Three years ago, we launched the Invesco Global Targeted Income strategy. Our goal was simple: to offer our clients a consistent monthly income whilst preserving their capital. The search for yield without taking excessive risk is an ongoing challenge in a world of record-low interest rates.

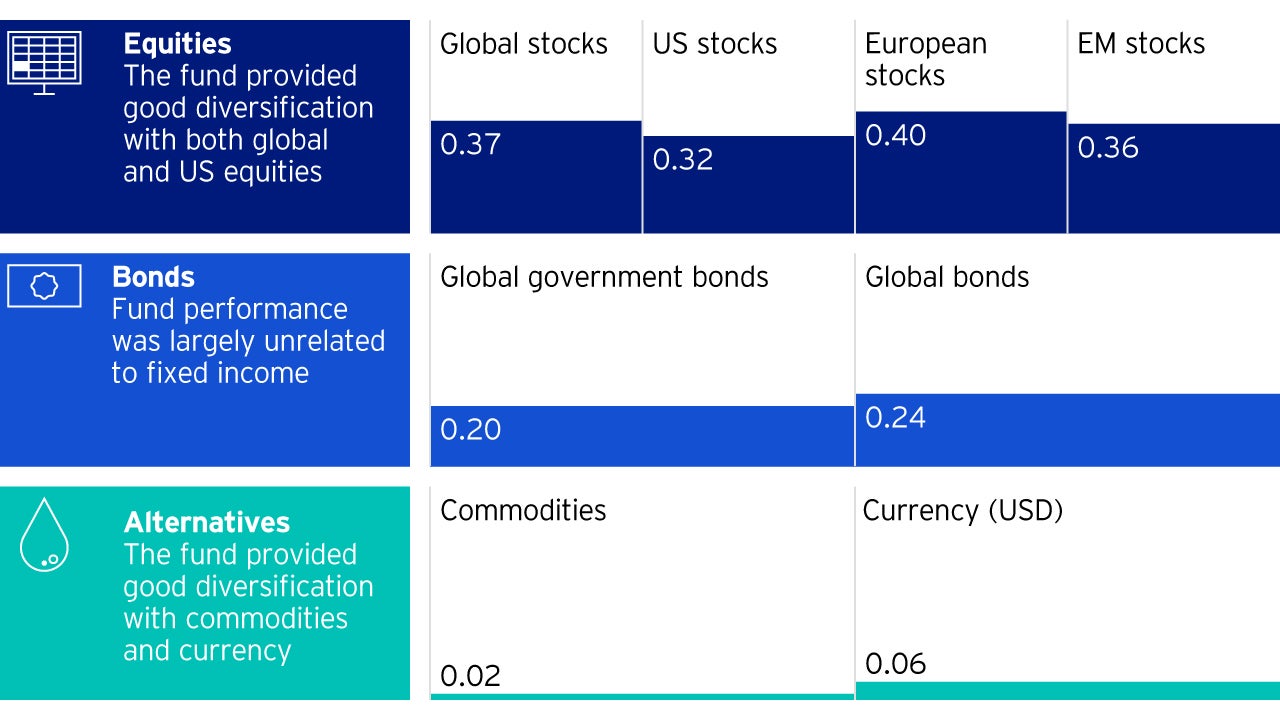

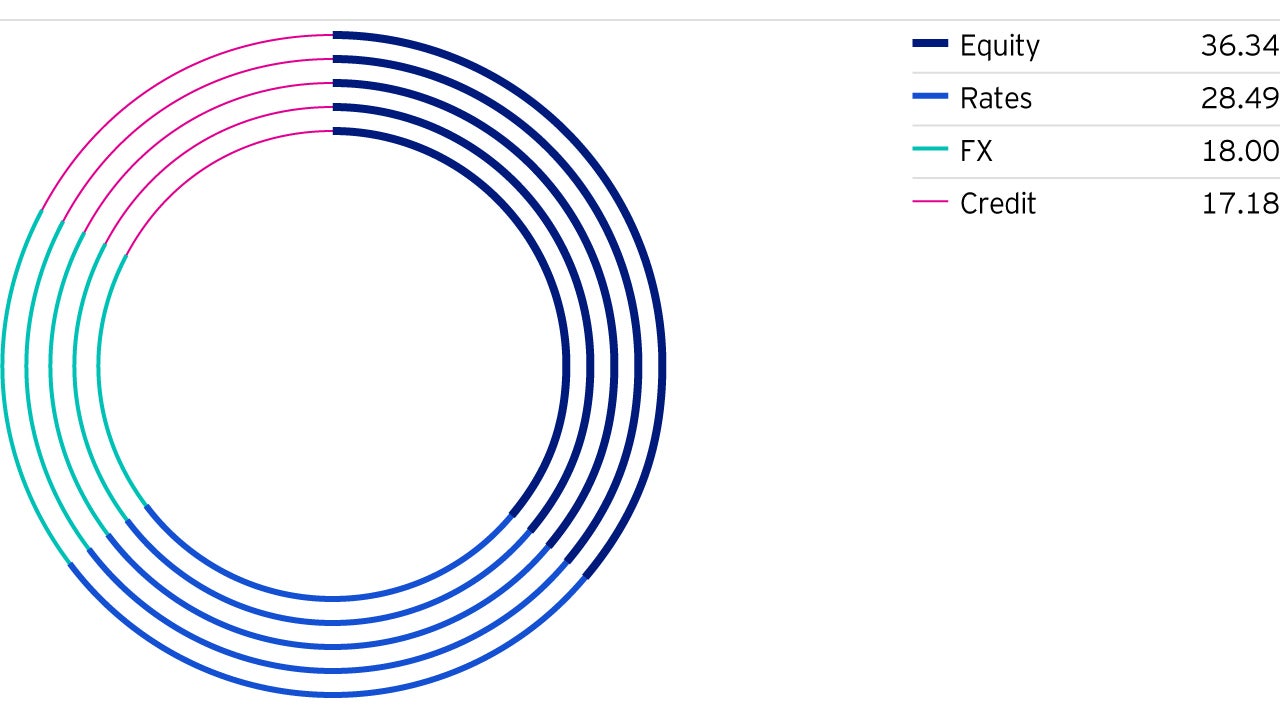

The fund targets a gross income of 3.5% per annum above UK 3-month LIBOR1 over rolling, three-year periods and aims to achieve this with less than half the volatility of global equities over the same, rolling three-year periods. We aim to achieve this through investing in long-term investment ideas implemented through a broad range of asset types.

We believed then, as we do now, that traditional income opportunities within both equities and bonds can still be found. Quite a few equities, for example, have great yields, but arguably, the risks associated with them is higher. With our ‘ideas-based’ approach to income investing, we hoped to provide our clients with an income option that diversifies their broader portfolio. We aim to achieve this through generating income and capital growth by accessing a wide range of asset types, all combined into a single risk-adjusted portfolio.

The end of November 2019 marked the end of the first three-year period for our fund. The year of our launch (2016) was marked by two events that have continued to shape the news since: the Brexit referendum in the UK and the US elections that gave the world President Donald J. Trump. The investment landscape has changed quite significantly over the three-year time frame, from the Federal Reserve tightening US monetary policy back in 2016, to embarking on an easing cycle in 2019.

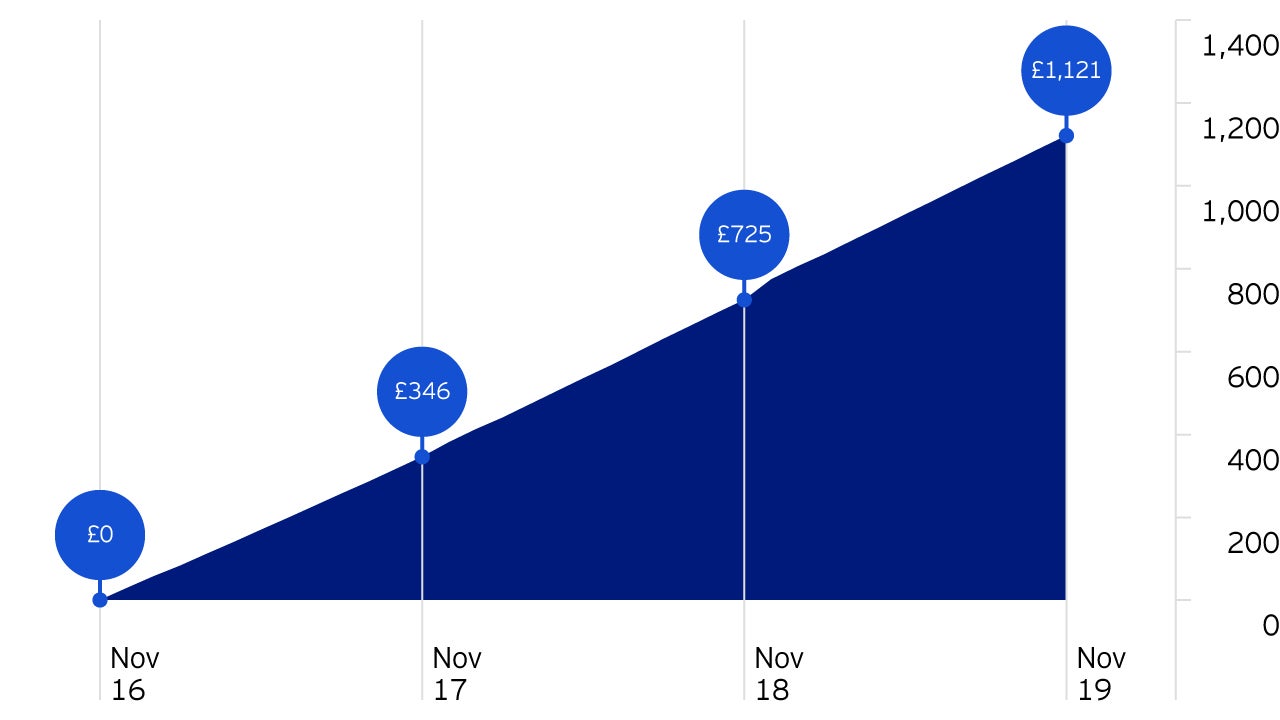

During this fragile time, the fund’s capital return has seen a minor loss at an annualized rate of -1.06%2. Much of this was due to a difficult 2018, but the fund’s capital largely recovered over the course of 2019. Over the past three years, our focus was firmly set on our income objective: delivering sustainable income regardless of the market conditions. We are pleased with our progress in this area so far: we have met our income target by generating an annualized income of over 4.22%1. A client who invested £10,000 into our fund at launch would have seen monthly income payments totaling over £1,1203 over the past three years (see Figure 1).