Precision of bonds, advantages of ETFs

BulletShares have a fixed maturity like an individual bond whilst providing the diversification benefits of a fund and the intraday trading capacity of an ETF.

Broad diversification

Investing across different BulletShares maturities allows investors to build a cost-effective, diversified laddered portfolio to manage interest rate risk and cash flows.

Targeted exposure

We offer ten low-cost BulletShares UCITS ETFs providing targeted exposure to USD and EUR investment grade corporate bonds, with maturities ranging from 2026 to 2030.

Access our BulletShares UCITS ETFs

Our BulletShares UCITS ETFs provide targeted exposure to USD and EUR investment grade corporate bonds, with maturity ranges from 2026 to 2030. We offer a choice of quarterly distributing or accumulating share classes which can provide a regular income stream like a bond or reinvest coupon payments until the final maturity.

USD

Invesco BulletShares USD Corporate Bond UCITS ETF

Accumulating and distributing share classes available

Total expense ratio: 0.10% p.a

Transcript

EUR

Invesco BulletShares EUR Corporate Bond UCITS ETF

Accumulating and distributing share classes available

Total expense ratio: 0.10% p.a.

Transcript

GBP

Invesco BulletShares GBP Corporate Bond UCITS ETF

Accumulating and distributing share classes available

Total expense ratio: 0.10% p.a.

Transcript

Access our BulletShares UCITS ETFs

Our BulletShares UCITS ETFs provide targeted exposure to USD investment grade corporate bonds, with maturity ranges from 2026 to 2030. We offer a choice of quarterly distributing or accumulating share classes which can provide a regular income stream like a bond or reinvest coupon payments until the final maturity.

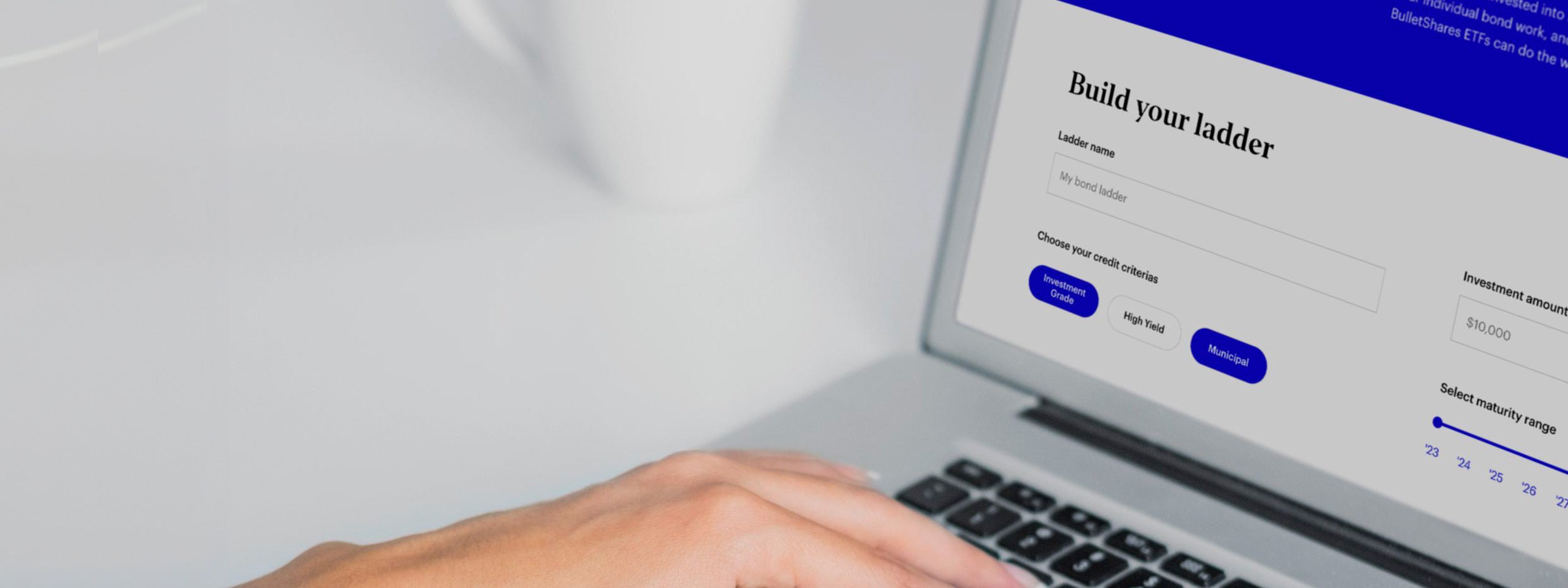

Building bond ladders with BulletShares ETFs

What are BulletShares and how they can help you build bond ladders.

Transcript: Show transcript

Build bond ladders with BulletShares ETFs

This marketing communication is for professional investors and qualified clients/sophisticated investors only. Investors should read the legal documents prior to investing.

Title screen #1: What are bond ladders?

Bond ladders are portfolios of bonds with sequential maturity dates. As bonds in the ladder mature, the proceeds can be used to cover a specific need, or they can be invested in new bonds with longer maturities. Each maturity is effectively a rung on the bond ladder, providing the investor with the choice to take the proceeds or to reinvest them. The same principle can be applied to fixed maturity ETFs as we’ll see in a moment.

But now that we understand the basics of bond ladders, let’s cover the potential benefits and how they can help investors.

Title screen #2: What are the potential benefits of bond ladders?

Bond ladders offer three main potential benefits:

- A laddered bond portfolio, consisting of staggered maturities, may reduce reinvestment risk whilst maintaining a consistent income stream.

- Bond ladders can also allow an investor to customize their portfolio’s maturity and duration profiles—or sensitivity to interest rate changes – to suit their financial goals.

- By holding bonds to maturity, it can reduce the impact of changing interest rates during an investor’s holding period. As such, bond ladders can provide potential advantages in both rising and falling interest rate environments.

Let’s explore the third benefit a bit more.

If interest rates increase, an investor would be able to reinvest the proceeds from maturing bonds in longer bonds with higher yields.

On the other hand, if interest rates decrease, an investor may choose to only reinvest a portion of the proceeds during a low-rate phase of the cycle while they wait for better opportunities in the future.

So far, we’ve only talked about bond laddering but how does that apply to BulletShares UCITS ETFs?

Title screen #3: How BulletShares ETFs can make building bond ladders easier

BulletShares defined maturity ETFs can make creating a laddered portfolio easy because they combine the benefits of individual bonds and exchange-traded funds.

Like individual bonds, BulletShares offer regular income potential (for distributing share classes), a defined termination date when the maturity proceeds are paid to investors, and control of portfolio maturity. But, because each ETF invests in a selection of bonds, they provide the diversification benefits associated with fund investment. And because they’re ETFs, our suite can offer the liquidity, transparency, and convenience provided by the ETF wrapper, all at a low cost. They allow investors to avoid the potential idiosyncratic risks, trading costs, research, and time, of building bond ladders using hundreds of individual bonds.

Our BulletShares ETFs provide targeted exposure to USD and EUR investment grade corporate bonds, with maturity ranges from 2026 to 2030.

Whatever you’re looking to accomplish with your bond portfolio, Invesco BulletShares Corporate Bond UCITS ETFs offer convenient, cost-effective solutions to help meet your potential income goals.

Investment Risks

For complete information on risks, refer to the legal documents.

Value fluctuation: The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Credit risk: The creditworthiness of the debt the Fund is exposed to may weaken and result in fluctuations in the value of the Fund. There is no guarantee the issuers of debt will repay the interest and capital on the redemption date. The risk is higher when the Fund is exposed to high yield debt securities.

Interest rates: Changes in interest rates will result in fluctuations in the value of the fund.

Securities lending: The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Environmental, social and governance: The Fund intends to invest in securities of issuers that manage their ESG exposures better relative to their peers. This may affect the Fund’s exposure to certain issuers and cause the Fund to forego certain investment opportunities. The Fund may perform differently to other funds, including underperforming other funds that do not seek to invest in securities of issuers based on their ESG ratings.

Concentration: The Fund might be concentrated in a specific region or sector or be exposed to a limited number of positions, which might result in greater fluctuations in the value of the Fund than for a fund that is more diversified.

Maturity Year Risk: The term of the Fund is limited. The Fund will be terminated on the Maturity Date.

Declining Yield Risk: During the Maturity Year, as the corporate bonds held by the Fund mature and the Fund’s portfolio transitions to cash and Treasury Securities, the Fund’s yield will generally tend to move toward the yield of cash and Treasury Securities and thus may be lower than the yields of the corporate bonds previously held by the Fund and/or prevailing yields for corporate bonds in the market.

Reinvestment Risk: The issuers of debt securities (especially those issued at high interest rates) may repay principal before the maturity of such debt securities. This may result in losses to the Fund on debt securities purchased at a premium.

Early Termination Risk: The Fund may be terminated in certain circumstances which are summarised in the section of the Prospectus titled “Termination”.

Important Information

Data as at 30.11.2023, unless otherwise stated. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change. For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German), and the financial reports, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus.

Index: “Bloomberg®” and the indices referenced herein (the “Indices”, and each such index, an “Index”) are trademarks or service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Index (collectively, “Bloomberg”) and/or one or more third-party providers (each such provider, a “Third-Party Provider,”) and have been licensed for use for certain purposes to Invesco (the “Licensee”). To the extent a Third-Party Provider contributes intellectual property in connection with the Index, such third- party products, company names and logos are trademarks or service marks, and remain the property, of such Third-Party Provider. Bloomberg is not affiliated with the Licensee or a Third-Party Provider, and Bloomberg does not approve, endorse, review, or recommend the financial products referenced herein (the “Financial Products”). Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Indices or the Financial Products.

Germany: German investors may obtain the offering documents free of charge in paper or electronic form from the issuer or from the German information agent (Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg, Germany).

Israel: No action has been taken or will be taken in Israel that would permit a public offering of the Fund or distribution of this document to the public. This Fund has not been approved by the Israel Securities Authority (the ISA). The Fund shall only be sold in Israel to an investor of the type listed in the First Schedule to the Israeli Securities Law, 1968, who in each case have provided written confirmation that they qualify as Sophisticated Investors, and that they are aware of the consequences of such designation and agree thereto and further that the Fund is being purchased for its own account and not for the purpose of re-sale or distribution other than, in the case of an offeree which is an Sophisticated Investor, where such offeree is purchasing product for another party which is an Sophisticated Investor. This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder. This document does not constitute an offer to sell or solicitation of an offer to buy any securities or fund units other than the fund offered hereby, nor does it constitute an offer to sell to or solicitation of an offer to buy from any person in any state or other jurisdiction in which such offer or solicitation would be unlawful, or in which the person making such offer or solicitation is not qualified to do so, or to a person to whom it is unlawful to make such offer or solicitation.

Italy: The publication of the supplement in Italy does not imply any judgment by CONSOB on an investment in a product. The list of products listed in Italy, and the offering documents for and the supplement of each product are available: (i) at etf.invesco.com (along with the audited annual report and the unaudited half-year reports); and (ii) on the website of the Italian Stock Exchange borsaitaliana.it.

Switzerland: The representative and paying agent in Switzerland is BNP PARIBAS, Paris, Zurich Branch, Selnaustrasse 16 8002 Zürich. The Prospectus, Key Information Document, and financial reports may be obtained free of charge from the Representative. The ETFs are domiciled in Ireland EMEA 3535690 /2024

Invesco BulletShares Corporate Bond UCITS ETFs

Our BulletShares UCITS ETFs can offer a cost-effective and convenient approach to portfolio laddering. They combine the benefits of investing in individual bonds with the added diversification benefits of an ETF.

Transcript

FAQ

BulletShares UCITS ETFs are defined-maturity exchange-traded funds (ETFs) that enable investors and financial professionals to build portfolios tailored to specific maturity profiles in investment grade credit. BulletShares are designed to combine the precision of individual bonds that have specific maturity dates with the potential advantages of ETFs such as diversification and transparency.

As BulletShares UCITS ETFs approach maturity, their duration decreases. In the last six months of the ETF’s maturity year, it is anticipated that the bonds in the portfolio will either mature or be called. Proceeds from these events will then be held in short-dated Bills and Bonds issued by the US Treasury.

BulletShares UCITS ETFs have defined maturities to simulate the investor experience of buying and holding individual bonds to maturity for use in bond ladders and other strategies. BulletShares UCITS ETFs have designated years of maturities that are included in the ETF’s name. Each BulletShares UCITS ETF is designed to terminate in mid-December of the designated year and make a final distribution at maturity. At each fund’s expected termination, the net asset value (NAV) of the ETF’s assets is distributed to investors without any action on their part.

A bond ladder is built with individual bonds of varying maturities. As the bonds mature, the anticipated proceeds can be used for income needs or reinvested in new bonds that mature in subsequent years. Investors may use bond ladders to help create some predictability and stability regardless of market volatility and interest rate environments. Since they have specific maturity dates, investors can use BulletShares UCITS ETFs to build bond ladders without the time and expense of using individual bonds.