Passive Environmental, Social and Governance (ESG) funds continue gathering assets at pace—€74.9bn of inflows over the past 12 months, according to Morningstar as of July 2021. But critics contend that passive funds, particularly exchange-traded funds (ETFs), fall short of providing real ESG benefits.

Common misconceptions about ESG ETFs include: misalignment with investor goals, overreliance on third parties, and a lack of meaningful outcomes.

Alignment of investor goals

ESG investing is subjective, with the most critical ESG issues, such as decarbonisation or gender equality, differing from investor to investor. Consequently, index-based ETFs may appear misaligned to personal investor ESG goals.

However, the full spectrum of ESG ETFs aims to bridge the gap and offers something for everyone.

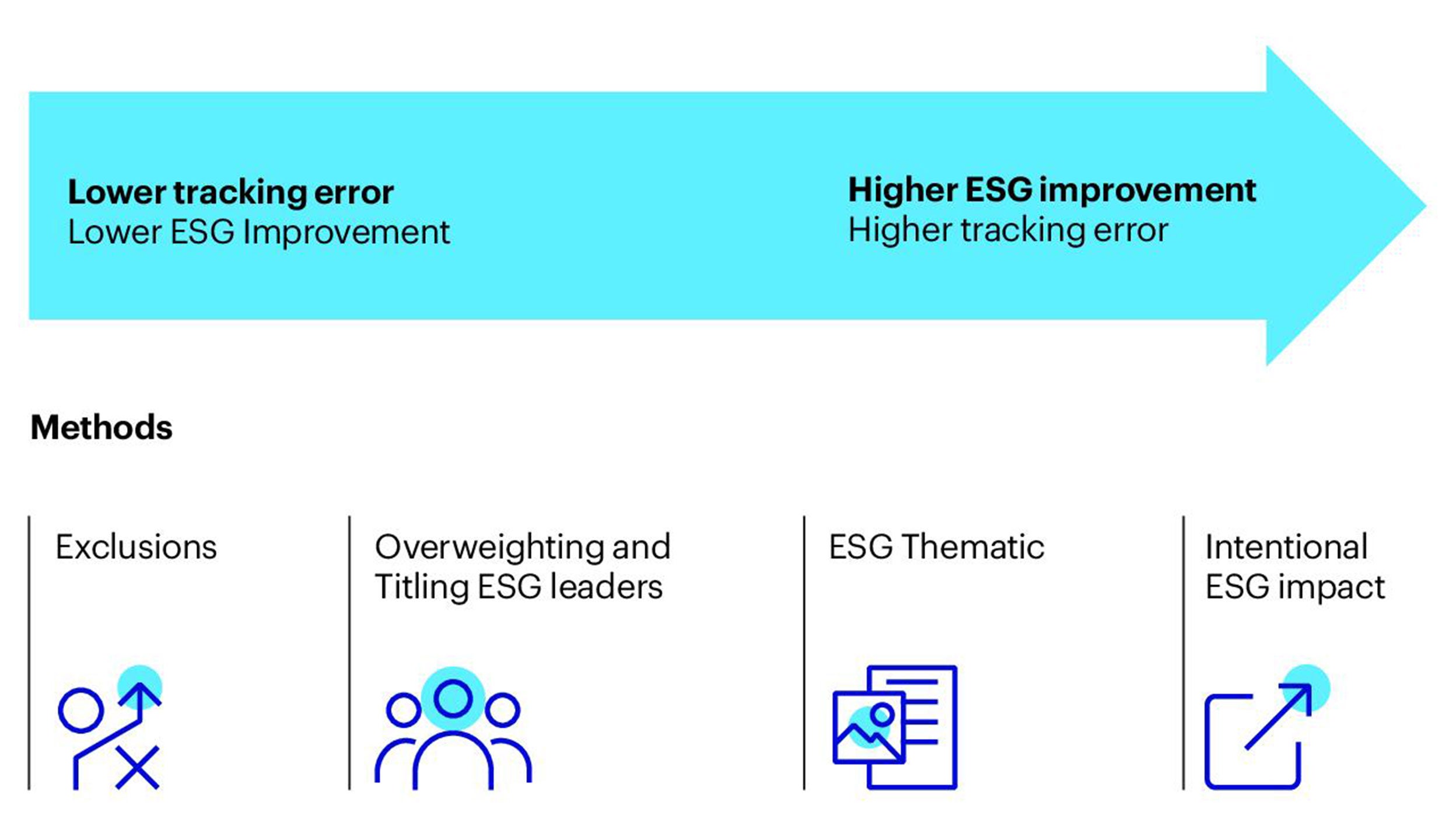

The journey begins with investors determining their own objectives. Which specific ESG issues are most important? Do investors have specific ESG outcomes to achieve? Do they have mandates to closely track a benchmark, or can they tolerate greater tracking error, or variance between portfolio returns and benchmark returns?

Answering these questions can guide investors to choose the appropriate ESG ETF for them from a spectrum of solutions.

For example, investors who need to closely track a benchmark and lack specific ESG targets can utilise a screened or exclusion ESG ETF, as this solution begins incorporating ESG considerations while minimising tracking error by omitting select companies or issuers.

At the other end of the spectrum is the example of an investor with clear ESG targets for a specific issue, like decarbonisation, who is comfortable with greater tracking error. This investor may select an ESG ETF with a thematic focus such as clean energy or an impact ETF.

Investors that are somewhere in between the two ends may find it helpful to consider ESG ETFs that go a step beyond simple exclusions by tilting portfolios more towards ESG leading companies and issuers, but without assuming high levels of tracking error or targeting specific ESG outcomes.