Market Monthly Market Roundup

In our monthly market roundup for January, Invesco experts provide an overview of a strong month for global equities and offer an update on the fixed income markets.

We see major risks in some sectors and stocks where the consensus is, to our minds, dangerously complacent. Simultaneously, we see much more compelling medium-term rewards in parts of the market which are a long way from most investors’ comfort zone.

We have spoken much about our focus on valuation as an investment discipline: we also see it as a risk control which over many years has generated good outcomes. It seems to us that keeping away from bubbles which could end up deflating nastily is a very important part of a long only investment approach.

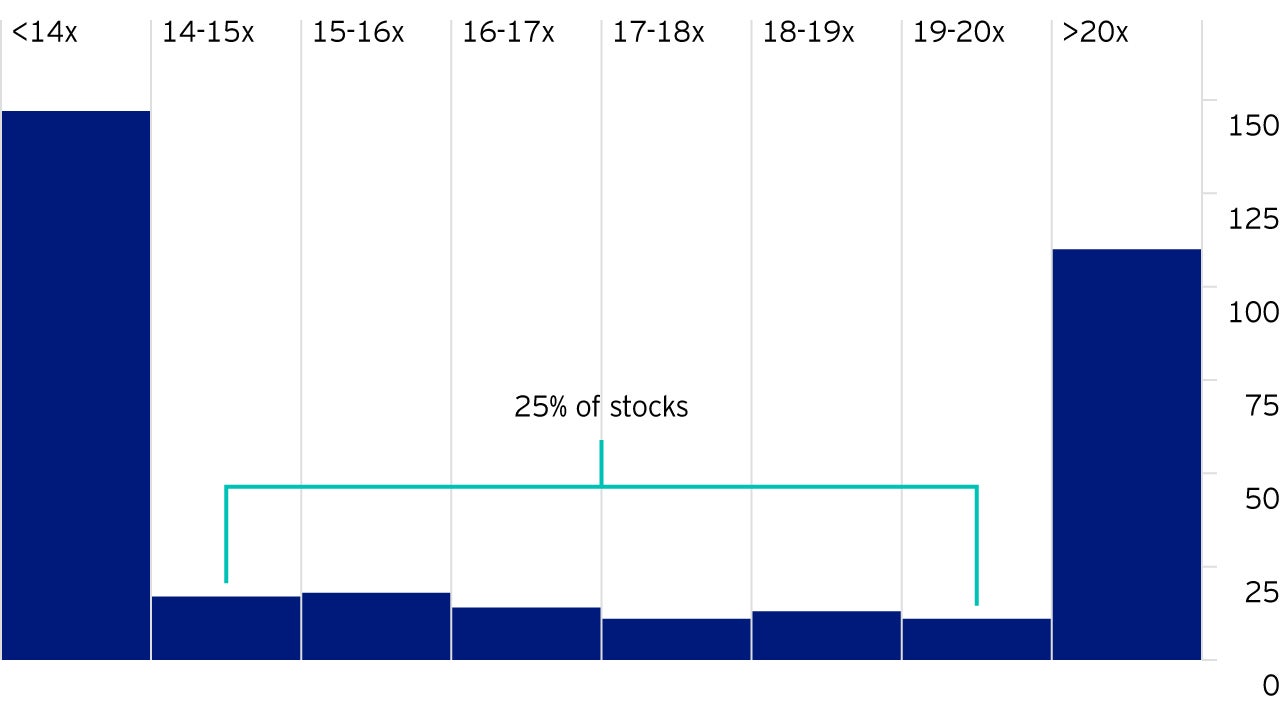

As Figure 1 below shows, the market has become polarised between ‘haves’ and ‘have-nots’. Sluggish European macro data (we see the glass as half full, most people see it as half empty), worsening Trumpian trade uncertainties and, for good measure, a couple of volte-faces from central banks have all fed the unprecedented rally in bond markets this year.

As a result, to a far greater extent than we had anticipated, European markets have been dominated even more this year by what can loosely be described as bond proxies and ‘quality growth’. Consumer Staples, Utilities, IT and Luxury (Consumer Discretionary) have led the pack.

This leads us to ask two important questions:

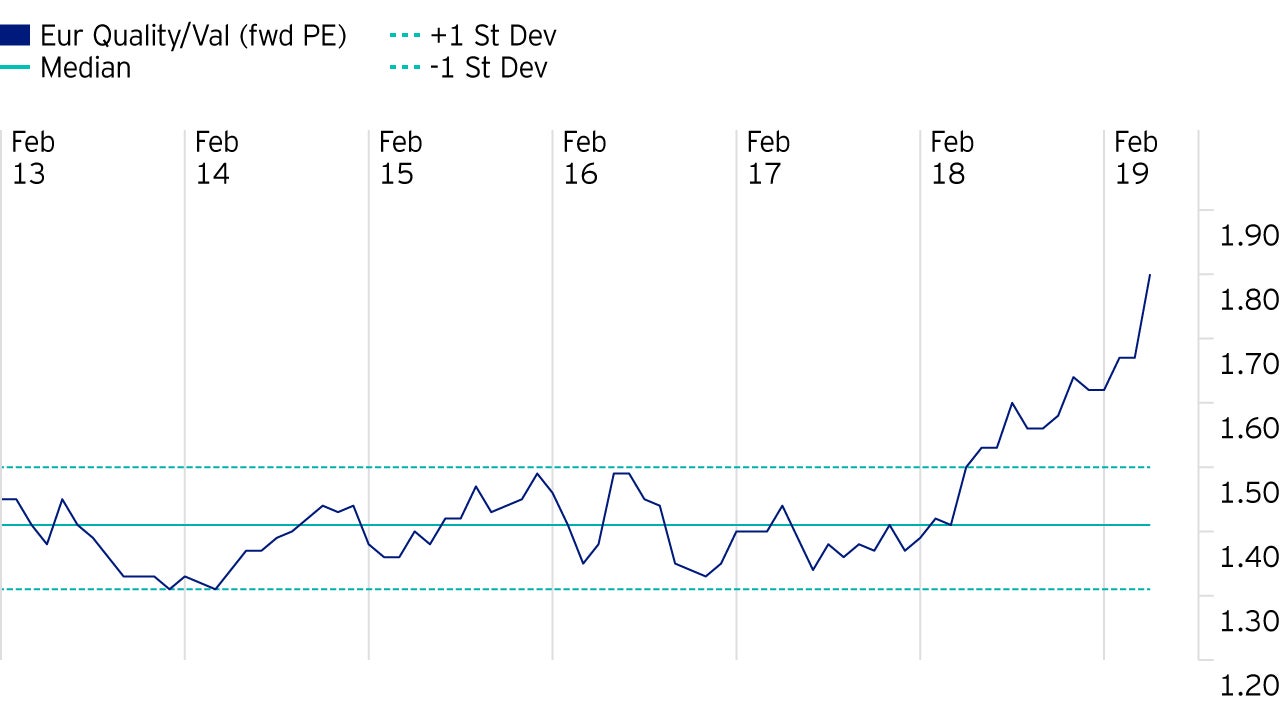

The next two charts show not only the scale of the problem our fund positioning has been facing as the outperformance of growth -v- value has ‘gone exponential’, but also that this phenomenon is out of sync with earnings trends. Growth stocks have surged (top), yet value stocks are now getting stronger earnings revisions than growth stocks (bottom):

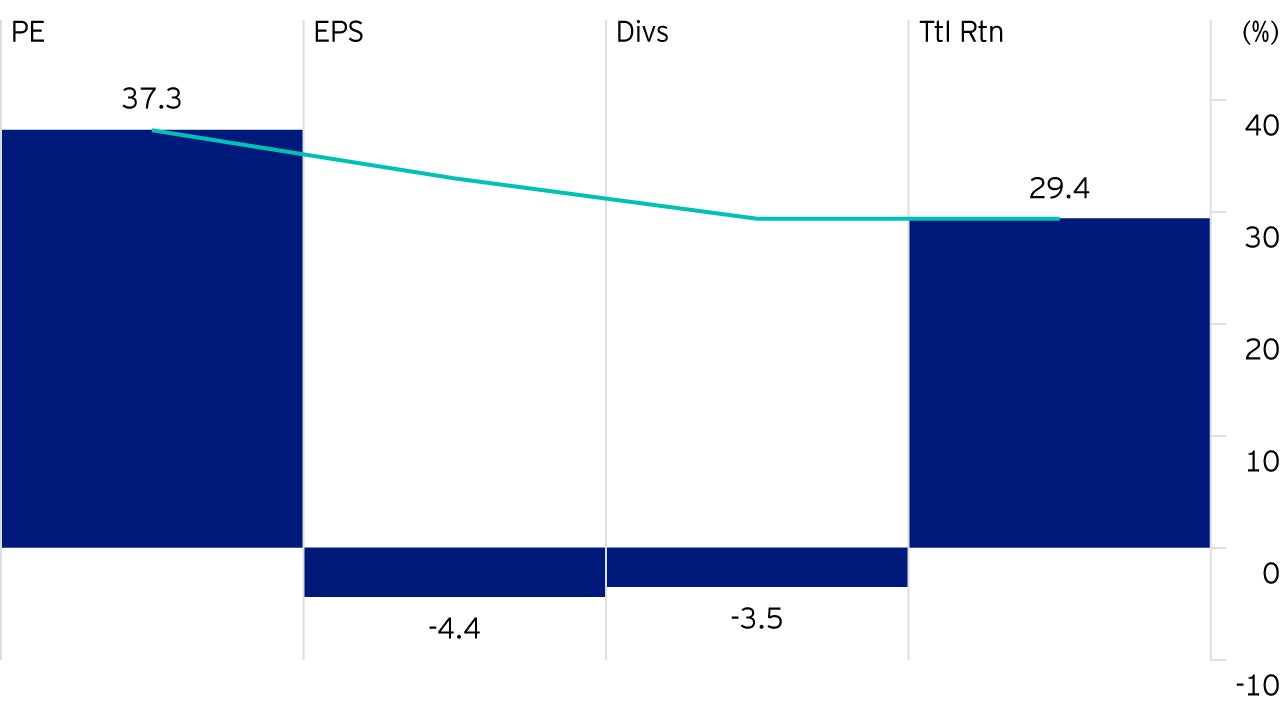

Equally, at a stock level there are plenty of examples of outperformance being driven by re-rating rather than fundamentals alone. The charts below show data relating to two particularly popular consumer staples stocks. We break out the drivers behind stock returns relative to the market from January 2017 to June 2019, I.e. the period during which the outperformance of ‘growth’ has been particularly powerful. In both examples, stellar shareholder returns relative to the market have been dramatically dominated by PE expansion, not because earnings or dividends have outstripped the market:

The answer is yes, but not uniformly. Do not forget that in the aftermath of the famous Nifty Fifty period in the US some decades ago, stock market darlings disappointed one by one over a period of time, rather than in one fell swoop.

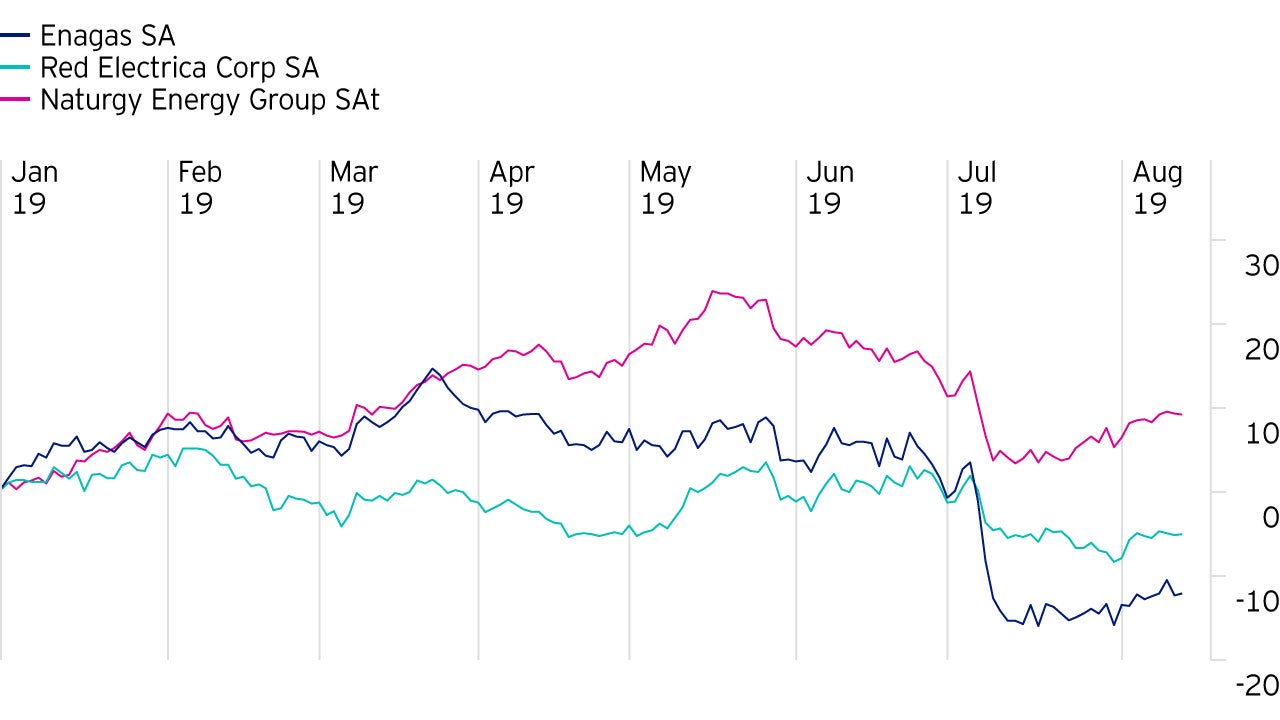

Examples from Europe in recent months would be the share price reactions to a negative regulatory review by the domestically focussed Spanish utilities Enagas, Red Electrica and Naturgy:

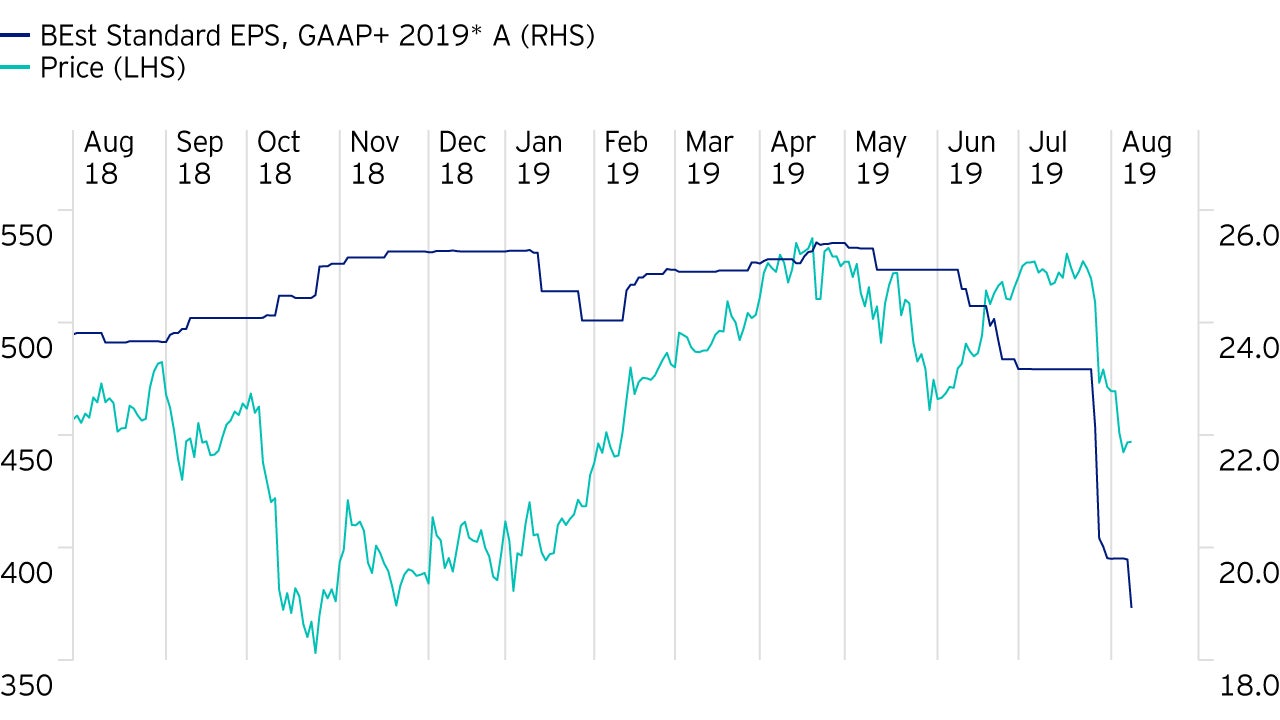

Even in the much-loved luxury sector, there have been reminders that earnings are not always immune from disappointment. In the chart below the red line shows how earnings expectations have started to fall at Kering, with the share price following to some extent:

As valuation-focussed investors, we want to be at the ‘Value’ end of the market at present (because that is where many of the most interesting valuations are), but that does not mean that we own bad companies. We try to be open minded: if we can find a good quality franchise with improving fundamentals, an undervalued return profile and interesting capital allocation policy, we will happily consider owning it - whatever the sector.

The increasingly prevalent view that financials, industrials and telecoms are verging on the un-investable whatever their valuation does not strike us a responsible way to look after our clients’ interests. Nor does ‘value’ preclude exposure to more defensive sectors: after all, our fund range has exposure to significantly undervalued, decent quality stocks even in pharmaceuticals and utilities.

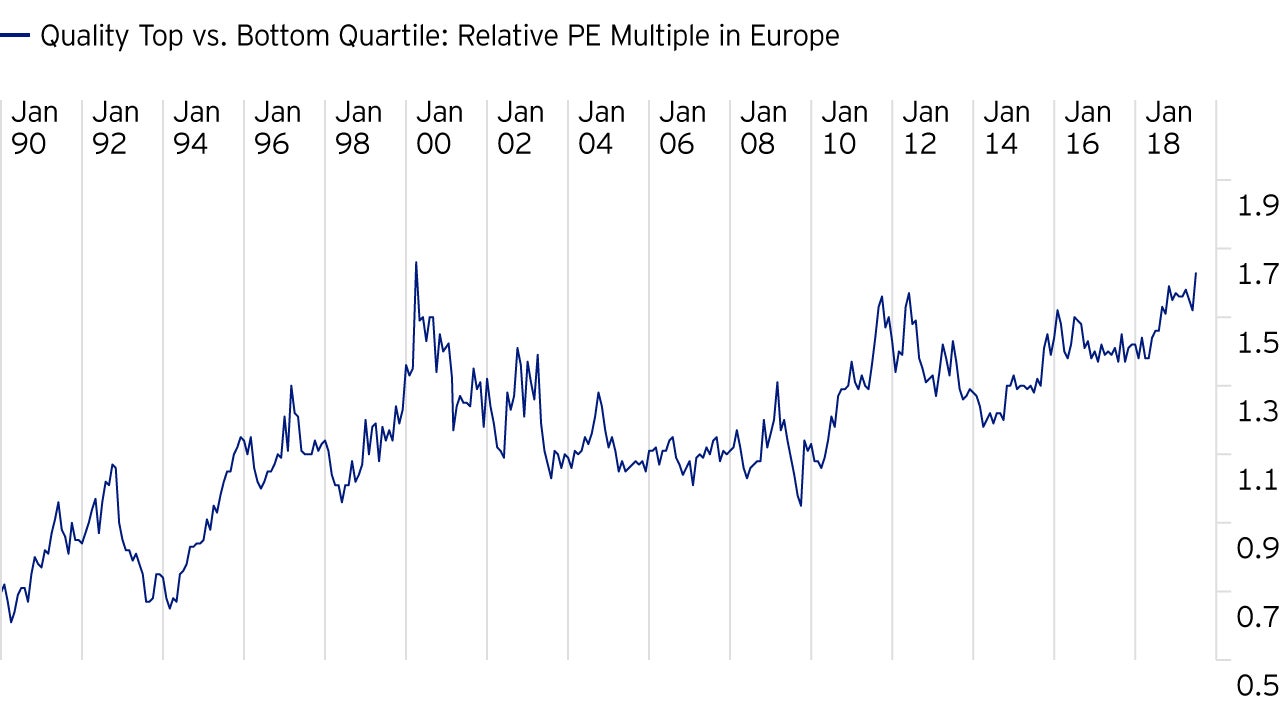

We try to be consistent in our investment approach even when faced with extraordinarily unusual market dynamics as we endeavour to look after our clients’ best interests in these statistically improbable times. As a final reminder of just how unusual things are, the chart below shows that the ‘valuation elastic’ between the two extremes of the market is back to TMT Bubble territory – and we all know what happened after that…

In our monthly market roundup for January, Invesco experts provide an overview of a strong month for global equities and offer an update on the fixed income markets.

Invesco Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

More than 30 years after the previous peak, we wonder if the Nikkei could set a new all-time high this year. Find out more