Executive summary

Middle Eastern economies are on an Economic Diversification 2.0 path focusing on 1) Financial market reforms; 2) Fintech and digitalization development; 3) Diversification into non-oil sectors such as renewable energy, tourism, and infrastructure; and 4) Greater regional integration.

We believe China fits right into this new economic growth model. The country is developing stronger ties with the Middle East region on the back of a few building blocks: trading partnerships and cooperation in areas such as energy, finance, infrastructure, the Digital Silk Road, clean energy, and tourism.

We believe the strategic China-Middle East alliance can reshape regional capital flows and the economic outlook of both markets. We anticipate rising investment flows between the two regions and higher growth potential for select sectors such as clean energy, fintech, and digital and traditional infrastructure. In our view, investors should pay close attention to the related investment opportunities emerging from this trend.

Economic Diversification 2.0 in the Middle East

The Middle East’s economic growth model relies heavily on oil as the main source of exports and fiscal revenue for countries in the region. Over the past several decades, Middle Eastern governments have used their oil wealth to develop their economies, increase public sector employment and boost spending on infrastructure, health, and education in order to raise living standards for their residents.

However, the current growth model is vulnerable given the region’s dependence on oil. Volatility and uncertainty in the global oil market can negatively influence economies in the Middle East, as evidenced by oil price shocks during the COVID-19 pandemic and Russia’s invasion of Ukraine. As such, it’s necessary for Middle Eastern economies to diversify their revenue sources and reduce their reliance on oil.

Economies in the region have therefore been on an Economic Diversification 2.0 path with an emphasis on four areas: 1) Financial market reforms; 2) Fintech and digitalization development; 3) Diversification into non-oil sectors such as renewable energy, tourism, and infrastructure; and 4) Greater regional integration.

- Financial market reforms

Middle Eastern economies have increasingly been implementing financial market reforms in the region to enable increased access by foreign investors.

Index inclusion

Following a number of regulatory and operational enhancements in local markets in certain Middle Eastern economies, major global index providers have started to include these countries into their major indices. For example, MSCI added Qatar and the UAE into its Emerging Markets Index in 2014 and added Saudi Arabia in 2019. These steps have positively impacted the domestic capital markets of these economies by enhancing market depth and liquidity. Index inclusion has also driven sustainable capital inflows into the region from the passive portfolio managers.

Attracting foreign investment

Over the past decade, governments in the Middle East have revised investment legislation and eased market entry for foreign investors. The region continues to open up to foreign investment, subject to licensing approvals and ownership thresholds for certain business sectors and in certain geographic zones. Several countries have also created free economic zones with looser foreign direct investment (FDI) restrictions than are typically in place. The general trend toward an investment-friendly environment in the Middle East continues as local governments aim to attract more inbound investment by foreign investors. For example, Egypt recently announced the launch of a "golden license" for certain categories of investment projects. In late 2020, the UAE removed the requirement for an Emirati partner for foreign entrepreneurs setting up businesses in the country, opening the way for 100% foreign ownership of firms across the Emirates.

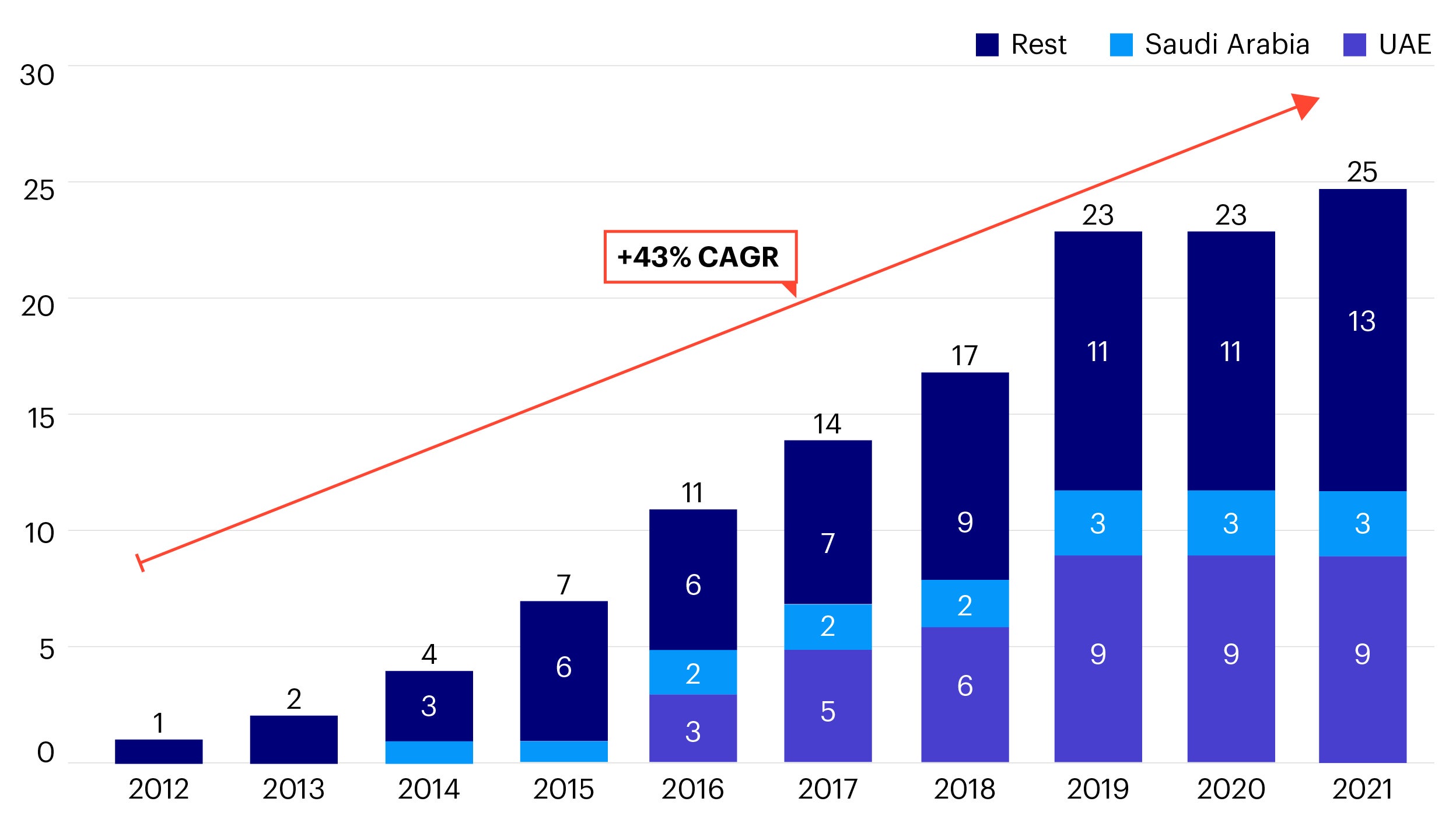

Attracting foreign investment is a key part of Saudi Arabia’s “Vision 2030” plan. In 2021, Saudi Arabia introduced a new national investment strategy that set an FDI goal of more than US $100 billion annually by 2030. Saudi Arabia unveiled its first integrated economic zone in Riyadh in late 2022, which is tax-free for companies for up to 50 years, in order to position itself as the region’s leading logistics hub and attract foreign investment. On the back of all these efforts, net FDI into Middle Eastern economies has been on an upward trend since 2014 (Figure 1). The region is forecast to have a record year of FDI inflows once again in 2023 according to a report published by Lumina Capital Advisors in January this year.1