Why China remains a springboard for electric vehicles

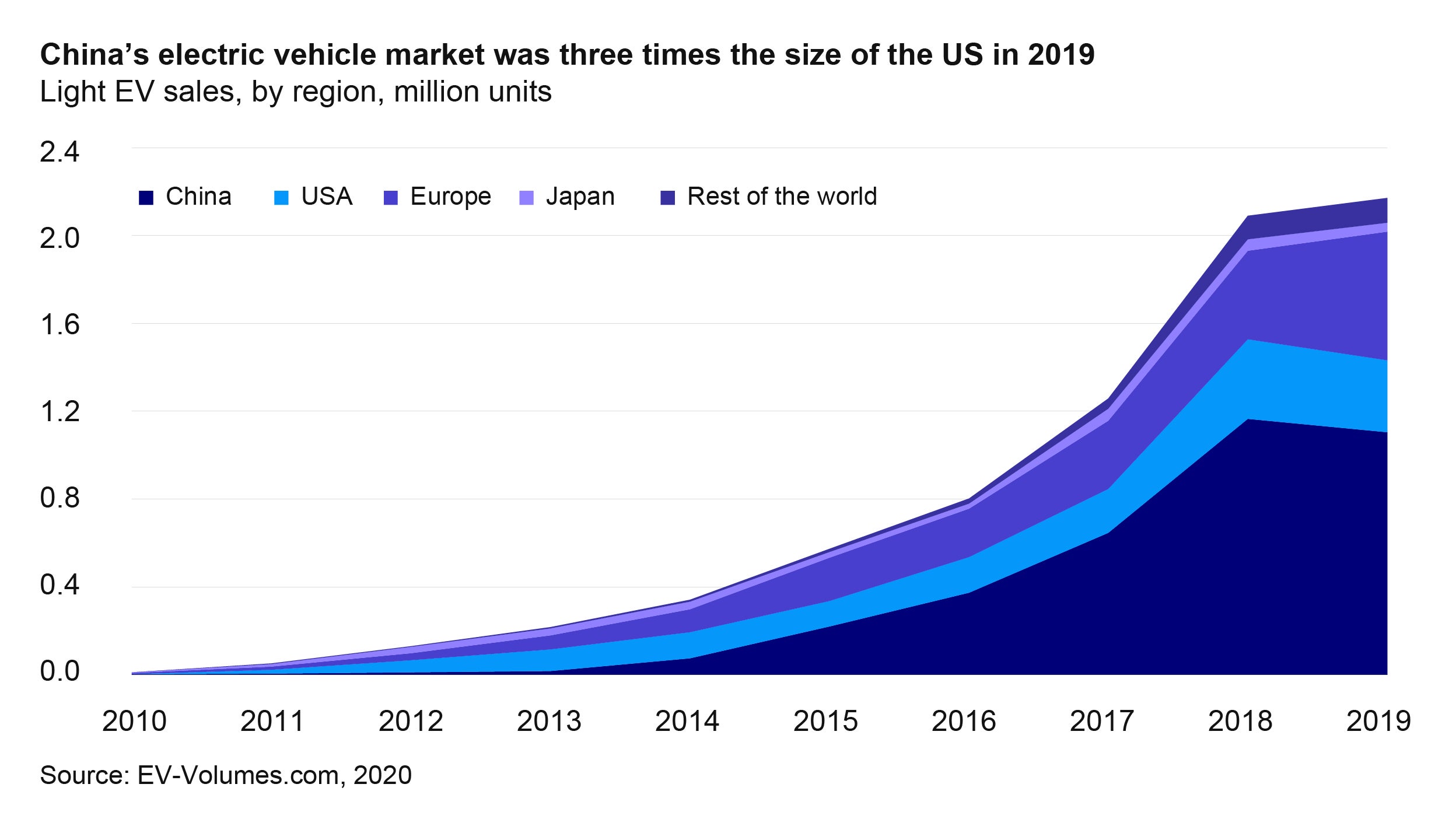

The global electric vehicle (EV) market has rapidly recovered from the pandemic-related demand shock as sales grew by 43% in 2020 reaching a record 3.24 million units. The combination of government subsidies, new regulatory emission standards and improving consumer acceptance have contributed to the global EV market share doubling in just a year. This market now represents 4.2% of the global automobile pie.

Even as COVID-19 decimated global car sales, China’s EV sales still managed to grow by 12% during 2020, accounting for roughly 50% of EV sales globally. However, this year marks an inflection point for China’s EV industry. Since January 2021, EV subsidies have been lowered by 25% and regulators plan to gradually phase out all subsidies by 2023.

Critics of the EV boom attribute the growth of China’s EV industry squarely to generous government subsidies and believe that the sales trend will fade once subsidies are cut. However, we predict that we are only at the beginning of a very long EV adoption cycle and that recent gains by China’s EV industry can be sustained and even strengthened over the next few years. According to the Chinese Association of Automobile Manufacturers (CAAM) the EV industry could grow by over 40% in 20211. We think there two reasons underpinning this trend.

1. Falling Cost Matters

A major contributing factor to the growth of China’s EV market has been the reduction in EV purchase costs. This has been happened for two reasons.

First, from a policy perspective, the Electric Vehicle Subsidy Scheme initiated by the Chinese government in 2009 has been effective in facilitating the rapid market penetration of EVs in China. A study in 2018 showed that subsidies were the primary reason for the purchase of an EV, followed by vehicle performance and vehicle cost2.

Given that production costs have fallen substantially since then and the industry has been gaining traction, market participants expected EV subsidies to be suspended in 2020. However, Beijing policymakers chose to extend subsidies until the end of 2022 - albeit at reduced levels each year - to provide additional support to the industry in light of the COVID-19 outbreak. Despite a 20% cut in EV subsidies at the beginning of this year, the EV market continues to show strong sales momentum, rising +287% y/y in March driven by greater supply of affordable mass-market Chinese EVs and a very low comparison base in 2020.3

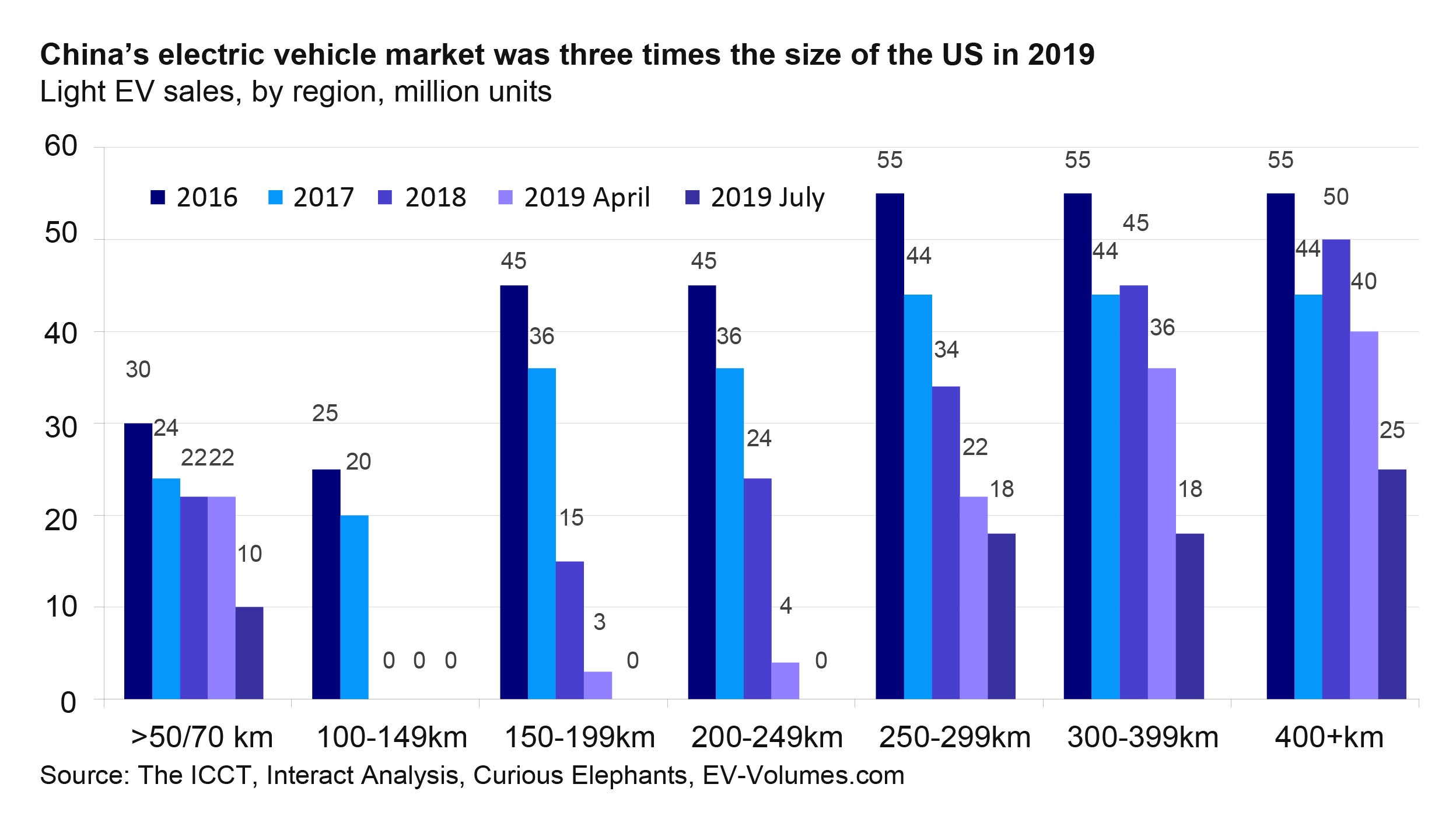

Second, from a production cost perspective, continued advancements in EV technology, increased efficiency of production methods and falling EV battery costs have contributed to making EVs more affordable for Chinese consumers. It is estimated that short-range EVs are projected to reach price parity relative to their gasoline counterparts by 2026, with long-range E Vs expected to reach price parity by around 20304. Battery costs – contributing to around 30% of overall EV costs5– have fallen more than 70% since 2014, reducing the premium of EVs over conventional international combustion engine (ICE) cars

2. Government support remains strong

Chinese government policy support will remain crucial for the development of the EV sector.

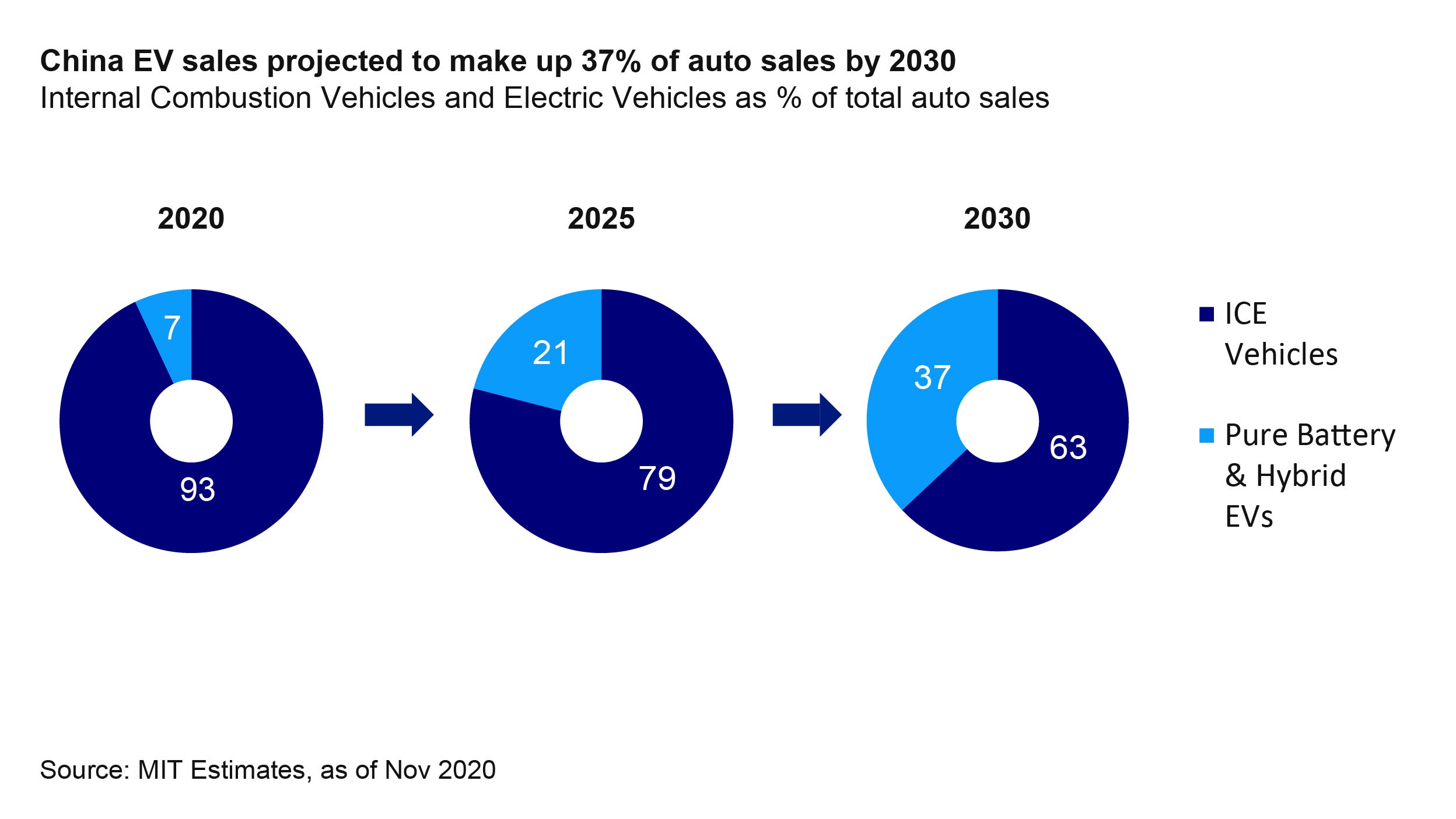

At the core of China’s EV boom is the government’s drive towards a greener economy. President Xi Jinping recently pledged for the country to achieve carbon neutrality by 2060 and achieve a peak in carbon emissions before 2030. To do so, the 14th Five-Year Plan sets a target for EV sales to consist of at least 20% of all new auto sales by 2025 and to 40% by 2030, from the current proportion of 5.4%. We think that this is an achievable target given the mandatory emission quotas for ICE cars. To date, only 3.3 out of 1,000 people in China own EVs, compared to 5.4 in the US and 6.1 in Europe.

According to the International Energy Agency, vehicle charging remains one of the industry’s main constraints in China6. Government policy is expected to be key in drawing investments into EV infrastructure in order to address the bottle neck in terms of charging networks in China over the next few years. The 2020 China Politburo Meeting set out a national-level EV charging plan to accelerate “new infrastructure” EV charging developments. For example, the Shanghai municipality plans to build 100,000charging stations in the next 3 years and even Yunnan province plans to build 200,000 charging stations by the end of 20217.

What does this mean for investors?

It’s possible that EV sales could taper off as the subsidy program ends, however we believe the industry will continue to enjoy strong longer-term tailwinds. Despite some near-term challenges such as the global semiconductor chip shortage, we expect there is still a lot of runway left for the EV market. Improving consumer acceptance, falling prices and stricter emission standards has the potential to drive greater adoption and fuel sales growth of both foreign and domestic EVs in China over the next few years.

Footnotes

-

1 China's electric vehicle sales to reach more than 1.3 mil units in 2020: CAAM, December 2020, https://www.spglobal.com/platts/en/market-insights/latest-news/metals/121720-chinas-ev-sales-to-reach-more-than-13-mil-units-in-2020-caam

2 Factors influencing purchase of electric vehicles in China, Danhua Ouyang, Xunmin Ou, Qian Zhang & Changgui Dong, December 2019.

3 China Association of Automobile Manufacturers. Data as of April 2021.

4 Evaluating Electric Vehicle Costs and Benefits In China In The 2020–2035 Time Frame, April 2021, https://theicct.org/sites/default/files/publications/EV-costs-benefits-china-EN-apr2021.pdf

5 Batteries For Electric Cars Speed Toward a Tipping Point, December 2020, https://www.bloomberg.com/news/articles/2020-12-16/electric-cars-are-about-to-be-as-cheap-as-gas-powered-models#:~:text=The%20battery%20pack%20is%20the,the%20total%20cost%20to%20consumers.

6 Global EV Outlook 2020, June 2020

7 UBS Report China 360, November 2020

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest or sell in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.