Asia: improver to innovator

Key takeaways

1.

2.

3.

Sustained investment in research and development has been instrumental in Asian corporate growth and development. No other region has managed to match the increase in expenditure on research and development since 2000.

In 2018, Asia-based companies accounted for more than two-thirds of all international patent, trademark and industrial design applications for the first time. Only two of the top 10 patent-filing companies were based outside of the region.1

Innovation from Asian companies has historically been linked with taking existing technologies and improving them, a trend that underpinned Asia’s export growth model in the first decade of the 21st century.

However, over the last decade it has become increasingly apparent that Asian companies, both large and small, are amongst the world’s most successful creators and managers of disruptive technologies.

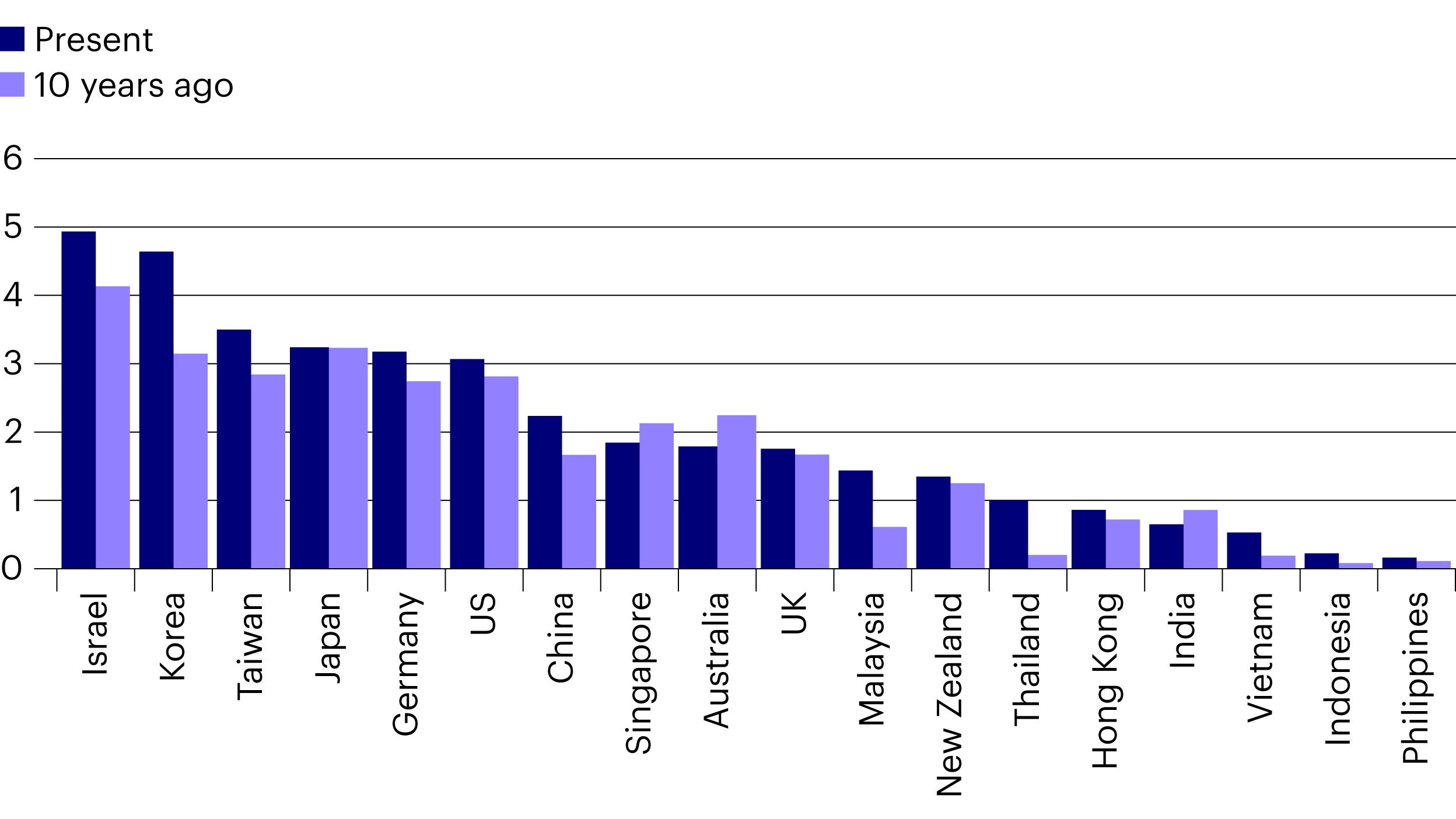

This is most evident in the North Asian economies of South Korea, Taiwan, Japan and China. As can be seen in the chart below, South Korea has one of the world’s highest rates of R&D spend to GDP, an increase that has been fully supported by government policy.

Measuring and valuing innovation remains a challenge. Asian companies continue to struggle with scepticism surrounding their ability to turn R&D spend into profits. We have greater confidence that they can deliver and believe that South Korea is a great example of a market where innovation is being undervalued.

The poster child for South Korean innovation is Samsung Electronics, which spent nearly US$18bn on R&D in 2020. Over the years, its investment has led to innovation in areas such as robotics, memory chips and OLED screen technology, ensuring that it has taken market share from its competitors and delivered higher profits year after year.

More interesting to us as a way of getting exposure to undervalued innovation is LG Corp, one of the biggest conglomerates in Korea with subsidiaries in areas including chemicals, electronics, telecoms, household products and solar energy.

LG Electronics is a regular inclusion in the top 10 list of patent applicants globally, as it develops its portfolio of smart consumer electronics.

Its investment in large OLED screen production has secured it global dominance in OLED TVs. So much so, that Samsung, the biggest seller of TVs worldwide, has to source its OLED panels from one of its closest competitors. Much in the same way that Apple have to source components for the iPhone from Samsung.

Meanwhile, LG Chem is a key supplier of patented OLED materials as well as being one of the world’s biggest manufacturers of conventional lithium-ion batteries. Battery supply is likely to remain tight for the foreseeable future given accelerating demand from electric vehicle (EV) manufacturers.

LG Electronics is also very much involved in the electric vehicle revolution. It has built expertise in EV powertrain, as well as in-car electronics, and it recently signed a JV with contract auto maker Magna Corp. This JV is expected to become a key manufacturing partner for technology companies, such as Apple, who want to move into EVs without undertaking the actual manufacturing.

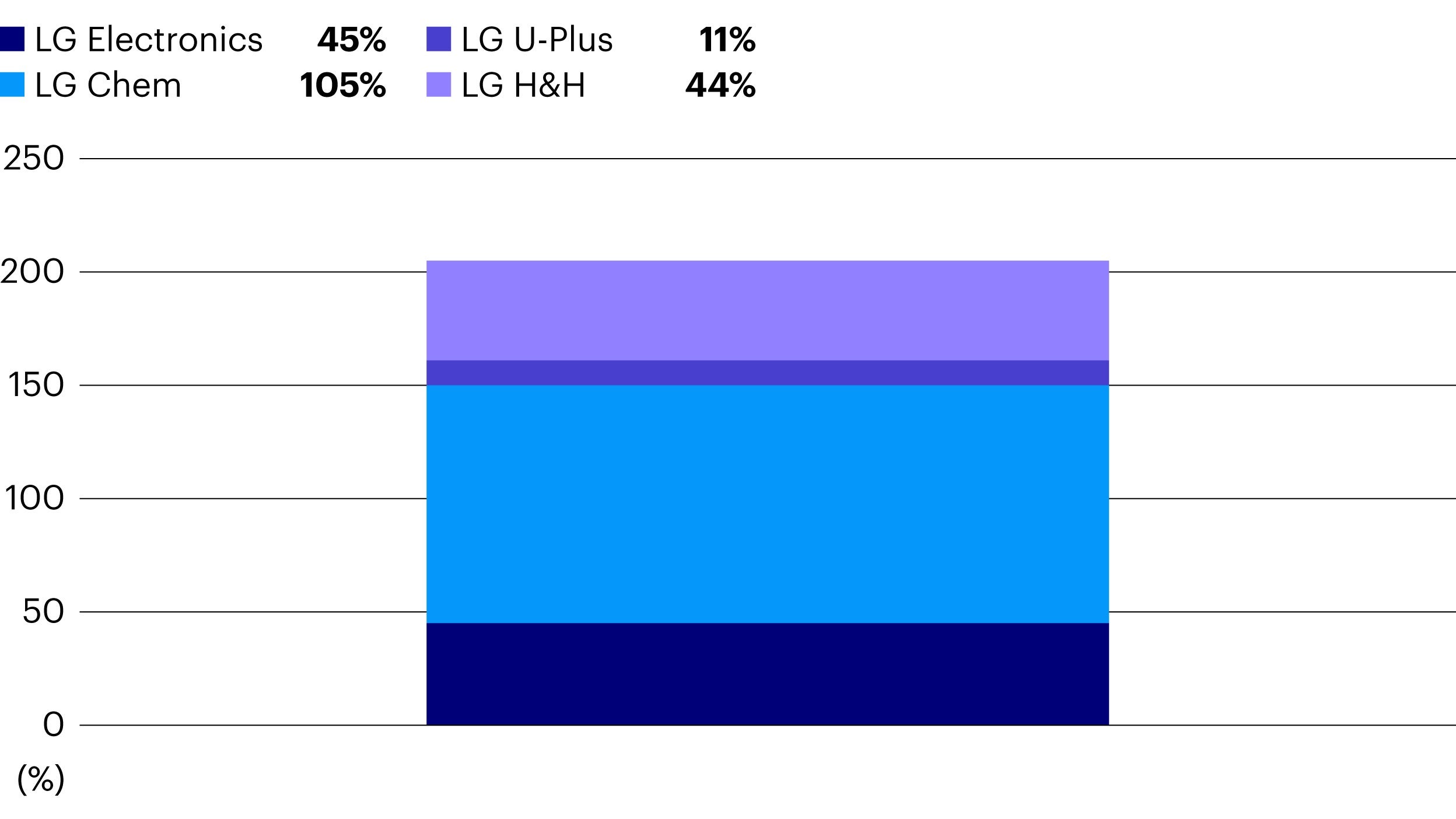

LG Corp owns 30-35% in each of LG Chem, LG Electronics and LG Household, all attractive growth stocks in their own right. However, as a holding company, LG Corp currently trades at a 57% discount to the combined value of these stakes, as can be seen in the chart below.

When you add in all their other assets, the discount to NAV is closer to 75%, for what is arguably one of the best-positioned companies in the EV space.

Chaebols’ long-term outlook favours R&D

Holding discounts are not uncommon, especially with the widely-reported governance concerns when investing in Korean chaebols (large family-owned conglomerates). While it can be argued that ownership structures are overly complicated and not always in the best interests of minority shareholders, the leaders of the business have a very long-term investment horizon. This is of great benefit when it comes to investment in R&D.

Management are investing for long-term growth and are not too focussed on meeting the often shorter-sighted demands of certain minority shareholders.

The LG Corp holding company arguably holds excess cash, but it is committed to paying out dividends of more than 50% of parent earnings, with a share buyback program and a commitment to further investment in areas such as clean energy and artificial intelligence.

Better appreciation of investors and returns to minority shareholders, combined with a greater contribution from auto assets in LG Electronics and LG Chem, suggest to us that the holding discount can narrow further over the medium-term.

Building conviction in Chinese incubators

China is another key area of innovation, although the valuation opportunity may be less evident than in South Korea. ‘Platform companies’ such as Alibaba and Tencent invest huge amounts in R&D and incubate large portfolios of innovative start-ups.

While it may be hard to build conviction that a specific company within one of these stables will become the ‘next big winner’, we do believe that their portfolios as a whole will make a good return on investment for the platform companies.

One company we have been able to build conviction in is Youdao, a subsidiary company of NetEase, an online gaming company we know very well. The company operates in online education services, which is a highly competitive sector, but appears to be close to an inflection point in its profitability.

What stands Youdao apart from its competition is the quality of its product, a reflection of strong tech-centric management. NetEase’s expertise shines through in initiatives to explore the gamification of education, making study more fun and engaging.

Ideas such as a pen that translates words as it hovers over them are reflective of efforts to provide students with tangibly better experiences and outcomes than competing products in an often too-homogenous market.

Innovation matters

The most innovative companies are often priced at a premium. However, sticking to our disciplined, valuation-led approach, it is still possible to find innovative companies in Asian and other emerging markets that are being undervalued.

Footnotes

-

1 Source: World Intellectual Property Organization.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest or sell in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.