Markets and Economy What drives the Asian consumer? – Digitalization

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

We believe Asian consumer demand represents one of the most exciting consumer stories in investment history. Supported by a large population base and fast economic growth, Asia’s consumer economy is simply massive. It has more than half of the world’s total middle class and is the world’s largest retail market. It is well documented that both of these are poised for further expansion.

At the heart of this, we see five mega trends propelling this sustained consumption growth in Asia - digitalization, premiumization, experience, urbanization and wellness. Each of these trends is unique and structural and reflects the driving forces behind this growth.

Despite disruptions caused by the ongoing pandemic, we believe these trends remain intact, with some even being accelerated during this challenging period. For example, our transition to an online lifestyle and our increasing awareness of personal health issues.

The Invesco Asia Consumer Demand Fund is manged by the Asia Equity Investment Team and is focused on consumer demand-related stocks in the Asia ex-Japan region. Launched in 2008, the fund has one of the longest track records in this sector.

We believe five mega trends represent significant forces of structural growth, which will shape the Asian consumer landscape in the years to come. These trends provide a stock selection framework for our highly active strategy that allows us to seek opportunities across economic areas, without being confined by traditional sectors.

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

The growing Asian middle class is a well-documented phenomenon. Unsurprisingly, as Asian consumers are becoming more affluent, they have an increased focus on quality of life.

As their income levels rise, Asian consumers have become increasingly engaged with a breadth of experiences from travel and fine dining to extreme sports to enrich their lives.

Cities are important engines of economic growth. Increased population density leads to more transactions, higher levels of information and interactions, which leads to greater efficiency and productivity.

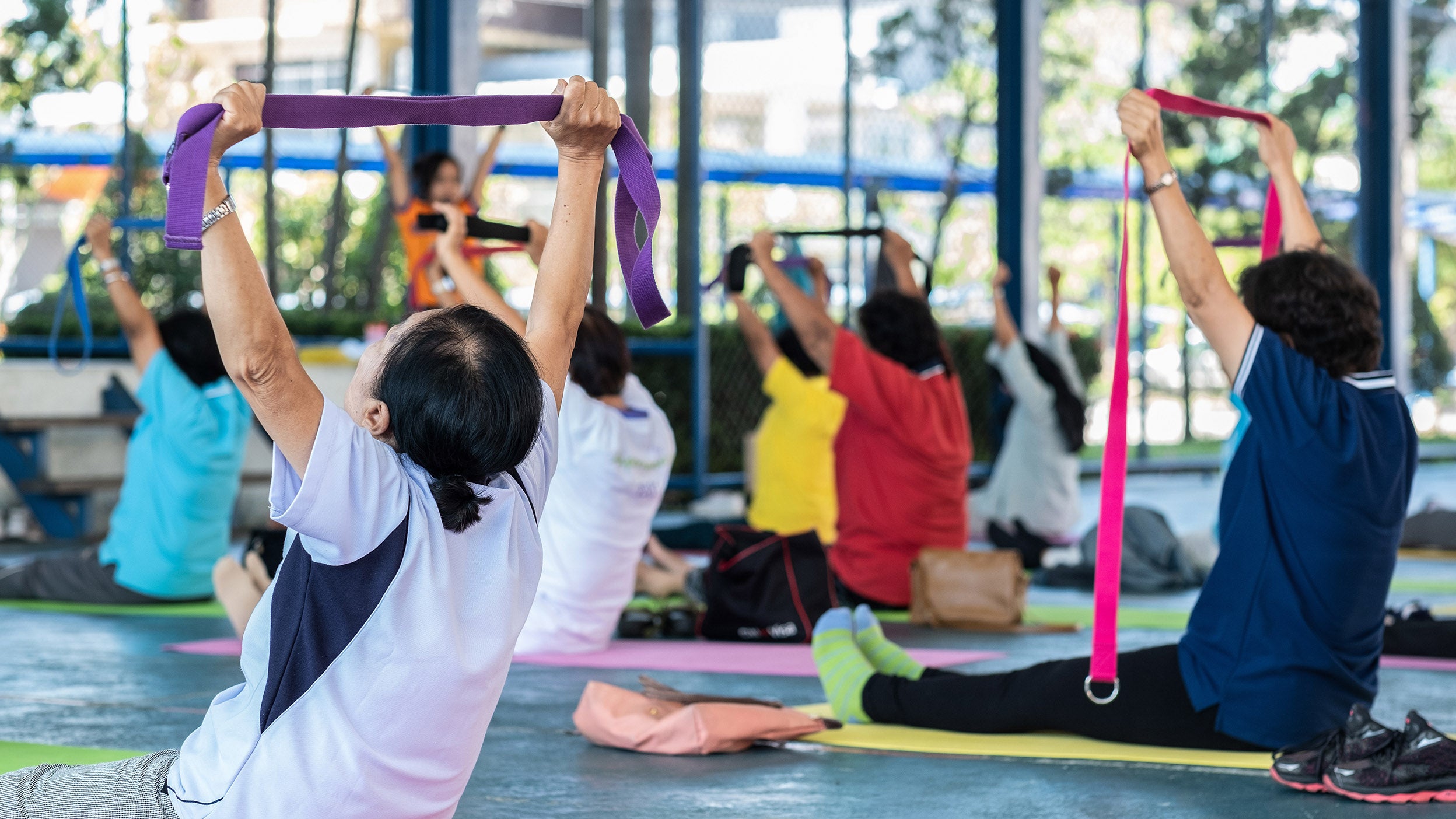

The pandemic has worked like a wake-up call, reminding us all how valuable and critical it is to stay healthy. Even before the pandemic, people in Asia were already starting adopt healthier lifestyles.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund. The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund.

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe (as defined below) and Professional Clients in Dubai, Jersey, Guernsey, Ireland, Isle of Man and the UK. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise.

This marketing communication is not for consumer use, please do not redistribute. Data as at 30.04.2021, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

This marketing communication is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks.

This marketing communication is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. This fund is domiciled in Luxembourg.

For the distribution of this document, Continental Europe is defined as Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Liechtenstein, Luxembourg, Netherlands, Norway, Spain, Sweden and Switzerland.

Issued by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg.

Denmark: The fund is registered in Denmark for professional investors only and not for public distribution. Dubai: Issued by Invesco Asset Management Limited, Po Box 506599, DIFC Precinct Building No 4, Level 3, Office 305, Dubai, United Arab Emirates. Regulated by the Dubai Financial Services Authority. Guernsey: The fund can only be promoted to Professional Clients. Isle of Man: The fund is an unregulated scheme that cannot be promoted to retail clients in the Isle of Man. The participants in the scheme will not be protected by any statutory compensation scheme. Switzerland: This document is issued in Switzerland by Invesco Asset Management (Schweiz) AG, Talacker 34, CH-8001 Zurich, who acts as a representative for the funds distributed in Switzerland. Paying agent for the fund distributed in Switzerland: BNP PARIBAS SECURITIES SERVICES, Paris, succursale de Zurich, Selnaustrasse 16, CH-8002 Zürich. Liechtenstein: The paying agent in Liechtenstein is LGT Bank AG, Herrengasse 12, FL-9490 Vaduz, Principality of Liechtenstein. UK: For the purposes of UK law, the fund/(s) is/are a recognised scheme/(s) under section 264 of the Financial Services & Markets Act 2000. The protections provided by the UK regulatory system, for the protection of Retail Clients, do not apply to offshore investments.