the Bitcoin network or venues on which bitcoin trades. For example, it may become difficult or illegal to acquire, hold, sell or use bitcoin in one or more countries, which could adversely impact the price of bitcoin.

Bitcoin faces scaling obstacles that can lead to high fees or slow transaction settlement times, and attempts to increase the volume of transactions may not be effective.