Alternatives Private credit quarterly roundup: Liberation Day market responses

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

Global capital markets have seen significant volatility in recent months as surging inflation has elicited a strong response from global central banks. This significant shift in the macroeconomic outlook has impacted the views on returns for all assets, and significant repricing of listed debt and equity markets has forced the rethinking of allocations to less liquid assets, such as private markets. In addition, many private market sectors are perceived to be more interest rate sensitive, resulting in asset allocators critically examining existing positions.

In this paper, we summarize Invesco’s latest long-term Capital Market Assumptions (CMAs) and review the recent trends in market asset allocation. Against this framework, we then examine the ongoing case for private market investments in a higher interest rate environment, where we find that the combination of returns on offer, as well as the diversification benefits, mean that the case for allocating capital to private market investments within a larger portfolio remains strong. Furthermore, we find significant evidence of stronger private market returns following market corrections, suggesting that this is a compelling opportunity for those not currently invested in private markets, or to increase allocations.

One of the key tenets of our CMAs is that the past is not necessarily prologue when it comes to forecasting returns and risk. In a world of higher inflation and interest rates, our baseline models for long-term asset prices have shifted significantly from the prior investment era. Cash rates now provide a high hurdle for risk assets, and persistently, inflation (albeit falling as of late) has left few asset classes unscathed. Luckily our approach to strategic asset allocation takes into account these long-forgotten variables when choosing between fixed income, equities, or alternatives.

Globally, private market investments continue to adjust to the increased yield environment, as lower liquidity and periodic valuations result in a lag before such impacts are fully reflected in pricing.

However, despite the capital market uncertainty, occupier fundamentals in most global real estate sectors remain robust. We continue to believe that demand remains for investment in yield assets, such as real estate, which offer both attractive long-term returns and also significant diversification against other asset classes.

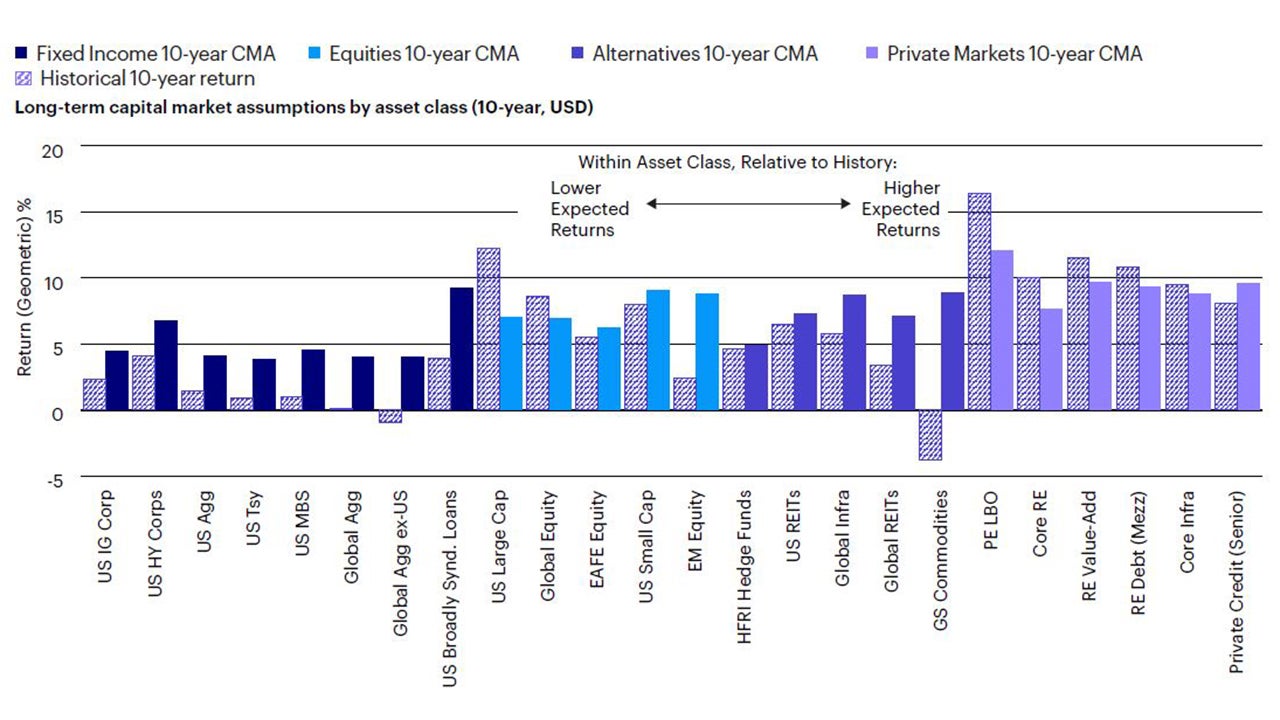

Figure 1 below summarizes our latest long-term CMAs (in USD), from which we will highlight a number of points:

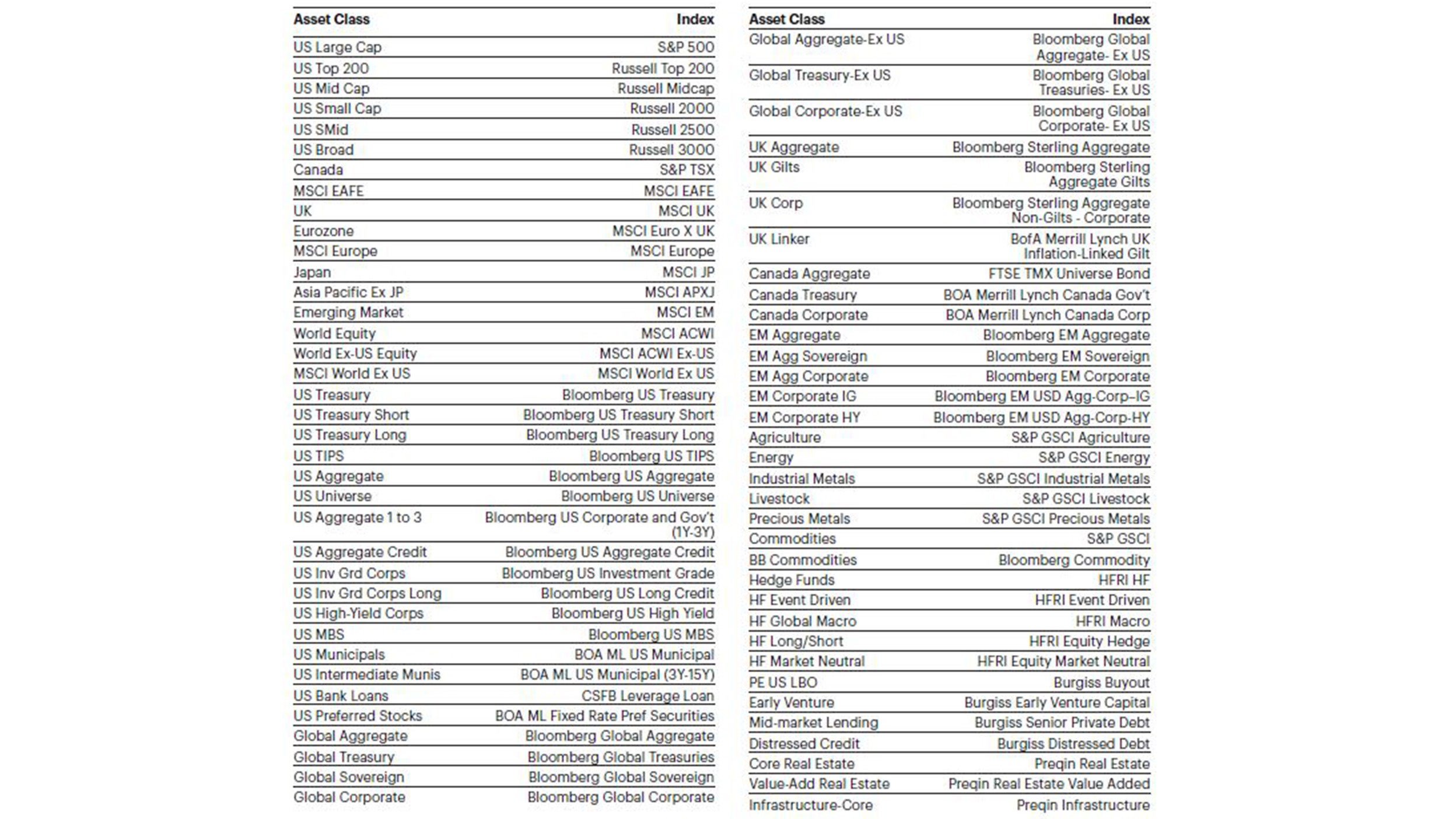

Source: Invesco, public CMAs and historical returns are as of March 31, 2023. Private CMAs as of March 31, 2023, and private historical returns as of March 31, 2022, the latest data available due to private market data lags. Private asset CMAs are net of normative fees, while public asset CMAs are gross of fees. Proxies listed on page 5. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. Please see page 6 for information about our CMA methodology. There is no guarantee that the simulated results will be achieved in the future. These estimates reflect the views of Invesco Investment Solutions, the views of other investment teams at Invesco may differ from those presented here.

While ungeared core real estate returns are expected to be in line with listed equities, diversification still provides a strong argument in favor of an allocation to real estate within any broader portfolio. At a global level, real estate offers considerable diversification against the traditional asset classes of equities and bonds, as shown in Figure 2. We see that core real estate equity has a negative correlation to both bonds and equity markets, while value-add real estate and real estate debt remain negatively correlated to treasuries but are slightly more correlated to equities, reflecting sensitivity to the wider business cycle.

Sources: Invesco, Bloomberg L.P., Burgiss as of March 31, 2022. Proxies listed on page 5. Latest data available due to private market data lags.

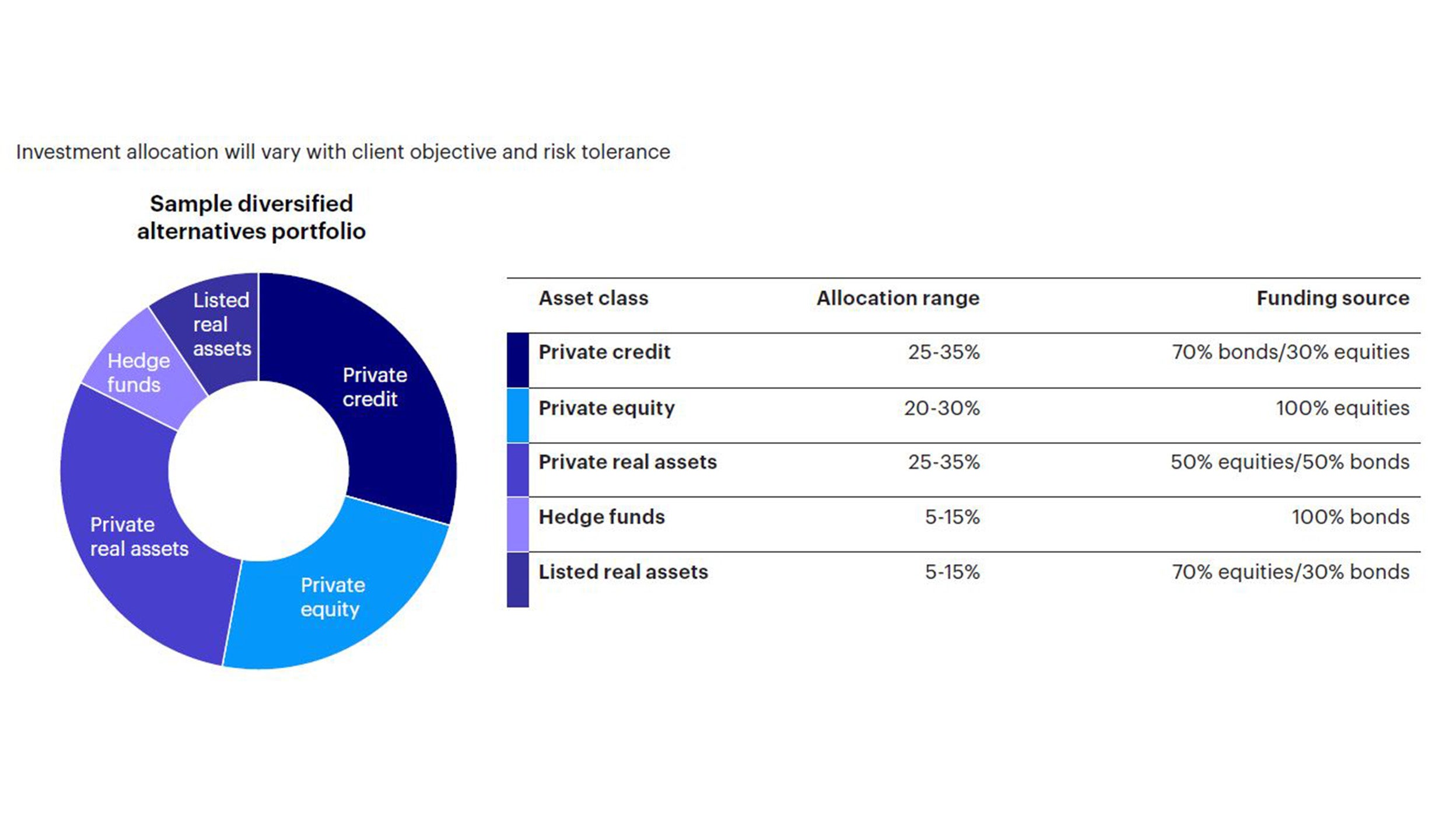

Funding these assets requires an understanding of key client considerations, such as liquidity risk and risk tolerance. For portfolios looking to diversify their public asset exposure with private assets, where to allocate from becomes a topic worth exploring. By understanding the types of characteristics and exposures that private assets have, one can make funding decisions based on credit and duration risk, sourcing mostly from public fixed income, or growth and inflation risk, and sourcing from public equity assets Figure 3.

The portfolios shown are for illustrative purposes only and do not constitute investment advice or investment recommendations.

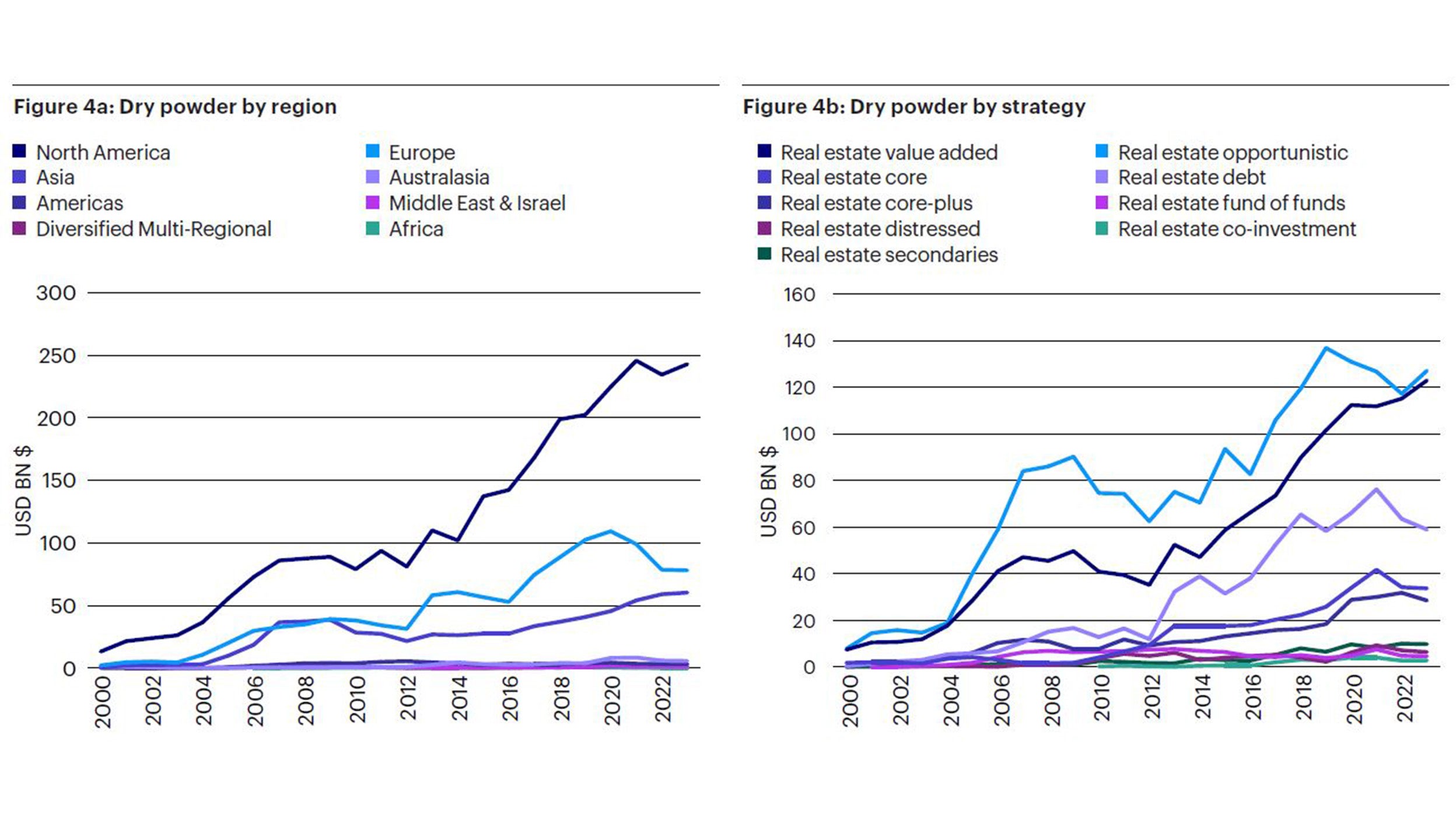

Despite the recent decline in real estate transaction activity there remains ample dry powder in major regions, notably in North America, awaiting attractive opportunities to arise amid the cloudy outlook. The key driver of the decline in transaction volumes in H2 2022 and Q1 2023 was the rapid rise in debt costs, which outpaced adjustments in cap rates and rendered debt dilutive to returns. As such, sellers have limited appetite for bringing deals to market given the current pricing environment while buyers are looking for price adjustments before committing, and this is exacerbated by a mis-match between the weight of selling pressure being at the core end of the market, and the dry powder being in higher return funds (Figure 4a and b).

Source: Invesco Investment Solutions, Invesco Real Estate, Preqin, as of May 31, 2023.

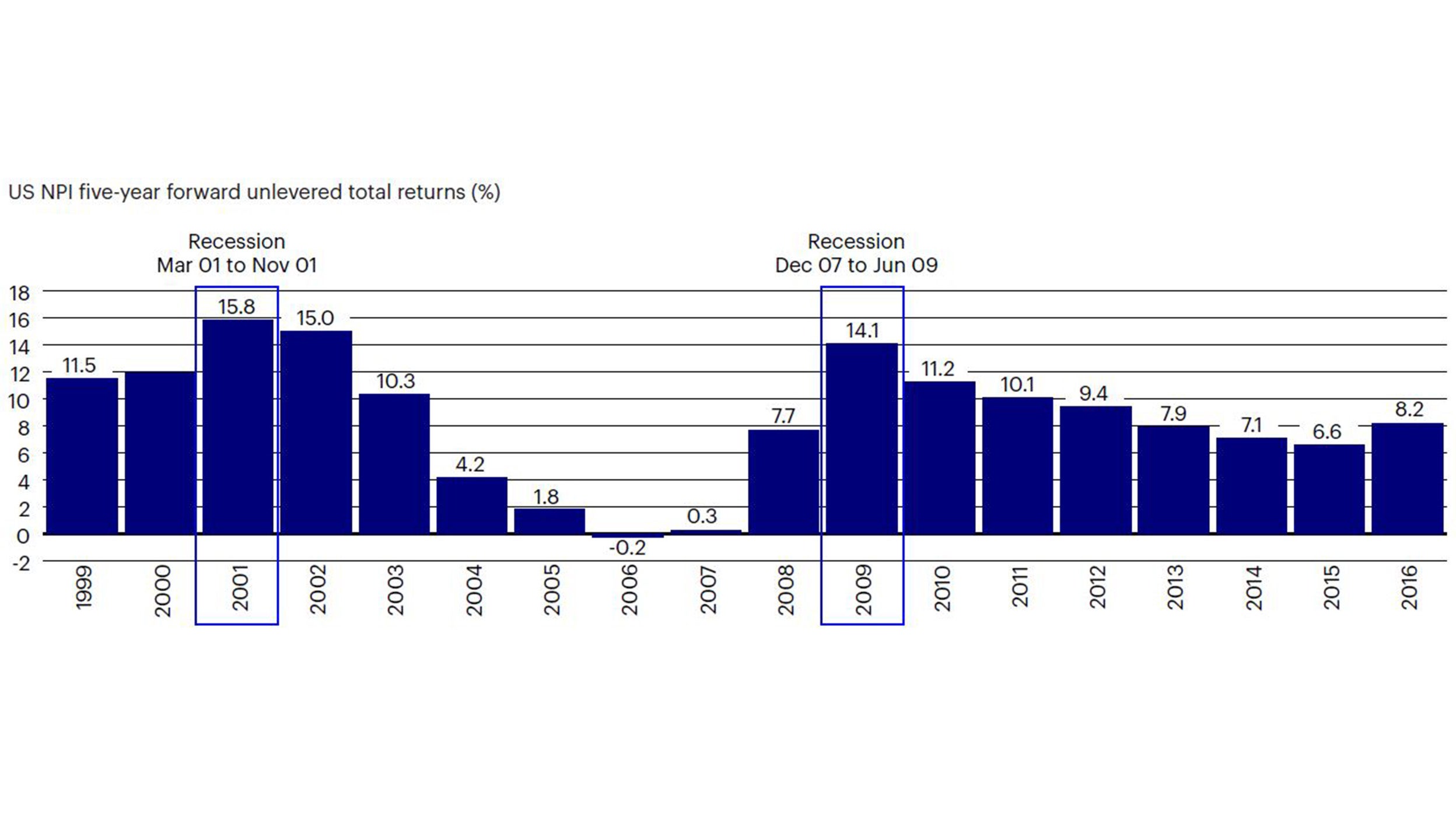

In addition, real estate investors have historically benefited from outsized returns after market corrections, as we show in Figure 5 below, using returns from the US NPI. Our conviction is that 2024 is likely to offer similar strong returns as real estate markets come out of the current market correction.

Based on data from NCREIF NPI, all property types and investment returns calculated from Q1 following calendar year of investment. Source: Invesco Real Estate using data from NCREIF, as of April 2023. Past performance is not a guarantee of future results.

We undertook a similar analysis for Europe, in this case using data on value-add funds, separated by the year of the first closing of the fund, and then looking at the performance over the following periods. Furthermore, even adjusting for the value impact of the tightening yield environment, we see a clear pattern of outperformance for funds that invested in the aftermath of the GFC and particularly the euro crisis in 2013. Outperformance is driven in these situations by a range of factors, not least of which is being able to benefit from mispricing when transaction volumes are reduced and also picking up assets for repositioning at times when current owners lack the confidence to undertake caped projects themselves.

Past performance is not indicative of future results. An investment cannot be made directly into an index.

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

Get an in-depth Q2 report from our alternatives experts including their outlook, positioning, and insight on valuations, fundamentals, and trends.

Invesco Real Estate’s value-add team discusses its approach in a challenging market highlighting a disciplined, local team-based execution programme and strategic investments in sectors like logistics and living.

Partner with our real estate, private credit and Invesco Solutions teams as you tackle the biggest issues of the day.