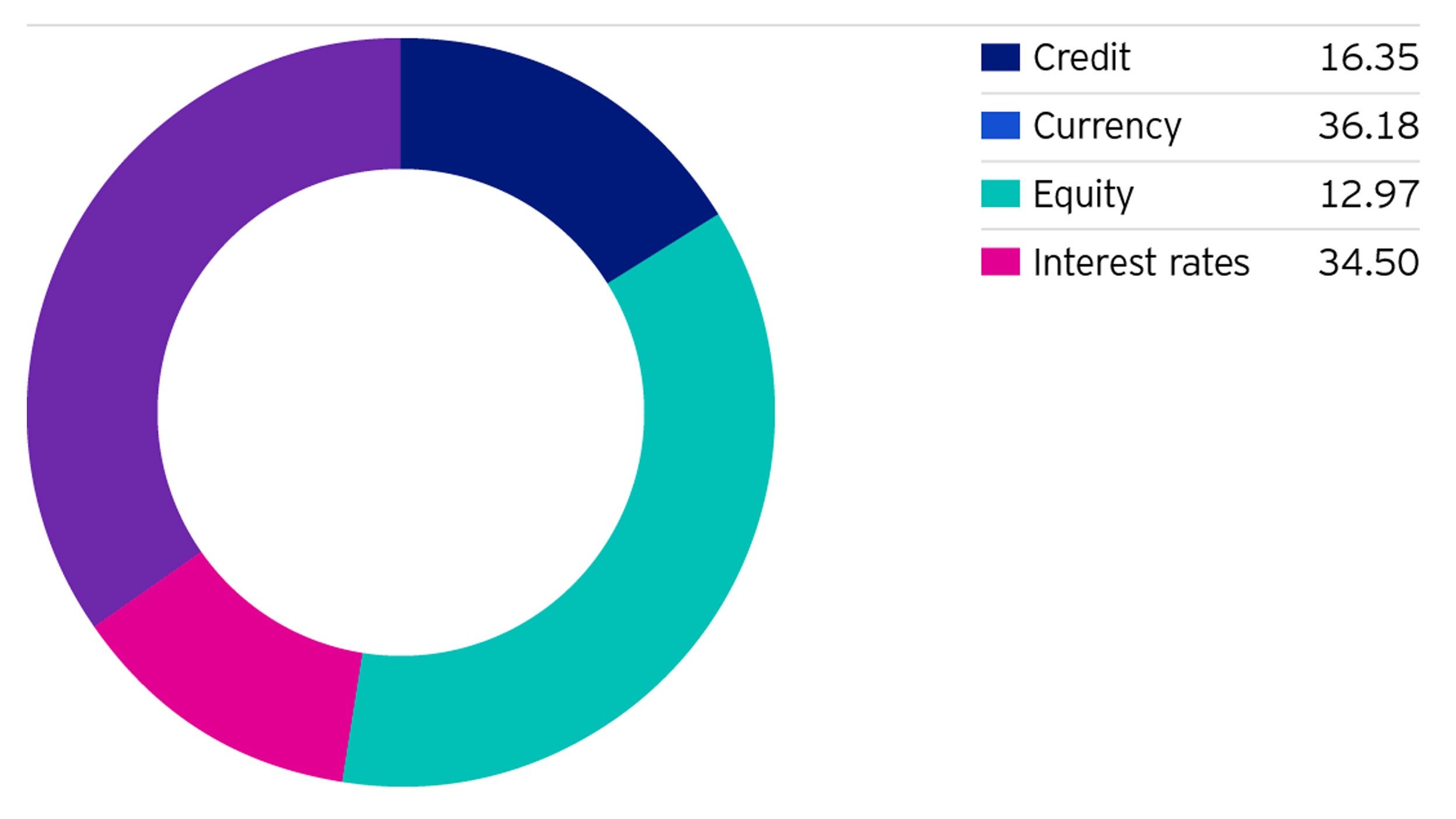

Income has been thrown firmly in the spotlight this year with dividend cuts happening across the Financials sector and elsewhere, highlighting the importance of diversifying income sources.

Hopefully, this is a temporary suspension of an important component of equity income. Prior to the Global Financial Crisis, banks accounted for over 20% of dividends within the FTSE 100 index. Banks are less important now than they were, but they still accounted for around 15% of overall index dividends last year, while energy companies accounted for around 22% of overall index dividends.

It is also startling to see that 20 stocks within the FTSE 100 index account for 74% of total market dividends (19 stocks if you combine the two Royal Dutch Shell share classes).

Outside of the UK, announcements in Germany and France are also putting dividends under pressure, with Germany urging any company that receives state aid to not pay a dividend. Meanwhile, state-backed companies in France are likely to be asked to stop paying dividends to shareholders.

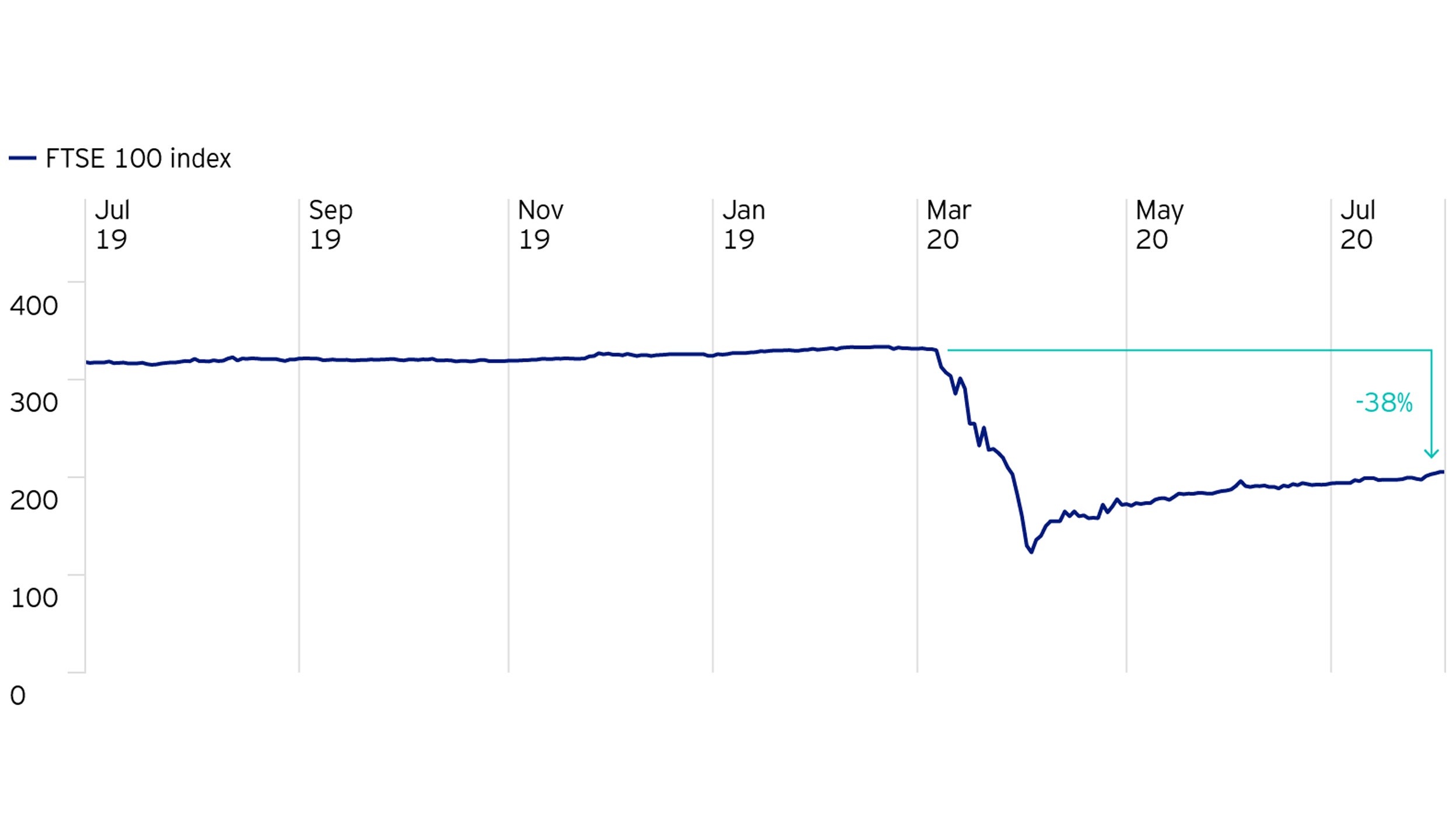

Dividend futures (yes, they do exist!) have priced in a pretty dramatic cut in dividends already. The FTSE 100 December 2020 dividend future remains 38% below February levels to reflect the expected cuts to dividends this year (and also in part the fall in the equity to adjust the dividend yield to the market level).