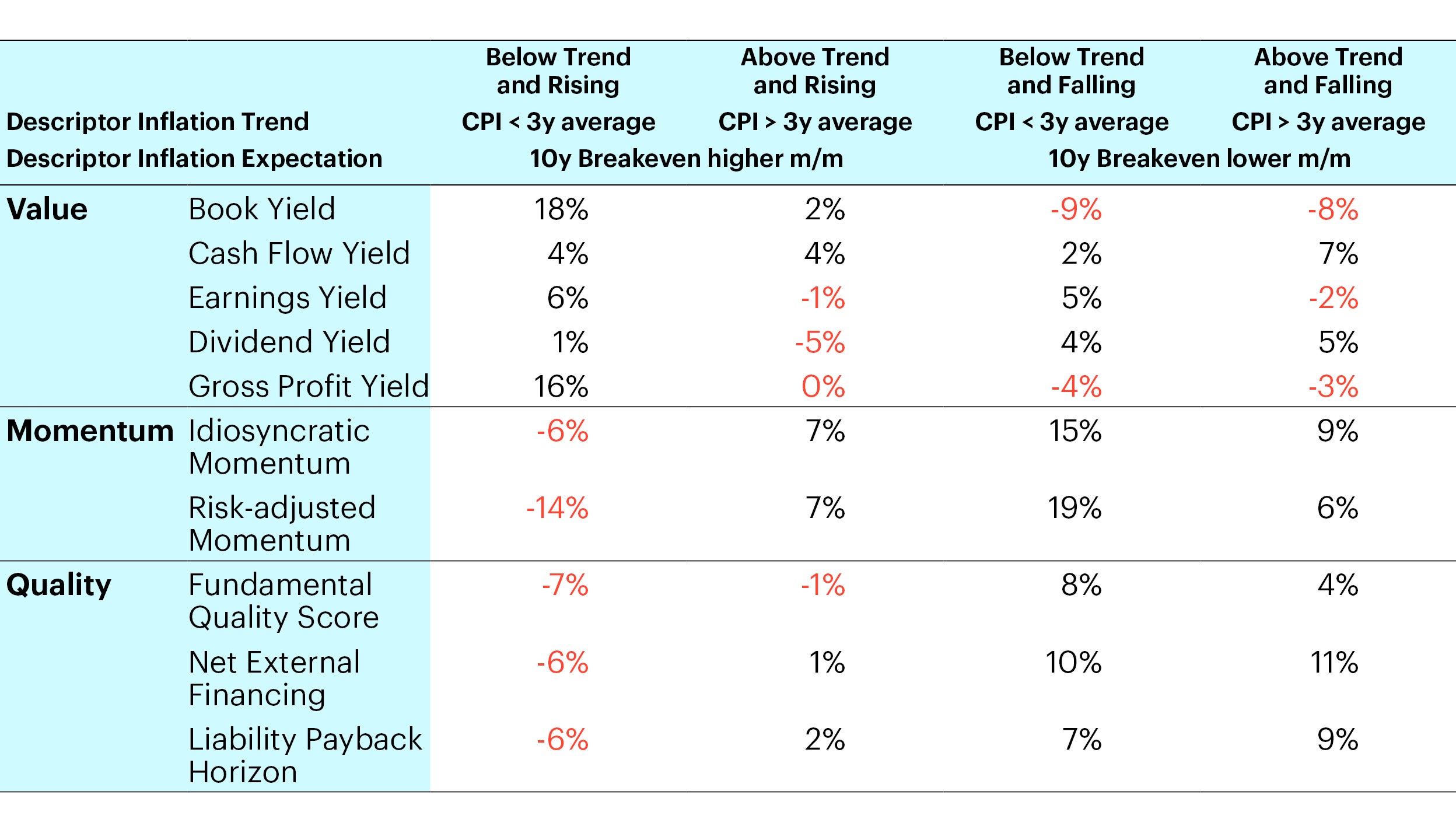

Periods of below trend and rising inflation tend to favour Value with pro-cyclical metrics, such as book yield or gross profit yield, performing best. When transitioning into an established / above trend inflation regime, cash-based Value factors, such as cash flow yield, outperform other Value metrics.

This is in line with the general concept that Value tends to show strong performance during economic recoveries, which is naturally when inflation expectations return. The idea is that rising inflation should also increase discount rates, making growth stocks, with projected earnings in the more distant future, relatively less attractive than value stocks.

Conversely, Momentum, which is usually negatively correlated to Value, performs worst in periods of below average but rising inflation. This suggests that such periods are characterized by sudden market rotations and disruptions to established trends that have adverse effects on the Momentum factor.

Yet, if inflation overshoots and we move into an above average inflation regime, momentum strategies show their strengths again.

Quality, on the other hand, usually delivers the strongest returns in periods of falling inflation expectations, which often coincide with a slowdown in economic momentum. In such market regimes, Value tends to suffer the most.

Conclusion

Our analysis highlights that investors tend to favor attractively valued stocks during periods of rising inflation expectations. This is because such an environment often implies higher-than-usual economic growth prospects, which support economically sensitive, ‘riskier’ value stocks.

With perfect inflation foresight, in our view some investors may wish to tactically shift factor exposures to take advantage of the interaction between inflation and factor returns. However, timing macroeconomic regimes is arguably as difficult as timing markets.

Thus, with average inflation foresight, we believe most investors are better off diversifying their factor exposure to deliver meaningful performance in various inflation regimes.