Synthetic ETF replication explained

For index ETFs, synthetic replication has recently gained equal footing with physical replication and, for tracking some indices, prominence at their expense. After briefly describing the two concepts, we compare them mainly from a taxation perspective. It turns out that synthetic replication can be more tax efficient in some cases, which may explain why it has achieved more widespread adoption even though physical replication could be more straightforward and easier to understand.

Over the 20 years that exchange-traded funds (ETFs) have been listed in Europe, investors have learned to understand and appreciate the two primary methods used to replicate an index. While ETFs using physical replication may have accounted for the lion’s share of assets in the early years, the synthetic replication model has gathered more acceptance in recent times. We’ve compared the two methods and find that synthetic replication can offer a structural advantage in some cases.

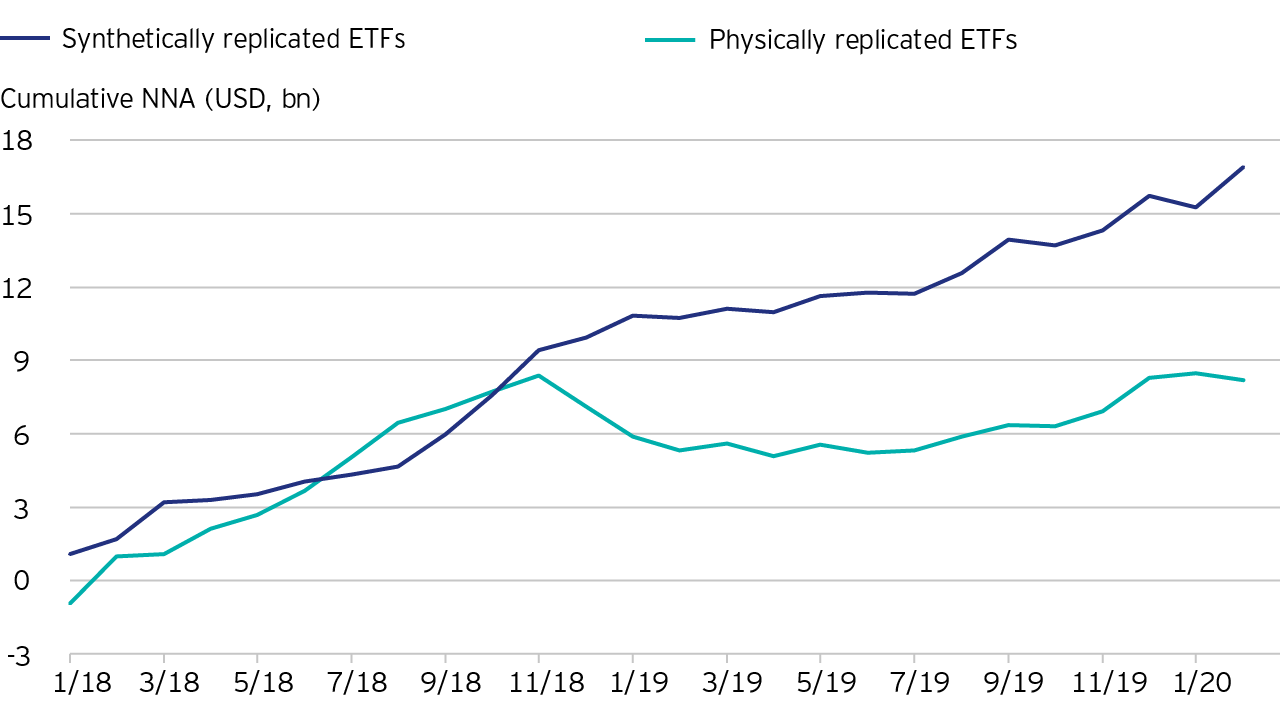

Synthetic replication appears to be gaining ground as the method of choice for passive index ETFs. Take, for example, Europe-listed ETFs that track the S&P 500: funds using synthetic replication accounted for nearly all of the USD 6.9 billion in net new assets in 2019 (figure 1). This is quite different from 2018, when synthetic and physical replication contributed more or less equally to asset growth.

Both synthetic and physical replication aim primarily to match as well as possible the performance of a specific reference index. The effectiveness of the replication method chosen can be measured by the tracking error (the volatility of the daily returns of the ETF versus the index) and tracking difference (the difference between the ETF’s return and the index return over time). Assuming perfect tracking, this tracking difference will be equal to the index return minus management fees. But, in reality, many ETFs will lag the index either by more than the amount of ongoing fees, or in some cases by less.

When structuring even the simplest passive product, an ETF issuer has several tools available, some of which depend on whether the index is going to be replicated physically or synthetically.

Full physical replication involves holding all the index securities in the same proportion as the index and rebalancing whenever the index does. Some physically replicating ETFs may use sampling techniques, which involves holding only a subset of the index that the portfolio manager hopes will offer a risk and performance profile similar to the index, but in a more cost-effective way than holding all the securities.

The second method is synthetic replication, which also involves holding a broad basket of securities, although not being limited to those of the index being replicated. The ETF issuer will have a list of securities it will accept into the basket. To match the index performance, the ETF uses swaps, whereby the swap counterparty agrees (via the derivative contract) to pay (or receive) any difference between the return of the index and the return of the basket of securities held.

How to improve performance

Using the example of the S&P 500, a physically replicating ETF may be able to improve performance relative to the standard net return index via certain tools or capabilities:

- The fund may be able to achieve lower withholding tax rates depending on where the fund is domiciled and what tax treaties are applicable. For example, an Irish-domiciled ETF pays 15% withholding tax on dividends received by the fund (instead of the normal 30% assumed by the net return index) due to a tax treaty between the US and Ireland.

- If the fund engages in stock lending, the level of revenue earned from the practice depends on how in-demand the index stocks are for borrowing and what portion of the revenue generated is passed on to the ETF. While offering a potential boost to performance, there is counterparty risk for the stocks on loan.

- Trading more intelligently around index rebalancing and corporate actions can deliver some improvement in performance, although mistakes or misjudgements in trading can result in underperformance.

ETFs and counterparty risk

Both replication methods may have exposure to counterparty risk, if the physical model includes securities lending. The issuer of a synthetically replicating ETF can mitigate counterparty risk by resetting the swaps to zero when certain conditions are met, such as excessive market movements or changes in the NAV of the ETF. In practice, these resets may occur daily. For issuers of synthetic and physical ETFs alike, risk of default can be reduced by dealing only with creditworthy counterparties.

Structural advantages of synthetic replication

There are many benchmarks for which synthetic replication has clear structural advantages over physical replication, often resulting in material performance gains versus the index. The replication of the MSCI World Index provides a useful case study given the sheer number of stocks and countries covered. The advantage available to synthetic replication models is due to the way that tax authorities in some countries treat physical investments versus derivatives. This section focuses on three areas: US dividend taxation, European dividend taxation and Stamp Duty / financial transaction taxes.

US dividend withholding tax

The MSCI World Index is weighted by market capitalization with shares of US companies comprising approximately 64% of the benchmark, making any efficiency gains through US tax treatment much more material to the overall effectiveness of the replication model. Foreign investors in US stocks are generally subject to a withholding tax on dividends of up to 30%, although many can reduce this to 15% through the application of tax treaties as was highlighted in the case of physically replicated ETFs domiciled in countries such as Ireland.

Under US tax law, certain types of derivatives are subject to an equivalent withholding tax rate if they pass through “dividend-equivalent” payments. Specifically, when a US bank writes a swap on an index with a non-US counterparty, it is generally required to withhold US dividend tax at the same rate as would apply to a physical investment by that same counterparty.

This would seem to level the playing field between physical and synthetic replication strategies, but the same rule that imposes this tax treatment on derivatives also specifies certain exemptions, and the MSCI World Index meets the criteria for these exemptions. Namely, section 871(m) of the HIRE Act explicitly excludes swaps written on indices with deep and liquid futures markets from the requirement to pay dividend withholding taxes.

This means that, while a European-domiciled physically replicating ETF will generally be able to achieve a maximum of 85% of the dividend yield of the US holdings in their MSCI World portfolio, a synthetically replicating ETF can achieve up to 100% of the full gross dividend amount. With an average dividend yield for US large-cap stocks of approximately 2%, this exemption means synthetically replicating funds can potentially achieve up to 30 basis points of additional performance on US exposures, which equates to around 19 basis points on the MSCI World Index1.

We can see the impact of this difference more clearly if we look at ETFs tracking a US-focused benchmark such as the S&P 500. The following chart shows the one-year performance of the five largest S&P 500 ETFs listed in Europe, two of which use physical replication and three which use synthetic. In figure 2, the dark blue line shows the average performance of the three synthetic funds while the light blue line shows the average of the two physical funds. All five funds outperform their benchmark, the S&P 500 Net Total Return Index, which assumes a 30% withholding tax rate. However, the average of the synthetic funds is 25 basis points higher than the average of the physical funds over the one-year period, in line with expectations.

Non-US dividend withholding tax

Tax authorities in Europe and many other countries take a similar approach to dividend withholding tax on foreign holders of shares. However, we can see that ETFs tracking the MSCI World Index are generally able to achieve better performance than would be assumed under application of these rates.

For physically replicating ETFs, withholding tax rates can once again be improved depending on fund domicile. Furthermore, some select investors may be able to obtain lower withholding tax rates and, if the physical ETF engages in stock lending, borrowers of shares may pass on a higher dividend percentage than the lender would receive on a physical holding. For ETFs that use synthetic replication, the index swap market will generally reflect the same enhanced economics available in the stock lending market. As such, the two models both can achieve outperformance, but neither model has an advantage.

Stamp Duty and financial transaction taxes

The synthetic advantage re-emerges in the application of financial transaction taxes. An ETF that physically replicates the MSCI World Index will buy most or all the stocks in the index. When buying shares in the UK, the ETF will generally be subject to a 50 basis-point Stamp Duty. There are also financial transaction taxes applied to the purchase of shares in Italy (10 basis points if traded on-exchange, 20 basis points off-exchange) and France (30 basis points). These costs are reflected in the price of creating shares in the fund.

For a synthetically replicating ETF, the swap counterparties purchase the replicating portfolio, not the fund. As this transaction is executed as part of the hedging of a derivative, i.e. the swap with the fund, the banks are generally exempt from both UK Stamp Duty and the financial transaction taxes imposed by France and Italy. Being exempt from paying taxes on these shares means an up-front cost advantage to the end-investor.

Conclusion

Physical and synthetic replication models both have merits as well as potential drawbacks. The preference of one over the other will vary between investors and may even change over time. A huge number of investors still prefer physical replication regardless of any advantages to be gained elsewhere, due partly to the simplicity of the structure. A physical model is easy to understand and explain to clients.

However, investors have started to adopt a more pragmatic stance, which may be leading to a preference for synthetic replication in certain situations. Depending on the indices replicated and the country of domicile, synthetic replication may result in lower withholding taxes, Stamp Duties and financial transaction taxes, structural advantages to which investors are increasingly drawn.

Footnotes

-

1 Based on the impact of the difference in withholding tax rates on dividends given the 10-year average yield on US large caps (using the S&P 500 as a proxy), and the allocation of US equities in the MSCI World Index (64% as at 1 April 2020).

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

A synthetic ETF’s ability to track a benchmark’s performance is reliant on the counterparties to continuously deliver the performance of the benchmark in line with the swap agreements and would also be affected by any spread between the pricing of the swaps and the pricing of the benchmark. The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose a synthetic ETF to financial loss.

Important information

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.