Active engagement in ESG: Why it matters

ESG issues are rarely as black and white as ratings would have us believe. Life just isn’t that simple. This is where an active approach can truly pay off

We have seen a ‘greenium’ emerge for sustainability bonds recently. However, we fear the higher price is not always justified. We believe an active and research-intensive approach is required to separate bonds with good ESG credentials from those that could disappoint.

Sustainability bonds are defined by the International Capital Market Association as bonds where the proceeds will be exclusively applied to finance, or re-finance, a combination of both green and social projects.1

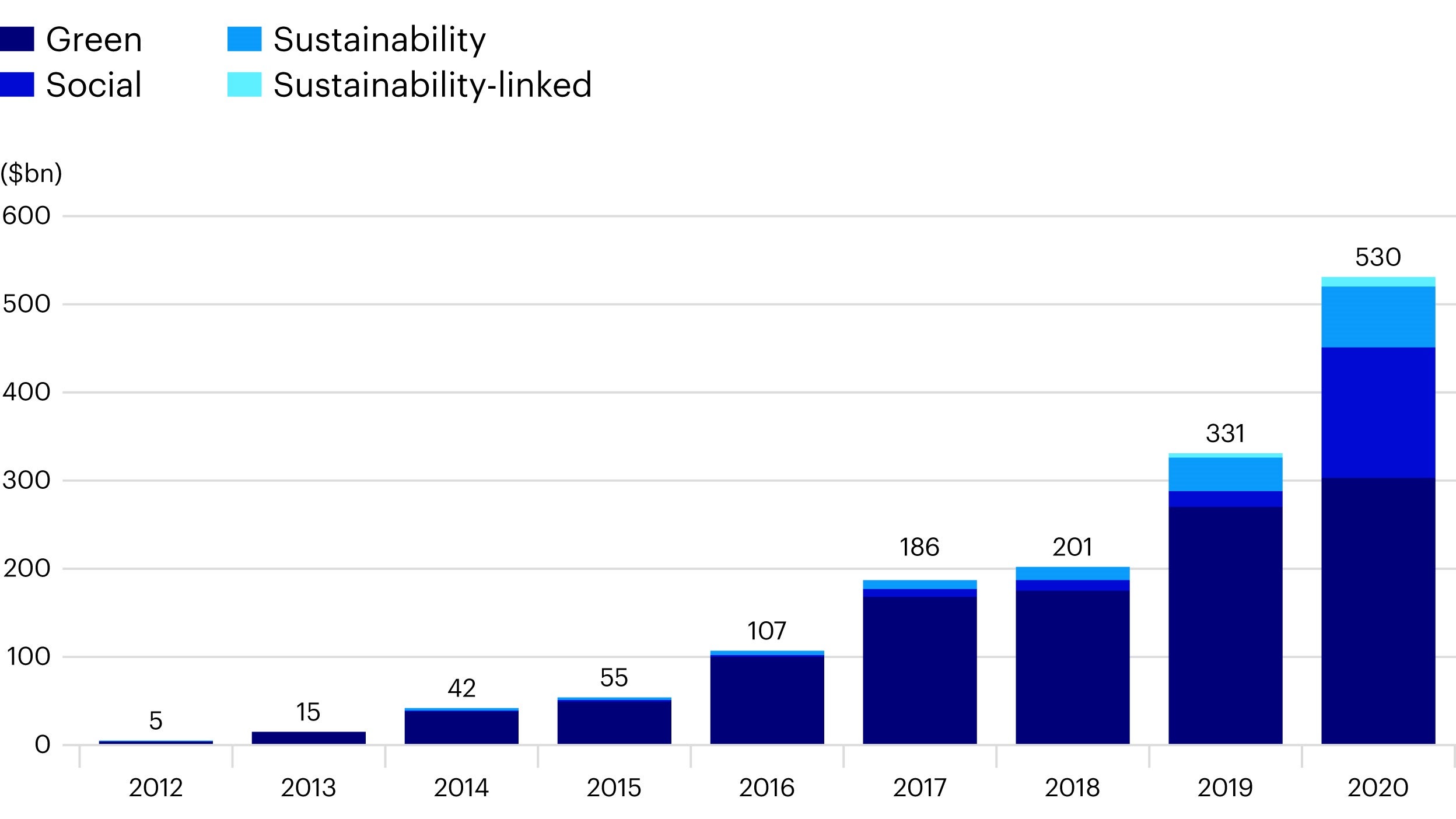

There was a big pick-up in sustainability bond issuance in Autumn last year when several issuers brought inaugural deals.

Following the European Commission’s 16 September 2020 announcement that it intended to issue an additional €225 billion of sustainability bonds to help fund the response to the Covid-19 pandemic, we believe the growth of this segment is set to continue.

This evolving asset class poses several new questions to fixed income analysts and portfolio managers that require a broader analytical toolkit than traditional new-issue or ESG analysis.

With the market applying an almost binary approach to the ‘greenium’ (a price differential between sustainability and non-sustainability bonds from the same issuer) we fear that there is insufficient analysis happening in the market around how much we should be prepared to pay for sustainability bonds. In short, is the ‘greenium’ worth it?

Default risk (thankfully low in global investment grade) and recovery rates should be identical for an issuer across sustainability and non-sustainability bonds, suggesting zero fundamental differential.

However, we believe there are several other factors that come into play.

Along with the many usual drivers of new issue concession, such as deal size, issuer rating, rarity, sector, market risk appetite, etc., we believe that an issuer’s sustainability bond program must also be assessed.

Our usual integrated ESG analysis (evaluating an issuer’s environmental, social and governance characteristics versus sector peers to derive an overall rating with a trend) does not fully address sustainability bonds because of the way these bonds target specific projects.

As an example, we might compare bonds from a highly-rated ESG issuer that issues a low-quality sustainability bond to bonds from a low-rated ESG issuer that issues a high-quality sustainability bond (though we think the latter would be unlikely). In this case, we would assess each issuer’s sustainability bond program.

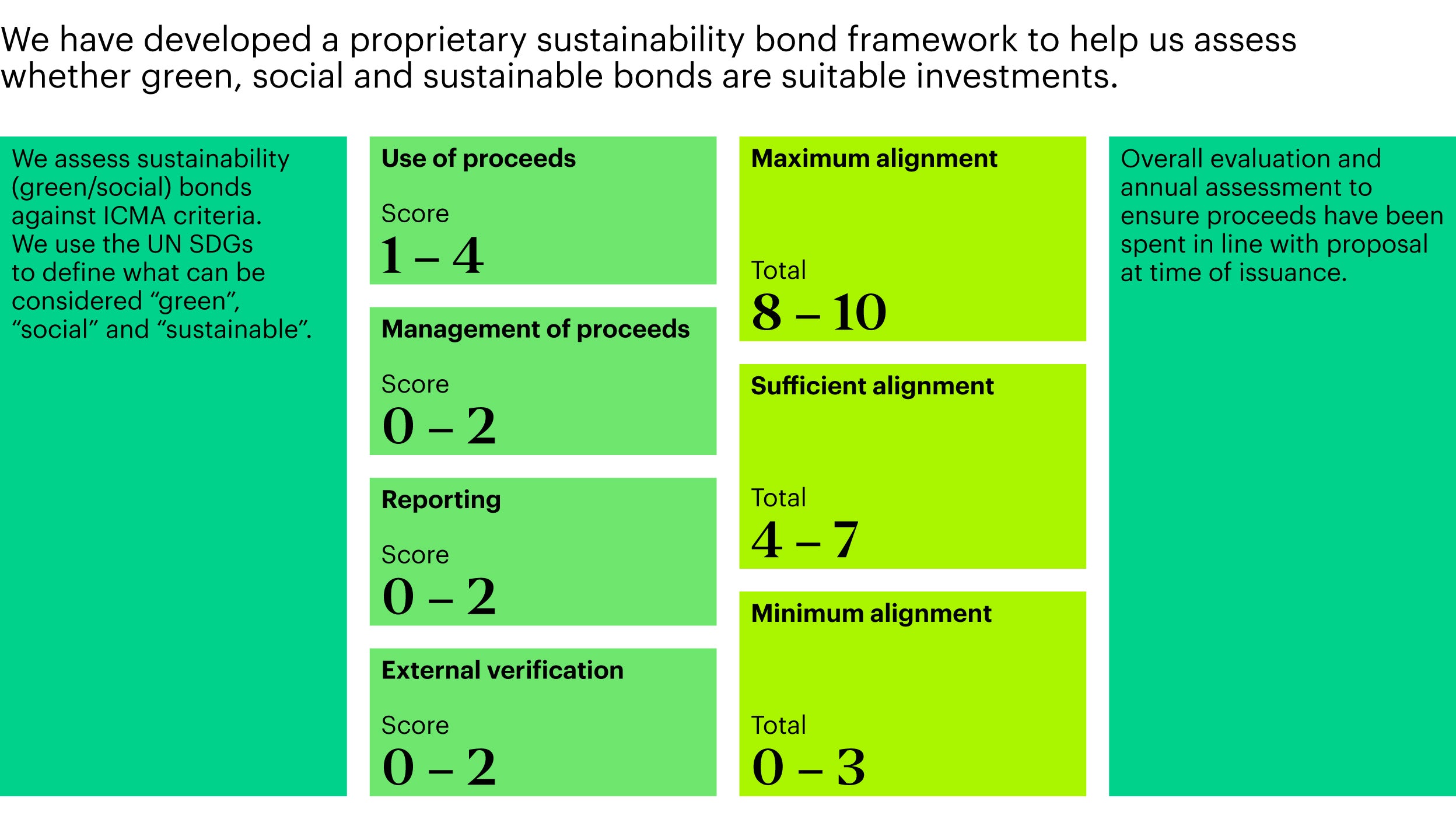

To do this, we have developed, in collaboration with our Global ESG team, the IFI Sustainability and Green Bond Framework.

This scorecard approach looks at factors such as the use of proceeds, the management of proceeds, and reporting and external verification. We use this to assess the alignment of the sustainability bonds with the United Nations Sustainable Development Goals (UN SDG).

All else being equal, we believe that a ’greenium’ is justified when the proceeds will be applied to projects that are well aligned with UN SDGs.

This output helps inform our investment decisions as we consider that a higher “greenium” can be justified for bonds with “maximum alignment” versus those with “minimum alignment”. However, we believe, in general, many investors do not appropriately differentiate between sustainability bonds with high and low alignment to UN SDGs and seem to apply a blanket premium to the asset class.

This is perhaps understandable, given that bonds are typically marketed as either ’green’ or ’non-green’. However, we believe a failure to fully assess a company’s sustainability bond program and its ongoing compliance is a risk – there are different shades of green.

Even if investors are not differentiating today, we believe it is inevitable in the medium-term, so it makes sense to avoid ’minimum alignment’ bonds, in our view.

The need to assess the many standard drivers of new issue concessions mentioned above, plus the quality of an issuer’s sustainability bond framework, means that we cannot adopt a one size fits all approach when assessing the appropriate ’greenium’ for a sustainability bond.

Invesco Fixed Income (IFI) closely monitors ESG risks across our portfolios. In the sustainability bond space, we apply the Sustainability and Green Bond Framework, which depends on having a well- resourced and experienced credit team to assess the issues raised above.

We seek to ensure that credit spreads adequately reflect downside risks, including those related to ESG factors. Where this is not the case, we will avoid ’at-risk’ names.

Sam Morton, Head of European Investment Grade ResearchIFI has long placed environmental, social and governance (ESG) concerns at front and centre of its investment strategy, with the recent growth in sustainability bonds proving further justification of its ESG drive.

International Capital Markets Association, Sustainability Bonds Guidelines, June 2018.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

All data is as of January 2020 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.