S&P 500 ESG ETF: Can doing good be good for returns?

Our S&P500 ESG ETF aims to deliver similar risk and return profile as the S&P500 with an improved ESG profile. Find out about our robust methodology.

Strong demand for passive ESG investments has led to the launch of more than 500 ESG ETFs over the past decade. More than $310 billion of assets are currently invested in ETFs classified by their issuers as ESG1. But with so many funds now available in Europe, how can investors find the ones most suitable to them? Here, we will explore and help define the broad range of ESG approaches, including both what they aim to do … and what they don’t aim to do.

This broad term “ESG” refers to a wide range of funds that consider environmental, social and corporate governance issues as part of their security selection and allocation methodology. The basic concept is nothing new; some active funds have been picking stocks and shunning others based on ethical interpretations for over a century. The more recent development has been in passive ETFs that follow ESG indices based on specific rules rather than an individual’s decision-making.

An ESG index is normally derived from a standard market-cap weighted index (the parent index). For example, the MSCI USA ESG Universal Select Business Screens Index and the MSCI USA ESG Climate Paris Aligned Benchmark Select Index are both derivations of the parent MSCI USA Index. These two ESG indices are constructed from the exact same universe of stocks but are substantially different from each other due to the approaches they take.

Index providers such as MSCI and S&P will generally use ESG ratings (or scores) to select and weight securities. These ratings are provided either by an external company specialising in ESG research and analysis, or internally if the index house has the necessary resource and expertise.

Source: Invesco, Bloomberg, as at 30 September 2023.

Based on the amount of assets held, ETFs that follow a strict “best in class” approach are the largest part of the ESG ETF market. However, in 2022 and so far in 2023, “climate” ETFs have gathered the most assets. As we look at each of the different approaches available, we will focus on the underlying indices being followed, as most ESG ETFs are passively managed.

The first stage of constructing any ESG index will be to remove any securities of companies involved in what the index provider has defined as controversial activities or industries, normally including the likes of controversial weapons, coal and tobacco. Some indices will have a short list of business exclusions while others will have a longer list, so investors should check what is being removed from the index at this stage of the process. As a general rule, the more securities that are removed, the more the ESG index performance is likely to deviate from that of the parent index.

Indices adopting an Exclusions approach typically follow a two-step process:

The intention of an Exclusions approach is generally to construct an index profile similar to that of the parent index but without any securities considered completely unacceptable, as defined by the index provider in the index methodology. This type of approach will almost certainly lead to an index that includes securities with low ESG scores or that are involved in business activities that may be excluded by stricter ESG approaches.

An Exclusions approach also won’t include any “positive” screens, such as amplifying the weight of companies that may have a higher ESG score or that are generating more green revenue. ETFs that follow an Exclusions-based index may sometimes be referred to as taking a “lighter-touch” ESG approach.

Indices adopting a Tilting approach will also aim to provide similar characteristics as the parent index but with a methodology intended to improve the overall ESG score or other relevant metrics such as, for example, lowering carbon intensity or increasing green revenues compared to the parent index. As mentioned, the first step in the approach taken by these indices will often be the same as for Exclusions:

The index methodology will define the targets and explain the mechanics of the tilting, but in general will increase the weight of certain securities and reduce the weight of others. The Tilting approach effectively rewards companies that are producing favourable ESG results and punishing those lagging behind (still having exposure to these laggards but at reduced weighting).

Indices adopting a Best-in-class approach are typically designed to focus on the companies exhibiting the highest ESG characteristics within their sectors, while totally excluding the lowest ESG performers. Again, the approach typically begins with exclusions:

The performance of these indices could normally be expected to deviate more from their parent index than other ESG approaches, depending on how many constituents are removed. The “lightest” best-in-class approaches may aim to capture around 75% of the parent index whereas the “strictest” versions could aim to capture only the top 25% of the market weight, selected based on ESG scores. The stricter the selection criteria, the more its performance is likely to deviate from the parent index.

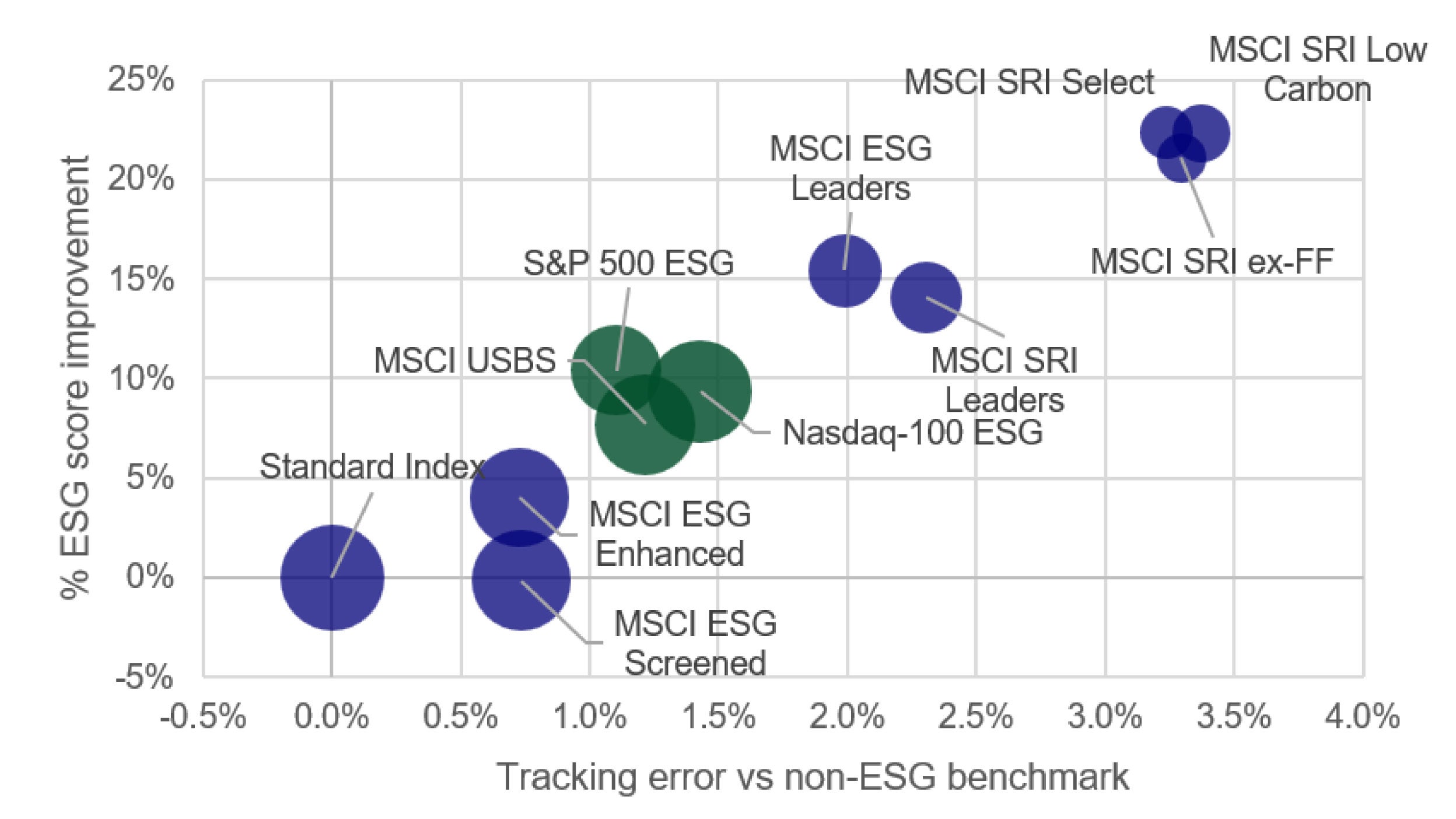

Source: Invesco, Bloomberg as at 31 May 2023; Nasdaq as at last rebalance, 20 Mar 2023; S&P DJI as at latest annual reconstitution, 28 Apr 2023; MSCI as at latest semi-annual reconstitution, 1 Jun 2023. Standard Index is MSCI USA, except for S&P 500 ESG (S&P 500) and Nasdaq-100 ESG (Nasdaq-100). Tracking Error calculated from common index inception date of 18 Mar 2016. Bubble size shows % market coverage by market cap.

Indices categorised as having a Climate objective will generally adhere to the principles behind the EU’s regulatory framework for climate-related investment funds. Most of these will be Paris-aligned benchmarks (PABs) while a smaller number will be Climate-transition benchmarks (CTBs). The European Commission established these benchmarks to provide investors with increased transparency into how indices that carry these designations plan on achieving their objectives related to greenhouse gas (GHG) emissions and the transition to a lower carbon economy.

Thematic indices are the final category, these strategies differ as they’re more likely to be concentrated on a narrow part of the market rather than offering broad exposure. Examples are clean energy or other environmental-focused indices. A thematic index will typically aim to capture those companies that are contributing to or benefiting from a powerful, long-term trend. Some indices may contain a small number of securities while others will be more diversified. How an index is constructed may also be worth considering. For example, an index can weight the constituents by market capitalisation, thematic exposure or spread exposure evenly (equal weighting).

Hopefully, this has provided you with a better understanding of the different approaches taken by the indices an ESG ETF may aim to follow. No approach is “better” or “worse” as they each aim to fulfil different objectives. The most important consideration for investors is which approach meets their own objectives, both in terms of ESG and financial performance. The next step is to find an ETF that can deliver that index performance as cost effectively as possible.

Our S&P500 ESG ETF aims to deliver similar risk and return profile as the S&P500 with an improved ESG profile. Find out about our robust methodology.

Invesco is committed to responsible investment by actively working to incorporate environmental, social and governance (ESG) practices across all areas of the firm.

For complete information on risks, refer to the legal documents.

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

The Fund’s ability to track the benchmark’s performance is reliant on the counterparties to continuously deliver the performance of the benchmark in line with the swap agreements and would also be affected by any spread between the pricing of the swaps and the pricing of the benchmark. The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss. The Fund intends to invest in securities of issuers that manage their ESG exposures better relative to their peers. This may affect the Fund’s exposure to certain issuers and cause the Fund to forego certain investment opportunities. The Fund may perform differently to other funds, including underperforming other funds that do not seek to invest in securities of issuers based on their ESG ratings. The Fund might be concentrated in a specific region or sector or be exposed to a limited number of positions, which might result in greater fluctuations in the value of the Fund than for a fund that is more diversified. The value of equities and equity-related securities can be affected by a number of factors including the activities and results of the issuer and general and regional economic and market conditions. This may result in fluctuations in the value of the Fund. The fund might purchase securities that are not contained in the reference index and will enter into swap agreements to exchange the performance of those securities for the performance of the reference index.

Data as at 31.10.2023, unless otherwise stated. By accepting this material, you consent to communicate with us in English, unless you inform us otherwise. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.

Belgium: This product is offered in Belgium under the Public Offer Exemption. This material is intended only for professional investors and may not be used for any other purpose nor passed on to any other investor in Belgium.

Switzerland: The representative and paying agent in Switzerland is BNP PARIBAS, Paris, Zurich Branch, Selnaustrasse 16 8002 Zürich. The Prospectus, Key Information Document, and financial reports may be obtained free of charge from the Representative. The ETFs are domiciled in Ireland. Germany: German investors may obtain the offering documents free of charge in paper or electronic form from the issuer or from the German information agent (Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg, Germany).

Italy: The publication of the supplement in Italy does not imply any judgment by CONSOB on an investment in a product. The list of products listed in Italy, and the offering documents for and the supplement of each product are available: (i) at etf.invesco.com (along with the audited annual report and the unaudited half-year reports); and (ii) on the website of the Italian Stock Exchange borsaitaliana.it.

Israel: No action has been taken or will be taken in Israel that would permit a public offering of the Fund or distribution of this document to the public in Israel. This Fund has not been approved by the Israel Securities Authority (the ISA). Accordingly, the Fund shall only be sold in Israel to an investor of the type listed in the First Schedule to the Israeli Securities Law, 1968, which has confirmed in writing that it falls within one of the categories listed therein (accompanied by external confirmation where this is required under ISA guidelines), that it is aware of the implications of being considered such an investor and consents thereto, and further that the Fund is being purchased for its own account and not for the purpose of re-sale or distribution. This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder. This document does not constitute an offer to sell or solicitation of an offer to buy any securities or fund units other than the fund offered hereby, nor does it constitute an offer to sell to or solicitation of an offer to buy from any person or persons in any state or other jurisdiction in which such offer or solicitation would be unlawful, or in which the person making such offer or solicitation is not qualified to do so, or to a person or persons to whom it is unlawful to make such offer or solicitation.

For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German), and the financial reports, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus. Index: The "S&P 500 ESG Index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Invesco. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Invesco.

The Invesco S&P 500 ESG UCITS ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the "S&P 500 ESG Index".