In keeping with this philosophy, we’ve complemented our successful strategies with a third and innovative element to take account of our clients’ evolving needs: Responsible Asset Allocation (RAA). Developed by our multi-asset team in Henley as a new component of the asset allocation process, RAA stands alongside the well-known concepts of Strategic Asset Allocation (SAA) and Tactical Asset Allocation (TAA) to help us deliver investment results while mitigating the impact on society and the environment.

Keeping with the topic of Responsible Investing (RI), another article highlights Invesco’s holistic approach that merges low volatility and ESG investing. By combining important RI principles and factor investing, we show how to optimize strategies for results that meet all of the criteria investors value.

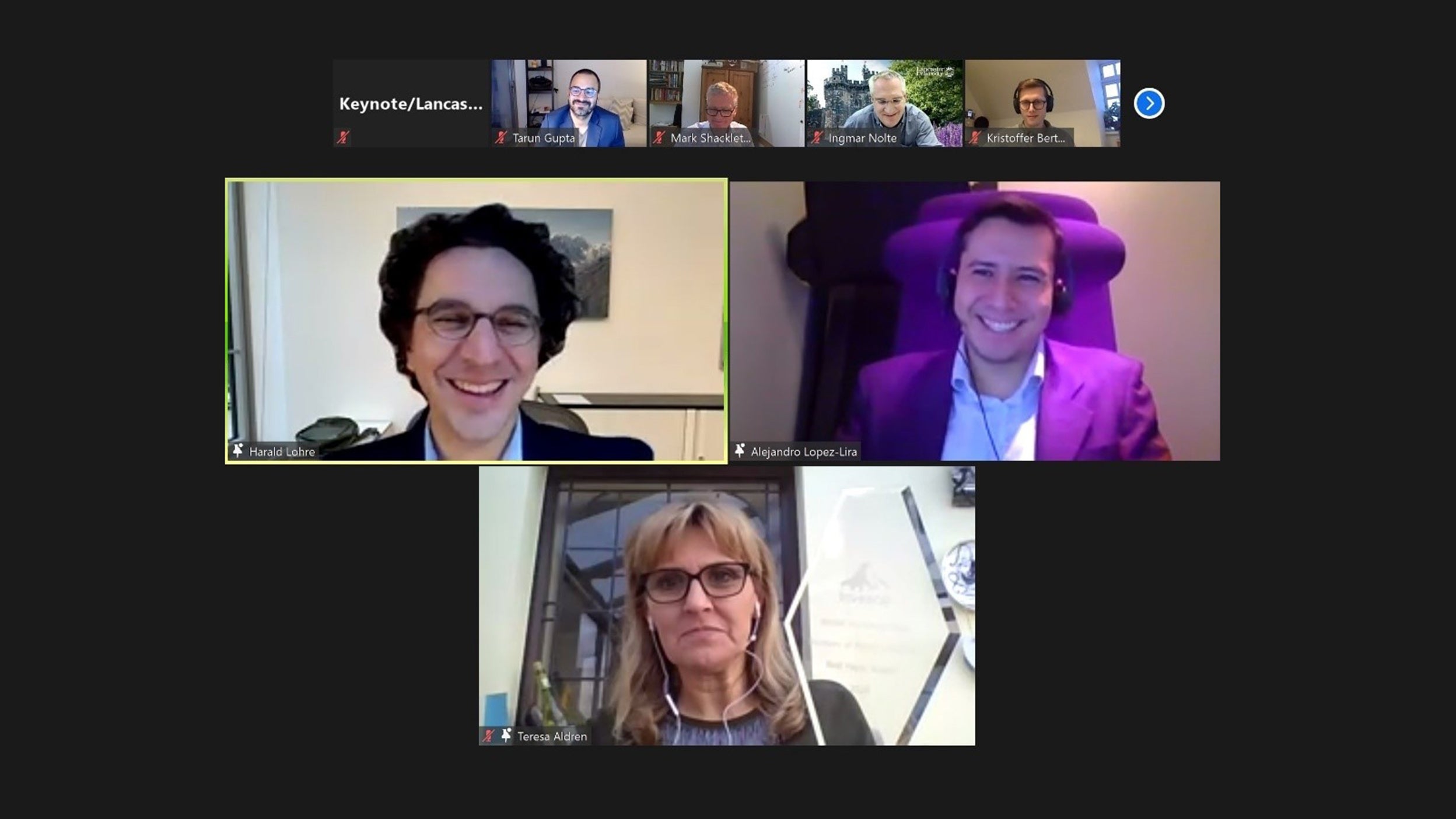

We’ve also included an article on climate change and its consequences for impact strategies and municipal bond investing, as well as a summary of this year’s – virtual – Advancing the Frontiers of Factor Investing conference at the Lancaster University Management School, which we co-hosted.

Turning from Responsible Investing to another key theme at Invesco – innovation – another article sets out how we convert immense volumes of unstructured financial data into a useful form for asset management. The raw data can be evaluated systematically using powerful computers and tools like natural language processing. Read this article to learn about the most effective methods and how we apply them.

We hope you enjoy this latest edition of Risk & Reward.