Alternatives

Yields maintain record highs and offer positive relative value

Invesco’s bank loans, direct lending and distressed credit teams to share their views as the second quarter of 2024 wraps up.

For investors, the years since 2008 have been eventful. There have been global crises, unparalleled government interventions and a period of ultra-low interest rates. Now we’re experiencing the highest level of inflation for a generation. Policymakers are raising interest rates in an attempt to control rising prices, and it’s creating volatility.

Over this period, assets under management in alternative strategies have grown exponentially. Between 2008 and the end of 2021, they increased from $3.1 trillion to $8.5 trillion. The growth in private markets is expected to continue at pace, especially given the challenging environment faced by global investors.

Source: Burgiss, Preqin as at Jan. 1, 1980 – December 31, 2021

Over the last few years, institutions have had to adapt to lower forecast assumptions from equities and bonds. This has accelerated the move towards alternatives, as institutions seek higher returns to meet their liability targets. This is shown through Invesco’s capital market assumptions (CMAs) which provide long-term estimates for the behaviour of major asset classes globally.

The unique characteristics of alternative assets such as private equity, private debt, and direct real estate mean that they offer diversification benefits. Typically, they also generate higher returns than public market assets.

Source: Invesco. Capital market assumptions as of 30 June 2022. Historical returns to 30 June 2022. Private credit returns refer to direct (unleveraged) returns. Refer to proxy information in the ‘important information’ section below for additional information. Past performance does not predict future returns. There can be no assurance that any estimated returns or projections can be realised, that forward-looking statements will materialise or that actual returns or results will not be materially lower than those presented. Data is unhedged GBP. An investment cannot be made into an index. Capital market assumptions are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. Refer to the ‘important information’ section below for additional CMA information. For illustrative purposes only. Forecasts are not reliable indicators of future performance. Real estate debt and private credit referred to is senior. Infrastructure debt referred to is high yield.

Private market assets can often generate additional returns through the value added by skilled management.

Private business owners often have greater control over their companies, as they are unconstrained by the burdensome regulations placed on public companies.

Because they are not required to carry out quarterly reporting, private businesses can afford to take a longer-term view. As a result, they can affect dramatic changes in management and strategy that may generate outsized returns.

For companies that depend on acquisitions to grow, private control can significantly enhance the speed and capacity for deal-making.

Although alternatives are attractive for a variety of reasons, they are not all the same. Private market opportunities are increasing in breadth, but growth in scale and complexity may make this market harder to navigate and implement.

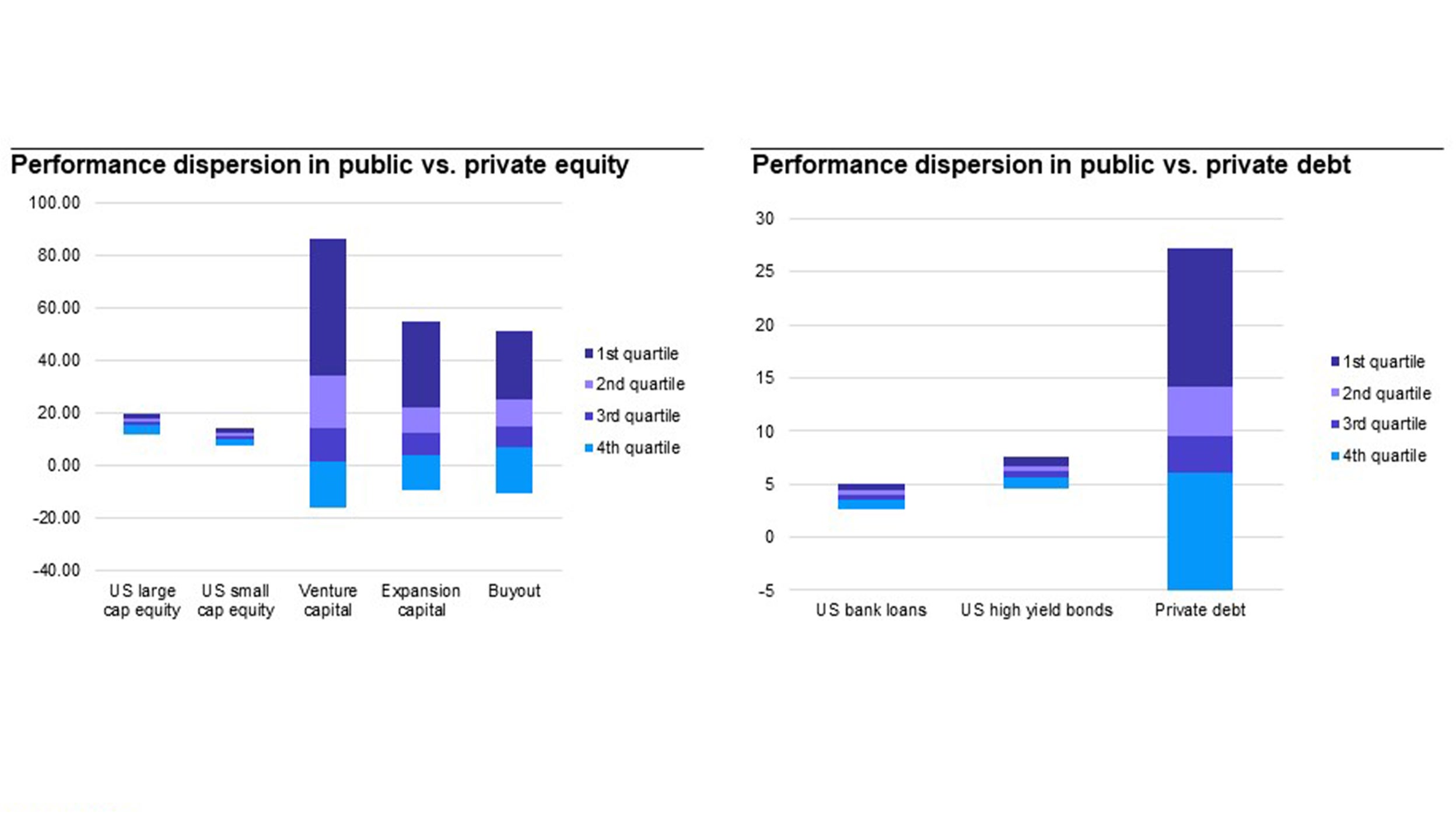

Source: Burgiss, Preqin. Data from 1 January 1983 - 31 March 2022.

Managing liquidity is a big consideration, as private market alternatives tend to have longer lock-up periods than public market investments. It is possible to manage this effectively, but the right skillset is needed to align the timing of capital flows with investors’ liquidity needs.

Resource challenges can also be an issue. A lot of time and expertise is needed when assessing private markets and sourcing compelling risk-adjusted return opportunities. These resources are particularly important during the manager selection process, as identifying top performing managers is essential.

Source: Morningstar, Burgiss. Data is based on 5-year annualized total returns for public assets and IRR to date for private assets. Data as of 31 December 2021. All returns are net of fees. Past performance is not indicative of future results.

Once key asset classes and managers have been identified, the next notable barrier is minimum AUM and fee requirements, which can be too high for many schemes to overcome. Recognising this challenge, Invesco has developed an Alternative Solutions Platform. This provides streamlined access to our in-house alternative capabilities together with high quality investments from leading partner firms.

Using this multi-manager platform, pension schemes can benefit from economies of scale and lower minimum investment requirements. Importantly, they can also tap into our expertise on asset classes like senior loans, real estate, private credit and infrastructure. The platform also gives pension schemes access to our global resources and proprietary analysis. Through this ‘extension of staff’ approach, we can reduce the administrative burden for schemes in terms of monitoring, oversight and reporting.

We started this piece by noting the rapid growth in alternative assets over the past decade and a half. And it’s a trend that isn’t going away any time soon. Investment Week recently noted that demand for alternative assets is ‘set to grow by up to 46% over the next 12 months’, with inflation, diversification and potentially higher returns driving this interest.

Through our analysis and research, we believe private markets can be highly complementary for many institutions. While some institutional investors may have struggled to access private market assets in the past, solutions like our Alternatives Platform are opening the asset class up to a wider audience today. We believe this is an important step in helping clients achieve their investment objectives against a challenging market backdrop.

Invesco’s Alternatives Opportunities outlook provides views on a variety of private asset classes from Invesco Investment Solutions and our partner firms. This semi-annual research presents a framework for analysing across and within alternative markets. For more information about the outlook for alternatives and how Invesco can help your organisation meet its investment objectives, please get in touch.

Partner with our real estate, private credit and Invesco Solutions teams as you tackle the biggest issues of the day.

Yields maintain record highs and offer positive relative value

Invesco’s bank loans, direct lending and distressed credit teams to share their views as the second quarter of 2024 wraps up.

Real estate 2024 investment outlook

Investing through market corrections has historically driven outperformance for real estate investors. We believe this will continue into 2024.

Insurance Outlook 2024

2024 should mark the beginning of the end for reforms to Solvency II. Having fired the starting gun in February 2019, almost four years later the Commission, European Parliament and European Council are negotiating the final contours of the reform package.

Date published: 20th September 2022.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

Capital market assumptions

Invesco Investment Solutions develops CMAs that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on a 10-year or 5-year investment time horizon, are intended to guide these strategic asset class allocations. For each selected asset class, we develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. For additional details regarding the methodology used to develop these estimates, please see our white paper Capital Market Assumptions: A building block methodology.

This information is not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. These asset class assumptions are passive, and do not consider the impact of active management. Given the complex risk-reward trade-offs involved, we encourage you to consider your judgment and quantitative approaches in setting strategic allocations to asset classes and strategies. This material is not intended to provide, and should not be relied on for, tax advice.

References to future returns are not promises or estimates of actual returns a client portfolio may achieve. Assumptions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. Estimated returns can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.

Indexes are unmanaged and used for illustrative purposes only. They are not intended to be indicative of the performance of any strategy. It is not possible to invest directly in an index.

Proxy information

Asset class |

Index |

Global Corporate-Ex US |

Bloomberg Global Corporate- Ex US |

UK Aggregate |

Bloomberg Sterling Aggregate |

UK Gilts |

Bloomberg Sterling Aggregate Gilts |

UK Corp |

Bloomberg Sterling Aggregate |

UK Linker |

BofA Merrill Lynch UK Inflation-Linked Gilt |

Canada Aggregate |

FTSE TMX Universe Bond |

Canada Treasury |

BOA Merrill Lynch Canada Government |

Canada Corporate |

BOA Merrill Lynch Canada Corporate |

EM Aggregate |

Bloomberg EM Aggregate |

EM Aggregate Sovereign |

Bloomberg EM Sovereign |

EM Aggregate Corporate |

Bloomberg EM Corporate |

EM Corporate IG |

Bloomberg EM USD Agg-Corp–IG |

EM Corporate HY |

Bloomberg EM USD Agg-Corp-HY |

Agriculture |

S&P GSCI Agriculture |

Energy |

S&P GSCI Energy |

Industrial Metals |

S&P GSCI Industrial Metals |

Livestock |

S&P GSCI Livestock |

Precious Metals |

S&P GSCI Precious Metals |

Commodities |

S&P GSCI |

BB Commodities |

Bloomberg Commodity |

Hedge Funds |

HFRI HF |

HF Event Driven |

HFRI Event Driven |

HF Global Macro |

HFRI Macro |

HF Long/Short |

HFRI Equity Hedge |

HF Market Neutral |

HFRI Equity Market Neutral |

PE US LBO |

Burgiss Buyout |

Early Venture |

Burgiss Early Venture Capital |

Mid-market Lending |

Burgiss Senior Private Debt |

Distressed Credit |

Burgiss Distressed Debt |

Core Real Estate |

Preqin Real Estate |

Value-Add Real Estate |

Preqin Real Estate Value Added |

Infrastructure-Core |

Preqin Infrastructure |