Emerging markets beyond COVID-19: all about picking and choosing

In the context of slow global growth, we believe investors can benefit from reducing home bias in favour of emerging market (EM) exposures. However, EM investing is much more than simply buying or selling the market.

Arnab Das, Global Market StrategistDespite not slowing the virus, many EMs are reopening national economies and opting for regional lockdowns.

In the context of slow global growth, low inflation and ultra-low yields (at least for some time to come), we believe investors can benefit from reducing home bias in favour of emerging market (EM) exposures. However, EM investing is much more than simply buying or selling the market.

Re-assessing emerging markets in the world beyond COVID-19

Post-lockdown re-openings, secondary outbreaks and rising global tensions raise crucial questions about the cycle and the long term, arguably more in EM than other asset classes:

1. Boost or cut EM exposure? Should investors seek higher growth hopes, inflation risks and hence yields in EM, expecting the global economy to recover sustainably, with low inflation, loose fiscal and monetary policies and a supportive financial environment? Or reduce EM exposure in fear of faltering recovery, rising inflation, higher trade/investment barriers, or all of the above?

2.Treat EM as one or pick and choose among countries and asset classes across the EM complex, including local currency, hard currency debt, or equity – as opposed to shifting index exposures?

We expect global financial conditions to continue to support EMs despite clear and present dangers, which we believe are reflected in higher risk premiums in many EMs relative both to developed markets (DM) at present and relative to EM history.

Easy macro policies, financial conditions, low inflation globally should support a gradual global recovery and ‘risky’ asset classes including EM, despite COVID-19 challenges.

We also believe investors should emphasize selectivity in EMs over time. Over the longer term, we expect EMs to reform domestic and international policies, causing growth models as well as macro and corporate performance to diverge. Investors should therefore be able to boost returns and may even be able to lower volatility via selective country and asset-class weightings.

The COVID-19 Great Compression…

The world suffered a “Great Compression” during the first half of 2020 as governments adopted lockdowns to protect public health, sacrificing private income and wealth. Deliberately compressing activity is very different than conventional recessions, in which monetary policy is tightened to stop inflation; or depressions, in which policy is too tight, causing financial stress or crises and multi-year downturn.

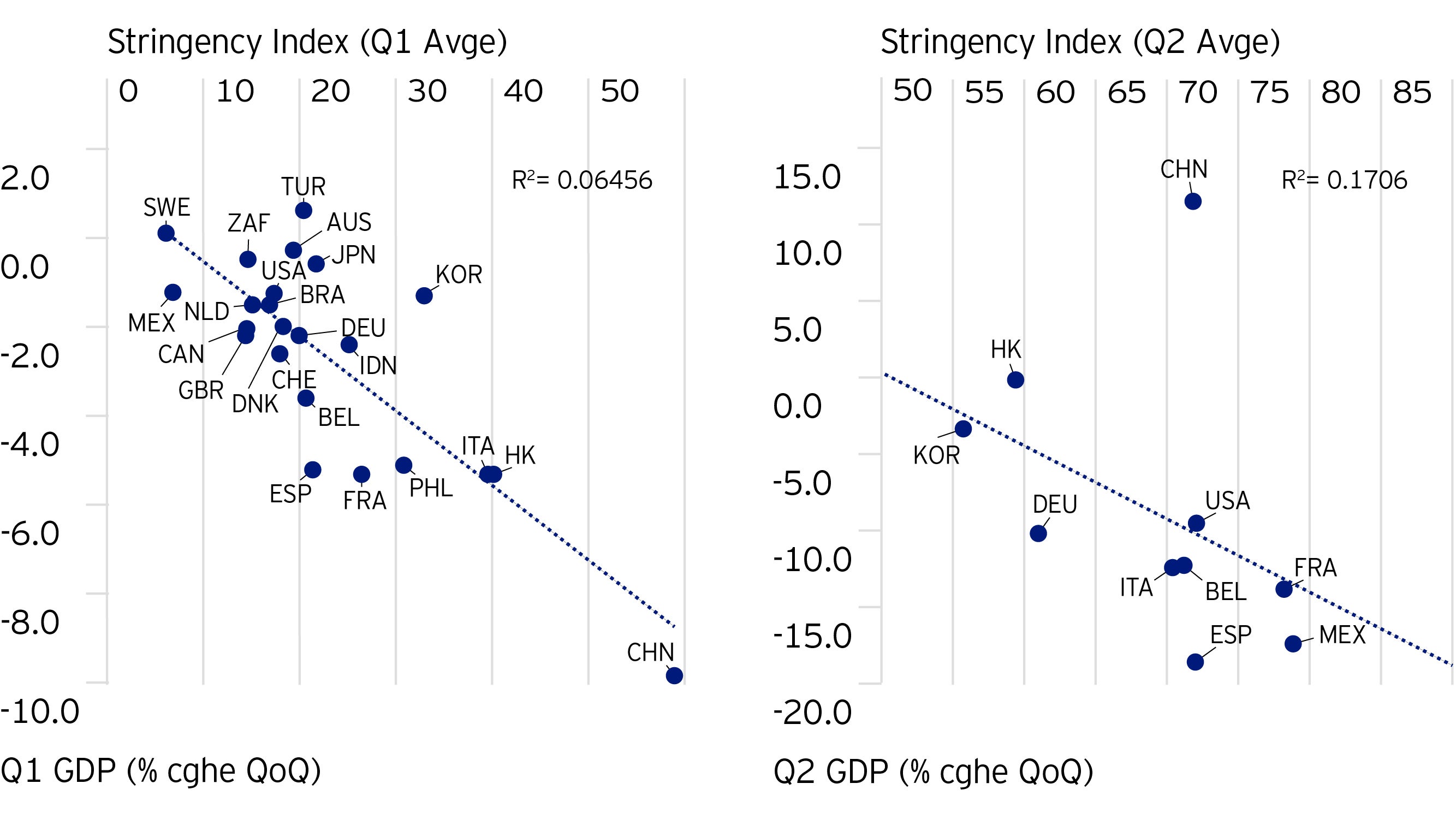

Almost regardless of economic structure – led by manufacturing, services, domestic demand or international trade, or size of government, the tighter the COVID-19 lockdown, the steeper the fall in GDP (Fig. 1, left chart).

This downturn was much faster, deeper and wider than economic downturns, which are more gradual and tend to respond to monetary or fiscal easing more directly; wars in which productive capacity is destroyed and must be rebuilt; or natural disasters, which tend to be much more geographically concentrated. Hence, mapping the COVID compression, the current rebound and recovery ahead requires factoring in the conceptual similarities in lockdowns and practical differences in reopening.

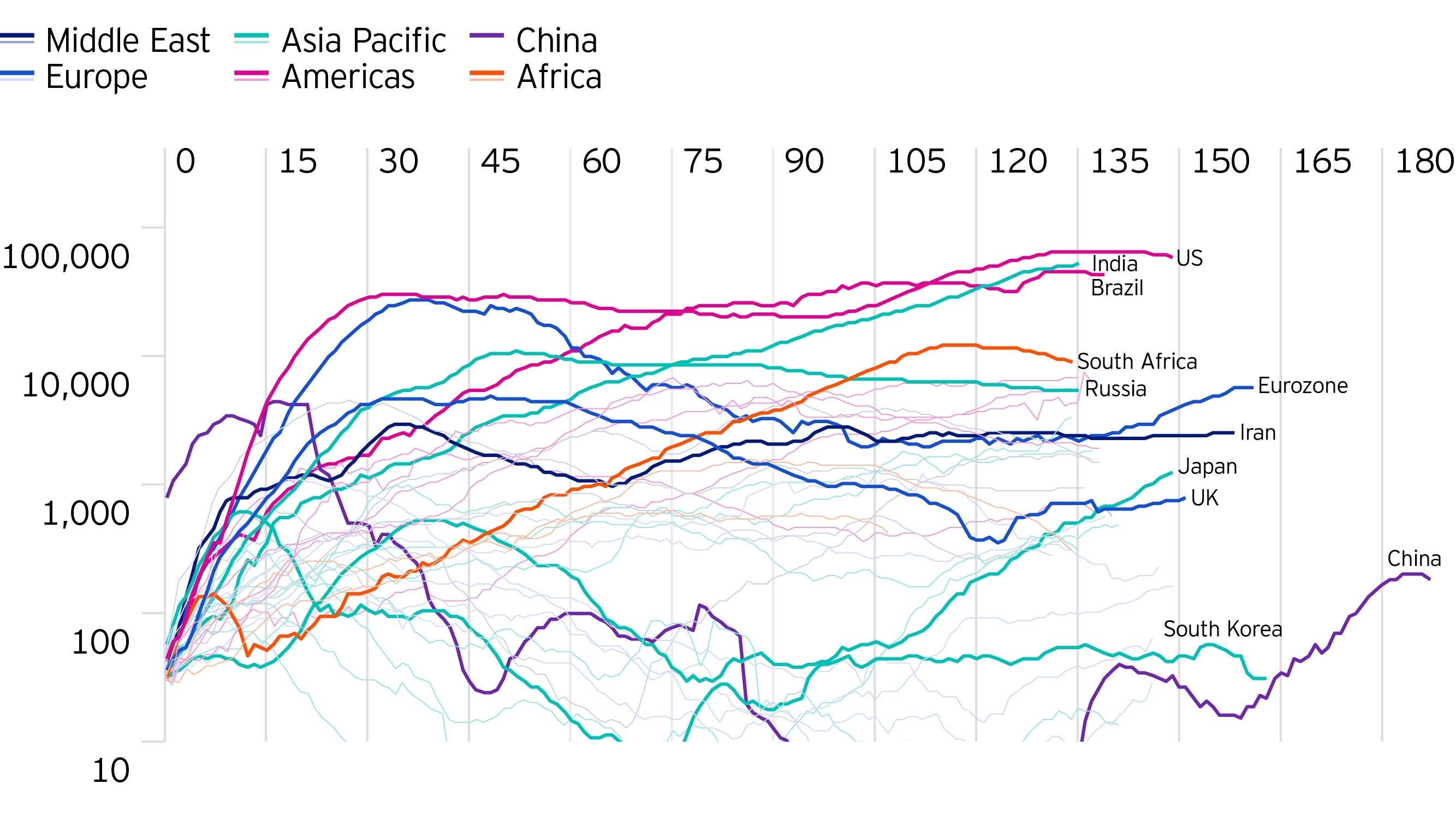

Despite the shared compression, we therefore expect much greater differentiation as economies emerge from lockdowns, given vast differences in economic characteristics, macro policies and effectiveness in containing COVID-19. China, first into the pandemic and lockdown in Q1 and first to rebound in Q2, is weakening the global link between lockdown intensity and GDP (Fig. 1, right chart).

… is pushing EMs to re-open, despite rising caseloads and deaths due to policy limitations –

Despite not slowing the virus, many EMs are reopening national economies and opting for regional lockdowns. These policies are not so different from China and DMs with effective lockdowns and regional outbreaks; or the US and UK, which are re-opening generally but locking down regionally, because of ineffective national lockdowns.

We reckon most EMs and DMs will not reimpose economy-wide lockdowns but continue with regional lockdowns unless they face severe second waves.

But there the similarities end: many EMs lack adequate space for social distancing; public hospitalization and treatment; and public borrowing to compensate for private income lost during lockdowns.

These challenges threaten DMs but are more severe in EMs – another reason the bar will be high for further nationwide lockdowns, reducing the chances of a double-dip economic compression and pressures on EM currency and asset valuations.

After all, its lockdowns and fear of the virus that have hit economies hardest, much more than the direct impact of illnesses and fatalities.

Re-opening rebound set to give way to a gradual, highly differentiated recovery

As lockdowns are released, we expect a re-opening rebound in many countries during Q2-3 as pent-up supply and demand are released. But afterward, we expect more gradual and differentiated recoveries as vast variations in fiscal space, in economic characteristics and in demographic exposure to the virus all come into play.

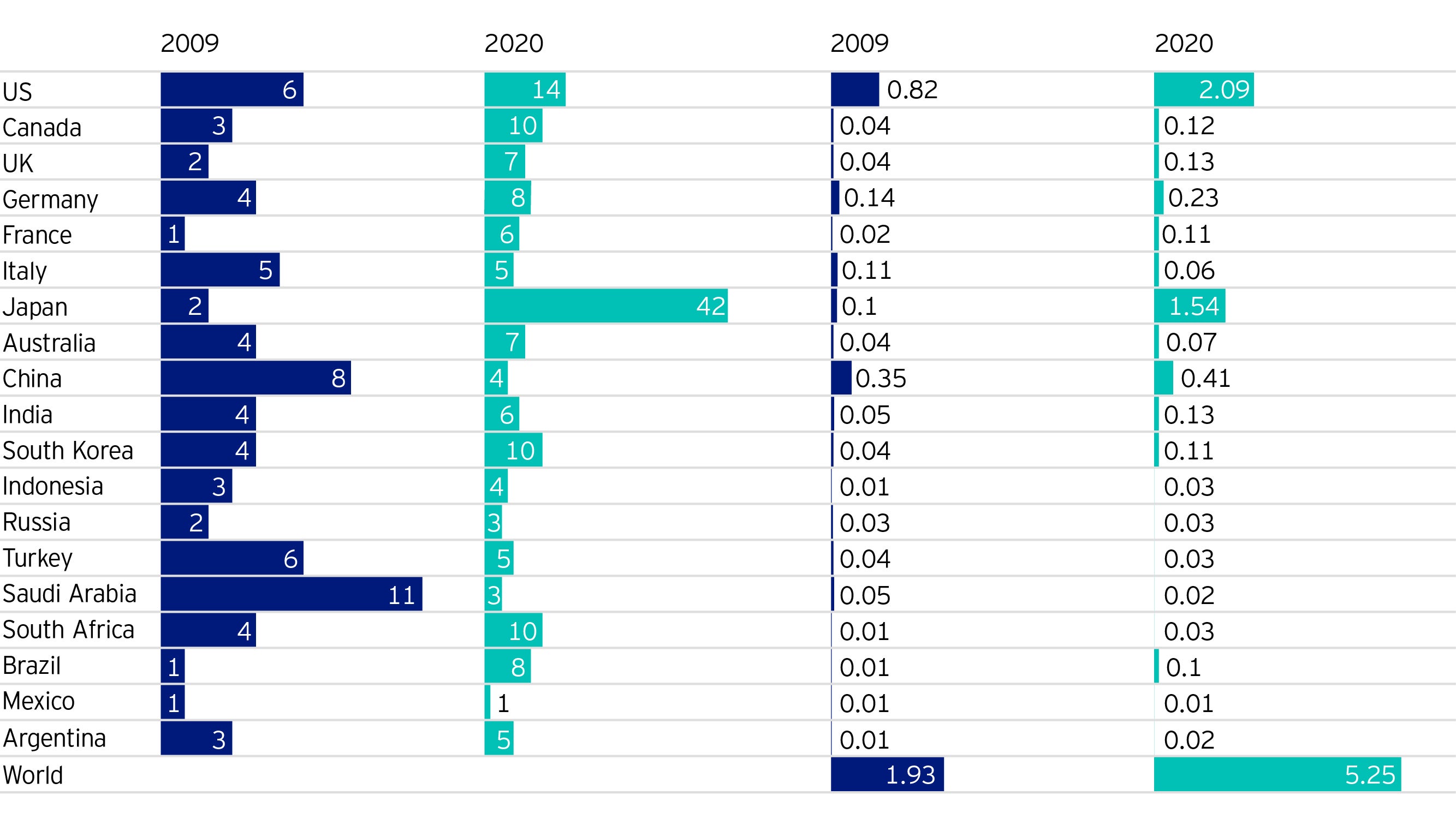

For example, fiscal support varies significantly across the G20 group of largest EM and DM economies, as well as from fiscal responses to the Global Financial Crisis – but is far larger as a share of global GDP today than in 2009.

These variations amid strong global fiscal support give us confidence that country performance will be differentiated amid global recovery.

Evolving international system points to gains from diversification and selectivity

During the heyday of globalization 1989-2009, EM investment was about capital gains generated by the convergence of high EM risk premiums to DM levels thanks to economic and financial integration.

The GFC slowed both globalization and global growth, and EM investment shifted to yield seeking and loss avoidance – essentially a carry play. Now, as international tensions rise, we expect EM countries to continue to adopt different regulatory, technological and policy frameworks, trade/investment partners and ultimately varied growth models. Therefore, the cyclical divergence now unfolding should lead to sustained diversity in economic performance.

This is a new world order in which, in the context of slow global growth and inflation and ultra-low yields (at least for some time to come), investors can benefit from reducing home bias in favour of EM exposures.

And, capitalizing on diverging EM policy choices and performance would be enhanced by actively picking and choosing EM regions, countries, currencies, sovereign and corporate debt and equity to overweight and underweight.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.