Equities Identifying sustainable growth businesses in emerging markets

This year has been unique in many ways. Will 2021 be any different? Read more.

At the time of writing, European markets have rallied by some 20% year to date. It would be very easy to assume markets are at multi-year highs, however, in reality we have only just marginally surpassed levels seen at the beginning of 2018. As we envisaged at the start of the year, markets have recouped much of the prior year’s losses following the reversal of several one-off issues and some easing of sentiment.

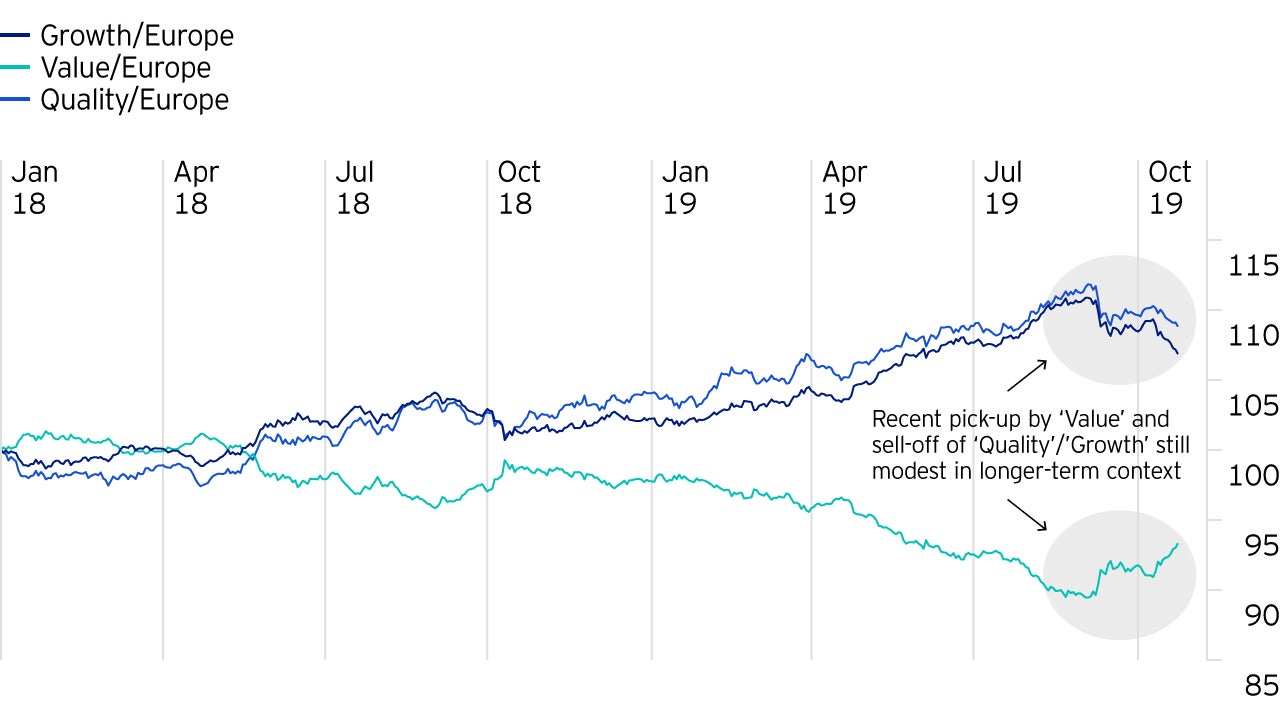

However, what has worked within the market for much of this year, has been very different to what we had hoped for. Headline performance has masked wide variations between factors within – there have been clear winners and losers and stock valuations have also become increasingly bifurcated.

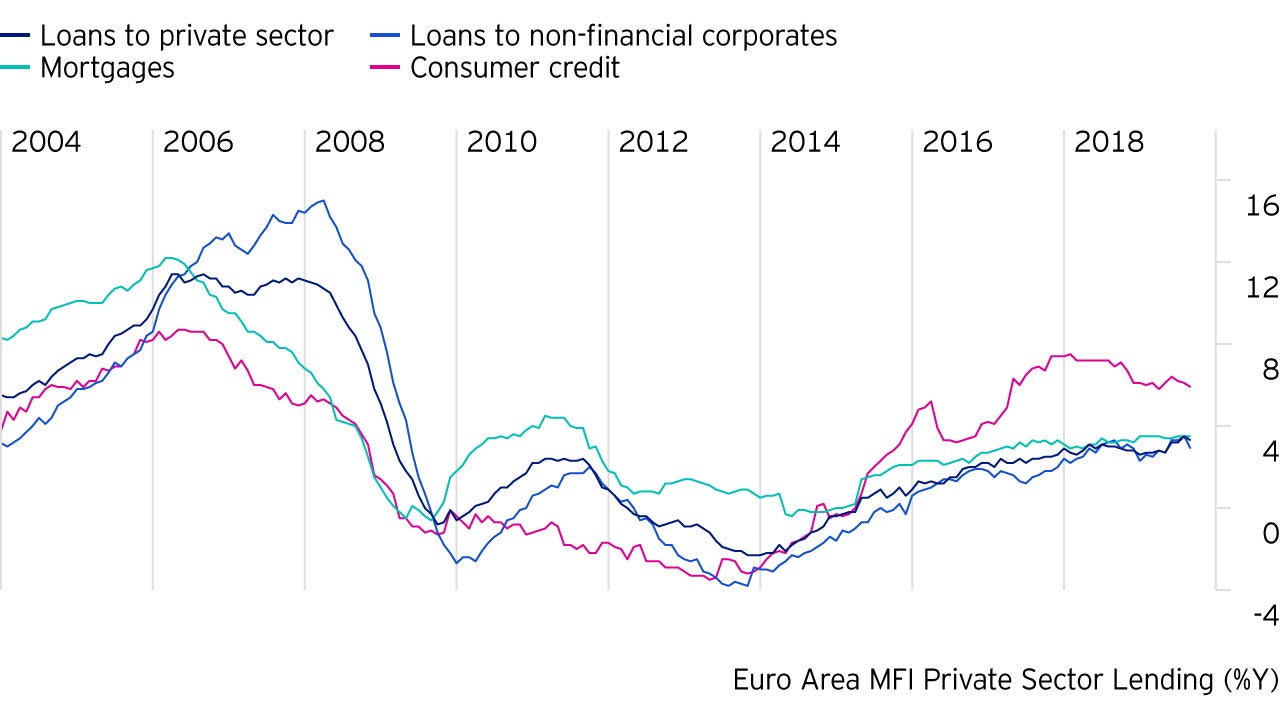

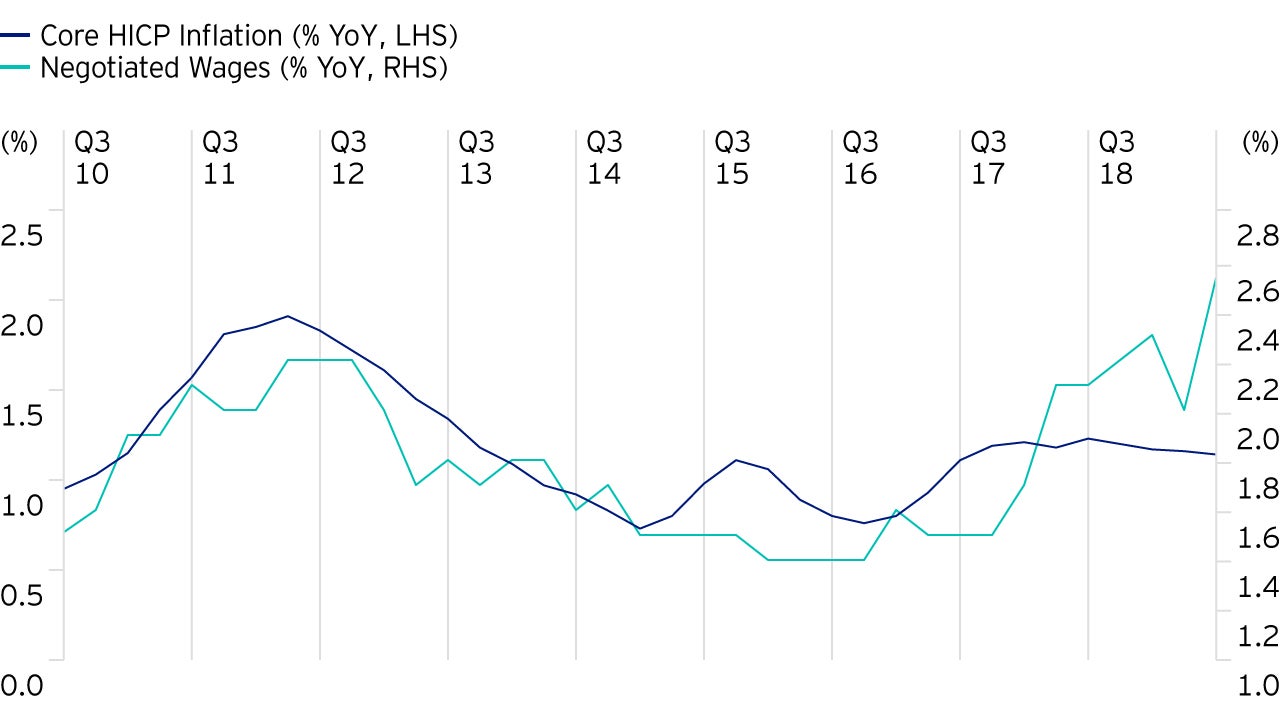

Sluggish European macro data (we see the glass as half full, most people see it as half empty), worsening Trumpian trade uncertainties and, for good measure, a couple of volte-faces from central banks have all fed the unprecedented rally in bond markets this year. Equity markets have generally been dancing to the bond markets’ tune.

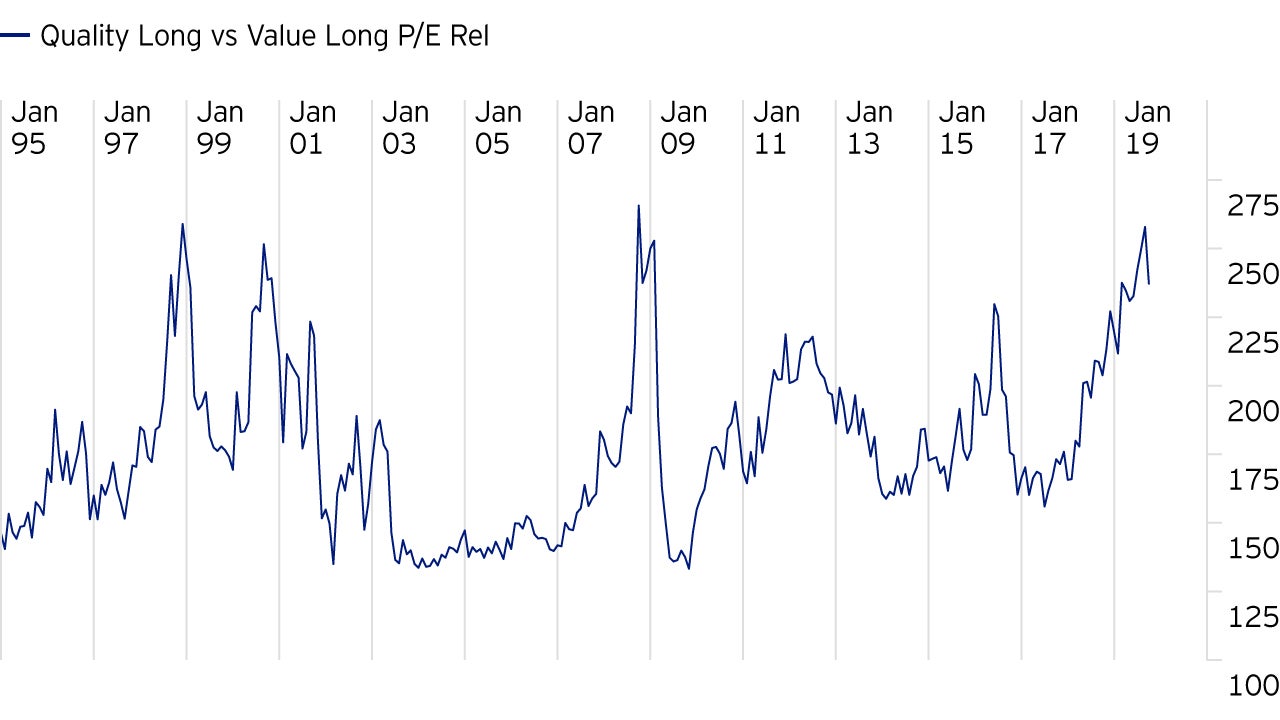

‘Bond proxy’ stocks and sectors perceived as traditionally ‘safe’ have been the ‘haves’, whilst the ‘have-nots’ have been economically-sensitive parts of the market which have been left behind. In valuation terms, the divergence between ‘Quality’ and ‘Value’ has surpassed levels last witnessed during the TMT crisis and Global Financial Crisis. Equally, at a stock level there are plenty of examples of outperformance being driven by re-rating rather than fundamentals alone. The market’s sometimes lazy analysis is to assume that ‘Quality’ / ’Growth’ stocks have a monopoly on quality business models. We know that this is simply not the case.

Better than expected economic data:

Less monetary, more fiscal:

Cracks are already starting to appear in some of the stocks which have benefited most from a decade of extremely accommodative monetary policy. Where does that leave us in terms of fund positioning as we go into 2020? We understand the logic of buying ‘duration assets’ if bond yields only ever fall, but as we have seen very recently, bond yields can also rise – and ‘duration assets’ has better turn out to be ‘durable’ or else the consensus in the market really do have problem.

Any recent examples? There have been negative regulatory reviews undermining the dividend growth capacity, and therefore the bond proxy status of some utilities. Certain consumer staples stocks and luxury goods companies have been seeing negative earnings revisions and subsequently their share prices have struggled. We are not saying that all ‘Quality’ stocks are disappointing, but rather that the list of poor performers is now long enough to discern a trend – a trend which can very easily continue into 2020.

To our minds, a far better risk reward balance can be found in sectors well away from the market’s focus. This is a similar message to the one we gave a year ago, but the logic is still intact, if not actually stronger today. Given the valuation argument is even more powerful now, it is then worth remembering that in Europe for long-term investors there is a strong correlation between the price you pay for assets and the returns you get.

‘Value’ stocks are in aggregate no longer front and centre in terms of earnings disappointments: indeed, earnings trends are currently stronger at the ‘Value’ end of the market than at the ‘Quality’ end of the spectrum. Macro-economic trends – and the policy making balance – also seems to have turned a corner. For 2020, we see an interesting combination of still loose monetary policy and supportive fiscal trends. To us, this sounds ‘economic growth friendly’ and ‘Growth stock unfriendly’.

We remain valuation focused in our stock analysis and that has led us to favour the ‘Value’ end of the market still going into 2020. We find a sufficiently diverse range of opportunities – industrial, cyclical, financial, defensive – at that end of the stock market to construct portfolios which we believe can offer our investors a very differentiated take on how to make money in Europe.

Daring to be different can ‘pay dividends’ – both literally and metaphorically!

This year has been unique in many ways. Will 2021 be any different? Read more.

Our investment teams from around the globe outline their expectations for 2020 to help investors plan for the coming year, wherever the markets take us.

Georgina Taylor explains how the Multi Asset team aims to take advantage of opportunities thrown up by anomalies in financial markets in 2020 and beyond.