Equities Identifying sustainable growth businesses in emerging markets

This year has been unique in many ways. Will 2021 be any different? Read more.

Economic growth has begun to moderate worldwide, as expected, but remains adequate to support real estate demand.

Heading into 2020, real estate appears more attractively priced relative to other asset classes than it did in early 2019 amidst even lower long-term government bond rates, which in turn may drive additional capital into the sector as investors widen their search for yield-bearing assets. While some risks have begun to recede (namely, upward pressures on inflation and interest rates), other geopolitical risks have crystalized to such a degree that our execution strategies have evolved to mitigate against them.

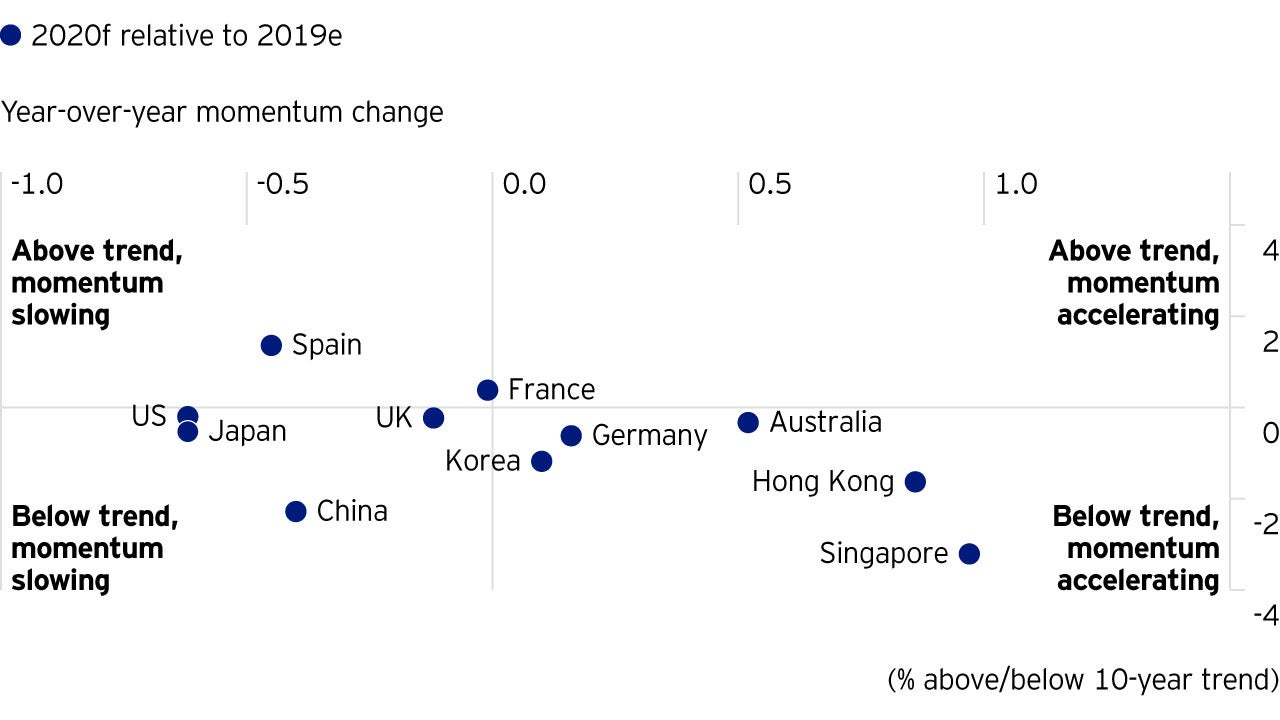

For some time now, our outlook for real estate in 2020 has been predicated on the expectation of moderating economic growth, and in that, not much has changed; growth is indeed slowing almost everywhere, but only modestly. Looking forward, the economic growth outlook can be viewed in two ways: from the change in expected absolute growth rates but also from the expected growth rate relative to longer-term trends (Figure 1). This provides a more nuanced perspective:

What does this mean for real estate demand? It suggests generally positive market fundamentals and a degree of convergence around much of the world. But it also suggests that the strength of demand could be vulnerable to macro risks.

Many of the more significant risks are geopolitical rather than economic. Trade wars, Brexit and the potential for monetary and fiscal policy missteps remain the most elevated in terms of likelihood and severity of impact to real estate fundamentals. The range and nature of risks suggest that on balance, no one country or region is much more insulated than any other.

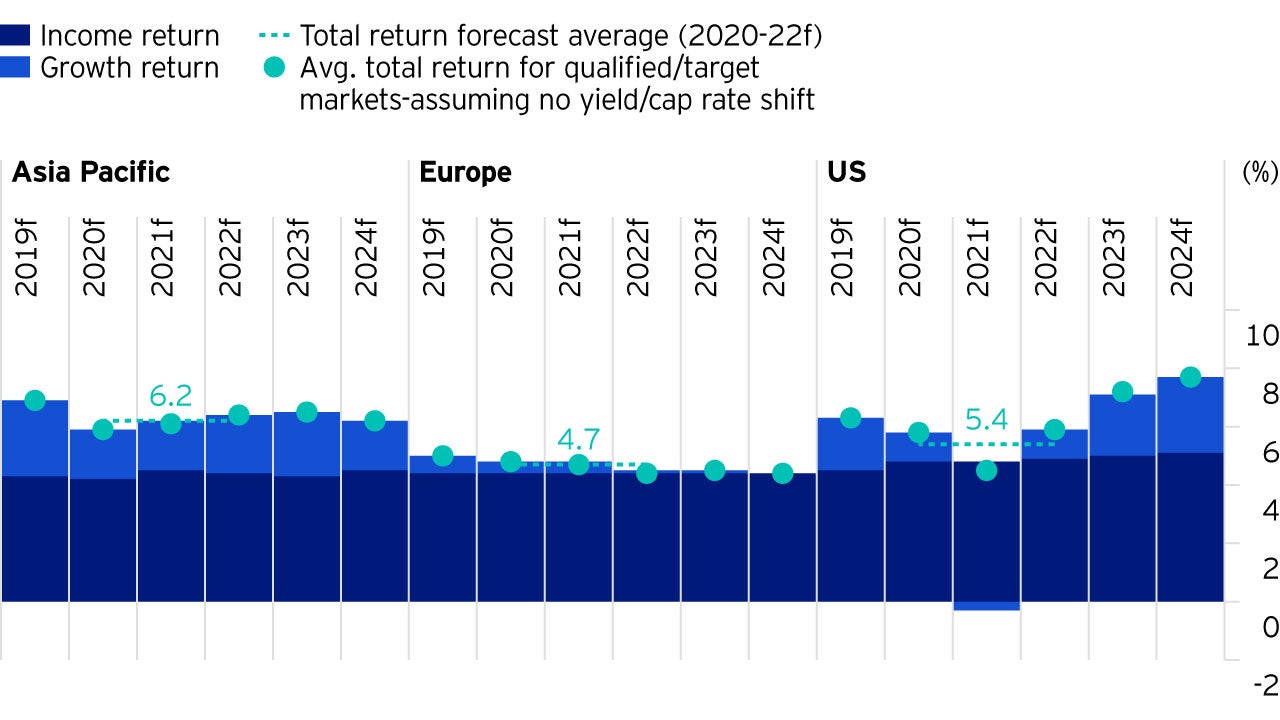

This contrasts somewhat with the variations in our base case market-level total return expectations, which continue to favour Asia Pacific over the next few years (Figure 2).

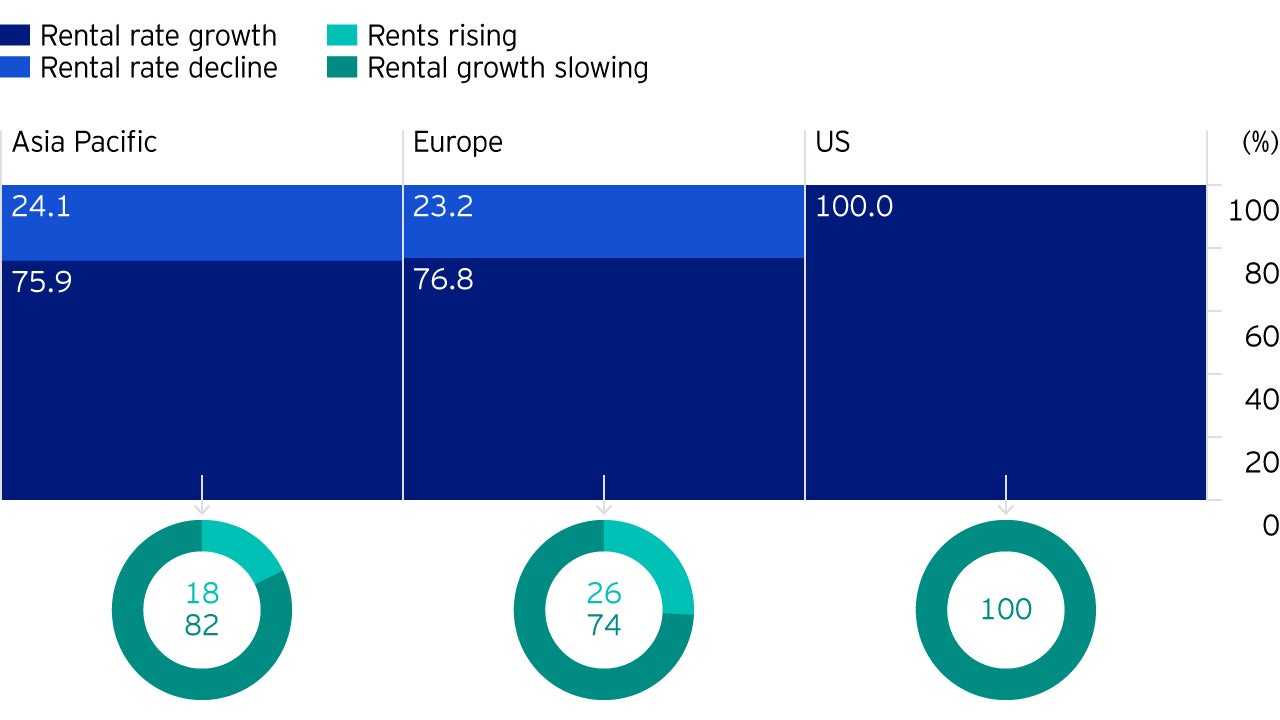

Differences in the regional total return outlook are driven in part by expectations of further rent growth.1 According to Invesco Real Estate forecasts, most market-sector combinations worldwide are likely to show continued rent growth through 2020. The differences lie in the relative change in growth momentum:

Generally, we believe diversification (by market, sector, asset, and more) is a benefit. Constructing a well-diversified portfolio is key to generating stable returns and lowering volatility in our view, particularly in periods of heightened uncertainty. Looking forward, we believe a wider divergence is likely to emerge in the performance of top quartile and bottom quartile assets within markets and sectors. Active asset selection and management to help mitigate imaginable downside risks is likely to become increasingly important.

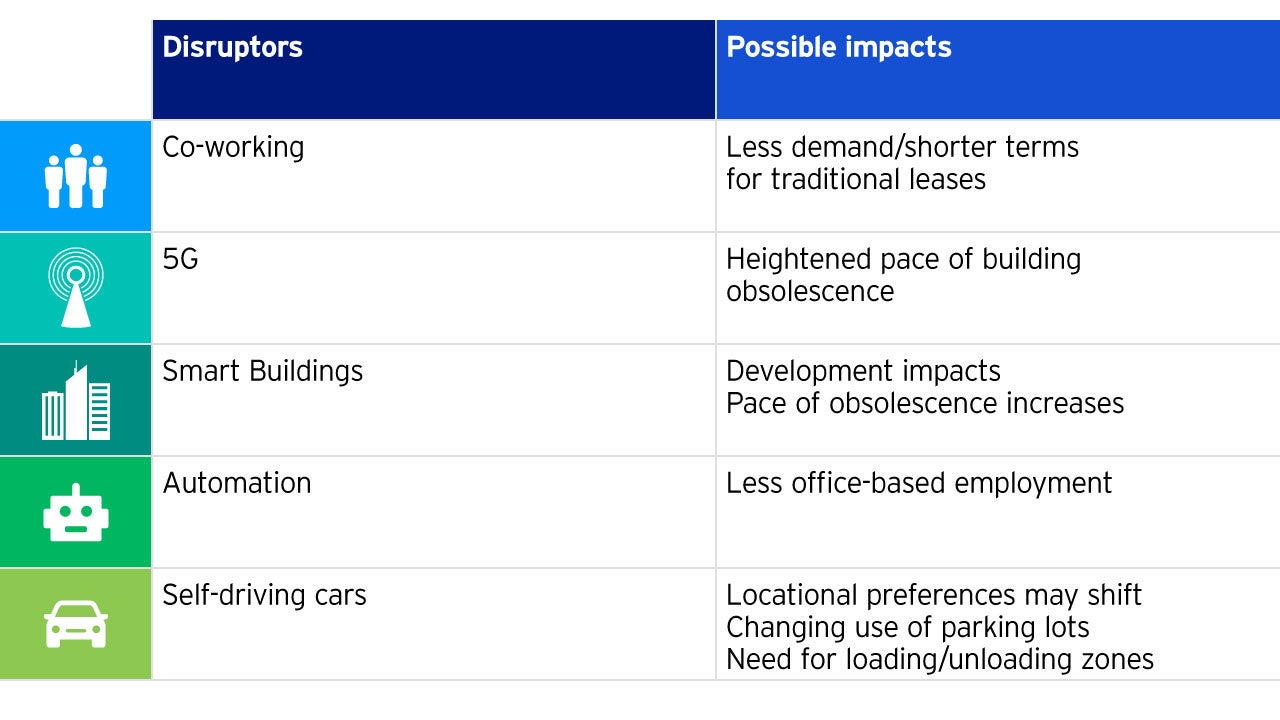

Traditionally, sector selection has been an important element in portfolio composition. It still is, but the performance characteristics of different sectors appears to be changing, disrupted by long-term trends in new technology. Historically, office and retail investments have accounted for the bulk of typical real estate portfolios; while we know many investors have been curtailing investment into retail, collectively these two sectors still comprise more than 60% of the MSCI Global Property Index.2

Why do we think asset-level performance may diverge? It is already happening. The rise of e-commerce has already changed the performance and nature of risk in the retail sector negatively, with a correspondingly positive impact on the logistics sector at the other end of the fulcrum. It has generated winner and loser assets. Given the myriad imaginable disruptors on the horizon, we believe that the office sector may be vulnerable to increasing technological disruption going forward (Figure 4). This will likely also generate winners and losers.

What does this mean in practice? Two general real estate execution themes spring to mind in order to take advantage of these insights:

2020 is likely to be a year marked by continued growth balanced somewhat precariously against a backdrop of persistent macroeconomic and geopolitical uncertainty. In our view, investors that can adopt defensive postures against any potential cyclical headwinds while leaning into longer-term structural trends are likely to emerge on the other side of the possible volatility in relatively better shape. This requires concentrating on markets and sectors that appear poised to offer growth prospects while simultaneously mitigating against current and future disruption. An extended capital market execution window as a result of monetary policy easing should allow sufficient time to execute on active asset strategies.

This year has been unique in many ways. Will 2021 be any different? Read more.

Our investment teams from around the globe outline their expectations for 2020 to help investors plan for the coming year, wherever the markets take us.

Georgina Taylor explains how the Multi Asset team aims to take advantage of opportunities thrown up by anomalies in financial markets in 2020 and beyond.