Asia: Coronavirus; 2019 and 2020

The coronavirus outbreak which originated in China has brought to a halt the positive market momentum we were seeing going into 2020. This outbreak is obviously concerning, reminiscent of SARS in 2002/03 and MERS in 2015, but this time the Chinese authorities have been swifter and more proactive in their response, even declaring the sort of quarantine only China can realistically engineer.

We wouldn’t hazard a guess on the duration or wider economic impact but it would not be unusual for markets to overreact. We will keep a close eye on developments and will report any decisions made in our funds to this effect. Naturally, tourism, transport and real estate are the most negatively affected industries so far whilst healthcare and utilities have been more resilient. Our exposure to any of these is relatively small. In the meantime, one of the major characteristics of our portfolios is the high exposure to strong balance sheets, which should offer some support should the outbreak worsen materially. Also, it is worth bearing in mind that our portfolios are significantly cheaper than the index, and starting valuations matter to subsequent long term returns.

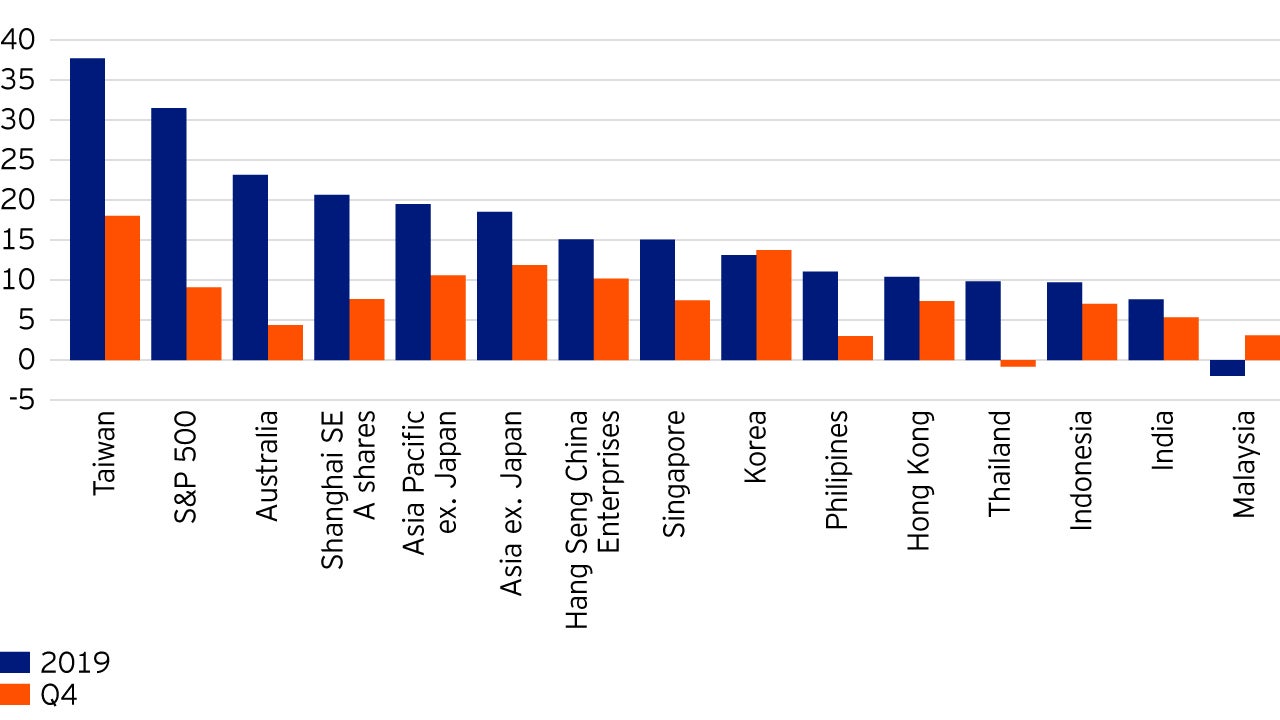

Looking back at 2019, Asian markets ended the year on a high note, returning +11.8% in Q4, and +18.5% for the full year (MSCI Asia ex. Japan Index , US$, Total Return).

A few key areas that stood out in 2019:

- Taiwan (+37.7%) and technology (+42.6%) led the way all year. Given Taiwan’s high exposure to technology and its competitive advantage as a ‘neutral’ player in what is increasingly becoming a technology arms race between the US and China. Our overweight in this area in the Asia Pacific equity strategy, and our exposure to stocks such as Taiwan Semiconductor Manuafcturing (TSMC) and Mediatek, added a lot of value. We have been taking profits given the re-rating but retain our notable holdings in these stocks as valuations are still reasonable and the demand outlook for the sector positive. As one client put it the other day: “Isn’t everything we do now linked to technology?”. Fortunately, Asia is home to many technology companies than can benefit from the “ubiquitous computing” wave.

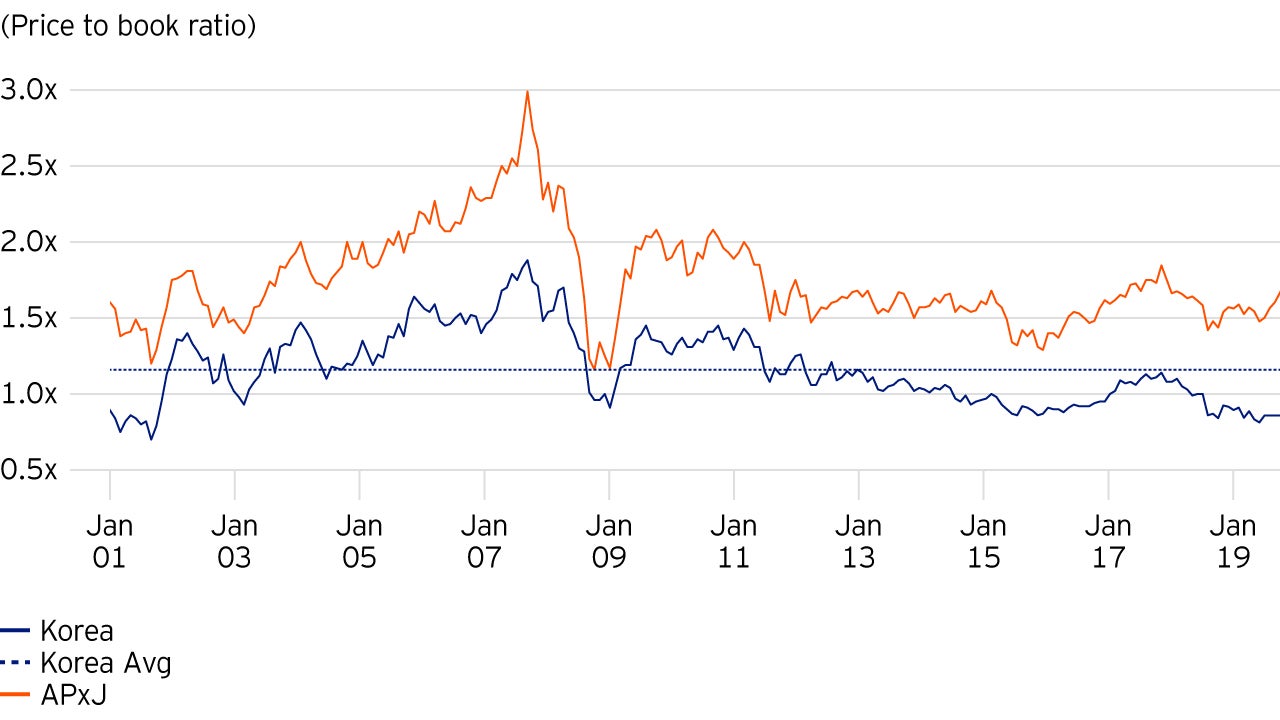

- Korea was disappointing but had a strong Q4. The market had de-rated to below the Global Financial Crisis (GFC) valuation levels over the course of the year, well below book value (see chart below), which we view as too pessimistic. We have witnessed a ‘perfect storm’ in Korea - external and internal factors (i.e. export dependant, cyclicality, minimum wage hikes, North Korea, spat with Japan, corporate governance). Our overweight in South Korea in the Asia Pacific equity strategy has hurt relative performance but we continue to believe that many stocks are worth much more than the market is pricing in, especially if we continue to see improvements in corporate governance (a structural theme) and a turn in the manufacturing cycle. The recent government stimulus is also a welcome development. Korea had a strong Q4 and is one of the strongest Asian markets so far this year.

- India’s lagging stock market reflects economic weakness. This has allowed us to invest in good companies in the mid-cap space which have rarely traded on what we consider acceptable valuations until now. The other positive is that India is less sensitive to the vagaries of trade disputes and we think some companies can capitalise on what is still structurally higher growth. This has been one of our biggest additions in 2H19.

- China remains a great stock pickers market. Within our Asia Pacific equity strategy, we are underweight banks and property and instead favour consumer sectors such as discretionary and internet which are structural themes at still reasonable valuations. We remain overweight in US-listed Chinese shares and we would stand to benefit if they emulated Alibaba’s secondary listing in Hong Kong - a course of action that is a real possibility as it has historically led to higher valuations.

2020

The strong narrative for Asia and EM equities going into 2020 includes a dialling down of US-China tensions; central bank easing; fiscal easing; a mild China stimulus; a more stable US$, and more importantly a global manufacturing cycle bottoming out especially in semiconductors and autos, with inventories having troughed.

The important question is whether the spread of this new virus is significant enough to turn the tide of the cyclical recovery under way. If not, we may view any further weakness as an opportunity to invest.

Investment risks

- The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. As a large portion of the strategy is invested in less developed countries, you shoud be prepared to accept significantly large fluctutions in value. The strategy maybe use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of a portfolio. The Manager, however, will ensure that the use of derivatives does not materially alter the overall risk profile of the strategy.

Important information

- Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.