Equities China’s healthcare sector – the opportunity for equity investors

Robust income growth and an ageing population are driving the fastest-growing major healthcare market in the world, according to the Economist Intelligence Unit (EIU).

Invesco recognized China’s huge investment potential early, launching its first Chinese equity fund back in 1992, and establishing the first Sino-American joint venture - Invesco Great Wall (IGW) Fund Management Company Limited in 2003. It launched the first Shanghai/Hong Kong/Shenzhen stock connect fund and is an innovator among onshore Chinese quantitative equity funds.

Today, Invesco provides one of the largest and most comprehensive investment platforms in China and continues to lead in this fast-changing market.

Invesco manages US$120 billion of China-related assets and has a global AUM of US$1,349.9 billion as at December 2020.2

Our Chinese equity strategies, including healthcare, allow investors to tap into the substantial potential of China’s A-share market.1 The A-share market is the world’s second largest, but it is still small relative to the size of China’s economy. Judging from China’s current pace of financial-market reforms, our belief is that the A-share market is set to grow rapidly. Here we outline the trends that make the asset class attractive:

Changes to indices and plans for capital-market reforms should strengthen the correlation between A-share performance and China’s economic development.

The A-share market is known to be volatile, reflecting the dominance of retail investors. Increasing participation from institutional investors should ensure the market becomes less susceptible to the sentiment of retail investors.

We expect China to focus on improving the quality of growth while gradually trimming excess capacity and bringing down leverage. As a result, we may see Chinese companies’ profit margins and financial strength gradually improve.

In our view, idiosyncrasies in the market point to opportunities for stock-picking strategies: actively managed median mutual funds have outperformed their benchmark by more than 6.6% over the past five years.

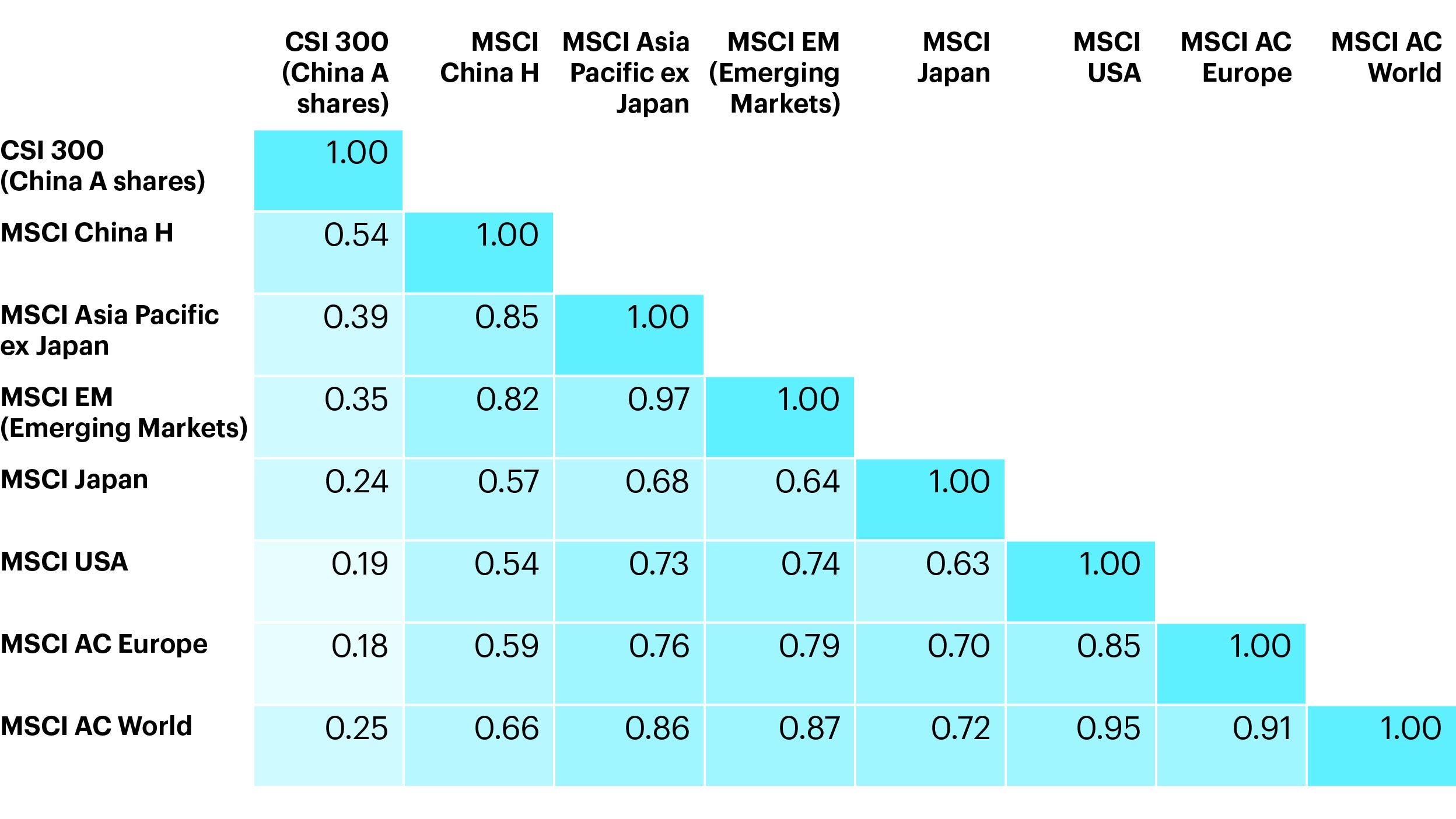

| CS 300 (China A shares) | 1.00 | |||||||

|---|---|---|---|---|---|---|---|---|

| MSCI China H | 0.73 | 1.00 | ||||||

| MSCI AC Asia Pacific ex JP |

0.54 | 0.84 | 1.00 | |||||

| MSCI EM (Emerging Markets) | 0.53 | 0.83 | 0.98 | 1.00 | ||||

| MSCI USA | 0.43 | 0.63 | 0.78 | 0.76 | 0.66 | 1.00 | ||

| MSCI AC European | 0.39 | 0.62 | 0.82 | 0.81 | 0.66 | 0.84 | 1.00 | |

| MSCI AC World | 0.46 | 0.70 | 0.89 | 0.87 | 0.72 | 0.96 | 0.94 | 1.00 |

| CSI 300 (China A Shares) |

MSCI China H |

MSCI AC Asia Pacific ex JP |

MSCI EM (Emerging Markets) |

MSCI Japan |

MSCI USA |

MSCI AC European |

MSCI AC World |

|

Source: Bloomberg, FactSet, data as of June 30, 2019.

We remain positive on the China healthcare sector and the wider A-share market in 2021. Having efficiently contained the pandemic, China is experiencing a strong economic recovery. The country is also seeing foreign and domestic inflows from bank wealth-management products into equity funds.

Robust income growth and an ageing population are driving the fastest-growing major healthcare market in the world, according to the Economist Intelligence Unit (EIU).

We focus on Chinese healthcare companies with long-term growth potential based on industry leadership, competitive advantage, clear business strategy and transparent corporate governance.

1 RMB-denominated equity shares of China-based companies that trade on the Shanghai and Shenzhen Stock Exchanges that are open to foreign investors.

2 Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in value.

As this strategy invests in a particular geographical region, you should be prepared to accept greater fluctuations in value compared to a strategy with a broader investment mandate.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

The strategy invests in a limited number of holdings and is less diversified, and therefore this may result in large fluctuations in value.

As this strategy is invested in a particular sector, you should be prepared to accept greater fluctuations of the value than for a strategy with a broader investment mandate.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

Further information on our products is available using the contact details shown.