Multi-factor strategies and ESG – perfect partners

Combining ESG considerations with the proven IQS multi-factor approach, we create risk-controlled portfolios that seek to outperform their benchmarks while enhancing ESG profiles.

Executive summary

- Awareness and importance of sustainability integration in investment processes are rising across investors and regulators

- Invesco Quantitative Strategies (IQS) has been at the forefront of customised multi-factor ESG solutions for more than 20 years

- The IQS ESG-integrated multi-factor approach allows flexible implementation of customised ESG criteria such as exclusions, positive screening and optimisation of ESG indicators

- Combining ESG considerations with the proven IQS multi-factor approach, we create risk-controlled portfolios that seek to outperform their benchmarks while enhancing ESG profiles

- In 2019, IQS developed a bespoke multi-factor low carbon UK equity strategy to address an investor’s desire to improve a portfolio’s environmental profile without sacrificing factor exposures

Read on below or download the pdf version here.

Rethink the importance of ESG solutions

Sustainability and responsibility in investments are on everyone’s lips, with climate change and environmental protection enjoying high attention. The 2015 Paris Agreement marked a significant step as governments acknowledged that actions are required to mitigate global warming and the impact of climate change. In July 2019, the UK was one of the first countries to lay out a plan to transform their financial system to legislate net zero emissions by 2050 by way of their Green Finance Strategy. The European Commission drafted the European Climate Law in March 2020, a legally binding target of net zero greenhouse gas emissions by 2050. Achieving these objectives will require unprecedented levels of investment in green and low carbon technologies, services and infrastructure. Furthermore, environmental considerations will not only increase in relevance for dedicated ESG investment strategies, but also for conventional investment strategies.

Asset managers need to anticipate the changing regulatory and market environment. While the Invesco Quantitative Strategies (IQS) team has been managing customised ESG portfolios for more than 20 years, ESG considerations have become an integral part of our standard multi-factor process for all portfolios since 2017. A thoughtful integration of ESG measures in our multi-factor approach, which builds on the proprietary factors Quality, Momentum and Value, can preserve the potential for outperformance while improving ESG characteristics of a portfolio.

Rather than implementing mere ESG exclusion criteria we observe rising demand for more customised solutions that aim at improving a portfolio’s ESG characteristics such as its carbon footprint. Building on our proven multi-factor approach, we therefore research and create tailored ESG solutions targeting to deliver a superior investment experience for our clients. The process of creating a bespoke multi-factor ESG strategy and its real-life portfolio implementation is outlined in this case study.

Creating a carbon-optimised portfolio solution

In 2019, IQS developed a bespoke low carbon solution for a client with the aim of reducing the overall carbon emissions of an existing multi-factor strategy to levels significantly below the FTSE All Share ex IT Index. The IQS investment team and the client outlined several project objectives, including stable and predictable carbon emission reductions over time, minimal impact on expected performance as well as the ability to quantify the low carbon impact on portfolio risk and return. Importantly, exposures to the IQS factors Quality, Momentum, and Value were to be maintained given that these are the major drivers of portfolio risk and return.

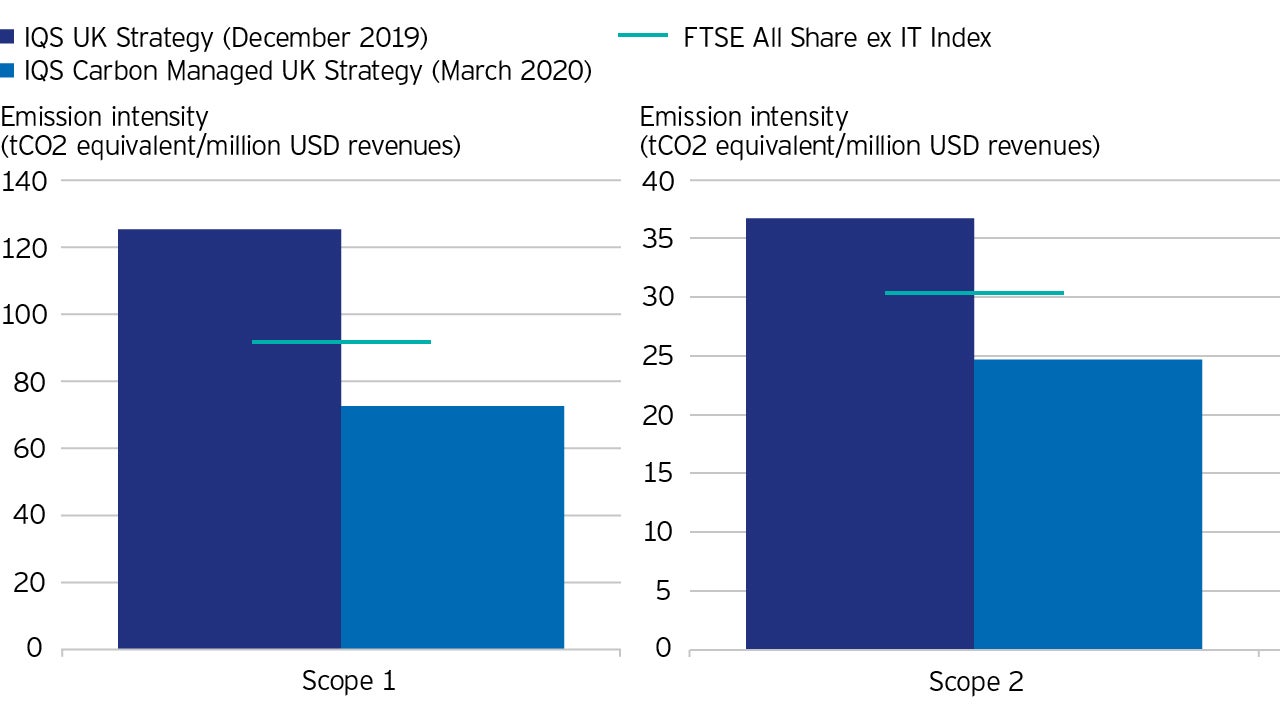

The ESG criterion of choice was to focus on the active management of carbon emission scope 1 and scope 2, for which the reliability and good coverage for the investable universe were given. Furthermore, we utilized carbon intensity data, i.e. carbon and its equivalents from other greenhouse gas emissions in tons per revenue measured in million USD, to make emissions comparable across companies of different market capitalisations and to apply a measure of efficiency that links an ESG criterion with a financial metric.

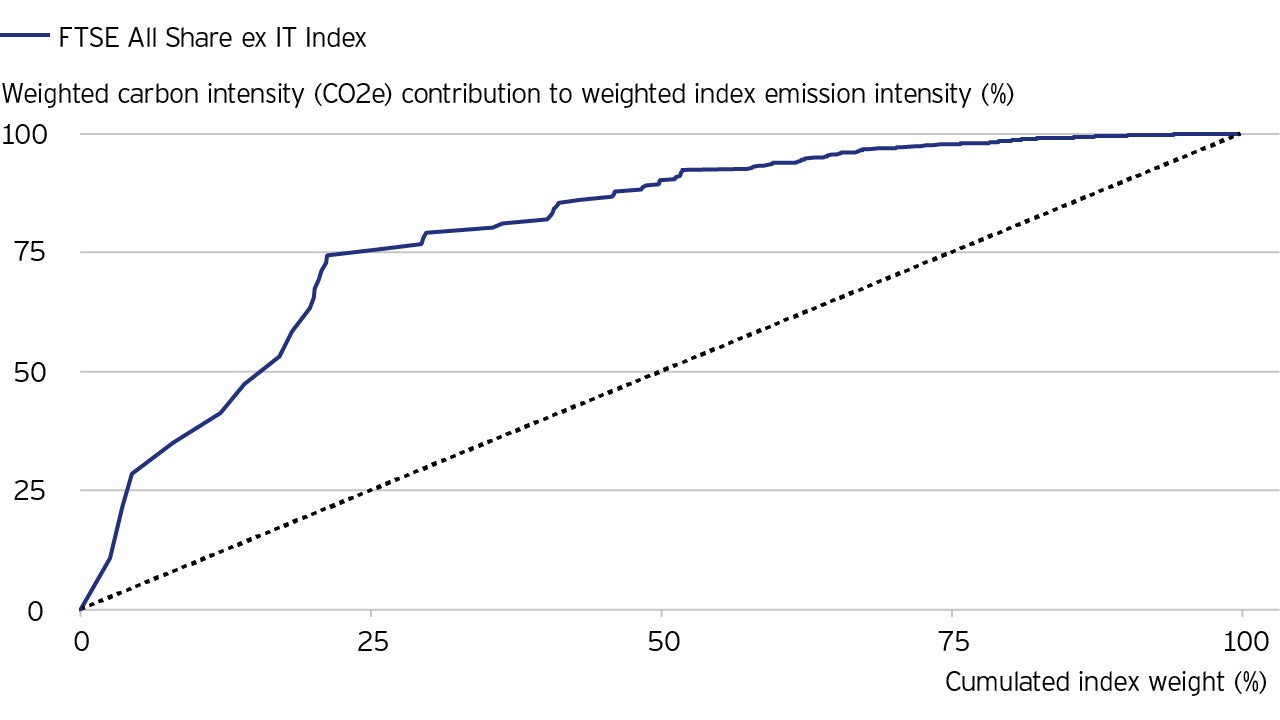

While the carbon reduction targets could have easily been achieved by divesting from certain sectors, such action would have jeopardised the characteristics of the incumbent multi-factor strategy such as low tracking error versus the benchmark and similar risk characteristics including index-relative industry limits. In particular, the index as well as the overall UK universe exhibit large exposures to high carbon and fossil fuel companies. Figure 1 illustrates the contribution of the index constituents to the index’ carbon footprint: Seven companies account for approximately half of the weighted carbon intensity, while they make up less than 20% of the index weight. Hence, reducing carbon exposure to desired levels calls for a cautious approach in order to keep risk and return characteristics in line with the index.

Implementation via two-step portfolio optimization

To address the client’s objectives, the implementation builds on a two-step portfolio optimization. The first step creates a tracking error minimal portfolio versus a capitalisation-weighted benchmark which incorporates the bespoke low carbon characteristic.1This allows to readily gauge the low carbon impact in terms of the return difference between the low carbon portfolio and the parent benchmark and the active risk needed to de-carbonise the benchmark. In the second step, the active IQS multi-factor investment process is applied relative to this low carbon portfolio with the intention to generate above benchmark returns in a thoroughly risk-controlled framework.

The two-step optimization comes with crucial benefits: First, it provides a transparent attribution that allows distinguishing between effects coming from either the low-carbon characteristic and the multi-factor management. Second, the two-step optimization prevents distorting the optimal portfolio due to overly binding constraints. As these would limit the solution space considerably, one could end up cutting-off the unconstrained optimal portfolio from the eligible set and obtaining a corner-solution. Having dealt with the low carbon constraint in the first step, the second portfolio optimization is guided by a favourable benchmark and does not need to trade-off low-carbon characteristics and expected factor-based equity forecasts.

Proof of concept: simulation and scenario analyses

Simulation analysis

The factor investing philosophy implies that portfolios with similar factor characteristics would carry similar return and risk expectations. Following this logic, the IQS multi-factor process seeks to replace stocks with negative ESG scores (in this case relating to a high carbon intensity) by alternative stocks that exhibit more positive ESG characteristics while maintaining overall factor characteristics and, hence, return and risk expectations.

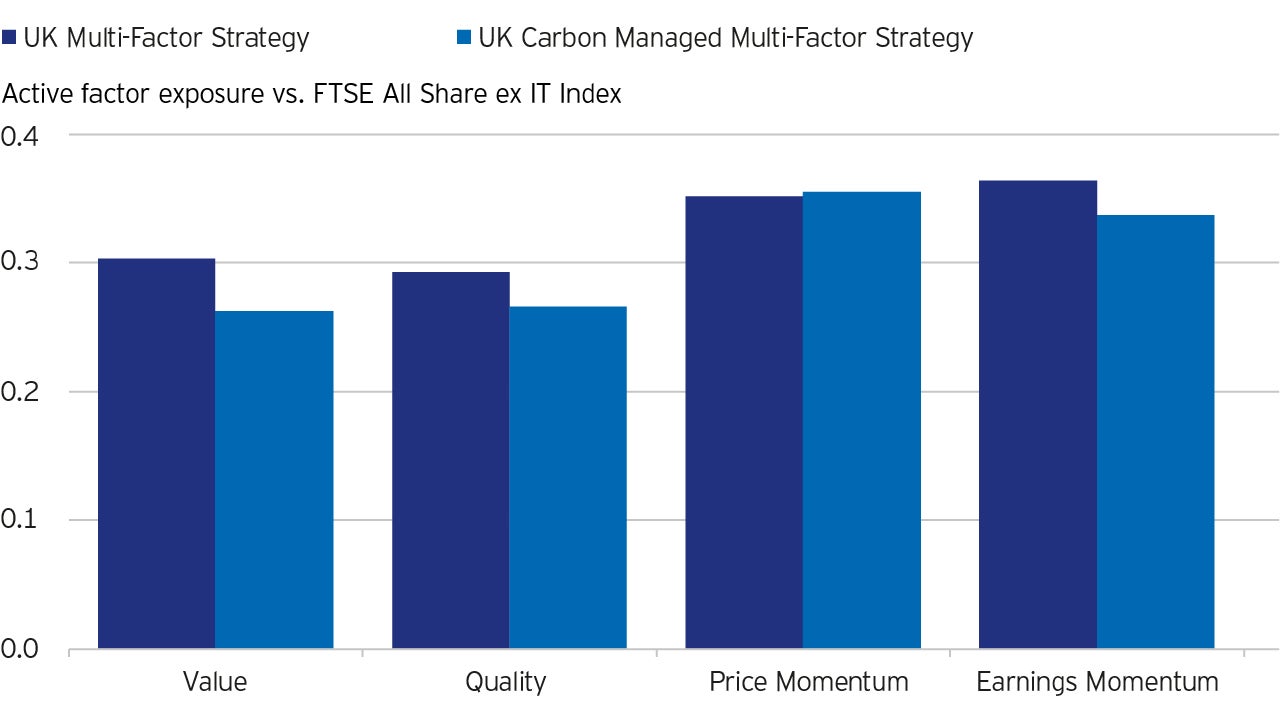

To validate this reasoning, we simulated the incumbent UK Multi-Factor Strategy and the new Carbon Managed UK Multi-Factor Strategy over time. Investigating average factor exposures in these two simulations we find that these remain literally unchanged, as illustrated in Figure 2. As expected, this also results in almost identical returns of these two strategies in long-term portfolio simulations.

Accordingly, the real-life new Carbon Managed UK Multi-Factor Strategy implemented in early 2020 consistently displayed similar factor characteristics as the original portfolio and, hence, similar risk and return expectations. At the same time, it reduced carbon emissions to the intended below benchmark levels in a stable, predictable and strictly risk-controlled fashion.

Scenarios analysis

In addition to analysing factor exposures and portfolio risk, we assessed the carbon intensities, which are now actively managed. We conducted a carbon intensity analysis comparing the initial and the new portfolio as part of TCFD2 reporting efforts.

In this regard, the Carbon Managed UK Multi-Factor Strategy shows significantly lower scope 1 and scope 2 emission intensities, hence matching the desired portfolio objectives, see Figure 3.

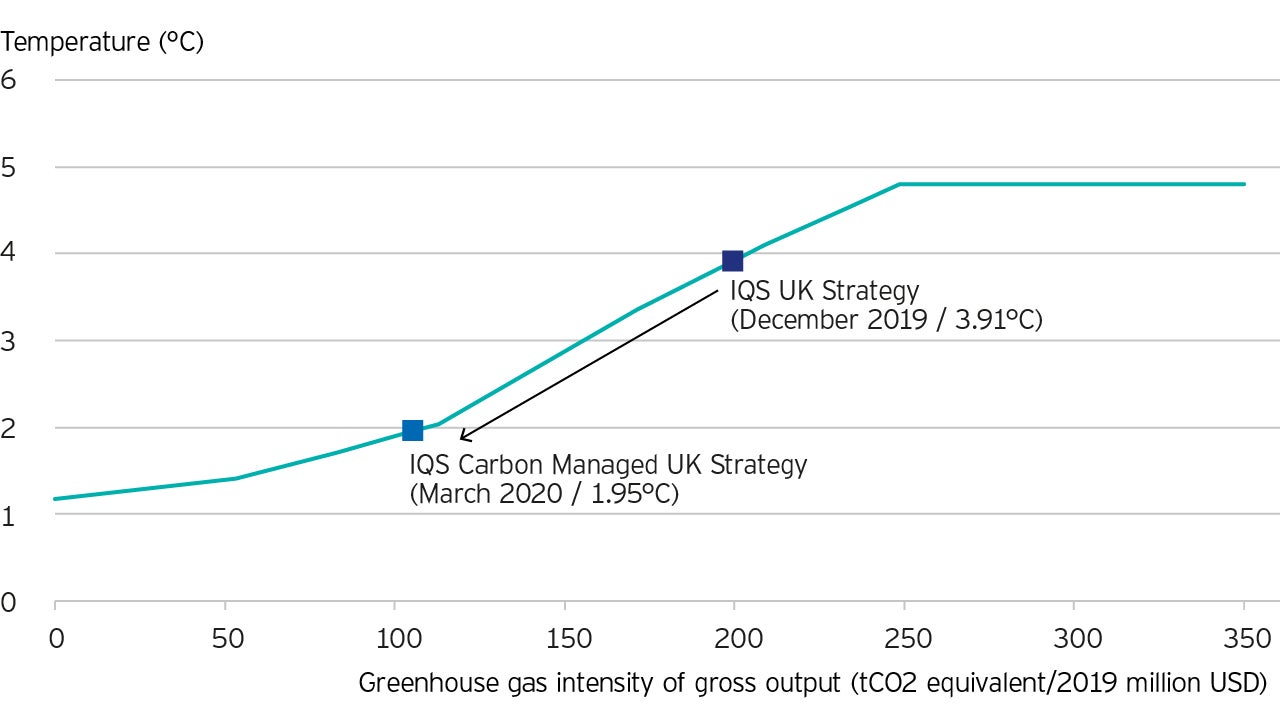

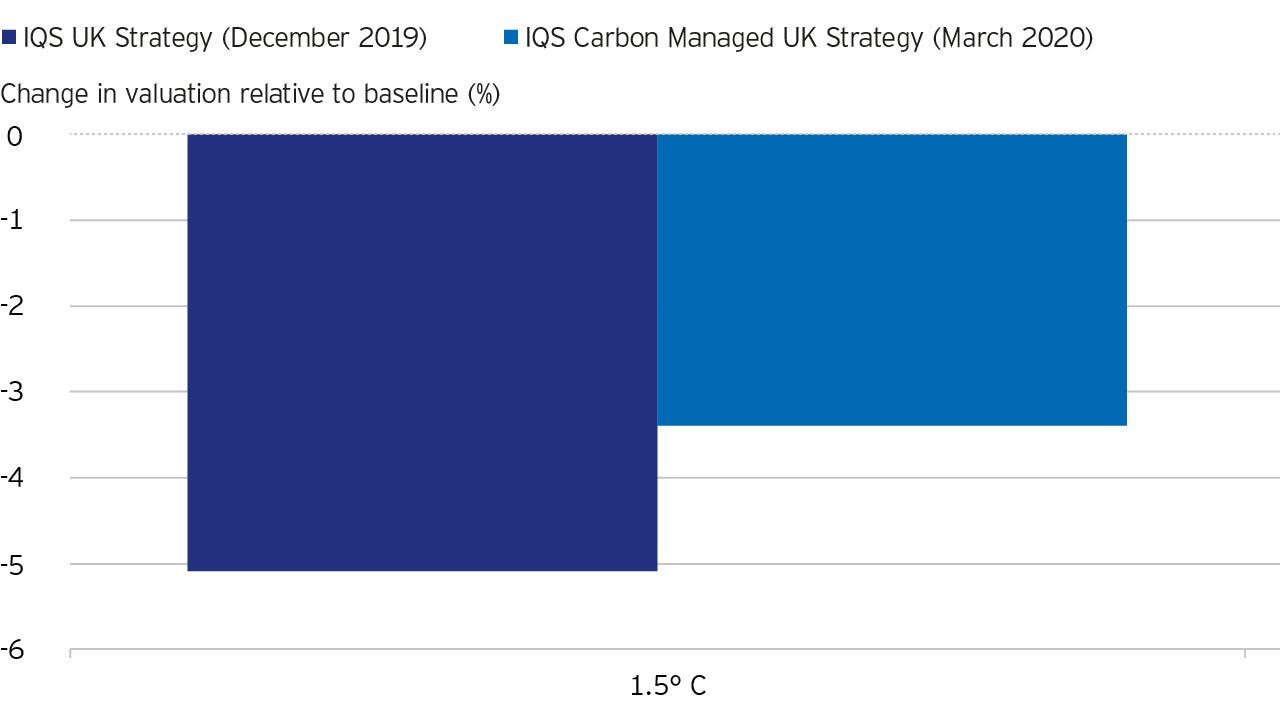

While the improvement of the portfolio’s carbon footprint was achieved by design, we conducted an additional analysis of the temperature alignment of the portfolios. Invesco collaborated with Vivid Economics to provide climate scenario analyses for listed equities portfolios, aiming to better understand the temperature alignment and the implications of various climate scenarios on their portfolios. Vivid Economics has conducted scenario-based analyses for Invesco using its Climate Risk Toolkit, thus investigating the impact of a high policy stringency scenario (1.5°C)3 on the portfolio before and after the introduction of the active carbon management strategy, among others.

It turns out, that the two-step optimization has a very positive impact: while the initial portfolio caused a 4-degree scenario increase, the new strategy significantly reduces the temperature outcome to a below 2-degree scenario, see Figure 4.

The improved resilience against risks arising from climate change transition is especially visible in the 1.5-degree scenario. The 1.5-degree scenario analysis assesses the performance impact on the portfolio holdings if the world temperature is increasing by 1.5-degree. The scenario analysis calculates the impacts of transition risks, e.g. higher carbon prices or discontinuation of business models, and physical shocks, e.g. changing annual average damages from extreme weather, on assets. The 1.5.-degree scenario is characterized by particularly high transition risks, as companies have to change their production methodology and to some extent their business models to stay within the carbon budget. In such a scenario, the carbon-managed portfolio significantly reduces the negative impact from the transition costs compared to the initial strategy, while still maintaining the risk characteristics of the UK benchmark as illustrated in Figure 5.

Outlook

There are two key trends in sustainable investing. First, ESG integration in investment processes is a standard requirement by investors for asset managers. Second, there is increasing focus on positive impact. Investors demand a shift from simply avoiding controversial investments to a more impactful ESG implementation. Customised solutions which amplify the positive notion of ESG are thus becoming more important.

Thoughtfully integrating ESG criteria into multi-factor equity strategies can have a significant impact on a portfolio’s ESG profile while maintaining risk and return characteristics similar to conventional factor strategies. The present case study of a carbon-optimised portfolio illustrates how the IQS multifactor approach can be adapted to significantly improve the portfolio’s ESG profile.

While the active Carbon Managed UK Multi-Factor Strategy is a case in point, IQS has conducted in-depth further research demonstrating that the general concept can be expanded to other investment universes and different multi-factor strategy setups, such as global portfolios and low volatility strategies. The IQS team continues and intensifies its efforts to scrutinise further ESG data sources across various data vendors in order to deliver superior investment solutions. As investor needs are diverse, continuous progress has to be made to structure and implement tailor-made solutions. Hence, exploring new ways to develop bespoke ESG portfolios remains high priority for IQS.

Notes

-

1 The first optimization step is similar to the one discussed in Andersson, M., Bolton, P., & Samama, F. (2016). Hedging climate risk. Financial Analysts Journal, 72(3), 13-32 who are creating a tracking error minimal index with a carbon option.

2 TCFD: Task Force on Climate-related Financial Disclosures

3 For this analysis, Vivid Economics’s toolkit incorporates publicly available scenarios from the Intergovernmental Panel on Climate Change’s (IPCC) 1.5°C scenario database. A high transition risk 1.5°C scenario is taken from the IPCC database, which offers scenarios from a variety of academically developed models. For more detail on the TCFD analysis, please refer to Invesco’s TCFD Reporting 2020

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This marketing document is exclusively for use by Professional Clients. This document is not for consumer use, please do not redistribute. This document is not for consumer use, please do not redistribute. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise.

This marketing document is not an invitation to subscribe for shares in a fund and is by way of information only, it should not be considered financial advice. Past performance is not a guide to future returns. Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is issued by Invesco Asset Management S.A., 18 rue de Londres, 75009, Paris, France. Authorised and regulated by the Autorité des marchés financiers in France; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; and Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany. Issued in Switzerland by Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland.

Data as at 12 June 2020, unless otherwise stated.